Moving your business is a massive headache. You’ve got boxes stacked to the ceiling, utilities to transfer, and clients to notify. Honestly, the last thing anyone wants to think about is paperwork. But here’s the thing: if you don't change business address with IRS records immediately, you are begging for a logistical nightmare.

Uncle Sam doesn't care if your mail forwarding is set up with the post office. If they send a high-stakes notice about your payroll taxes or an audit request to your old warehouse in Des Moines while you’re sipping coffee in your new Austin office, the clock starts ticking the moment that letter hits the old porch. Miss a deadline because the mail sat in a puddle for three weeks? That’s on you.

Most people think a quick update on their tax return is enough. It isn't. Not even close.

Why the Post Office Isn't Enough

The United States Postal Service (USPS) is great for birthday cards. It’s less great for official federal tax documents. While a change of address with the USPS technically forwards mail, the IRS often uses specific databases that don't sync up instantly with local post office records.

If you rely solely on forwarding, you're playing a dangerous game with "Statutory Notices of Deficiency." These are the scary letters that give you a strict 90-day window to dispute a tax bill in Tax Court. If the IRS mails it to your "last known address"—which is the one they have on file—the law considers you notified. It doesn't matter if you never saw the envelope. You lose your right to fight the bill in court before paying it. That’s a massive financial risk.

The Form 8822-B Strategy

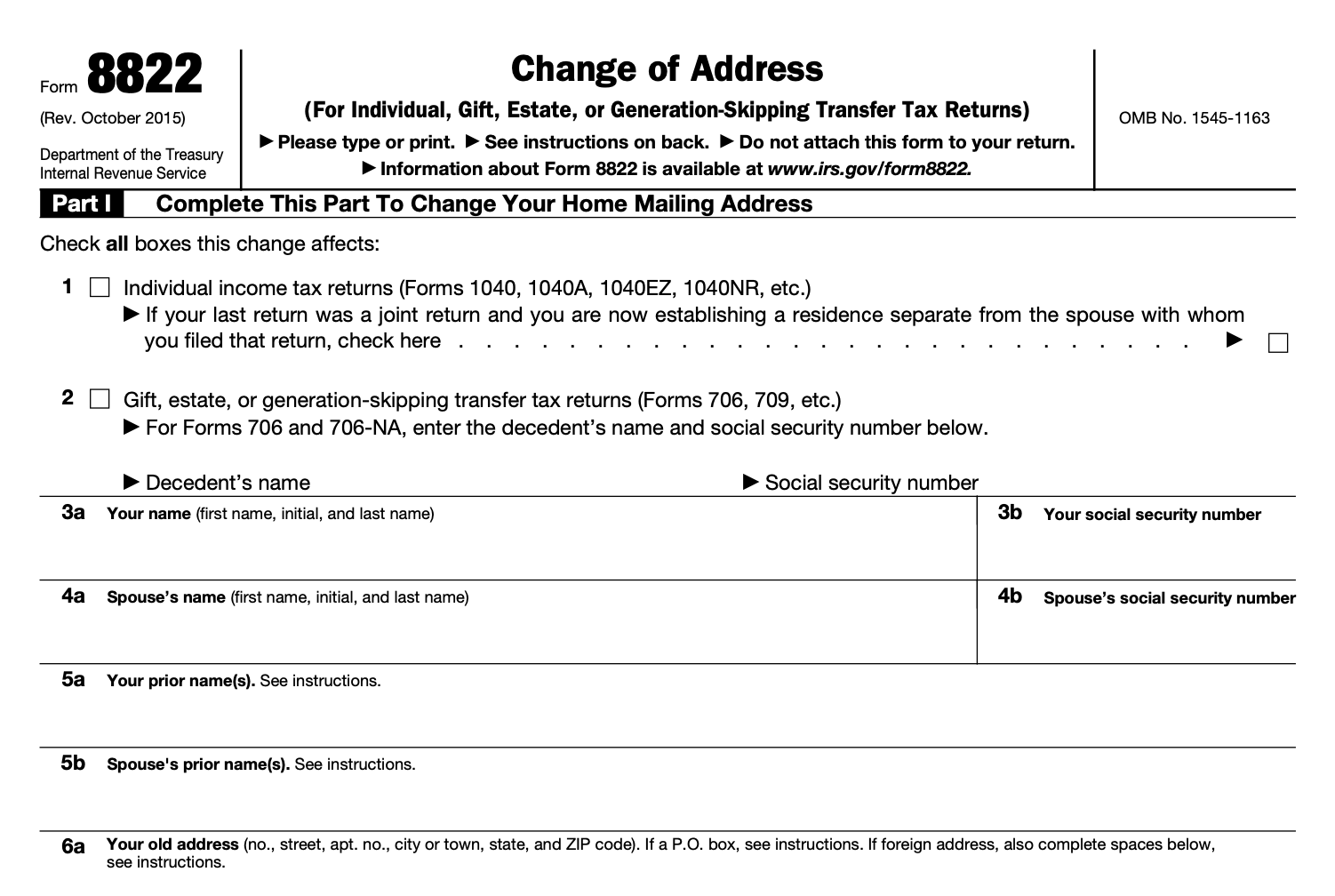

If you want to be bulletproof, you need Form 8822-B, Change of Address or Responsible Party — Business. This is the gold standard. It is a dedicated document designed for one thing: telling the IRS exactly where you are.

