You probably have one in your wallet right now. Or maybe you're thinking about opening a Total Checking account because you saw a $300 bonus offer taped to a branch window. The chase bank debit card is arguably the most common piece of plastic in America. It’s blue, it’s everywhere, and honestly, it’s kind of basic. But "basic" isn't always a bad thing when we're talking about your rent money.

Most people think a debit card is just a tool to get cash out of an ATM. That's a mistake. If you're just using it to withdraw twenties, you're missing out on some weirdly specific perks that Chase hides in their mobile app. You're also potentially exposing yourself to some annoying fees if you don't know how the "overdraft" game is played in 2026.

The Real Deal on Card Types

Not every chase bank debit card is the same. It’s not just about the color.

If you have a standard Chase Total Checking account, you get the classic blue Visa. It does the job. If you’re a student, you might have the High School or College version, which is basically the same but with lower daily withdrawal limits to keep you from blowing your textbook money on a weekend trip.

Then there’s the fancy stuff. Chase Sapphire Banking and Chase Private Client.

These cards feel heavier. They look cooler. But the real difference isn't the aesthetic; it’s the ATM fee waivers. If you’re a Private Client, Chase won’t charge you for using a non-Chase ATM, and they’ll often refund the fee the other bank charges you. For everyone else? You're looking at $3.00 for every "out of network" transaction, plus whatever the ATM owner wants to snatch. It adds up fast. I’ve seen people lose fifty bucks a month just because they were too lazy to find a branch.

Does the metal card matter?

Short answer: No.

Long answer: Only if you like the "clink" sound it makes on a restaurant table. The Chase Sapphire Banking debit card is often a heavier, premium-feeling card. It doesn’t actually make your money go further, but it’s a nice ego boost. Just remember that if you try to put a metal card through a paper shredder, you're going to have a very bad afternoon.

✨ Don't miss: Bed and Breakfast Wedding Venues: Why Smaller Might Actually Be Better

The Security Features Nobody Uses

Chase spends billions on security. You should probably use it.

The "Lock/Unlock" feature in the app is a lifesaver. Seriously. If you lose your wallet at a bar, don't panic and cancel the card immediately. Just toggle the lock in the app. It stops all new purchases but lets your recurring Netflix subscription go through. If you find your wallet in the couch cushions the next morning, you just toggle it back on. No need to wait seven days for a new card in the mail.

Fraud Alerts are Aggressive

Chase is famously twitchy about fraud. If you suddenly buy a $2,000 laptop in a state you've never visited, your chase bank debit card will likely get declined instantly. You'll get a text. You reply "Yes," and then you have to run the card again. It’s annoying in the moment, but it’s better than someone draining your checking account. Unlike a credit card, where you're spending the bank's money, a debit card is linked to your cash. If a hacker gets your PIN, that money leaves your account immediately. While Chase has a "Zero Liability" policy, it can still take a few days to get that money back. That’s a few days where you can’t pay your electric bill.

Chase Offers: The "Hidden" Cashback

This is the part most people ignore.

Inside the Chase mobile app, there’s a section called "Chase Offers." It’s sort of like digital coupons, but you don't have to clip anything. You just tap "Add to Card" for brands like Starbucks, Chewy, or Best Buy. When you use your chase bank debit card at those places, Chase just drops a few bucks back into your account a week later.

It’s not huge money. We’re talking 5% or 10% here and there. But if you’re already buying coffee, why not get it for 50 cents less? It’s basically free money that requires three seconds of tapping.

The Overdraft Nightmare (And How to Skip It)

Let’s talk about the "Overdraft Assist" program. It’s a relatively recent change.

🔗 Read more: Virgo Love Horoscope for Today and Tomorrow: Why You Need to Stop Fixing People

Back in the day, if you went $2 over your balance, Chase would hit you with a $34 fee. People hated it. Now, Chase gives you a bit of a cushion. If you overdraw your account by $50 or less, they don't charge you the Insufficient Funds Fee.

Also, they give you until the end of the next business day to get your balance back to $0 (or at least within that $50 buffer) before they penalize you. It’s a massive improvement. But honestly? Just turn off "Overdraft Protection." If you don't have the money, your card should just get declined. It's embarrassing at the grocery store, sure, but it's cheaper than paying fees.

Dealing with "Pending" Transactions

This trips people up all the time. You check your balance, it says you have $100. You spend $40. Your balance still says $100, but your "Available Balance" says $60.

Always look at the Available Balance.

Gas stations are the worst for this. They often put a "hold" on your card—sometimes up to $100—just to make sure you can pay for the fuel. That money is frozen. You can't spend it. It usually clears in 24 hours, but if you're living paycheck to paycheck, those holds can cause a chain reaction of declined transactions.

Travel and International Use

If you take your chase bank debit card to London or Tokyo, be prepared for the 3% Foreign Exchange Fee.

Every time you swipe, Chase takes 3% off the top for the "convenience" of converting your dollars. It’s a racket. If you travel a lot, you’re better off using a credit card like the Sapphire Preferred which has no foreign transaction fees.

💡 You might also like: Lo que nadie te dice sobre la moda verano 2025 mujer y por qué tu armario va a cambiar por completo

However, Chase is part of a massive global network. You can find ATMs almost anywhere. Just be aware that the exchange rate you get at a random ATM in an airport is usually terrible. If you must get cash abroad, try to find a major bank's ATM rather than those generic "Global Cash" kiosks that look like they haven't been cleaned since 1998.

