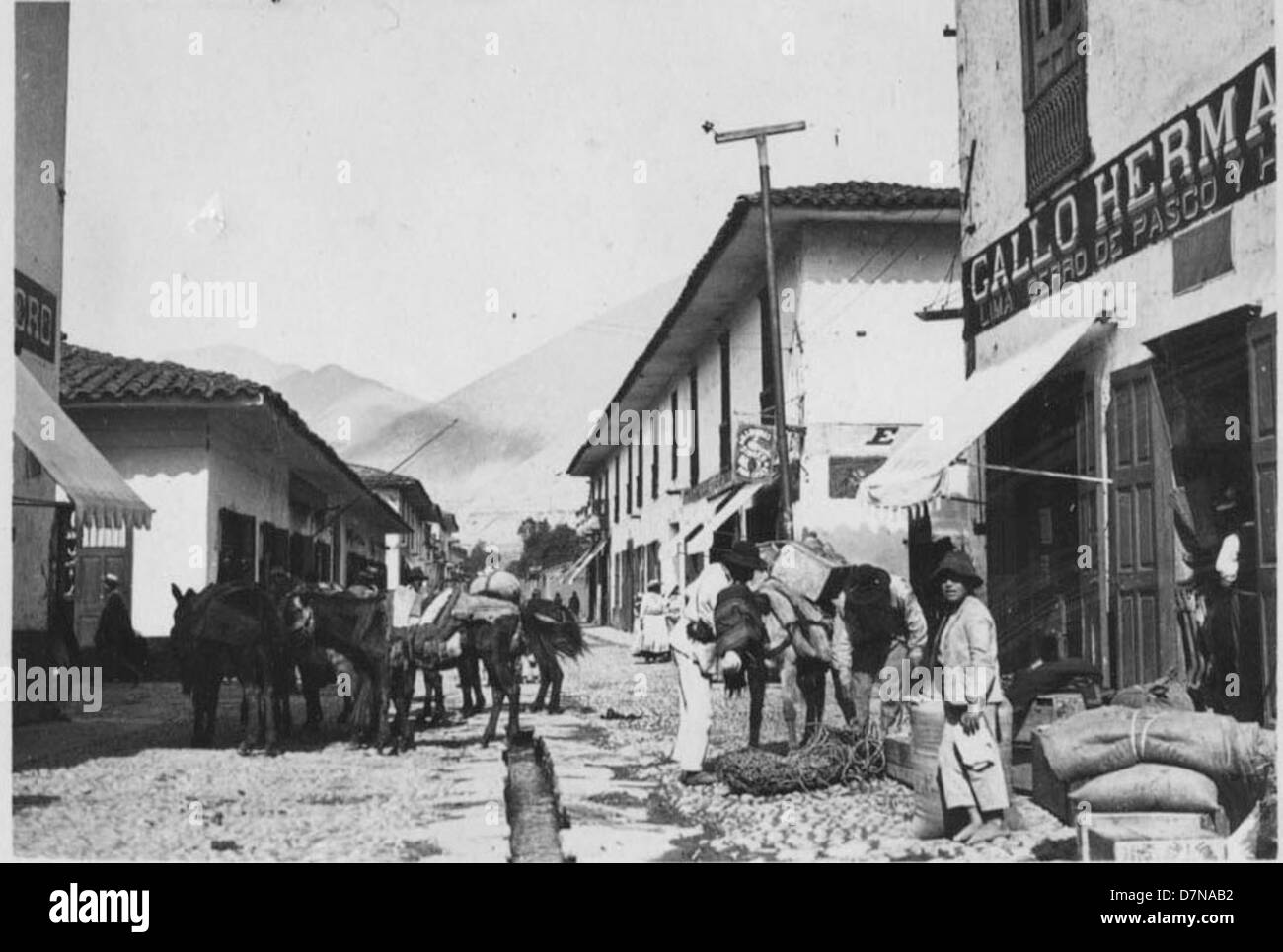

Mining stocks are a weird beast. One day you’re looking at a hole in the ground, and the next, you're looking at a multi-billion dollar environmental remediation project that happens to be sitting on a mountain of silver and zinc. That’s basically the vibe with Cerro de Pasco stock (TSXV: CDPR) right now.

If you’ve been tracking the Canadian venture markets lately, you’ve probably noticed the ticker CDPR popping up in more conversations. It’s not your typical "dig a new hole" mining company. Honestly, it’s more of a recycling project on a massive, industrial scale. They are trying to re-process historical tailings in Peru—basically mining the waste left behind by 100 years of previous operations.

It sounds smart, right? But the stock has been a bit of a rollercoaster.

