You’ve seen the charts. Those jagged, mountain-like lines that seem to only go up when the world feels like it’s falling apart. Most people look at a chart of gold prices over time and see a simple "safe haven." But that's a surface-level take. Honestly, gold is a lot weirder than that. It’s not just a hedge against inflation; it’s a mirror of human fear, government blunders, and the slow-motion decay of paper money.

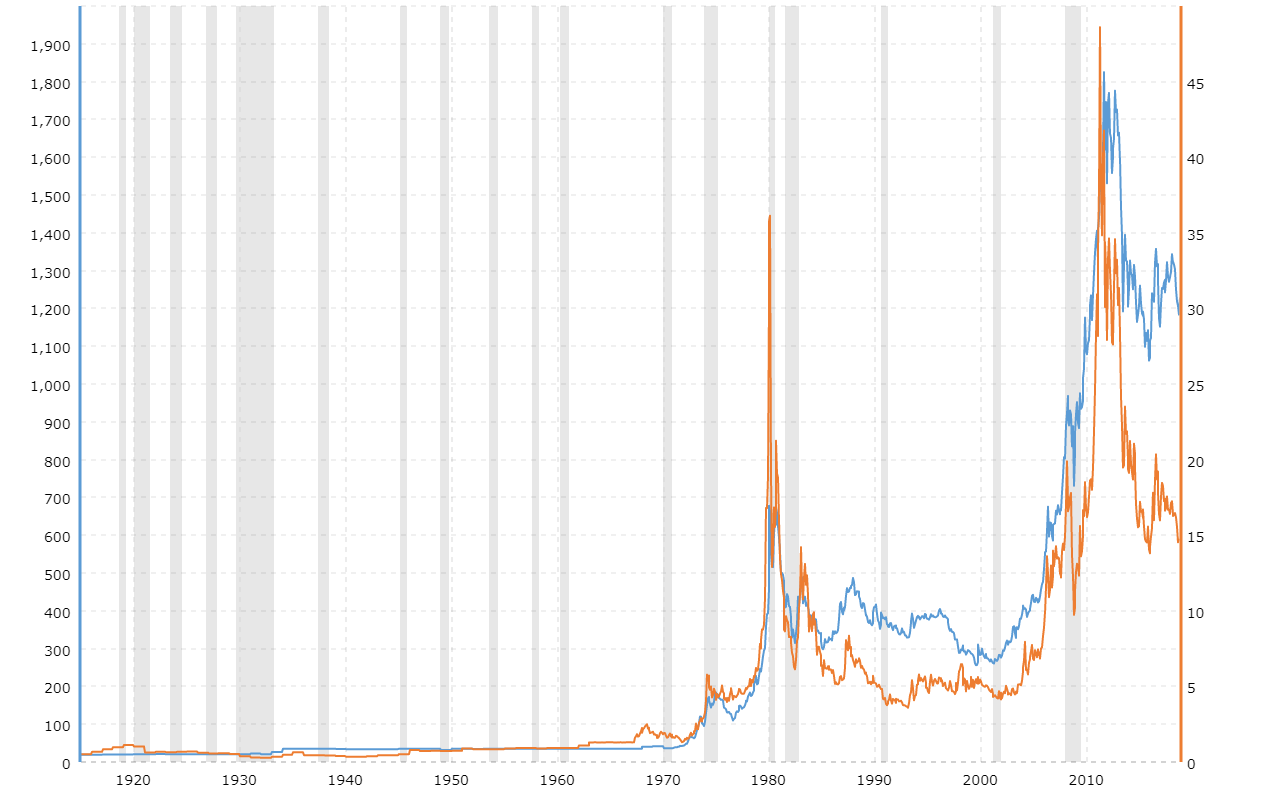

Gold stayed flat for basically a century. Seriously. Between the mid-1800s and 1933, you could rely on gold being about $20.67 an ounce. Then, the government stepped in. The Gold Reserve Act of 1934 bumped it to $35, and it sat there, frozen, for decades.

It wasn't until 1971—the "Nixon Shock"—that the real roller coaster began.

The Breakout That Changed Everything

When Nixon severed the dollar's tie to gold, he didn't just change a policy; he uncaged a beast. Before 1971, gold was a boring currency anchor. Afterward, it became a speculative firebrand.