Practical Steps to Manage Your Card

Don't just let the card sit in your wallet. Be proactive.

First, go into the app and set up "Real-time Alerts." Set it to notify you for every transaction over $1.00. Yes, your phone will buzz every time you buy a taco. But you’ll also know the exact second someone tries to use your card number at a gas station in another country.

Second, check your "Daily Limits." Chase usually defaults to a $500 or $1,000 daily ATM withdrawal limit. If you know you're going to buy a used car or need a lot of cash for a contractor, you can sometimes call them to temporarily raise that limit. Conversely, if you're worried about security, you can ask them to lower it.

Third, use the "Clean Up" method for your subscriptions. The Chase app now has a feature that shows you all the recurring charges hitting your debit card. It’s a great way to realize you're still paying $14.99 a month for a gym you haven't visited since the Obama administration.

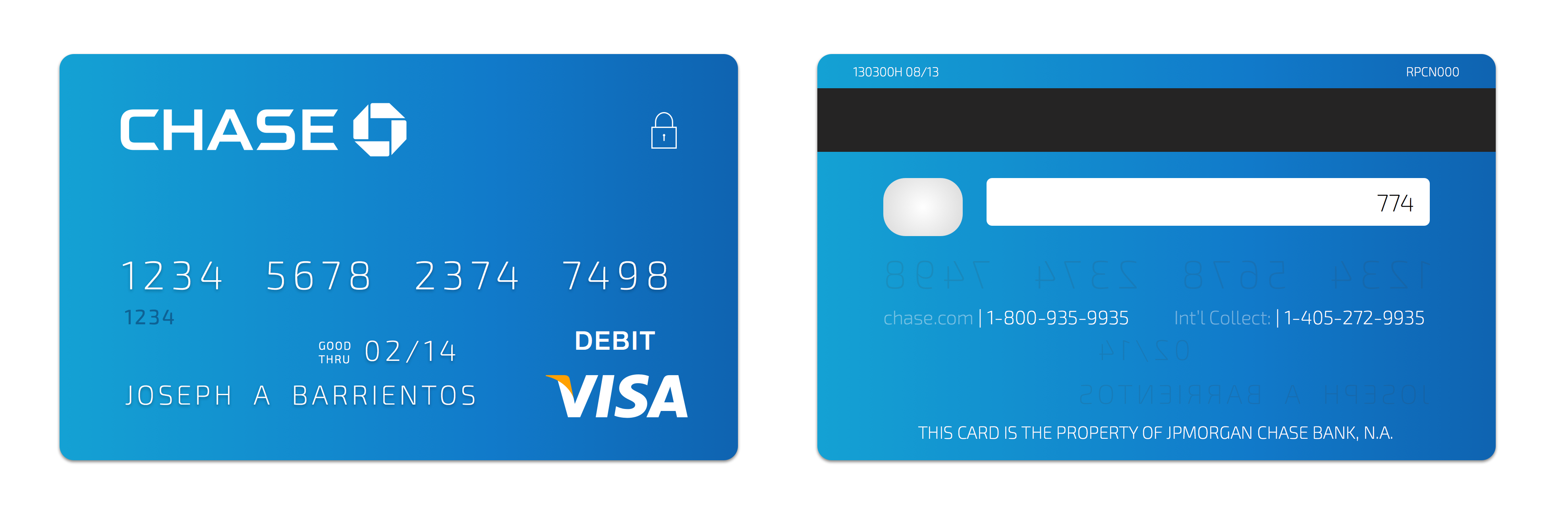

If Your Card is Stolen

- Lock it immediately via the app.

- Call 1-800-935-9935. This is the main Chase customer service line.

- Review your transactions. Go back through the last 48 hours. Thieves often "test" a card with a $1.00 purchase at a charity or a gas station before going for the big hit.

- Update your Apple Wallet/Google Pay. Once you report a card stolen, Chase will usually issue a digital version of the new card almost instantly. You can add this to your phone and keep spending via NFC while you wait for the physical card to arrive in the mail.

The chase bank debit card isn't a complex financial instrument. It’s a gateway to your liquid net worth. Treat it with a little bit of respect, toggle the right settings in the app, and it’ll serve you just fine without costing you a fortune in hidden fees.

Stop using it for every single purchase if you can avoid it—credit cards offer better rewards and better fraud protection—but for those times you need cold hard cash or a direct link to your checking account, there isn't a more reliable piece of plastic out there. Keep the app updated, check your "Offers" once a week, and for the love of everything, stay away from those out-of-network ATMs. Those $3 fees are how they get you.

Actionable Next Steps

- Open the Chase Mobile App: Scroll down to "Chase Offers" and activate at least three deals for places you already visit.

- Check your Alert Settings: Enable push notifications for any transaction over $0.01 to ensure you see fraud as it happens.

- Verify your Overdraft Status: Decide if you want "Standard" coverage or if you'd rather have the transaction declined. Turn off "Overdraft Protection" if you want to avoid potential fees entirely.

- Set a Travel Notice: If you’re heading out of state or out of the country, use the "Profile & Settings" menu to let Chase know so they don't freeze your account the moment you buy a souvenir.