Money feels weird right now. Everyone is yelling about stocks or Bitcoin, but sometimes you just want your cash to sit somewhere safe and actually grow a little. That’s where the whole conversation around CD certificate of deposit pros and cons starts to get interesting.

It’s basically a pact. You give the bank your money for a set time—maybe six months, maybe five years—and they promise not to touch the interest rate. You promise not to touch the principal. If either of you flinches, there are consequences. But in a world where the Federal Reserve changes its mind every few weeks, that "locked-in" feeling is exactly why people are flocking back to them.

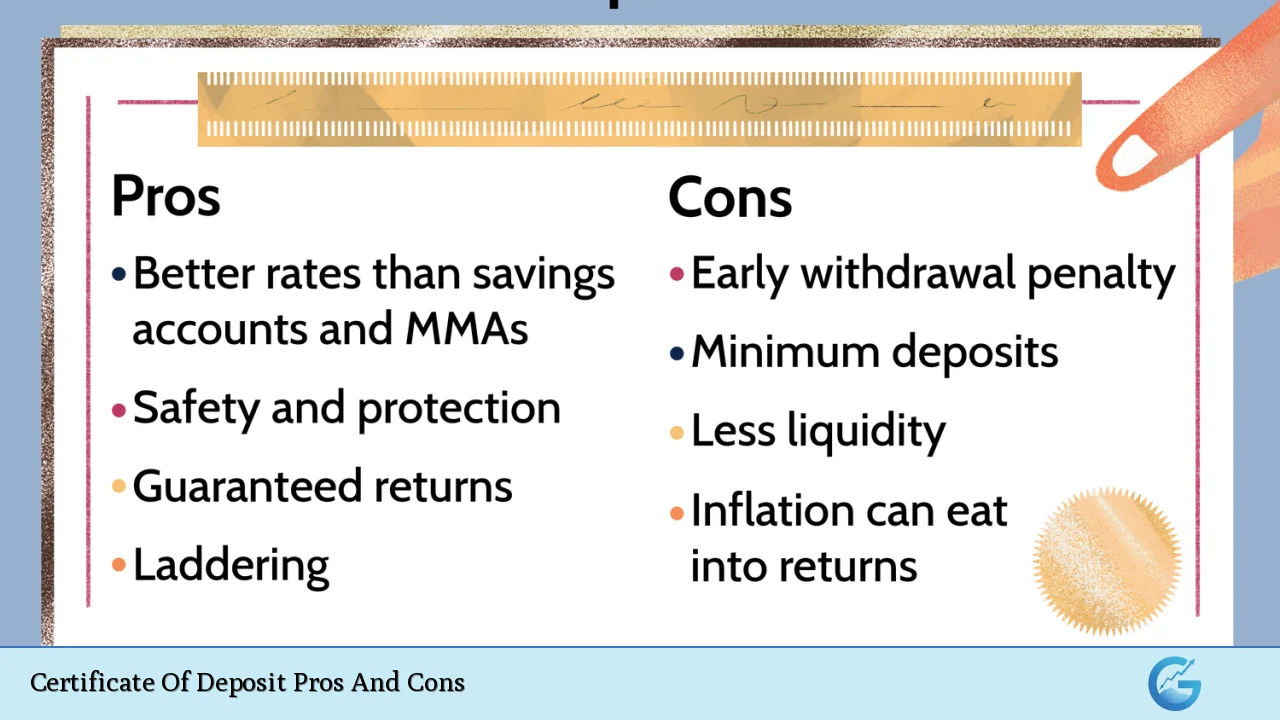

The Good Stuff: Why People Love Certificates of Deposit

The biggest draw is the certainty. Total, 100% boring certainty. Honestly, in a volatile market, boring is a luxury. When you open a CD, you know exactly what you’re getting. If the paper says 4.5% APY, you get 4.5% APY. It doesn’t matter if the stock market craters or if the bank has a bad quarter. That rate is a legal contract.

Safety is the other big pillar. Most CDs are backed by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). This means even if your bank literally disappears overnight, the government has your back up to $250,000 per depositor, per insured bank. It’s about as close to a "sure thing" as you can get in the financial world.

There’s also a psychological benefit that people rarely talk about. It’s "forced" discipline. If you’re the type of person who sees a healthy savings account balance and suddenly decides you need a new espresso machine, a CD stops you. Since there is a penalty for taking the money out early, it creates a mental barrier. Your money is "away." It’s working. You can’t touch it without feeling the sting of a penalty, and for a lot of us, that’s a very good thing.

Better Rates Than Your Average Joe Account

Standard savings accounts are often a joke. You might be earning 0.01% at a big national branch while they’re lending your money out for 7% on car loans. CDs usually offer significantly higher yields because you’re giving the bank "term liquidity." You’re telling them, "I won't ask for this money back for two years," which allows the bank to use that capital more effectively.

📖 Related: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

The Reality Check: Where CDs Fall Short

Everything has a price. With a CD, the price is your freedom. The "liquidity risk" is the main event when discussing CD certificate of deposit pros and cons. If your car transmission explodes or you have a medical emergency, that money is behind glass. To break that glass, you have to pay.

