You’ve seen the charts. If you’ve been following the canopy growth stock price, you know it looks less like a steady climb and more like a heart rate monitor in a high-speed chase. Honestly, the volatility is enough to give any retail investor a headache. But if you’re looking at that $1.20 to $1.30 range in early 2026 and thinking it’s just another "penny stock" story, you’re missing the actual drama happening behind the scenes at the Smith Falls headquarters.

It’s easy to get cynical. Most people do. They see a company that once traded at massive premiums now sitting in the bargain bin. But the reality of January 2026 is miles away from the hype-fueled bubble of 2018 or the "dark days" of 2023.

The Reality of the Canopy Growth Stock Price Today

Right now, we are seeing a massive tug-of-war. On one side, you have the "sell the news" crowd who got bored after the initial spike from President Trump’s December 2025 executive order on rescheduling. On the other, you have a company that just pulled off a financial magic trick.

On January 8, 2026, Canopy announced a strategic recapitalization that basically saved their skin. They didn't just borrow money; they restructured their whole existence. They secured a $150 million credit facility and pushed their debt maturities out to 2031.

That’s a big deal.

A year ago, analysts were whispering about "going concern" warnings. Now? The company has roughly C$425 million in cash on hand. It’s a complete 180. The market cap is sitting around $417 million to $450 million depending on the hour, which is a far cry from the billions of yesteryear, but it’s arguably the healthiest the balance sheet has looked in years.

Why the $2 Mark is the New Battleground

Most traders are staring at that $2 ceiling. The Motley Fool and other outlets have been debating whether it's a "falling knife" or a "coiled spring." In mid-January 2026, the stock has been hovering around $1.22.

- The Trump Factor: The executive order to move cannabis to Schedule III was a massive psychological win. But implementation at the DEA is slow. The "implementation lag" is what's keeping the price suppressed right now.

- Revenue Growth: In their Q2 fiscal 2026 report, they actually showed a 6% revenue increase to $67 million.

- The US Entry: Canopy USA is now fully operational. This is their vehicle to finally own Acreage, Wana, and Jetty.

The market is currently pricing Canopy as a "maybe." It's no longer priced for bankruptcy, but it's certainly not priced for a US takeover yet. That gap—that "maybe"—is where the current volatility lives.

What's Actually Moving the Needle in 2026?

It’s not just about some guy in a suit saying "weed is legal." It's about the math.

