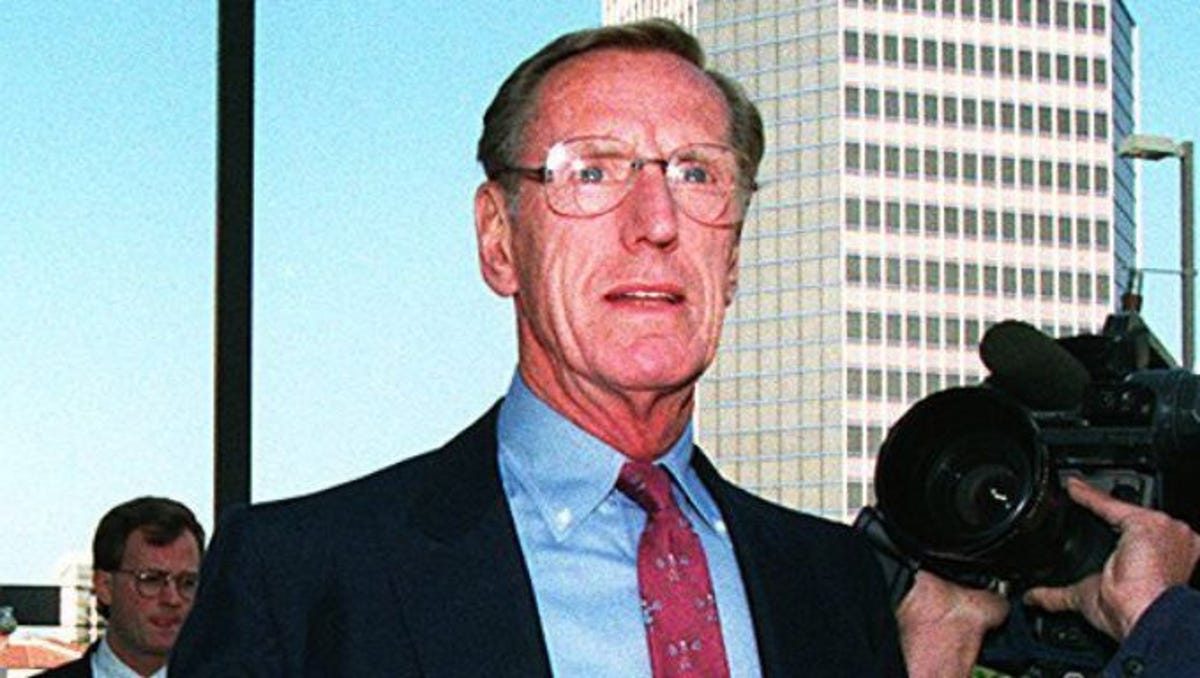

You’ve probably seen the grainy 1980s footage of men in expensive suits sitting before a Senate committee, looking sweatier than they’d like. Among them was Charles H Keating Jr, a man who became the literal face of corporate greed long before the 2008 housing bubble was even a glimmer in a subprime lender's eye.

Most people remember him as the guy who bought a bank and then crashed the economy. That’s the shorthand version. But the real story is much weirder, more hypocritical, and honestly, a lot more tragic for the thousands of seniors who lost everything.

The Man Who Wanted to Clean Up America

Before he was a "bankster," Keating was a crusader. It’s a bit of a head-scratcher today, but in the 1950s and 60s, he was the country's most prominent anti-pornography activist. He founded Citizens for Decent Literature. He wasn't just a guy with a sign; he was a powerhouse. He even got appointed to a federal commission on obscenity by Richard Nixon.

When the rest of the commission suggested that maybe pornography wasn't destroying the fabric of the soul, Keating lost it. He filed a dissenting report calling their findings "moral anarchy." This is the same man who would later be accused of siphoning millions of dollars from a federally insured bank to fund a lifestyle that would make a Roman emperor blush.

The irony is thick.

He lived in a world of black and white morality when it came to what people watched in their bedrooms, but when it came to the ledger books of Lincoln Savings and Loan, everything was a very convenient shade of gray.

How Lincoln Savings and Loan Became a Weapon

In 1984, Keating’s company, American Continental Corp (ACC), bought Lincoln Savings and Loan. This was the era of deregulation. The rules were loosening, and Keating saw an opening. He didn't want to just give out home loans; he wanted to play the market.