You’ll need your Employer Identification Number (EIN), your old address, and your new one. Simple. But there is a catch that catches people off guard. You also have to report changes to your "responsible party." If the person in charge of your business finances changed along with the move, and you don’t tell the IRS within 60 days, you’re technically in violation of federal tax code. Most small business owners have no idea that 60-day rule even exists.

Don't just mail it and hope for the best. Send it via Certified Mail with a Return Receipt Requested.

Why? Because the IRS loses mail. Frequently. Having a stamped receipt from the post office is your only "get out of jail free" card if they claim they never heard from you. It’s the difference between a five-minute phone call to resolve a misunderstanding and a two-year battle with an agent who thinks you're dodging them.

Changing Your Address via Tax Filings

Maybe you’re moving right around tax season. In that case, you can technically change business address with IRS officials by just putting the new info on your return. If you're filing a Form 1120 for a corporation or a Form 1065 for a partnership, the address you type on the front page becomes your new address of record once the IRS processes that return.

It sounds easy. It is easy.

But it's slow.

Tax returns take months to process, especially with the backlogs the IRS has been dealing with lately. If you file your return in March but move in January, there’s a massive gap where the IRS still thinks you live at the old spot. This is why pros almost always recommend the 8822-B even if you're about to file a return. It’s about redundancy.

What About Employment Taxes?

If you have employees, you’re filing Form 941 every quarter. You can update your address there too. But again, this only updates the address for that specific tax type in some cases. The IRS computer systems are famously old—we’re talking 1960s-era code in some branches—and sometimes an address change in the "employment tax" bucket doesn't automatically migrate over to your "income tax" bucket.

The Nuance of "Responsible Party" Changes

This is where things get sticky. The IRS defines a "responsible party" as the person who has a level of control over the funds or assets in the entity that, as a practical matter, enables the individual, directly or indirectly, to control, manage, or direct the entity and the disposition of its funds and assets.

If you sold your business or brought on a new managing partner during the move, you have to report this. If you don't, and the business owes back taxes, the IRS might go after the old responsible party listed in their system. It creates a mess of personal liability that no one wants.

State and Local Ripple Effects

Changing your address with the IRS is just the first domino.

📖 Related: Finding a Fifth Wheel Wrecker for Sale: Why You Might Be Looking for the Wrong Tool

Most states have an "automatic" system where they receive data from the IRS, but you can’t trust it. You need to contact your Secretary of State's office. If you're an LLC or a Corporation, you likely have a "Registered Agent." If you were your own registered agent and you moved, you must update this with the state immediately. If someone tries to sue your business and the "service of process" goes to an old address where you no longer reside, the plaintiff can sometimes get a default judgment against you.

You lose the case before you even knew it started.

Then there are the local permits. If you move across town, your city business license might be tied to your specific zoning. Moving from a commercial zone to a home office? You might be violating a local ordinance you didn't even know existed.

Verbal Notification: Don't Rely on It

You can call the IRS at 800-829-4933 to update your address. You'll wait on hold. You'll talk to a person who may or may not be having a good day. They will ask you to verify your identity, your EIN, and probably some details from your last filed return.

While they can update your address over the phone, it’s the least "traceable" way to do it. If the agent makes a typo—hitting "St." instead of "Ave."—your mail goes into the void. Stick to the paper forms. Written records are your best friend in a federal audit.

Steps to Take Right Now

If you are in the middle of a move or just finished one, do not wait for the next tax cycle.

- Download Form 8822-B from the official IRS.gov website. Do not use third-party "filing services" that charge you $50 for a free form.

- Fill out lines 1 through 7 with your business name, EIN, and old address.

- On line 8 and 9, enter the new mailing address. If your physical location is different from where you get mail, make sure that is clear.

- Check if your "responsible party" has changed. If it’s still you, leave that part alone or confirm the details.

- Sign it. An unsigned form is a piece of trash to the IRS.

- Take it to the Post Office. Send it Certified Mail.

- Keep the tracking number and a copy of the signed form in a permanent "Legal/Tax" folder.

Once the IRS has this, it usually takes 4 to 6 weeks to fully propagate through their systems. During that window, check your old address if you can, or make sure your USPS forwarding is active.

Finally, update your "Doing Business As" (DBA) filings if your move took you into a new county. Many business owners forget that DBAs are often county-level registrations. If you moved from Orange County to Los Angeles County, your old DBA might not carry the same legal weight. Check with the County Clerk to see if you need to re-file or "withdraw" the old name and register it in the new jurisdiction.

Taking these steps ensures that your business remains in "good standing." It sounds like corporate jargon, but it’s actually the difference between a smooth-running company and one that gets hit with "failure to respond" penalties that can spiral into the thousands of dollars. Take the thirty minutes to fill out the 8822-B. Your future self will thank you when you aren't fighting a lien over a letter you never received.