Every single morning, thousands of trucks line up at the Ambassador Bridge, idling as they wait to cross from Windsor into Detroit. It’s a loud, smelly, and remarkably expensive ritual. Most people don't realize that nearly $2.5 million in goods moves across that single bridge every minute. That is the reality of Canada trade with US—it’s not just a series of policy papers or boring diplomatic meetings in Ottawa and D.C. It is the lifeblood of the North American economy, a massive, interconnected machine that dictates the price of your groceries, the availability of your car parts, and the stability of millions of jobs.

The scale is staggering. We are talking about two countries that share a border over 5,000 miles long and a trading relationship worth roughly $1.3 trillion annually. Honestly, it’s the kind of volume that’s hard to wrap your head around until you see the numbers.

The CUSMA Reality Check

Back in 2020, the old NAFTA was swapped out for the Canada-United States-Mexico Agreement, or CUSMA (the Americans call it USMCA). Some people thought it would change everything. Others thought it was just a rebrand. The truth? It’s a bit of both. It tightened the rules on things like automotive parts, requiring more of a car to be made in North America to avoid tariffs. This was a huge deal for Ontario’s "Auto Alley" and the manufacturing hubs in Michigan and Ohio.

But here is the thing about Canada trade with US that most people overlook: it’s incredibly integrated. We don't just sell things to each other; we make things together. A single spark plug or engine component might cross the border half a dozen times before it's actually installed in a finished vehicle.

Energy is the Secret Sauce

When Americans think of trade, they often think of maple syrup or maybe some lumber. But the real heavyweight is energy. Canada is, by a massive margin, the largest supplier of foreign oil to the United States. In 2023 and 2024, Canada provided more crude oil to the U.S. than all OPEC countries combined. Think about that for a second. Without this flow, the American energy grid and transport system would look very different—and be much more expensive.

It isn't just oil, though. We’re talking about electricity, uranium for nuclear plants, and increasingly, the critical minerals needed for the "green" revolution. As the world tries to move toward EVs, the U.S. is looking north for lithium, cobalt, and graphite. The U.S. Department of Defense has even started funding Canadian mining projects because they view this trade as a matter of national security. It’s high-stakes stuff.

👉 See also: Why Saying Sorry We Are Closed on Friday is Actually Good for Your Business

Why the "Softwood Lumber" Drama Never Dies

If you’ve followed the news at all over the last few decades, you’ve probably heard about softwood lumber. It is the never-ending story of Canada trade with US. Basically, American producers claim Canadian timber is unfairly subsidized because it grows on "crown land" (government-owned land) where stumpage fees are lower than private market rates in the States.

The U.S. levies duties. Canada appeals to the WTO or a CUSMA panel. Canada usually wins or gets the duties reduced. Then the cycle starts all over again.

- Impact on Housing: These duties aren't just a headache for politicians. They add thousands of dollars to the cost of building a new home in the U.S.

- The Stalemate: Neither side seems willing to blink, leading to a "business as usual" state of constant litigation.

It’s a classic example of how specific domestic interests can gum up a relationship that is otherwise incredibly smooth. You have the broader economic benefit of cheap lumber competing against the protectionist needs of local industry. It's messy.

The Digital and Service Frontier

While trucks and pipelines get the headlines, the invisible side of Canada trade with US is exploding. We’re talking about services. Software development, financial consulting, architectural services, and tech. Toronto, Vancouver, and Montreal have become massive tech hubs that feed directly into Silicon Valley and New York.

The "brain drain" used to be a one-way street toward the U.S., but now we see a "brain circulation." Companies like Google, Amazon, and Microsoft have massive footprints in Canada, partly because the immigration system makes it easier to bring in global talent, and partly because of the favorable exchange rate. The Canadian dollar (the "Loonie") usually sits well below the U.S. Greenback, making Canadian labor a bargain for American firms.