Basically, he took the safe, boring money of depositors—many of them elderly folks in Phoenix and Southern California—and dumped it into "junk bonds" and massive, speculative real estate deals. Think of it like taking your grandma's grocery money and putting it all on a single hand of blackjack.

🔗 Read more: United Breaks Guitars: What Really Happened to United Airlines

- The "Junk Bond" Trap: His staff actively encouraged customers to move their money out of insured accounts and into ACC junk bonds.

- The Lie: Many of these customers, some in their 80s and 90s, thought these bonds were backed by the government. They weren't.

- The Result: When the bubble burst, 23,000 people were left holding worthless paper. We’re talking about $200 million in life savings just... gone.

It’s hard to overstate the human cost. These weren't "sophisticated investors." They were people looking for a safe place to put their retirement fund who trusted a man who projected an image of a pious, family-oriented leader.

The Keating Five: A Masterclass in Political Pressure

You can't talk about Charles H Keating Jr without talking about the "Keating Five." When federal regulators finally started sniffing around Lincoln’s books in 1987, Keating didn't hide. He went on the offensive.

He had donated roughly $1.3 million to five U.S. Senators: John McCain, John Glenn, Alan Cranston, Dennis DeConcini, and Donald Riegle. He expected a return on that investment. He essentially called them into a room and asked them to get the regulators off his back.

It worked. For a while.

The regulators backed off for two years. Those two years cost the American taxpayers an extra $2 billion because it allowed the rot inside Lincoln to grow even deeper. When the bank finally collapsed in 1989, it became the most expensive failure in the entire Savings and Loan crisis, costing the government around $3.4 billion total.

The Legal Rollercoaster and the Final Act

The 90s were a blur of courtrooms for Keating. He was convicted of fraud, racketeering, and conspiracy. He actually went to prison, serving about four and a half years of a 12-year sentence.

Then, things got weird.

In 1996, his convictions were overturned on a technicality related to jury instructions. For a moment, it looked like he might walk away entirely. But in 1999, at age 75, he finally took a plea deal for wire and bankruptcy fraud. He was sentenced to "time served" and walked free.

He spent his final years in Phoenix, largely out of the spotlight, working as a business consultant. He died in 2014 at the age of 90.

Why the Keating Story Still Matters in 2026

If you think this is just ancient history, you're missing the point. The mechanics of the Lincoln Savings and Loan collapse—deregulation, political "pay-to-play," and the targeting of vulnerable investors—are patterns that repeat every few decades.

Key Takeaways from the Keating Legacy:

- Trust, but Verify the Insurance: The biggest tragedy of the S&L crisis was that people didn't realize their money had moved from a "savings account" to a "corporate bond." Always check for FDIC (or NCUA) coverage.

- Deregulation is a Double-Edged Sword: When banks are allowed to act like hedge funds, the risk doesn't disappear; it just moves to the taxpayer.

- Moral Grandstanding is a Red Flag: Keating used his reputation as a "moral" leader to deflect scrutiny from his business practices. Character is better measured by how a person handles other people's money than by what they lobby against in their spare time.

Actionable Steps for Today's Investor

If you want to avoid being the next victim of a "Keating-style" collapse, you have to be proactive.

- Audit Your "Safe" Investments: Review your brokerage and bank accounts. Ensure you know exactly which assets are federally insured and which are "unsecured" corporate debt.

- Research Executive Backgrounds: It’s easier than ever to look into the history of corporate leaders. Look for a history of litigation or regulatory "slaps on the wrist."

- Support Regulatory Transparency: The "Keating Five" scandal led to significant ethics reforms in the Senate. Staying informed on how campaign finance affects financial regulation is the only way to prevent history from hitting "repeat."

Charles H Keating Jr wasn't just a "bad guy" in a vacuum. He was a symptom of a system that allowed ambition to override ethics. Understanding how he operated is the best defense against the next version of the same story.

📖 Related: Why What Color Is Your Parachute 2025 Is Still the Only Job Search Book You Actually Need

To better understand the financial safeguards in place today, you should investigate the current limits of FDIC insurance and how "Too Big to Fail" policies have evolved since the original Savings and Loan crisis. Overlapping these historical lessons with modern banking regulations is the most effective way to protect your personal wealth from institutional instability.