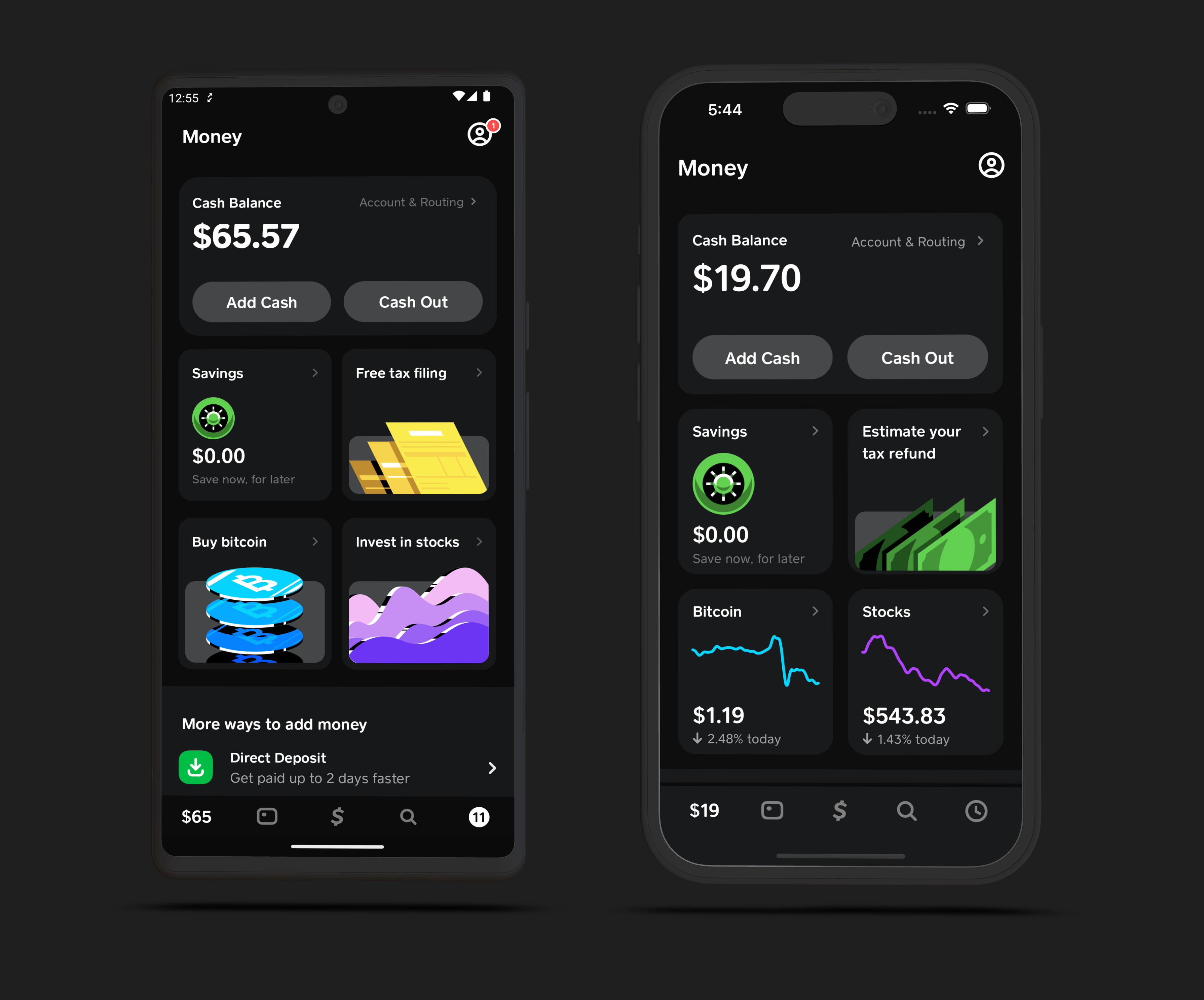

You've probably seen that neon-green icon on half the iPhones in the checkout line at Target or while splitting a massive sushi tab with friends. It’s ubiquitous. But honestly, most people are just scratching the surface of what Cash App for iPhone actually does these days. It isn’t just a Venmo clone anymore.

It’s a bank. It’s a brokerage. It’s a crypto wallet. And if you aren't careful, it's also a target for some of the most sophisticated phishing scams hitting iOS users right now.

Let's get real for a second. Apple has its own "Cash" feature built right into iMessage, yet millions of us still download Block Inc.’s app. Why? Because the ecosystem is sticky. Between the "Boost" rewards and the ability to buy fractional shares of Tesla while you're waiting for your latte, it has become a financial Swiss Army knife that feels more like a social network than a dusty banking app.

The iOS Experience: Why It Feels Different

The Cash App for iPhone version is specifically optimized for the Apple ecosystem in ways the Android version sometimes lags behind. If you're on an iPhone 15 or 16 Pro, you’ve likely noticed the haptic feedback when a payment goes through. It’s satisfying. But the real magic is the integration with FaceID.

Security is the big elephant in the room.

