You’re standing in line at a grocery store, the person behind you is breathing down your neck, and you realize you haven’t moved money into your checking account to cover the $80 worth of organic kale and oat milk sitting on the conveyor belt. Ten years ago, you’d be sweating. Today, you just pull out your phone. The capital one app iphone experience has become so ubiquitous that we barely think about the engineering wizardry happening between the biometric sensor and the bank's mainframe. It’s just there.

But honestly, most people are using maybe 10% of what this piece of software actually does.

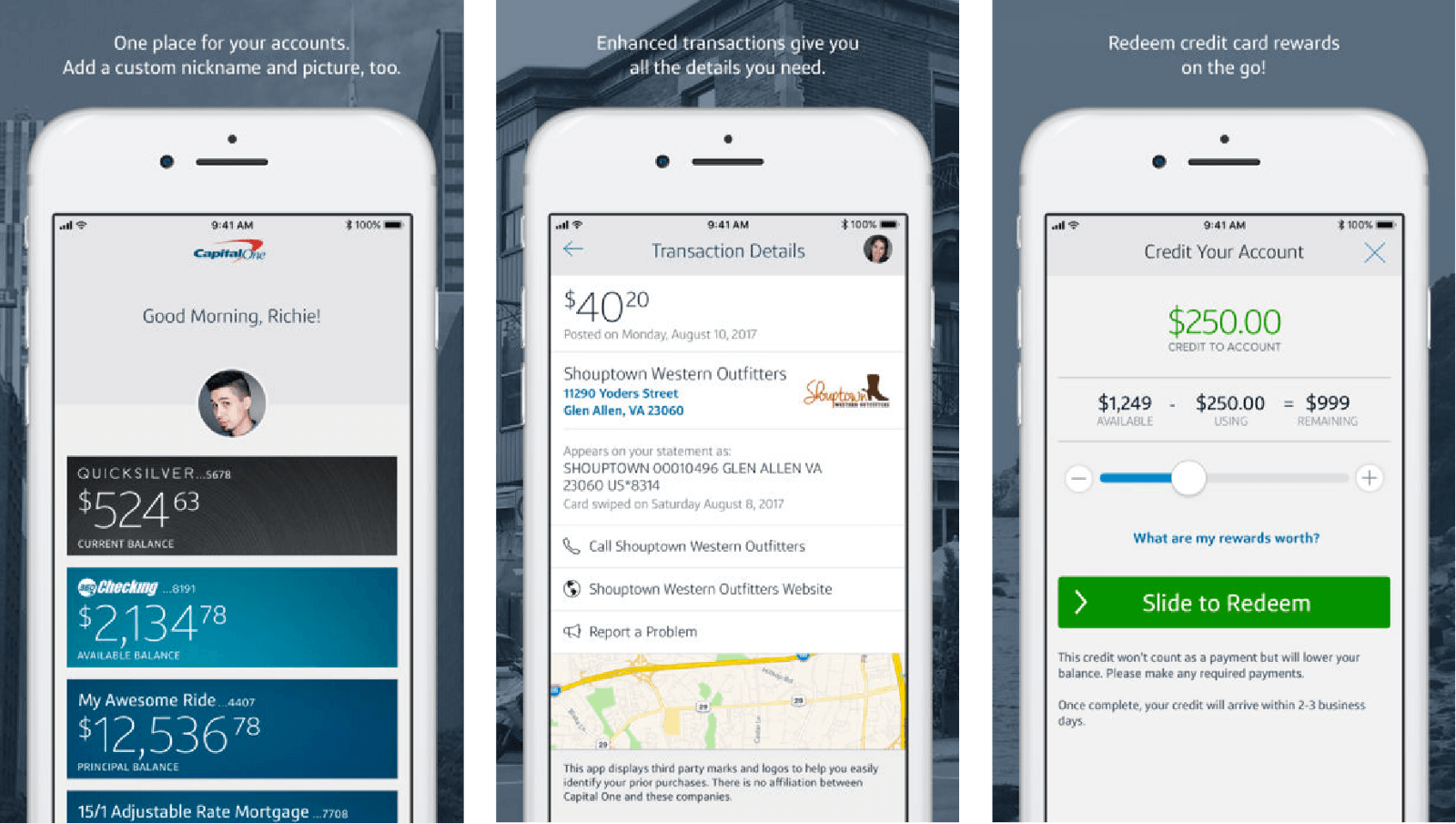

Managing money on iOS has changed. It isn't just about checking a balance anymore; it’s about how Apple’s specific hardware ecosystem—the Secure Enclave, the Taptic Engine, and that vibrant OLED screen—interacts with your credit card data. Capital One has leaned harder into the Apple ecosystem than almost any other major "big bank," and that’s why the app usually sits near the top of the App Store charts with millions of reviews.

What’s Actually Under the Hood of the Capital One App iPhone Version?

If you've used the app on an old iPhone 8 versus a brand-new iPhone 15 or 16 Pro, the difference is jarring. Speed matters. Capital One’s developers have clearly prioritized "native" feeling interactions. When you swipe to pay a bill, the haptic feedback feels intentional. It’s not just a buzz; it’s a tactile confirmation that your money moved.

One thing people get wrong is thinking the app is just a wrapper for their website. It’s not. The iOS version is built to leverage FaceID almost instantly. Most of us take for granted that we can glance at our phones and see our Venture X or Quicksilver balance without typing a single character. This uses the iPhone’s Secure Enclave, meaning Capital One never actually "sees" your face data; they just get a digital "thumbs up" from iOS that you are who you say you are.

