You’re standing at the grocery store checkout. The line behind you is getting long. You swipe your card, and it’s declined. Your phone buzzes a second later with a text asking if you just spent $2,400 at an electronics store in a state you haven't visited in years. Panic sets in. You need the chase card fraud phone number right now, but searching for it while standing in an aisle is a nightmare of ads and third-party sites.

Honestly, the most direct way to reach Chase's fraud department is 1-800-955-9060.

If you're outside the U.S., you'll need to call them collect at 1-302-594-8200.

Don't just trust a random number you see in a text message, though. Scammers have gotten incredibly good at "spoofing." They make your caller ID say "Chase Bank," but it’s actually a guy in a basement trying to get your PIN. Real Chase employees will never ask for your password or a one-time passcode over the phone if they called you. It’s a messy world out there, and banking security is the front line.

Why the Chase Card Fraud Phone Number is Your Best Defense

When things go wrong, speed is everything. Federal law—specifically the Electronic Fund Transfer Act and the Fair Credit Billing Act—protects you, but those protections often hinge on how fast you report the problem. If you lose your physical card, you have to act. If you see a weird charge for "Prime Video" that isn't yours, you have to act.

Most people think they should just call the general customer service line on the back of their card. You can do that. It works. But you'll likely sit through a maze of automated menus about your balance or recent deposits before getting transferred to the actual fraud specialists. Calling the chase card fraud phone number directly skips a lot of that bureaucratic fluff.

👉 See also: ¿Quién es el hombre más rico del mundo hoy? Lo que el ranking de Forbes no siempre te cuenta

The fraud department operates 24/7. They have to. Criminals don't take the night off, and neither does the automated system that flags "unusual activity" on your account. Sometimes, the system is too aggressive. I’ve had my card blocked because I bought a coffee in a different zip code. It’s annoying, sure, but it’s better than the alternative.

Spotting the Spoof: Don't Get Played

Here is the thing about phone numbers: they are easily faked. This is where most people get tripped up. You get a call. The caller ID literally says "Chase Fraud." The person on the other end sounds professional. They might even know the last four digits of your card number.

They tell you there is a suspicious transaction. To "verify" your identity, they ask you to read back a code that was just texted to your phone. Stop. If you do that, you are likely giving them the keys to change your password or authorize a wire transfer.

If you are ever in doubt, hang up. It feels rude, but do it anyway. Then, manually dial the chase card fraud phone number yourself. By initiating the call, you ensure you are actually talking to JPMorgan Chase and not a sophisticated phishing operation. It’s the only way to be 100% sure.

What Happens When You Actually Call?

Once you get a human on the line, the process is pretty standard. They will walk you through your recent transaction history. "Did you spend $14.95 at a gas station in Ohio?" "No." "Did you spend $0.00 at a random website?" That $0.00 charge is a classic "ping." Scammers use it to see if a card is active before they hit it with the big charges.

✨ Don't miss: Philippine Peso to USD Explained: Why the Exchange Rate is Acting So Weird Lately

If fraud is confirmed, Chase will close that card immediately. It’s dead. You can’t use it for that grocery bill you were trying to pay. They will then mail you a new card with a new 16-digit number, usually arriving in 3 to 5 business days. If you're a Sapphire Preferred or Reserve holder, they usually overnight it for free because of the premium status.

Managing the Digital Aftermath

Wait. Your card is dead, but what about your Netflix? Your gym membership? Your electric bill?

This is the hidden headache of credit card fraud. Once you get off the phone with the fraud department, you have to update your payment info everywhere. However, Chase has a feature in their mobile app called "Spend and Charge Stack" (or similar terminology depending on the current app version) that sometimes allows you to see your new card details digitally before the physical plastic arrives. You can add the new "virtual" card to Apple Pay or Google Pay almost instantly. It’s a lifesaver.

- Check your "stored" cards in browser autofill.

- Update your Amazon and Walmart accounts.

- Don't forget the recurring utility bills.

- Review your "Authorized Users" to make sure their cards weren't the leak.

The Different "Flavors" of Chase Fraud

Not all fraud is the same. There is a big difference between someone stealing your physical wallet and someone buying your card info on the dark web after a major retailer data breach.

- True Fraud: Someone you don't know used your card. You are protected by $0 Liability Protection. You won't pay a cent of those charges.

- Merchant Disputes: This isn't technically fraud, but the fraud department often handles the intake. This is when you did buy something, but the company sent you a broken toaster and won't give you a refund.

- Family Fraud: This is the awkward one. If your teenager uses your card to buy $500 worth of "skins" in a video game, Chase might not consider that fraud. They call that "unauthorized use by a known party," and it's much harder to get your money back.

If you're dealing with a lost or stolen card, you can actually handle most of it in the Chase Mobile app without even calling the chase card fraud phone number. There is a "Replace a lost or damaged card" button under "Account Services." You can even "Lock" your card instantly. Locking it is great if you think you just misplaced your wallet in the house and don't want to go through the hassle of changing your number yet.

🔗 Read more: Average Uber Driver Income: What People Get Wrong About the Numbers

A Note on Identity Theft vs. Card Fraud

If someone just has your card number, that’s a headache. If someone has your Social Security number and is opening new accounts in your name, that’s a catastrophe.

If you suspect your actual identity is compromised—maybe you see a Chase account on your credit report that you never opened—you need the Chase Identity Theft department. You should also contact the three major credit bureaus (Equifax, Experian, and TransUnion) to put a freeze on your credit. Card fraud is a leaky faucet; identity theft is a flooded basement. Treat them with different levels of urgency.

