You’re standing in line at a grocery store. The person in front of you is fumbling with three different plastic cards, looking visibly stressed because they can't remember which one has the balance to cover a $40 steak. Honestly, it’s painful to watch. Especially when you know that half the stuff people think they need a physical wallet for has basically been moved into their phone.

But here is the thing. Most people treat their banking apps like a digital filing cabinet. They log in, squint at a balance, maybe pay a bill, and then close it. If that’s how you're using the Capital One mobile app, you’re kind of missing the point. It’s not just a window into your bank account; in 2026, it has become a weirdly smart financial bodyguard that does things your local branch manager never could.

The Eno Factor: More Than Just a Chatbot

Let's talk about Eno. Most bank "assistants" are just glorified FAQ search bars that make you want to hurl your phone across the room. Eno is different. It’s built into the Capital One mobile app to act more like a second set of eyes on your money.

📖 Related: JBL Charge Essential 2: What Most People Get Wrong About This Speaker

I remember a specific instance where a friend got a notification from the app while we were at lunch. It wasn't a "you spent money" alert. It was Eno pointing out that a subscription she thought she canceled six months ago had just charged her again. That’s the "surprising charges" feature. It looks for duplicates, weirdly high tips at restaurants, or those "gotcha" price hikes on your internet bill.

Virtual Cards are the Real MVP

One feature that people constantly overlook is the ability to generate virtual card numbers. If you’re shopping on a site that looks a little "sketchy" or you just don't want your real digits floating around the dark web, you can create a unique number for that specific merchant.

If that merchant gets hacked? No big deal. You just delete that virtual card in the Capital One mobile app. Your actual physical card stays perfectly safe in your pocket. It’s a level of security that feels almost paranoid in a good way.

Why CreditWise is Addictive (In a Good Way)

Most of us have a love-hate relationship with our credit scores. It feels like a mysterious grade given by people who don't know us. But Capital One tucked CreditWise right into the main dashboard.

It uses the VantageScore 3.0 model from TransUnion. Is it exactly what a mortgage lender sees? Maybe not perfectly, but it’s close enough to be a vital compass.

- The Simulator: You can actually "test" financial moves. Want to see what happens if you close that old card you never use? Punch it into the simulator.

- Dark Web Monitoring: It’s a bit spooky, but the app scans for your Social Security number or email address in places they shouldn't be.

- Real-time Alerts: If a new account is opened in your name, you’ll know before the ink is dry on the application.

The Stuff Nobody Tells You

There’s this weird misconception that the Capital One mobile app is only for credit card junkies. That's just wrong. If you have a 360 Checking or Savings account, the app is basically your remote control for those funds.

You can do the standard "snap a photo of a check" thing, which honestly feels like magic even though we’ve been doing it for years. But the "Add Cash in Store" feature is the real sleeper hit. You can literally walk into a participating retailer (like CVS or Walgreens), show a barcode in your app, hand the cashier actual paper money, and it shows up in your 180 checking account. No ATM required.

The "Card Lock" Panic Button

We’ve all had that heart-stopping moment where you reach for your wallet and it’s not there. Instead of calling customer service and waiting on hold for twenty minutes to cancel your card, you just toggle the "Lock" switch in the app.

Found it under the car seat five minutes later? Toggle it back on. No harm, no foul, and no need to wait 7-10 business days for a new piece of plastic to arrive in the mail.

Navigating the Interface

Look, no app is perfect. Sometimes the Capital One mobile app feels a little crowded because they keep stuffing more features into it. There are shopping offers, travel portals, and insurance perks all competing for your attention.

But the "Zelle" integration is smooth. Sending money to a friend for pizza takes about four taps. And if you’re someone who likes to organize, you can actually reorder your account tiles. It sounds small, but putting your most-used account at the very top makes a massive difference when you’re trying to check a balance while juggling a toddler and a bag of groceries.

👉 See also: macOS Tahoe: Why the New Mac Software Update is Kinda Polarizing

Is It Actually Secure?