✨ Don't miss: Why A Force of One Still Matters in 2026: The Truth About Solo Success

Agriculture: More Than Just Wheat

Walk into any grocery store in the Midwest and you're eating the fruits of Canada trade with US. Canada is a top export market for U.S. processed foods, fruits, and vegetables. In return, Canada sends back beef, pork, and grains. The "Buy American" or "Buy Canadian" sentiments are strong, but the supply chains are so intertwined that "buying local" often means buying something that crossed a border twice before it hit the shelf.

The Challenges Ahead: Protectionism and Policy

It’s not all sunshine and easy shipping. The biggest threat to the current state of Canada trade with US is the rise of protectionism. Both major U.S. political parties have shifted toward more "America First" policies. Whether it's the Inflation Reduction Act's subsidies for American-made tech or potential universal baseline tariffs, Canada often finds itself scrambling to secure "carve-outs."

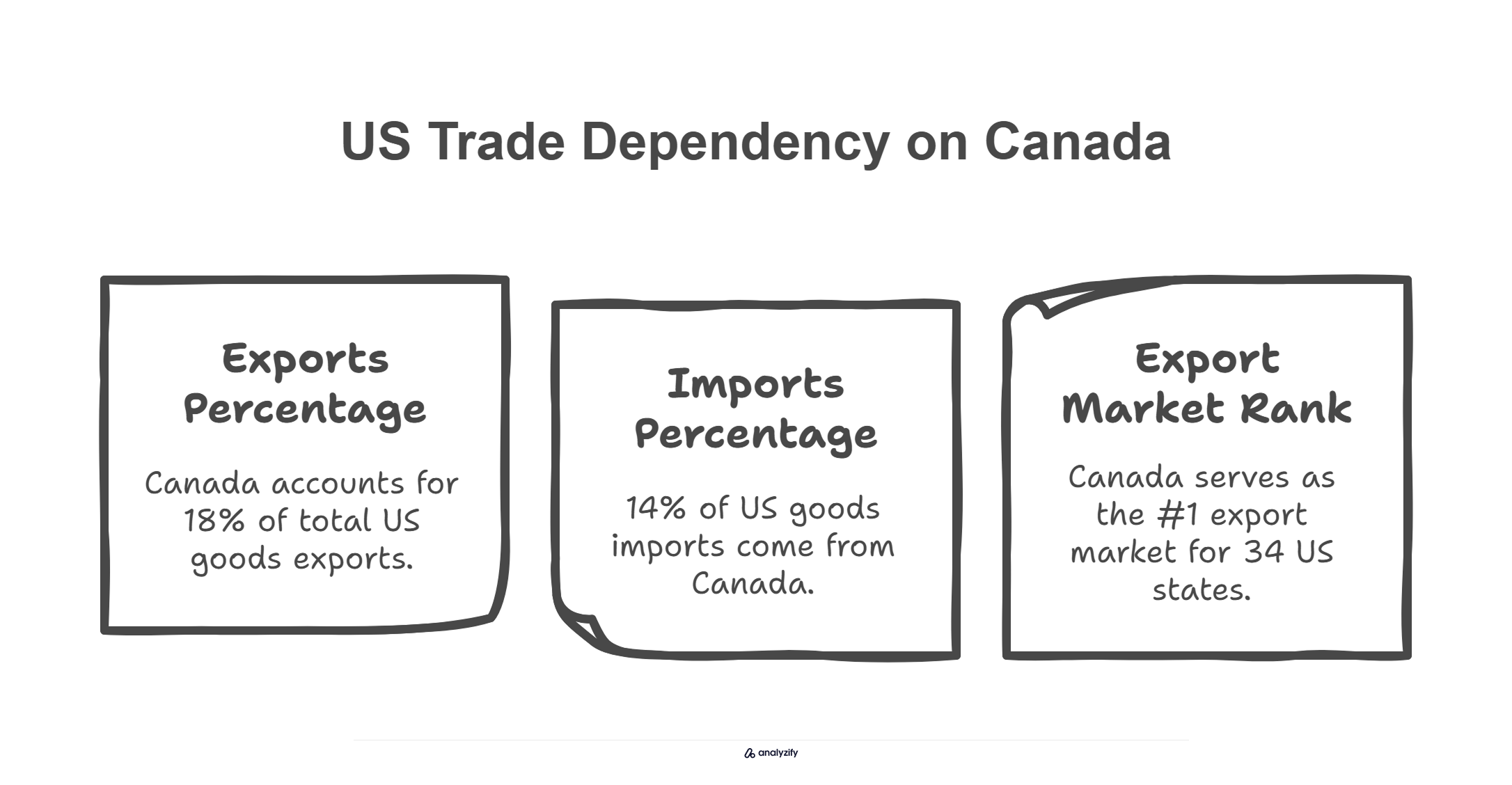

The 2026 review of CUSMA is looming large. This isn't just a "check-in." It’s a "sunset clause" provision that could technically end the deal if the parties don't agree to extend it. Negotiators are already sweating. Canada’s strategy has always been to remind the U.S. that 35 out of 50 U.S. states count Canada as their number one export market. If you mess with that trade, you aren't just hurting Canadians; you're hurting workers in Pennsylvania, Michigan, and Florida.

Dairy: The Great Irritant

We can't talk about trade without mentioning milk. Canada’s supply management system—which basically controls the price and production of dairy to protect farmers—is a huge thorn in the side of U.S. trade representatives. The U.S. wants more access to the Canadian market. Canada wants to protect its farmers. It's a localized fight that punches way above its weight in trade negotiations.

The Small Business Perspective

If you’re a small business owner, the Canada trade with US landscape is both an opportunity and a nightmare of paperwork. The "De Minimis" threshold is a big one here. This is the value of goods that can be shipped across the border duty-free. The U.S. has a high threshold ($800), while Canada’s is much lower, which has long been a point of contention for retailers.

🔗 Read more: Who Bought TikTok After the Ban: What Really Happened

