Honestly, if you’re waiting for the Bank of Canada to drop a bombshell this month, you might want to find a new hobby. The target for the overnight rate is sitting at 2.25% right now. It has been there since late October 2025. And according to almost every signal coming out of Ottawa, it’s not going anywhere on January 28, 2026.

Tiff Macklem is basically telling us the "easy" cuts are over.

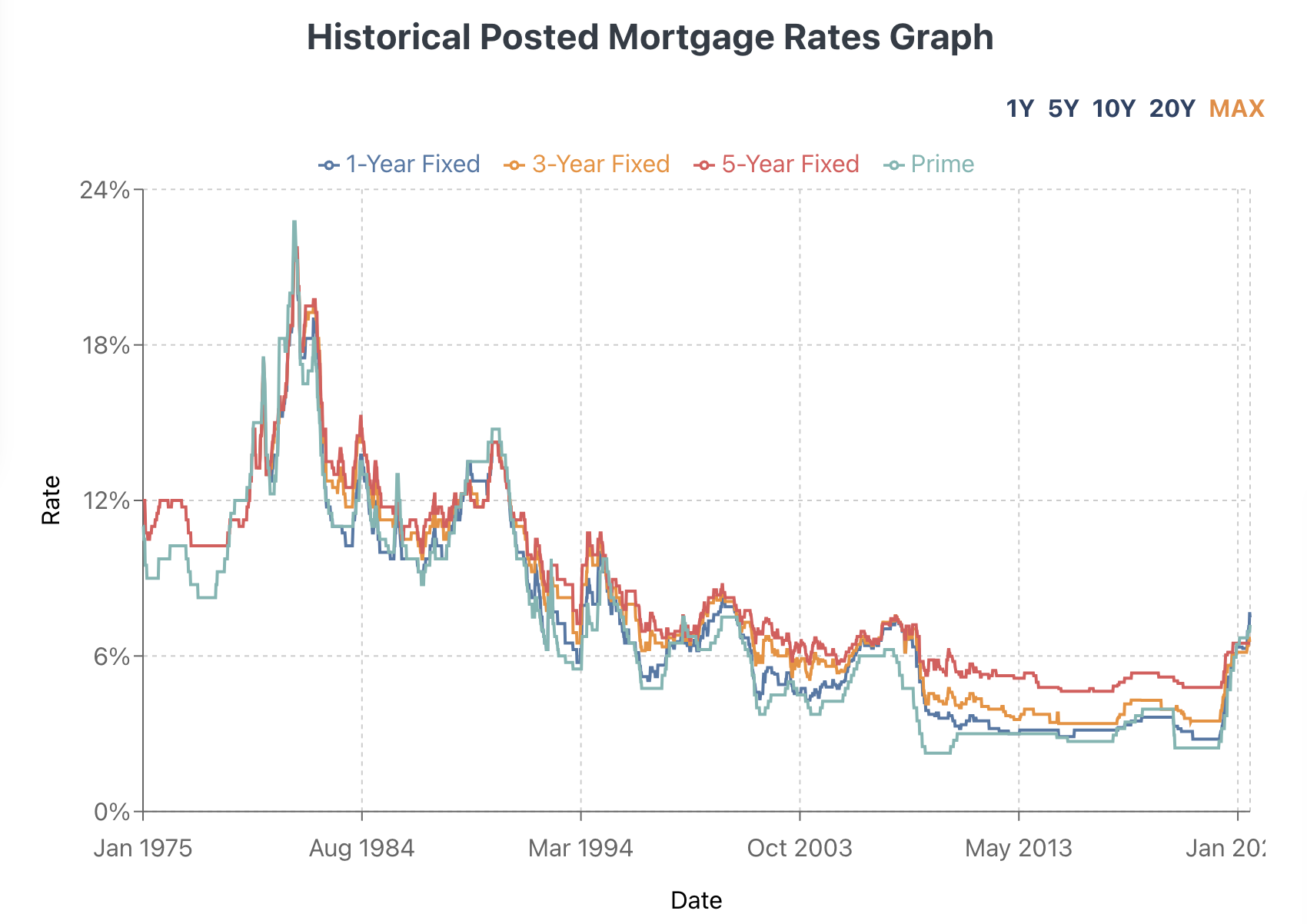

We’ve seen the rate tumble from that painful 5.0% peak in mid-2024 down to where it is today. It felt like a relief at first. But now? We are in the "structural adjustment" phase. That’s central-bank-speak for "we’re holding our breath and hoping we don't have to hike again."

