You're standing in front of the machine, paycheck in hand or maybe a wad of cash from a side gig, wondering if this hunk of metal and glass is actually going to take your money without a fuss. Can you deposit money at a Wells Fargo ATM? Yes. Honestly, it’s one of the most basic things the machine does, but if you haven't done it in a while, or you're switching from a different bank, the process can feel a little high-stakes. Nobody wants their cash eaten by a machine.

Wells Fargo has one of the largest ATM networks in the United States. They've spent years upgrading these machines to be "envelope-free," which is a huge relief for anyone who remembers the old days of licking sticky seals and hunting for a pen that actually worked. Nowadays, you just feed the bills or checks directly into the slot. It’s fast. Usually.

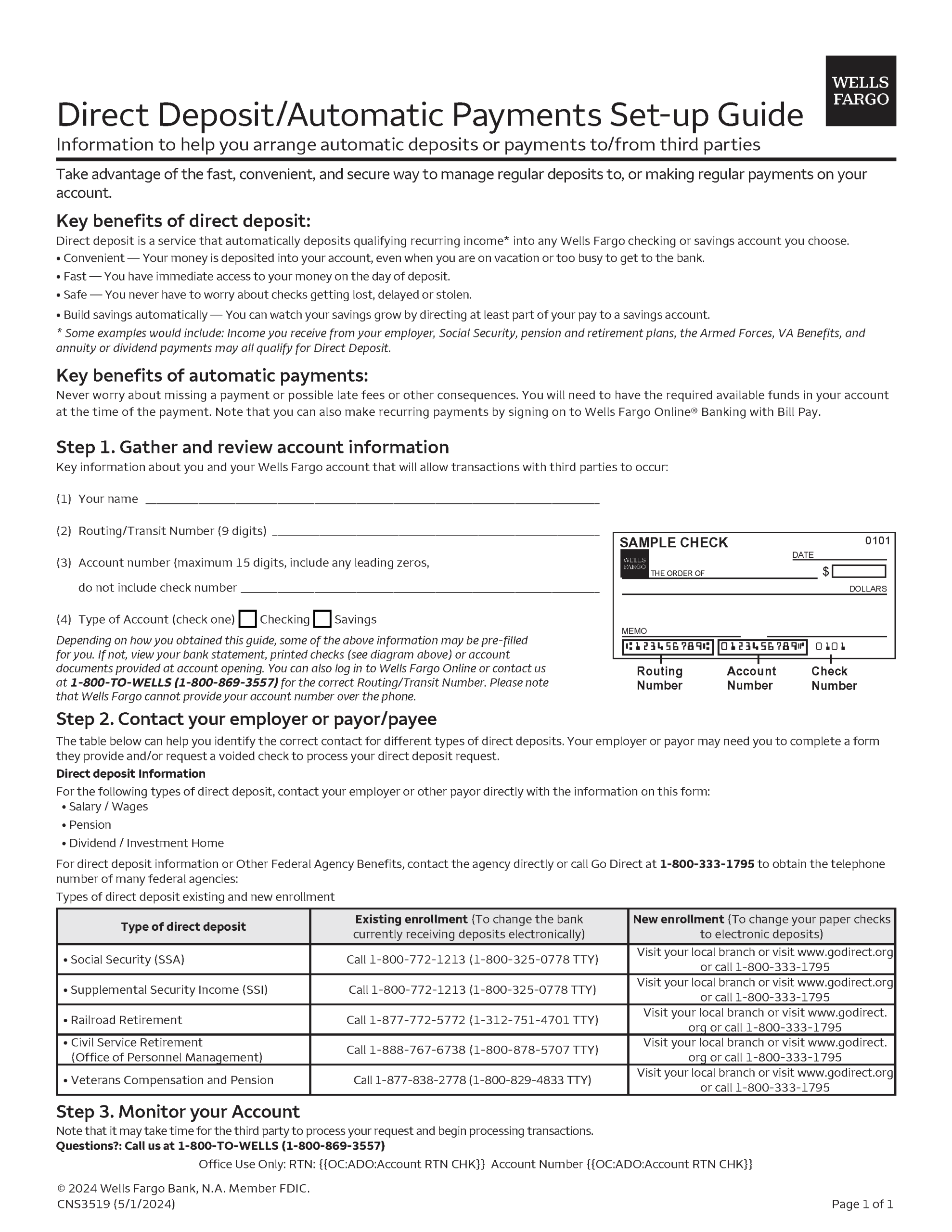

But there are nuances. Not every single machine with a Wells Fargo logo is built the same way, and there are definitely rules about what kind of money you can shove in there and when that money actually shows up in your "available balance."

The Reality of Making a Deposit at the Machine

Most Wells Fargo ATMs are part of their "ExpressStore" or advanced banking network. This means they handle the heavy lifting. You walk up, slide your debit card in, punch in your PIN, and look for the "Deposit" option on the screen. It's usually pretty prominent. If you don't see it, you might be at a "cash-only" or "dispense-only" machine, which are often found in third-party locations like grocery stores or gas stations where the bank doesn't want to deal with the security risk of holding large amounts of incoming cash.

Check the screen first.

Once you select deposit, the machine opens a mechanical shutter. This is where the magic happens. You don't need an envelope. In fact, if you try to use an envelope in a modern Wells Fargo machine, it’ll probably spit it back at you or, worse, jam the whole system. You just stack your bills neatly. You don't even have to sort them by denomination anymore. The machine has internal sensors—optical and magnetic—that read the bills as they fly through the internal sorter.

📖 Related: Dollar Against Saudi Riyal: Why the 3.75 Peg Refuses to Break

How Much Cash Can You Actually Feed It?

There is a limit. You can't just dump a bucket of coins or 500 individual one-dollar bills into the slot and expect it to work. Generally, Wells Fargo ATMs allow you to deposit up to 30 items at a time. That includes a mix of cash and checks. If you have 50 bills, you'll need to do it in two separate transactions.