E-commerce has made this even more complex. When you order a pair of boots from a boutique in Montreal and you live in Texas, you're participating in international trade. The logistics industry—companies like FedEx, UPS, and various freight forwarders—has built an entire sub-economy just around navigating the customs and brokerage fees that come with these small-scale transactions.

Making Sense of the Future

So, where is this all going? The trend is "friend-shoring." In a world where supply chains from China are seen as risky or politically sensitive, the U.S. and Canada are leaning into each other more than ever. It's safer. It’s closer.

However, the "Buy American" rhetoric isn't going away. Canada will have to continue fighting for its place at the table, proving over and over again that it is an essential partner rather than just another foreign competitor. The relationship is robust, but it’s also high-maintenance. It requires constant tending by diplomats and CEOs alike.

What You Should Do Next

Understanding the flow of goods is one thing, but acting on it is another. If you're involved in cross-border commerce or just curious about how these shifts affect your wallet, here are the practical moves to consider.

- Monitor the 2026 CUSMA Review: If you are in manufacturing or agriculture, the "sunset clause" talks will be the most significant economic event of the decade. Keep an eye on the "Rules of Origin" discussions, as these dictate which products qualify for duty-free status.

- Audit Your Supply Chain: Businesses should look at their "North American Content" percentages. With tightening regulations, relying on components from outside the bloc can lead to surprise tariffs.

- Leverage Section 321: For U.S. importers, understanding Section 321 can allow for duty-free entry of shipments valued under $800, which is a massive boon for e-commerce entrepreneurs.

- Watch the Exchange Rate: Since so much of Canada trade with US is priced in USD, the strength of the Canadian dollar is often more important than the actual trade policy. A weak Loonie makes Canadian exports attractive but makes it expensive for Canadian firms to buy American machinery.

The border might look like a line on a map, but economically, it's more like a zipper. It’s designed to hold things together while allowing for the occasional opening and closing. Navigating it requires more than just a passport; it requires an understanding of a massive, complex, and deeply human system of exchange.