Moving Forward: Secure Your Account

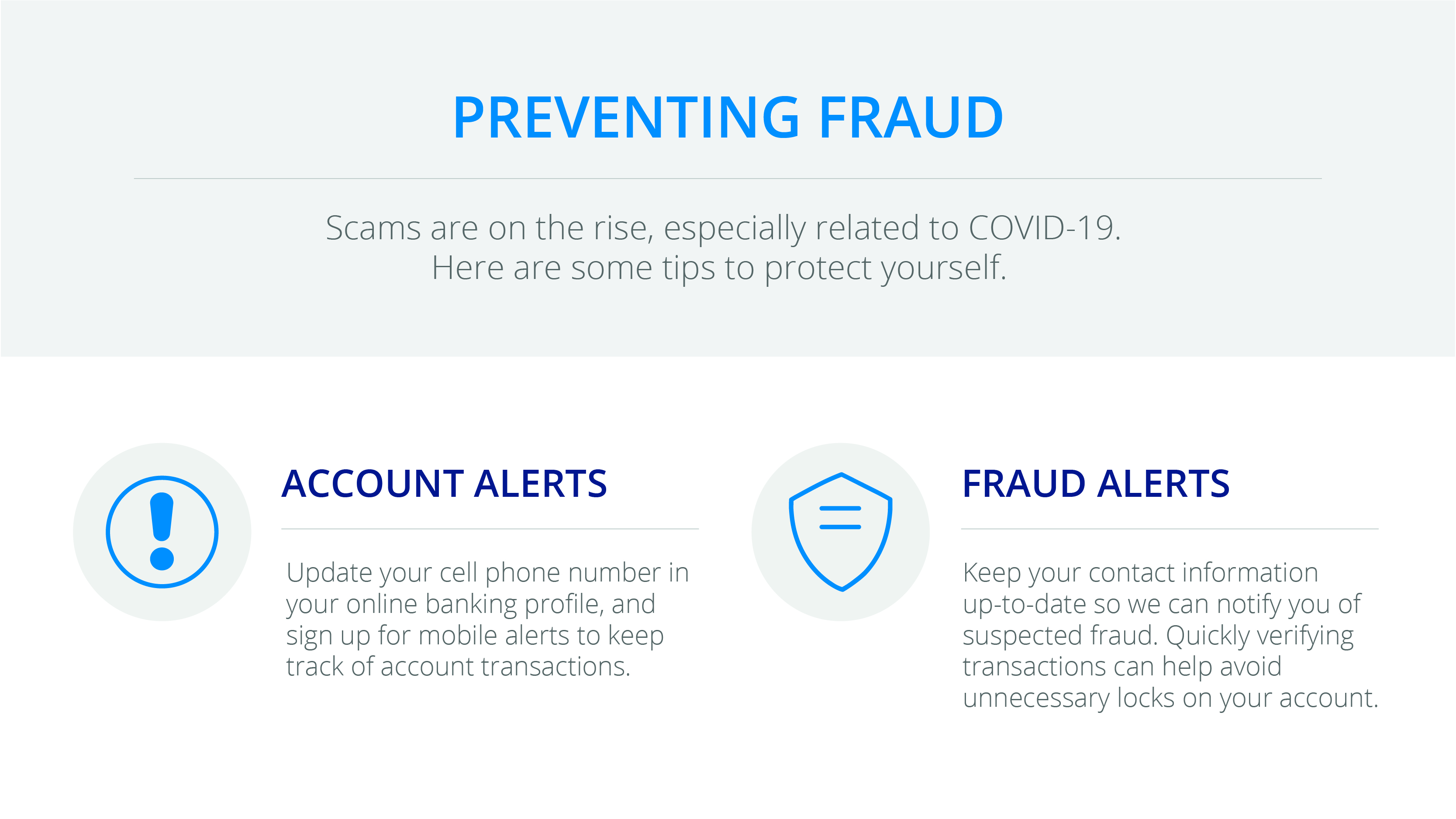

Once the dust settles and your new card arrives, don't just go back to business as usual. The fact that you had to search for the chase card fraud phone number means your defenses were breached somewhere.

Switch to paperless statements so your info isn't sitting in an unlocked mailbox. Turn on "Push Notifications" for every single transaction. I have mine set to alert me for any charge over $0.01. Yes, my phone dings every time I buy a bagel, but I also know the exact second an unauthorized charge happens.

Also, stop using your debit card for online shopping. Seriously. If your Chase Debit card is compromised, the money leaves your actual bank account immediately. While you'll likely get it back, you might be broke for the few days it takes Chase to investigate. With a Chase Credit card, you’re playing with the bank’s money while the dispute is pending. It’s much safer.

Your Actionable Next Steps

- Save the number now: Add "Chase Fraud" (1-800-955-9060) to your phone contacts. You don't want to be Googling this while panicked.

- Audit your statements: Go back three months. Look for small, weird charges ($1.00 or $2.00) from names you don't recognize.

- Lock it down: Log into the Chase app and enable "Transaction Alerts."

- Freeze your credit: If you haven't done this yet, go to the three bureau websites and do it. It’s free and prevents people from opening new Chase cards in your name.

- Check your digital wallet: Remove any old, expired, or unused cards from your phone's payment apps to reduce your "attack surface."

Dealing with bank fraud is a rite of passage in the digital age. It's not a matter of "if," but "when." Having the right phone number is the first step in taking your power back from the scammers. Stay skeptical of incoming calls, keep your app updated, and never share a security code with anyone—even if they claim to be from the bank.