Honestly, if you’ve been following the climate tech world for a while, carbon capture always felt like that "cool project" that was forever five years away. It’s been a cycle of big promises, pilot plants that underperformed, and a whole lot of PowerPoint slides. But things look different this morning.

Just today, January 13, 2026, the industry took a massive leap from theory into actual business. Bain & Company—yeah, the global consulting giant—just signed a deal to buy 9,000 metric tons of carbon removal credits from 1PointFive’s Stratos facility. This isn't just another press release. It’s part of the carbon capture ccs news today that shows the money is starting to flow toward high-integrity, permanent removals rather than just cheap forest offsets that might burn down next summer.

The Stratos plant in Ector County, Texas, is basically the "poster child" for this shift. It’s currently winding through its startup phase, aiming to be the biggest Direct Air Capture (DAC) facility on the planet. We're talking about pulling 500,000 tons of $CO_2$ out of the sky every year. To give you some scale, that's like taking 100,000 cars off the road. Every. Single. Year.

What’s Actually Happening with CCS Right Now?

You might hear people say CCS is "unproven."

That’s kinda true and kinda not. If you look at the Global Status of CCS 2025 report that just came out, there are now 77 projects operating globally. That’s a 30% jump in capacity since 2017. But the real carbon capture ccs news today isn't just about the number of plants; it’s about who is running them and who is paying for them.

ExxonMobil is currently the heavy hitter here. They aren't just playing around with lab tubes anymore. They’ve locked in contracts for roughly 9 million metric tons of $CO_2$ per year with third-party customers. They're building what they call an "end-to-end" system. Basically, they capture the gas at a factory in Louisiana or Texas, shove it through their existing 1,300 miles of pipeline, and bury it deep in the Gulf Coast.

📖 Related: Why Doppler 12 Weather Radar Is Still the Backbone of Local Storm Tracking

The 2026 Startup Surge

We are entering a massive "on-stream" year. Several big projects are hitting their start-up dates right now:

- Linde (Beaumont, TX): Aiming for 2.2 million tons per year.

- CF Industries (Donaldsonville, LA): Targeting 2.0 million tons.

- Nucor (Convent, LA): Getting ready to capture 0.8 million tons.

These aren't tiny experiments. These are industrial-scale operations that are supposed to prove whether this tech can actually scale without breaking the bank.

The Problem Nobody Likes to Talk About

Look, let’s be real. CCS has a "trust" problem.

Critics, like those at the IEEFA, point out that almost no CCS project has ever hit its 100% target capture rate. Most hover around 80%. There's also the "business as usual" argument—that oil companies are just using CCS as a hall pass to keep pumping oil.

Then there's the cost. Capturing carbon from the air is still wildly expensive. We’re talking $600 to $800 per ton in some cases. For this to actually save the planet, we need that number to drop closer to $100.

👉 See also: The Portable Monitor Extender for Laptop: Why Most People Choose the Wrong One

A Nanotech Breakthrough?

There is some light at the end of the tunnel, though. Engineers at MIT recently developed a new nanofiltration membrane. This thing is designed to stop ions from mixing and creating water during the capture process. If it works at scale, it could make CCS systems six times more efficient and cut costs by 30%.

That’s the kind of tech shift that changes the "why" of carbon capture from "because we have to" to "because it actually makes financial sense."

Why the EU Just Changed the Game

While the US is focused on tax credits (the famous 45Q credits that pay companies to bury carbon), Europe is taking a different route.

As of January 1, 2026, the EU’s Carbon Border Adjustment Mechanism (CBAM) is officially in force. This is basically a "green tariff." If you want to sell steel or cement into the EU, and you made it in a way that spewed tons of carbon, you’re going to get hit with a massive fine.

This has sent a shockwave through the global supply chain. Suddenly, if you’re a steel mill in China or a fertilizer plant in the US, you need CCS. Not because you're trying to be "green," but because your exports will be too expensive if you don't.