It's important to keep the bills flat. If they're crumpled, torn, or have a stray staple from a tax return, the machine is going to reject them. It's a security feature. The machine is looking for specific markers to ensure the currency is legitimate, and a giant fold across Benjamin Franklin's face makes that hard to do.

Can You Deposit Money at a Wells Fargo ATM Using a Check?

Depositing checks is where people usually get a little nervous. You sign the back—don't forget to write "For Mobile Deposit Only" or whatever specific endorsement the screen asks for—and slide it in. The machine scans the front and back. It uses Optical Character Recognition (OCR) to read the amount written on the line.

Sometimes it misses.

If the machine thinks your $100.00 check is a $10.00 check, don't panic. The screen will show you a digital image of the check and ask you to confirm the amount. You can manually edit it right there. If the check is so messy that the machine can't read it at all, it’ll just hand it back to you. At that point, you're stuck going inside to talk to a teller or using the mobile app on your phone.

👉 See also: Cox Tech Support Business Needs: What Actually Happens When the Internet Quits

The "Cutoff Time" Trap

This is the part that catches people off guard. Just because you put money into the machine at 9:00 PM on a Friday doesn't mean you can spend it at 9:05 PM.

Wells Fargo typically has a cutoff time for ATM deposits. Usually, it's around 9:00 PM local time, but this varies by location. If you beat the cutoff on a business day (Monday through Friday, excluding holidays), the funds are generally considered received that day. If you deposit at 11:00 PM on a Saturday, that money isn't "officially" arriving until Monday.

- Cash Deposits: Usually available almost immediately for withdrawals or purchases.

- Check Deposits: Wells Fargo often makes the first $225 to $500 available right away, but the rest might be held until the next business day while they verify the funds with the sending bank.

Things That Can Go Wrong (and How to Fix Them)

Machines are great until they aren't. We've all heard the horror stories of an ATM "eating" a deposit. If the machine loses power or glitches while your cash is inside, the first thing you do is stay put. Wait a minute to see if it resets or prints a "decline" or "error" receipt.