When you're sending $500 to a landlord, you want that biometric wall. iOS provides a "Secure Enclave"—a dedicated chip that keeps your FaceID data separate from the rest of the system—and Cash App taps into this natively. Most people forget to toggle on the "Security Lock" in the app settings, which is a massive mistake. If your phone is unlocked and someone grabs it, they can drain your balance in seconds unless you’ve forced that secondary FaceID check for every single outgoing cent.

Setting Up the Right Way

Don’t just link a debit card and call it a day.

✨ Don't miss: Why the Rooster 136 is Still the Best Entry-Level Mechanical Keyboard You Can Buy

If you want to use Cash App for iPhone like a pro, you need to understand the distinction between your linked bank and your Cash Balance. Your Cash Balance is held at partner banks like Sutton Bank or Wells Fargo. It’s FDIC insured, but only if you’ve gone through the identity verification process. If you haven't uploaded your ID, you're essentially playing with a digital gift card that has very few legal protections.

- Open the app and tap the Profile Icon.

- Hit "Security & Privacy."

- Toggle on "Lock Mode." This is non-negotiable.

The "Boost" Hack Nobody Mentions

Everyone knows about the Cash Card—the physical Visa you can order. But the "Boosts" are where the actual value stays. These are instant discounts. We aren't talking about "cash back" that arrives in thirty days. We're talking about 10% off at Starbucks or $5 off a grocery run, applied the second you swipe.

On iPhone, you can add your Cash Card to Apple Wallet. This is huge.

You get the Boost rewards even when using Apple Pay on your Apple Watch or iPhone. You don't even need the plastic card in your pocket. Just make sure the Boost is "activated" in the app before you tap your phone at the terminal. I’ve seen people lose out on hundreds of dollars a year simply because they forgot to tap that "Activate" button in the app five seconds before paying.

It’s annoying, sure. But it’s free money.

Investing for People Who Hate Math

Cash App basically turned the stock market into a game. You can buy $1 of Berkshire Hathaway. That’s wild. For iPhone users, the interface is incredibly clean, showing you sparklines of your portfolio’s performance over the last day, week, or year.

But here is the catch: the fees.

While buying stocks is generally "commission-free," the "spread"—the difference between the buy and sell price—can sometimes be slightly wider than what you'd find on a dedicated platform like Fidelity. And Bitcoin? Don't even get me started on the volatility. If you’re using Cash App for iPhone to trade BTC, you’re paying for convenience. There are cheaper ways to buy crypto, but there aren't many easier ways.

When Things Go Wrong (And They Will)

Let’s talk about the "Accidental Send."

We've all been there. You type in "$cashtag" and send $200 to "JohnDoe" instead of "John_Doe." On an iPhone, the UI is so fast it’s almost a liability. Once that money hits another person's account, it is gone. Cash App is not a credit card. You cannot just "chargeback" a peer-to-peer payment.

The support team at Block Inc. is notoriously difficult to reach via phone. They prefer the in-app chat. If you get scammed, your best bet isn't calling a random 1-800 number you found on Google—those are almost always fake "support" scams designed to steal your login—it's using the official "Support" tab within the app itself.

Real talk: If a stranger sends you $100 "by accident" and asks you to send it back, don't. It's a classic "stolen card" scam. They send you money from a compromised account, you send them "clean" money from your balance, and then a week later, the original $100 is clawed back by the bank, leaving you out of pocket. Just leave the money there and tell them to contact support to reverse it.

The iPad Limitation

Wait, can you use it on an iPad?

Sorta. There isn't a native "iPadOS" version of Cash App that takes advantage of the big screen. You're just running the iPhone app scaled up. It looks a bit goofy, but it works. However, for security reasons, you can really only have your account active on one primary device at a time without triggering fraud alerts. Stick to your iPhone.

Taxes and the IRS (The Boring but Vital Part)

Since the tax law changes regarding 1099-K forms, the IRS is looking closer at digital payments. If you're using Cash App for iPhone to run a small business—like selling vintage clothes or freelance graphic design—you need a "Business Account."

If you use a personal account for business transactions and hit the threshold (which has been fluctuating between $600 and much higher amounts depending on the latest Congressional flip-flopping), Cash App will freeze your funds until you provide a Taxpayer Identification Number.

Be proactive. Keep your personal "splitting the pizza" money separate from your "I sold a couch on Craigslist" money.

Actionable Steps for iPhone Users

If you want to make sure your setup is airtight and optimized, do these three things right now:

- Enable the "Cash PIN": Go to your profile > Privacy & Security > Superior Security. This ensures that even if someone knows your iPhone passcode, they can't move your money without a second, different PIN.

- Check your "Request" settings: Set it so only "Contacts Only" can send you requests. This stops "AirDrop-style" spam where strangers blast payment requests to random $cashtags in crowded areas.

- Verify your Identity: Upload the photo of your driver’s license. It unlocks higher sending limits and, more importantly, ensures your balance is actually FDIC insured through their partner banks. Without this, you're essentially unbanked.

The power of Cash App for iPhone is the speed, but that speed is a double-edged sword. Use the biometric locks, take advantage of the Apple Pay integration for those "Boosts," and for the love of everything, double-check the $cashtag before you hit send. It’s a powerful tool, but it requires a bit of "digital hygiene" to keep your money where it belongs.