By 1980, gold hit an astronomical $850. Adjust that for today's inflation, and you're looking at something around $3,500. People were panicking over the Iran hostage crisis and double-digit inflation. It felt like the end of the world. Then, it just... stopped.

Gold spent the next 20 years in the "desert."

In 1999, the Bank of England did something famously questionable. They sold off about half of the UK's gold reserves at the absolute bottom of the market—around $250 an ounce. This era was nicknamed "The Death of Gold." Tech stocks were the new king, and nobody wanted "pet rock" bullion.

2008 and the Great Decoupling

When the housing market imploded in 2008, gold did something counterintuitive. It didn't just shoot up immediately. It actually fell at first because everyone needed cash to cover their losses elsewhere.

Once the initial panic subsided, the rally was relentless. It peaked at $1,921 in 2011. Why? Because the Fed started printing money (Quantitative Easing) and investors got spooked that the dollar would become worthless.

Fast forward to the 2020s. We've seen a total paradigm shift.

Why the 2020-2026 Surge is Different

If you look at a current chart of gold prices over time, the last few years look like a vertical wall. We saw gold break $2,000 during the pandemic, but the real madness started in 2024 and 2025.

As of early 2026, gold has been flirting with the $4,600 mark.

- Central Banks are Hoarding: Countries like China, Russia, and even smaller emerging markets aren't just buying gold; they're vacuuming it up. They want to rely less on the US dollar.

- The "Real Rate" Myth: Usually, when interest rates go up, gold goes down. Not lately. In 2025, rates stayed high, yet gold kept breaking records. That's a sign that people are hedging against systemic collapse, not just inflation.

- Geopolitics: From the Middle East to Ukraine and tariff wars, the world is messy. Gold loves a mess.

On October 21, 2025, the market got a reality check. Gold had been basking at all-time highs near $4,380 when it suddenly plummeted 6% in a single day. People called it a crash. In reality, it was just a massive "profit-taking" event where big institutional players cashed out.

What the Data Actually Tells Us

History shows us that gold doesn't move in a straight line. It moves in "steps."

We had the $35 step. Then the $300-$400 step in the 90s. Then the $1,200-$1,800 step after 2011. Now, we seem to be establishing a new floor much higher up the mountain. Experts at J.P. Morgan and other major firms have been eyeing the $5,000 level for late 2026.

But there’s a catch.

Gold doesn't pay interest. If you hold a bar of gold, it just sits there. You're betting that the world will get more chaotic or that the dollar will lose value faster than the gold "opportunity cost." Sometimes, that's a bad bet for a long time. Ask anyone who bought in 1980 and had to wait until 2008 just to break even in nominal terms.

🔗 Read more: No Cosigner Student Loans: How to Actually Get Funded Without Your Parents

Actionable Insights for the Modern Investor

Looking at a chart of gold prices over time isn't about timing the exact top. It's about understanding the "why" behind the "what."

- Don't chase the vertical line. If gold has gone up 20% in two months, you're probably too late for that specific leg of the journey. Wait for the "October 2025" style corrections.

- Watch the Central Banks. They are the "smart money" in this space. If the World Gold Council reports that central banks are still net buyers, the long-term trend is likely still up.

- Check your "Paper" vs. "Physical." Most people buy gold ETFs (like GLD), which is fine for trading. But in a true systemic crisis—the kind that drives gold to $6,000—having physical coins in a safe is the only way to ensure you actually own the asset.

- Diversify your hedges. Silver often lags behind gold but then moves with way more "velocity." In 2025, silver actually outperformed gold on a percentage basis once it finally caught the spark.

Gold is currently in a "super-cycle." The combination of massive government debt and geopolitical fragmentation means the yellow metal is likely to remain the center of the financial universe for the rest of the 2020s.

Keep a close eye on the $4,000 support level. If it holds during the next dip, the path to $5,000 is wide open. Just remember: gold is a long-term insurance policy, not a get-rich-quick scheme. Treat it with the same respect you'd give a loaded weapon or a complex insurance contract. It's there to protect you when everything else fails.

Next Steps for You

- Download a 50-year inflation-adjusted chart to see where current prices sit compared to the 1980 peak.

- Review your portfolio allocation; most experts suggest 5-10% in precious metals to balance out stock market volatility.

- Monitor the DXY (US Dollar Index), as a sustained drop in the dollar usually acts as rocket fuel for gold prices.