If it doesn't, grab your phone. Take a photo of the ATM's ID number—usually located on a sticker near the screen or the card slot. Then, call the number on the back of your Wells Fargo card immediately. They can see the transaction logs in real-time. If there's a discrepancy, they’ll open a "Regulation E" claim. Usually, the bank will give you a provisional credit for the amount you claim you deposited while they manually count the machine's cash box at the end of the week.

Don't leave without some kind of record. If the machine didn't give you a receipt, write down the exact time, the location, and what happened.

✨ Don't miss: Canada Tariffs on US Goods Before Trump: What Most People Get Wrong

Can You Use a Non-Wells Fargo ATM?

If you have a Wells Fargo account but you're at a Chase or Bank of America ATM, can you deposit money there? Usually, no. While most banks are part of networks like Plus or Star for withdrawing money, depositing is a much more closed-loop system. Most ATMs will not accept deposits for a different financial institution. You'll put your card in, and the "Deposit" option simply won't appear on the menu.

Pro Tips for a Smoother Experience

- Count your cash before you get to the machine. Don't be that person standing in the drive-thru lane counting a stack of twenties while a line of cars forms behind you. Know exactly what you have.

- Use the "Receipt with Image" option. When the machine asks if you want a receipt, choose the one that prints a tiny picture of your checks. It’s the best evidence you have if something goes sideways later.

- Check for skimmers. It sounds paranoid, but give the card reader a little wiggle. If it feels loose or bulky, don't put your card in. Find another machine.

- Go during bank hours if you're nervous. If you're depositing a very large amount of cash—say, a few thousand dollars—it’s always safer to do it inside. If the machine jams on $2,000, your stress levels are going to be a lot higher than if it jams on $20.

Breaking Down the "Available Balance" vs. "Actual Balance"

When you finish your deposit, you'll look at your app and see two numbers. The actual balance includes the money you just dropped in. The available balance is what you can actually spend. Wells Fargo is pretty transparent about this, but it’s easy to miss. If you deposit a $5,000 check, your actual balance might jump up immediately, but your available balance might only go up by a few hundred dollars until the check clears.

This is to prevent fraud. If the check bounces, Wells Fargo doesn't want to be out the five grand they let you spend.

The Evolution of the ATM

It's wild to think that Wells Fargo was one of the first banks to really push the envelope-free tech. According to industry reports from the ATM Industry Association (ATMIA), this shift reduced maintenance calls by nearly 40% because envelopes were the primary cause of jams. For you, it means you can basically treat the ATM like a digital teller that never sleeps.

Wells Fargo also has "Cardless ATM" access now. You can use the Wells Fargo Mobile app to get an "Access Code." You type that code into the ATM, and you can perform your deposit without even taking your wallet out. It’s incredibly convenient if you’re the type of person who leaves their physical card in their other jeans.

Actionable Steps for Your Next Deposit

If you need to get money into your account right now, here is the most efficient way to handle a Wells Fargo ATM deposit:

- Locate a Branch ATM: Use the Wells Fargo app to find a "Full Service" ATM. These are almost always attached to a physical branch.

- Prep Your Items: Remove all paper clips, rubber bands, and staples. Make sure your checks are signed.

- Check the Time: If it's after 9:00 PM, understand the money might not "settle" until the following business day.

- Insert and Confirm: Feed your stack (up to 30 items) into the slot. Watch the screen carefully as it counts your cash. If the total is wrong, hit "Cancel" immediately to get your money back.

- Keep the Paper: Always take the receipt. At least until the money shows up as "Available" in your online banking portal.

Depositing money doesn't have to be a chore. As long as you're using a modern Wells Fargo machine and your bills are relatively crisp, you’ll be in and out in under two minutes. Just stay aware of your surroundings, especially at night, and keep that receipt as your golden ticket.