Canadian Interest Rates Bank of Canada: The Hold Nobody Expected to Last

A lot of people thought we’d be back to 1% or 1.5% by now. Not even close. The Bank of Canada is playing a very delicate game with a 2.25% rate that they consider to be at the bottom of the "neutral range."

Why not lower? Inflation is a stubborn beast.

While the headline CPI (Consumer Price Index) sat at a comfortable-looking 2.2% in late 2025, the core measures—the stuff the Bank actually cares about, like CPI-trim and CPI-median—are still hovering around 2.8%. That is way too close to the top of the 1% to 3% target range for Macklem to feel like a hero.

💡 You might also like: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

Then there’s the elephant in the room: the USMCA renegotiations.

Trade tensions with the U.S. are casting a massive shadow over 2026. If tariffs start flying or supply chains get choked up again, we could see "cost-push" inflation. That’s when things get more expensive not because people are spending too much, but because it costs more to make and move goods. If that happens, the Bank of Canada might actually have to raise rates later this year.

Scotiabank and National Bank have already started whispering about rate hikes by Q4 2026. Imagine that. After all the waiting for cuts, we might be headed back up before the decade is out.

What 2.25% Actually Means for Your Wallet

If you have a variable-rate mortgage, you’ve probably stopped refreshing your banking app every ten minutes. The prime rate is holding steady at 4.45%. It’s better than 7.2%, sure, but it’s still high enough to hurt.

- Mortgages: 5-year fixed rates are currently hanging out between 3.5% and 4.3%.

- The Loonie: Our dollar is struggling because the U.S. Federal Reserve is keeping their rates much higher (around 3.5% expected by year-end).

- Savings: High-interest savings accounts aren't the goldmines they were a year ago, but they’re still beating the meager 0.5% we saw during the pandemic.

There is a real split in the room right now. TD Economics thinks the Bank will stand pat at 2.25% for a long time—maybe all the way through 2027. Meanwhile, analysts like Robert Hogue at RBC think we might see the rate climb back toward 3.25% if the economy proves too resilient.

📖 Related: How Much Do Chick fil A Operators Make: What Most People Get Wrong

It’s confusing. It’s messy. It’s the Canadian economy in 2026.

The Real Reason the Bank Won't Budge

Macklem is worried about "overheating."

GDP growth in the third quarter of 2025 surprised everyone by hitting 2.6%. That’s a lot of heat for an economy that was supposed to be cooling down. If the Bank cuts more now, they risk lighting a fire under the housing market.

In Toronto and Vancouver, condo prices have actually been sliding—down about 22% in some parts of Ontario from their peak. The Bank knows that if they drop the overnight rate to 1.75% or lower, all that "pent-up demand" will explode. They want a "soft landing," not a "rebound into a brick wall."

Wait and see. That is the mantra for the January 28 announcement.

👉 See also: ROST Stock Price History: What Most People Get Wrong

Actionable Steps for the Rest of 2026

Stop waiting for a 2% mortgage. It’s likely not coming back. If you’re renewing this year, look at 2-year or 3-year fixed terms to hedge your bets. You get the stability of a fixed payment without being locked in for half a decade if rates do somehow take a surprise dive in 2028.

Keep an eye on the January 28 Monetary Policy Report. Don't just look at the rate; look at the "bias." If the Bank removes the phrase "about the right level," start preparing for a hike.

If you’re an investor, the narrowing gap between Canadian and U.S. rates is going to be the big story for the Loonie. A weak CAD makes imports (like your groceries and your iPhones) more expensive. Plan your budget for a 72-to-75 cent dollar for the foreseeable future.

The 2026 mandate review is also coming up. Macklem has already confirmed they aren't changing the 2% inflation target. This means they are staying the course, even if it feels like a slow grind for the rest of us.

Focus on debt reduction while rates are "stable." This is the window. Use the lack of volatility to pay down the principal before the next economic shock—whatever it may be—rolls across the border.