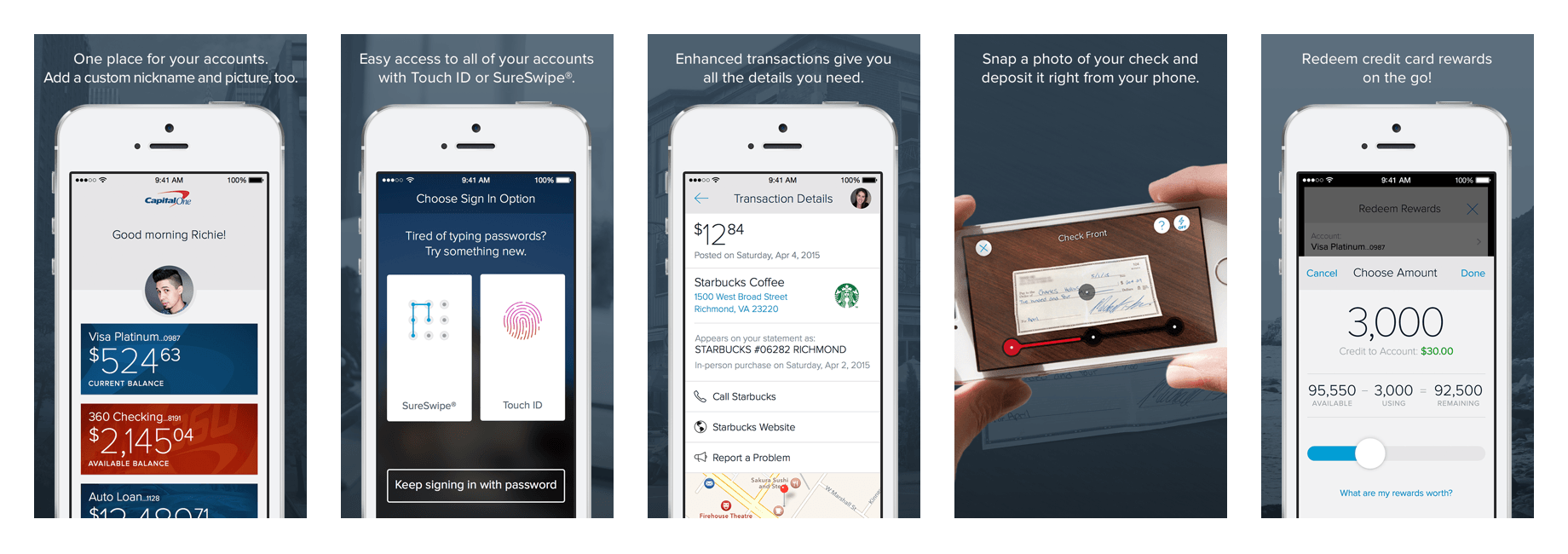

Security is the big elephant in the room. Capital One uses SureSwipe—where you trace a pattern—alongside the standard FaceID and fingerprint stuff.

But the real security is the "Mobile App Verification." When you try to log in from a new computer, instead of waiting for a flaky SMS code that might get intercepted, the app sends a push notification to your "trusted" device. You just tap "Yes, it's me." It’s faster and significantly harder for hackers to spoof.

Actionable Steps for Power Users

If you want to actually get the most out of this tool, stop just "checking your balance."

First, go into your profile and set up Instant Purchase Notifications. Knowing the exact second a charge hits your account is the best defense against fraud. Second, spend ten minutes in the CreditWise simulator to see how your utilization ratio is affecting your score. You might find that paying down a specific balance by just $200 jumps your score significantly.

🔗 Read more: Alphanumeric Explained: What These Characters Actually Mean for Your Digital Life

Finally, check the Shopping Offers before you buy anything major online. Often, there’s a 5% or 10% statement credit hiding in there for stores you’re already using. It's essentially free money that most people leave on the table because they can't be bothered to click a link.

Don't just let the app sit there. Use the virtual cards for your next "free trial" and see how much less you worry about being charged when the trial ends. Manage your money like it's 2026, because it is.