Let’s be real for a second. Looking at college price tags feels a lot like staring at the sticker on a new car—you know nobody actually pays that "MSRP" number, but it’s still enough to make your stomach drop. When you start digging into tuition for Colorado Christian University, you’re going to see two very different worlds. There is the traditional undergraduate experience at the Lakewood campus, and then there’s the massive "College of Adult and Graduate Studies" (CAGS) which is mostly online. They don't cost the same. Not even close.

Trying to figure out your actual out-of-pocket cost is a bit of a puzzle. Honestly, it’s frustrating. You’ve got base tuition, then "student activity fees," then technology fees, and if you're living on campus, the housing costs in Lakewood (which is basically Denver) are... well, they’re high.

But here is the thing: CCU is a private, interdenominational Christian university. It doesn't get state funding like CU Boulder or CSU. That usually means a higher entry price, but it also means they have their own buckets of institutional aid that public schools can't touch.

The Breakdown: Traditional Undergraduate Costs

If you’re a high school senior or a transfer student looking for the "classic" college experience—dorms, Chapel, intramural sports, and hiking on the weekends—you are looking at the College of Undergraduate Studies (CUS). For the 2025-2026 academic year, the tuition for Colorado Christian University for full-time traditional students is roughly $40,300.

Wait. Don't close the tab yet.

That $40k is the "gross" price. According to CCU’s own financial aid data, nearly 100% of first-time freshmen receive some form of financial aid. Most students are seeing that number chopped down significantly by merit scholarships. If you have a high GPA or solid ACT/SAT scores, you might see $10,000 to $20,000 shaved off before you even look at federal grants.

Room, Board, and the Denver Factor

You have to live somewhere. CCU’s housing isn't your typical 1970s cinderblock cell. They have high-end apartment-style living, which is great for your quality of life but tough on the wallet. Budget at least $13,000 to $16,000 for room and board.

When you add the "mandatory fees"—which cover things like technology, security, and student activities—you’re looking at an "all-in" sticker price hovering around $56,000 to $58,000 per year.

🔗 Read more: Chuck E. Cheese in Boca Raton: Why This Location Still Wins Over Parents

It's expensive. I'm not going to sugarcoat that.

However, compared to other private Christian colleges like Pepperdine or Baylor, it’s actually somewhat mid-range. But if you’re comparing it to an in-state public school, it’s a leap. You are paying for a specific worldview-integrated education and a smaller community. For many families, that’s the value proposition.

The Online and Adult Reality

Now, if you are a 30-year-old nurse finishing a BSN or a veteran getting a business degree, the math changes completely. The College of Adult and Graduate Studies (CAGS) uses a "pay-as-you-go" model. You aren't paying $40k a year; you’re paying by the credit hour.

For most undergraduate online programs, the tuition for Colorado Christian University is currently $498 per credit hour.

Let's do some quick math. A standard 120-credit degree, if you started from zero, would cost you about $59,760 in total tuition. Most people don’t start from zero, though. CCU is notoriously "transfer-friendly." They take military credits, prior learning assessments, and even credits for "life experience" in some cases.

Why the Price Varies for Adults

Not all credits are created equal. If you are in the nursing program (BSN), expect to pay more—roughly $575 per credit. If you’re an active-duty military member, that price drops significantly to $250 per credit for undergraduate courses to match the Military Tuition Assistance cap.

It’s a smart move. It makes the school accessible to people who aren't sitting in a classroom at 10:00 AM on a Tuesday.

💡 You might also like: The Betta Fish in Vase with Plant Setup: Why Your Fish Is Probably Miserable

Hidden Costs People Forget to Mention

I’ve talked to enough students to know that the "Net Price Calculator" never tells the whole story.

- Books: CCU uses a lot of digital materials now, but you should still budget $1,000 a year.

- The "Colorado" Tax: If you move here from out of state for the Lakewood campus, you’re going to want to ski. Or hike. Or go to Red Rocks. Denver is pricey. If your budget is tight, the "social cost" of being a student in an expensive metro area is something to consider.

- Course-Specific Fees: Lab fees for science majors or clinical fees for nursing students can add $200-$500 per semester.

How to Actually Lower the Cost

You shouldn't pay full price. Seriously. If you’re looking at tuition for Colorado Christian University, your first move has to be the FAFSA (Free Application for Federal Student Aid). Even if you think your parents make too much money, do it anyway. It’s the gatekeeper for federal subsidized loans and the Pell Grant.

The Scholarship Tier System

CCU offers "Distinguished Achievement" scholarships. These are strictly merit-based.

- President’s Scholarship: This is the big one. It can cover a massive chunk of tuition.

- Deans and Trustees Scholarships: These usually range from $12,000 to $18,000 per year.

- Legacy Awards: If your parents or siblings went to CCU, there’s usually a small grant (around $1,000) waiting for you.

The CCU "Partner" Discount

This is a bit of a "pro-tip" for adult learners. CCU has partnerships with hundreds of corporations, churches, and non-profits. If you work for a partner organization, you might get a 10% to 20% discount on your tuition. It’s worth asking your HR department or the CCU admissions counselor if your employer is on that list.

Is it Worth the Investment?

This is the $60,000 question.

If you just want a piece of paper that says "Bachelor of Arts," you can find cheaper options at a community college or a large state school. You go to CCU because you want a specific environment. You want professors who start class with prayer and a curriculum that doesn't shy away from faith.