Early withdrawal penalties are no joke. Sometimes it’s three months of interest. Sometimes it’s six. In some nasty cases, if you haven’t earned enough interest yet, the penalty can even eat into your original principal. You actually end up with less money than you started with. It’s rare, but it happens if you’re not careful with the fine print.

The Inflation Trap

Then there’s inflation. This is the silent killer. If your CD is paying you 4% but the price of eggs, rent, and gas is going up by 5%, you are technically losing purchasing power. You’ll have more "dollars" at the end of the term, but those dollars will buy fewer things. This is why financial advisors like Suze Orman often suggest being careful about locking up too much cash for too long when inflation is sticky.

No "Up" Side

If you lock in a 5-year CD at 3% and suddenly interest rates across the country jump to 6%, you’re stuck. You have "opportunity cost" regret. You’re watching everyone else earn more while you’re tethered to a rate from two years ago. It feels like staying at a party after the music has stopped.

The Different "Flavors" of CDs

Not all CDs are the same rigid box. Banks have gotten creative to keep people from jumping ship to high-yield savings accounts.

👉 See also: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

- No-Penalty CDs: These let you withdraw your money for free after a short initial period (usually 7 days). The catch? The interest rate is almost always lower than a traditional CD. You're paying for the exit door.

- Bump-Up CDs: If the bank raises its rates for new customers, you can ask them to "bump up" your rate to match. Usually, you can only do this once during the term.

- Step-Up CDs: These have a pre-scheduled interest rate increase. You start at 2%, then it goes to 3%, then 4%. It sounds great, but often the "blended" average rate is still lower than what you’d get with a standard fixed CD.

- Brokered CDs: You buy these through a brokerage like Charles Schwab or Fidelity instead of a bank. They often have higher rates and you can sell them on the secondary market if you need to leave early, though you might sell at a loss if rates have risen.

Strategy: The "Ladder" Method

If you’re worried about the cons—specifically the lack of access to your cash—the "CD Ladder" is the standard expert move.

Instead of putting $50,000 into one 5-year CD, you split it. You put $10,000 into a 1-year CD, $10,000 into a 2-year, and so on. Every year, one of those CDs "matures." When the 1-year CD ends, you reinvest that money into a new 5-year CD.

Eventually, you have a 5-year CD maturing every single year. This gives you a constant stream of available cash while still capturing the higher interest rates of long-term deposits. It smooths out the risk. It’s smart. It’s what the pros do to balance the CD certificate of deposit pros and cons without losing sleep.

Tax Implications You Might Forget

Uncle Sam wants his cut. Even if you don't withdraw the interest—even if the bank just adds it to the CD balance—you still owe taxes on it every year. The bank will send you a 1099-INT form.

This catches a lot of people off guard. They think, "I haven't touched the money, so I don't owe taxes." Wrong. You owe taxes on the interest in the year it was earned. If you're in a high tax bracket, that 5% rate might actually feel like 3.5% after the IRS is done with you. For this reason, some people prefer putting CDs inside an IRA (Individual Retirement Account) to defer those taxes.

✨ Don't miss: Big Lots in Potsdam NY: What Really Happened to Our Store

How to Actually Pick One

Don’t just walk into the bank down the street. Big traditional banks (the ones with the marble pillars and the fancy pens) usually have terrible CD rates. They don't need your money; they have plenty.

Look at online banks like Ally, Marcus by Goldman Sachs, or Capital One. Because they don't have to pay for thousands of physical buildings, they pass those savings on to you in the form of higher rates. Credit unions are also a goldmine. Local credit unions often run "specials" on weird terms—like a 7-month or 13-month CD—to hit their internal funding goals. These odd-term CDs often have the best rates in the building.

What Most People Get Wrong

The biggest myth is that CDs are only for old people. While it's true that retirees love them for the "fixed income" aspect, they are incredibly useful for anyone with a specific goal.

Are you buying a house in two years? Don't put that down payment in the stock market. A 10% dip in the S&P 500 could ruin your closing. Put it in a 2-year CD. You’ll get a guaranteed return and, more importantly, the money will definitely be there when the realtor calls.

Final Actionable Steps

Before you move a single dollar, do these three things:

- Calculate your "Peace of Mind" Number: How much cash do you need in a regular savings account for emergencies? Don't touch that. Only put the excess into a CD.

- Check the "Fine Print" on Penalties: Read the disclosure. Is the penalty 90 days of interest or 270? If you think there’s even a 20% chance you’ll need the money, go for a shorter term or a No-Penalty CD.

- Compare APY vs. Compounding Frequency: Look for "Daily Compounding." Some banks compound monthly or quarterly. Daily compounding means you earn interest on your interest faster, which adds up over a long term.

- Shop the "Odd" Terms: If a bank is offering a 5.0% on a 9-month CD but only 4.2% on a 12-month CD, take the 9-month. Banks run these "specials" to balance their books, and you can exploit that for better gains.

Deciding on a CD isn't about getting rich. It's about protecting what you've already worked hard to earn. Weigh the CD certificate of deposit pros and cons against your own timeline, and if the math works, lock it in. Just make sure you're okay with that money being "off-limits" until the timer hits zero.