✨ Don't miss: Silicon Valley on US Map: Where the Tech Magic Actually Happens

The Reality of Storage

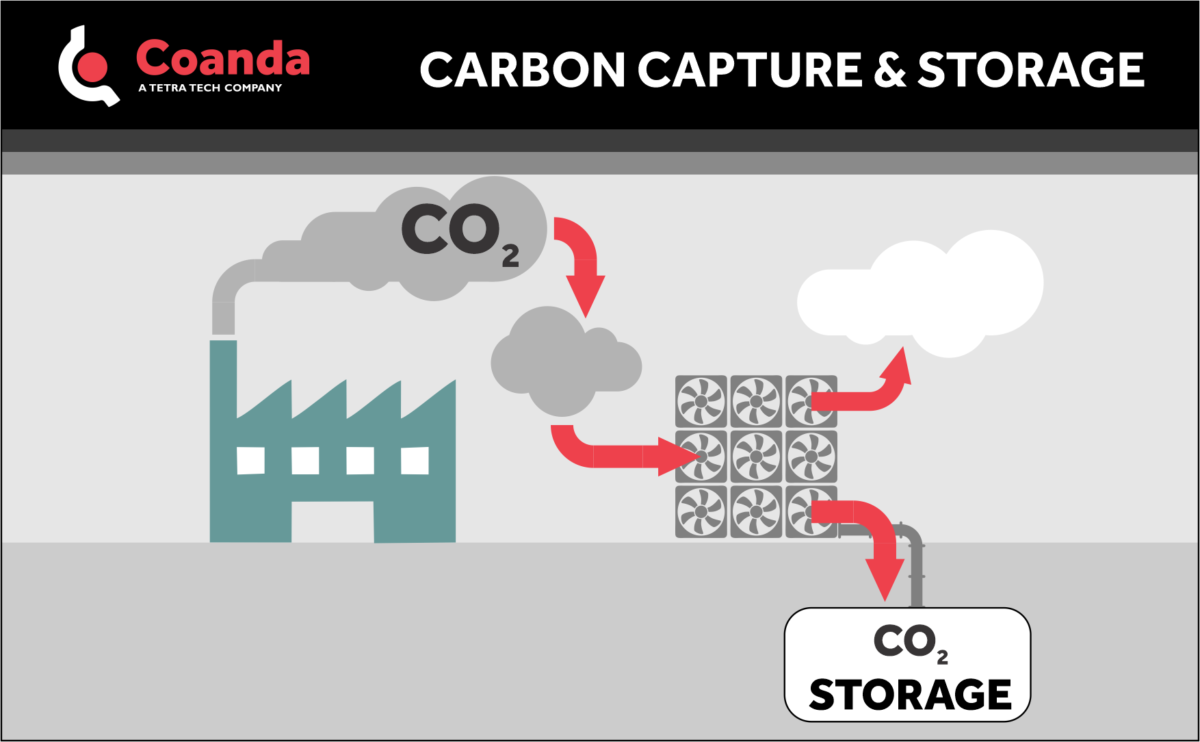

Capturing the carbon is only half the battle. You have to put it somewhere.

This is where the local news gets messy. Just this morning, news broke that a Louisiana lawmaker is proposing new bills to strictly regulate where these $CO_2$ pipelines go. People are worried about leaks. In Alabama, a watershed authority just moved to block a storage project over concerns about groundwater safety.

This "Not In My Backyard" (NIMBY) sentiment is the single biggest threat to CCS. You can have the best technology in the world, but if you can't get a permit to bury the gas, the whole system grinds to a halt.

Actionable Insights: What You Need to Watch

If you’re looking at carbon capture ccs news today to figure out where the industry is headed, keep your eye on these three things:

- The "Stratos" Milestone: Watch if 1PointFive actually hits its 500,000-ton target by the end of the year. If they do, the DAC market will explode. If they don't, investors might get cold feet.

- The Methane Disclosure: ExxonMobil claims they’ll hit their 2030 methane reduction targets this year—four years early. Watch their 2026 filings. This will be a huge indicator of whether "Big Oil" is actually cleaning up its act or just marketing.

- The CBAM Expansion: The EU is already talking about expanding their carbon tax to include machinery and appliances by 2028. This means the pressure to decarbonize is moving further down the consumer line.

Carbon capture isn't a "silver bullet." It's more like a "silver buckshot"—one small part of a much larger, much messier solution. But for the first time in a decade, the "news today" is about actual tons being captured and actual checks being written.

Next Steps for Implementation

- Audit your supply chain for high-carbon materials (steel, aluminum, cement) that will be impacted by the EU's CBAM tariffs in 2026.

- Evaluate carbon removal providers based on "permanence" metrics (look for 10,000-year storage guarantees like those offered by Climeworks or 1PointFive).

- Monitor Class VI injection permit approvals in your local region via the EPA dashboard to gauge the progress of regional carbon hubs.