Then there’s the Apple Watch integration. It’s a bit of a sleeper hit. You can check your remaining credit limit or recent transactions on your wrist while jogging. Is it essential? Probably not. Is it convenient when you’re trying to remember if that subscription hit your account yet? Absolutely.

The Eno Factor: More Than Just a Bot

We need to talk about Eno. Capital One’s assistant isn't just a generic chatbot that loops you into a cycle of "I don't understand that." On the iPhone, Eno acts as a push-notification powerhouse.

It’s kinda creepy but mostly helpful. Eno watches for "double charges" or "unusual tips." If you go to a restaurant and the server accidentally fat-fingers a $200 tip instead of $20, Eno sends a notification to your iPhone lock screen. You can tap it, see the discrepancy, and deal with it before the transaction even clears. Most banking apps just let the charge happen and make you fight it three days later.

Real-World Security: Beyond the Password

Security on the capital one app iphone is less about the password and more about the "Card Lock" feature. This is the ultimate "I lost my wallet at the bar" panic button.

Open the app.

Tap your card.

Toggle the "Lock" switch.

Instantly, the card is dead to the world. If you find your wallet under the passenger seat of your car ten minutes later, you just toggle it back on. No need to call a 1-800 number and wait on hold for twenty minutes listening to smooth jazz while someone in a call center verifies your mother's maiden name.

Virtual Cards and the Apple Pay Connection

This is where the iPhone's specific tech shines. Capital One allows you to generate virtual card numbers via Eno. This is huge for those sketchy websites where you don't really trust the payment processor. You get a unique number, use it once, and then delete it.

Moreover, adding your Capital One card to Apple Wallet directly from the app is seamless. You don't have to take a photo of the card like it's 2015. You just tap a button in the Capital One interface, and it pushes the tokenized data to Apple Pay. It’s secure because the actual card number isn't stored on the phone or sent to the merchant. It’s all tokens.

Why the Interface Doesn't Feel Like a "Bank"

Banks are usually boring. They use corporate blues and greys and fonts that look like they were designed for a 1990s law firm. Capital One’s iOS design language is different. It uses a lot of white space, bold typography, and intuitive iconography.

- The "Spending" wheel gives a visual breakdown of where your money went (usually "Food & Drink" for most of us).

- CreditWise is baked directly into the app, so you can see your TransUnion credit score without a separate login.

- Rewards redemption is a two-tap process. If you want to erase a travel purchase with miles, you just tap the transaction and hit "Redeem."

It’s built for the "swipe" generation. It feels more like Instagram for your money than a financial ledger. Some purists might find it too flashy, but for the average person trying to manage a budget on the subway, it’s exactly what’s needed.

The Limitations: It’s Not All Sunshine

No app is perfect. The capital one app iphone can sometimes feel cluttered because they try to cram everything in. You’ve got your checking, savings, credit cards, auto loans, and investment accounts all in one feed. If you only have one credit card, the UI feels clean. If you have five different accounts, it can get a bit noisy.

Also, the "Zelle" integration inside the app can occasionally be finicky on iOS if your contact list isn't synced perfectly. It’s a common gripe in tech forums. Sometimes the app requires a full force-close and restart after an iOS update to get the biometric login to "stick" again. It’s a minor annoyance, but when you're trying to pay someone back for pizza, it feels like an eternity.

The Impact of iOS Updates

Whenever Apple drops a new version of iOS, Capital One is usually in the first wave of updates. They were early adopters of Dark Mode, which honestly saves your eyes when you’re checking your balance at 2 AM wondering why you bought that thing on late-night TV. They also utilize "Live Activities" occasionally for certain tracking features, keeping you updated on the status of a dispute or a card delivery right on your Lock Screen.

Actionable Steps for Power Users

If you want to actually get the most out of your iPhone’s banking setup, don't just use it to check your balance.

📖 Related: Getting the Most Out of the Apple Store Greenwich Avenue: What Locals Actually Need to Know

- Enable Push Alerts for Every Transaction: Go into the app settings and turn on notifications for every cent spent. It’s the fastest way to catch fraud. You’ll know your card was skimmed at a gas station before you’ve even pulled out of the parking lot.

- Set Up Autopay via the App: Don't rely on memory. The mobile interface makes it easy to set up "Amount Due" or a fixed monthly payment.

- Use the "Shared Access" Feature: If you have a partner or a kid who needs to see the account but shouldn't have full control, you can manage those permissions directly from your iPhone.

- Check CreditWise Weekly: Since it's free and built-in, use it to monitor for identity theft. The iPhone app will ping you if a new inquiry hits your credit report.

- Download Statements as PDFs: If you’re applying for a mortgage or a rental, you can generate and "Share" a PDF statement directly to an email or a cloud drive using the native iOS Share Sheet. No printer required.

The reality is that your phone is your wallet now. The capital one app iphone experience is a benchmark for how mobile banking should function—fast, tactile, and deeply integrated into the hardware it sits on. It turns a chore into a quick habit. By utilizing the biometric security and Eno's proactive monitoring, you're essentially putting a high-end security guard and an accountant in your pocket.

Keep your app updated. iOS evolves fast, and the security patches bundled into these updates are your first line of defense against increasingly sophisticated mobile threats. Check your "Spending" tab once a week to stay grounded, and use the "Lock Card" feature the second you can't find your wallet. Simple habits, powered by good software, make a massive difference in your financial health.