The Big Deal with Quiulacocha

The heart of the story for anyone holding Cerro de Pasco stock is the Quiulacocha Tailings Project. For a century, the Cerro de Pasco mine in central Peru dumped its waste into this massive area. Back then, they weren't as good at extracting every bit of metal. Today, we have better tech.

The company just wrapped up a huge milestone in early January 2026. They finished their "Phase 1" work. This wasn't just some desk study; they actually pulled 12.3 tonnes of bulk samples from the tailings. They had to freeze the material to keep it stable and ship it all the way to Lima for testing.

📖 Related: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

Why does this matter for the stock price? Because mining the "waste" is much cheaper than traditional underground mining if the metallurgy works. You don’t have to blast rock. You just scoop it up and process it. If those 12.3 tonnes show they can efficiently pull out silver, zinc, and lead, the valuation could shift significantly.

Getting Rid of the Trevali Ghost

One thing that was really dragging down Cerro de Pasco stock for a while was a messy legal fight with Trevali Mining. It was one of those "corporate divorce" situations that investors hate. It involved the 2021 purchase of the Santander Mine and a whole lot of disputed payments.

Fortunately, they finally settled this in December 2025.

- The Payout: CDPR agreed to pay CAD 2 million.

- The Benefit: They wiped about USD 4.08 million in liabilities off their books.

- The Result: A "material gain" on their financial statements and one less headache for the CEO, Guy Goulet.

Clearing the air like this is usually a pre-requisite for big institutional investors to even look at a small-cap stock. Nobody wants to buy into a lawsuit.

👉 See also: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

Let’s Talk Numbers (and the Risk)

Look, CDPR isn't for the faint of heart. As of mid-January 2026, the stock is trading around CAD 0.62 on the TSX Venture. It’s had a wild year. At one point, it was down in the $0.20s, so if you bought in then, you're feeling pretty good.

But check out the fundamentals. The price-to-book ratio is currently sky-high—we're talking over 40x in some reports. That screams "overvalued" to traditional value investors. However, in the mining world, people pay for the potential of what's in the ground (or in this case, the tailings pond), not just what's on the current balance sheet.

The company has a moderate debt load, with a debt-to-equity ratio around 0.59. They have about $11 million in cash, which sounds like a lot until you realize how much it costs to build a processing plant in the Andes.

What Most People Get Wrong

People often think Cerro de Pasco stock is just another Peruvian silver play. It’s not.

✨ Don't miss: Big Lots in Potsdam NY: What Really Happened to Our Store

There is a huge "Green" angle here that the market is starting to price in. This isn't just about making money; it's about environmental remediation. The Quiulacocha tailings are a massive environmental liability for the Peruvian government. By re-processing them, CDPR is actually cleaning up the site.

In 2026, that "ESG" (Environmental, Social, and Governance) label matters. It makes it way easier for the company to get permits. In fact, they recently signed a surface use agreement with the local Quiulacocha community. Getting the locals on your side in Peru is half the battle. If you don't have the "social license" to operate, your stock is basically worth zero.

The Technical Outlook

If you’re a chart person, the signals are mixed but leaning bullish.

- Moving Averages: The 10-day moving average recently crossed above the 50-day. Usually, that’s a "golden cross" signal that says the trend is shifting up.

- RSI: It has dipped into oversold territory a few times recently, suggesting the selling might be exhausted.

- Analyst Targets: Some analysts have put a target of CAD 0.65 on it. We're hovering right near that now, so the question is whether the next batch of assay results from the 12.3-tonne sample will push it into the $0.80 range or if we've hit a ceiling.

Actionable Insights for Investors

If you're looking at Cerro de Pasco stock, you sort of have to treat it like a venture capital investment rather than a stable blue-chip.

- Watch the Assays: The results from the bulk sampling in Lima are the next big catalyst. If the recovery rates for gallium and silver are higher than expected, the stock will likely pop.

- Keep an Eye on Dilution: Small mining companies often need more cash. They recently did a $15 million private placement (with billionaire Eric Sprott participating, which is a good sign), but more raises could be coming if they move to full-scale construction.

- The Political Climate: Peru is a mining powerhouse, but its politics can be... let's say "dynamic." Any change in mining taxes or environmental laws in Lima will hit this stock immediately.

The strategy here seems to be a "wait and see" for the technical data from the Phase 1 lab tests. If the chemistry works, the "waste" becomes a goldmine. If it doesn't, it's just a very expensive pile of dirt.

Next Steps:

Keep a close watch on the SEDAR+ filings for the final assay results from the December bulk sampling program. Additionally, monitor the progress of the "Phase 2" drilling permit (the DIA), as this will be the green light the company needs to prove the full depth of the Quiulacocha resource.