From a purely "business" perspective, look at the ROI. CCU’s nursing and education grads have very high placement rates. The "alumni network" in the Christian non-profit and business world is also a tangible asset.

📖 Related: Why the Siege of Vienna 1683 Still Echoes in European History Today

However, debt is real. Taking out $100,000 in loans for a degree in youth ministry is a recipe for a very stressful decade after graduation. You have to be pragmatic. Use the net price calculator, get your actual financial aid award letter, and then decide if the monthly payment is something you can live with.

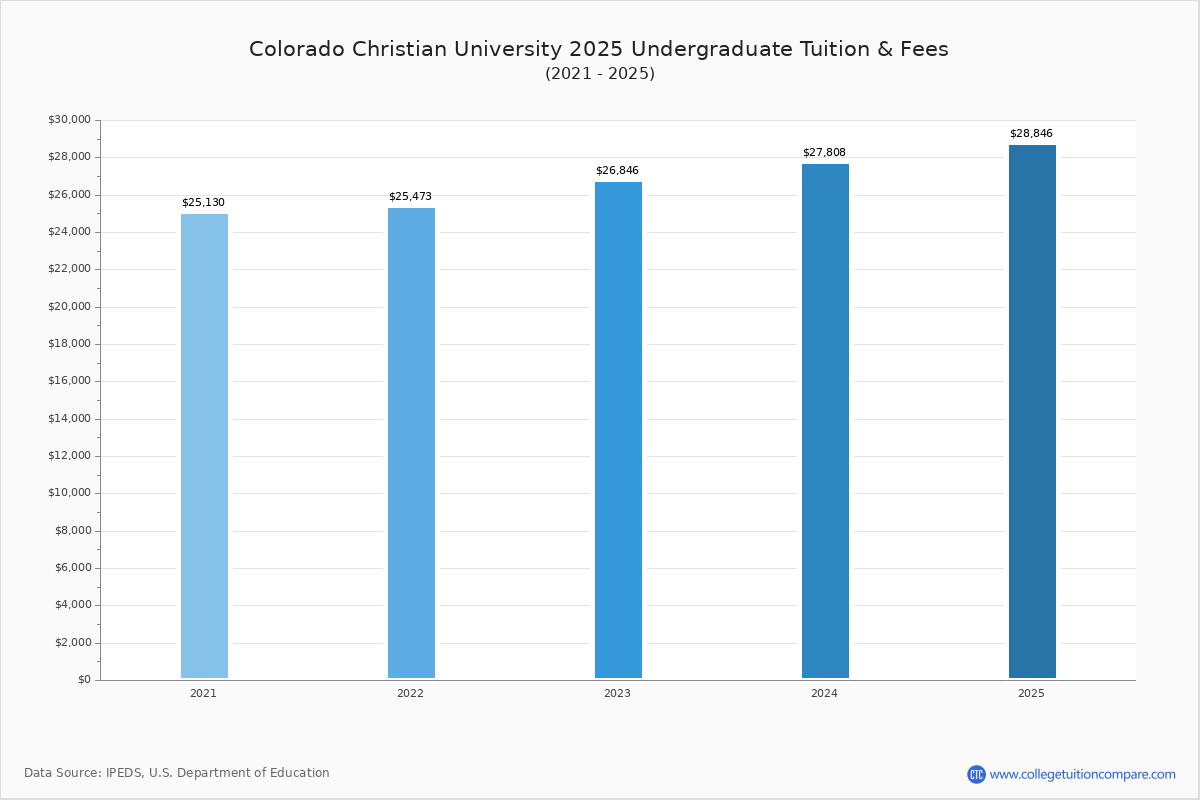

Nuance: The "Price Freeze" History

Interestingly, CCU has a history of trying to keep costs stable. For several years in the late 2010s and early 2020s, they actually froze tuition for the adult programs. While inflation has forced some increases recently, they tend to be more transparent about their hikes than many other private institutions.

They also offer a "Tuition Lockdown" for some programs where your rate is guaranteed not to increase as long as you remain continuously enrolled. That’s huge for planning a three-year or four-year degree.

Critical Next Steps for Prospective Students

Stop guessing. If you are serious about attending, you need hard numbers based on your specific financial situation.

- Submit the FAFSA early. Use the CCU school code (009401). This is the only way to see if you qualify for the Colorado Student Grant, which is essentially "free money" for state residents.

- Apply for the "Impact Scholarship." This often requires a separate application or an interview. It’s for students who show leadership potential in their churches or communities.

- Request a "Preliminary Transcript Evaluation." If you are an adult learner, send your unofficial transcripts to an admissions counselor. They will tell you for free how many credits will transfer. This is the fastest way to lower your total cost because the cheapest credit is the one you don't have to take.

- Compare the "Net Price," not the "Sticker Price." Take your total estimated cost, subtract all grants and scholarships, and that is your number. Compare that number—not the $40,300—to other schools.

- Look into the "Employment Study Program." This is CCU’s version of work-study. It’s not just about filing papers; many of these jobs are on-campus and can help shave a few thousand dollars off your room and board bill each year.

The tuition for Colorado Christian University is a significant investment, but for many, the culture and the specific academic focus justify the premium. Just make sure you go in with your eyes wide open and your FAFSA already filed. Don't let the sticker price scare you off until you see your actual financial aid package.

The most expensive mistake you can make is assuming you can't afford it before you even apply. Apply, see the package, and then run the numbers. That's the only way to make a smart decision.