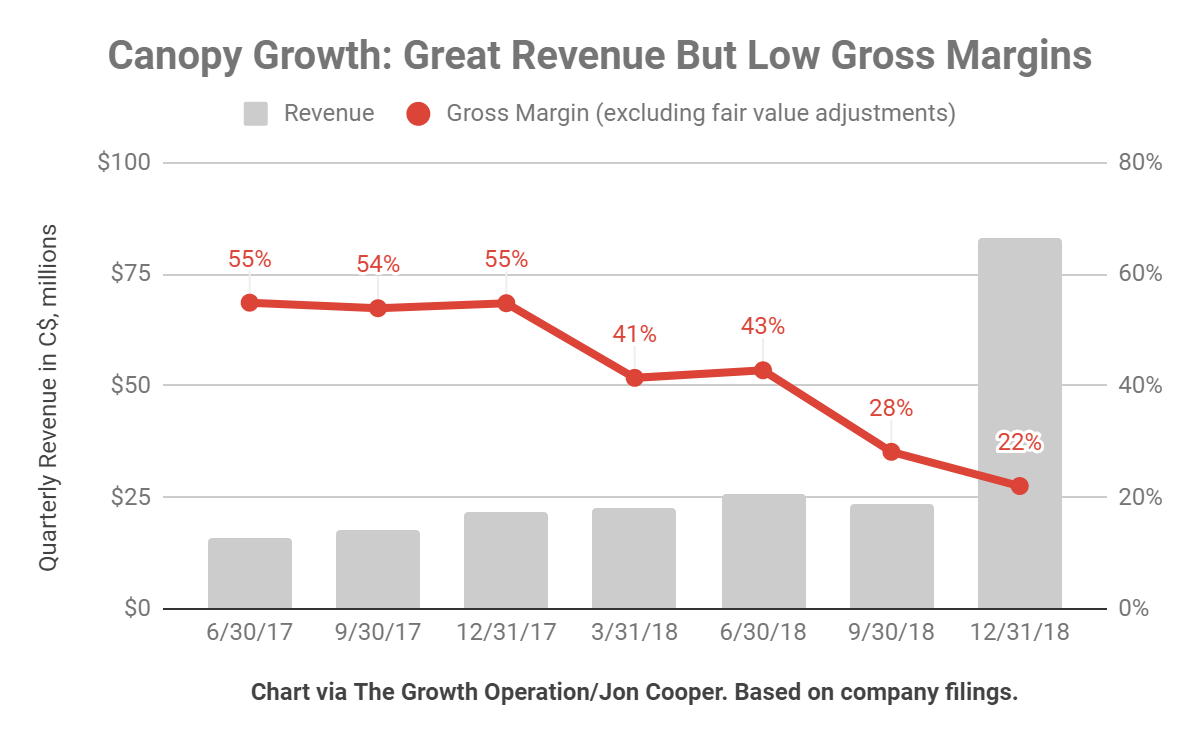

The company's gross margins jumped to 33% in late 2025. That’s a huge improvement from the low 20s we saw previously. They’ve been cutting costs like crazy—SG&A expenses dropped 13% because they finally stopped spending like drunken sailors.

But here is the kicker: International markets are still a mess. While the Canadian adult-use revenue grew by a staggering 30%, their international business tanked by 39% due to supply chain nightmares in Europe. You can't just look at the Canadian growth and ignore the fact that Germany and the rest of the EU are proving harder to crack than expected.

CEO Luc Mongeau is betting the farm on "high-value" segments. They’ve pivoted heavily toward medical cannabis and vapes. The 7ACRES and Tweed brands are carrying the weight right now, specifically with those infused pre-rolls that everyone seems to be buying.

The Elephant in the Room: Rescheduling

Let's talk about that December executive order. It didn't "legalize" anything. It just told the Attorney General to hurry up.

If you're tracking the canopy growth stock price, you have to understand the tax implications of Schedule III. Currently, Section 280E of the tax code prevents cannabis companies from deducting normal business expenses. It’s a death sentence for profits. If rescheduling actually crosses the finish line in 2026, Canopy’s US assets suddenly become 30-40% more profitable overnight.

That is the "moonshot" everyone is waiting for.

Is the Current Price a Value Play or a Trap?

Sorta depends on your stomach for risk. Honestly, if you're looking for a safe "set it and forget it" index fund vibe, this isn't it.

The stock has a 52-week range of $0.77 to $2.90. We are currently sitting right in the middle of that. Some analysts, like those at Piper Sandler, have kept a "Sell" rating with a $2 target, which is ironic because the target is higher than the current price. It shows they expect a bounce but don't trust the long-term story.

Meanwhile, the "Moderately Bullish" activity on TipRanks suggests that the recent debt restructuring has cleared the path for a mid-year rally.

Critical Data Points for Investors:

- Cash Position: C$425 million (post-recapitalization).

- Debt Maturity: Extended to 2031 (massive breathing room).

- Revenue Driver: Canadian adult-use is up 30%.

- Risk Factor: DEA delays on rescheduling and SAFER Banking stalling in the Senate.

Actionable Insights for Watching the Ticker

If you're holding or thinking about jumping in, stop watching the daily noise. It’ll drive you crazy. Instead, watch these three specific things:

First, keep an eye on the DEA's public hearing schedule for rescheduling. Any official date for a final rule will likely cause a double-digit percentage move in the stock.

Second, look at the Q3 fiscal 2026 earnings report coming in February. Specifically, check if that 30% growth in Canada is holding or if it was just a one-time spike from new product launches like the All-In-One vapes.

Third, watch the "Canopy USA" integration. If they officially close the MTL Cannabis Corp acquisition and start showing consolidated US revenues, the "Canadian LP discount" might finally start to disappear.

📖 Related: Exchange Rate Dollar to MYR: Why Your Ringgit Isn't Going as Far as It Used To

The canopy growth stock price is no longer just a meme. It’s a real company trying to survive a transition from a subsidized hype-beast to a lean, mean, US-focused operator. It’s messy, it’s risky, and it’s definitely not for the faint of heart, but for the first time in three years, they actually have the cash to fight the battle.

Next Steps for Investors:

- Verify the "Going Concern" Status: Check the latest SEC filings to confirm that the January recapitalization has officially removed the liquidity warnings.

- Monitor the 280E Tax Status: Track the Federal Register for the final rule on Schedule III, as this is the primary catalyst for valuation re-rating.

- Assess Portfolio Risk: Ensure any position in CGC is sized appropriately for a high-volatility sector, as the stock frequently experiences 5-10% swings in a single trading session.