You've probably seen the headlines. Some lifeguard in Los Angeles makes $500,000, or a retired university coach is pulling in a pension that looks like a lottery jackpot. It makes for great clickbait, honestly. But if you're actually trying to understand the California public employee salary landscape—maybe because you’re looking for a job or just want to know where your tax dollars go—the reality is a lot more "cubicle" and a lot less "mansion."

California is the largest employer in the state. Basically, if the state government were a private company, it would be a Fortune 500 titan. We are talking about over 230,000 state workers, and that doesn't even count the army of people working for cities, counties, and school districts.

The Massive Gap Between "Base" and "Total"

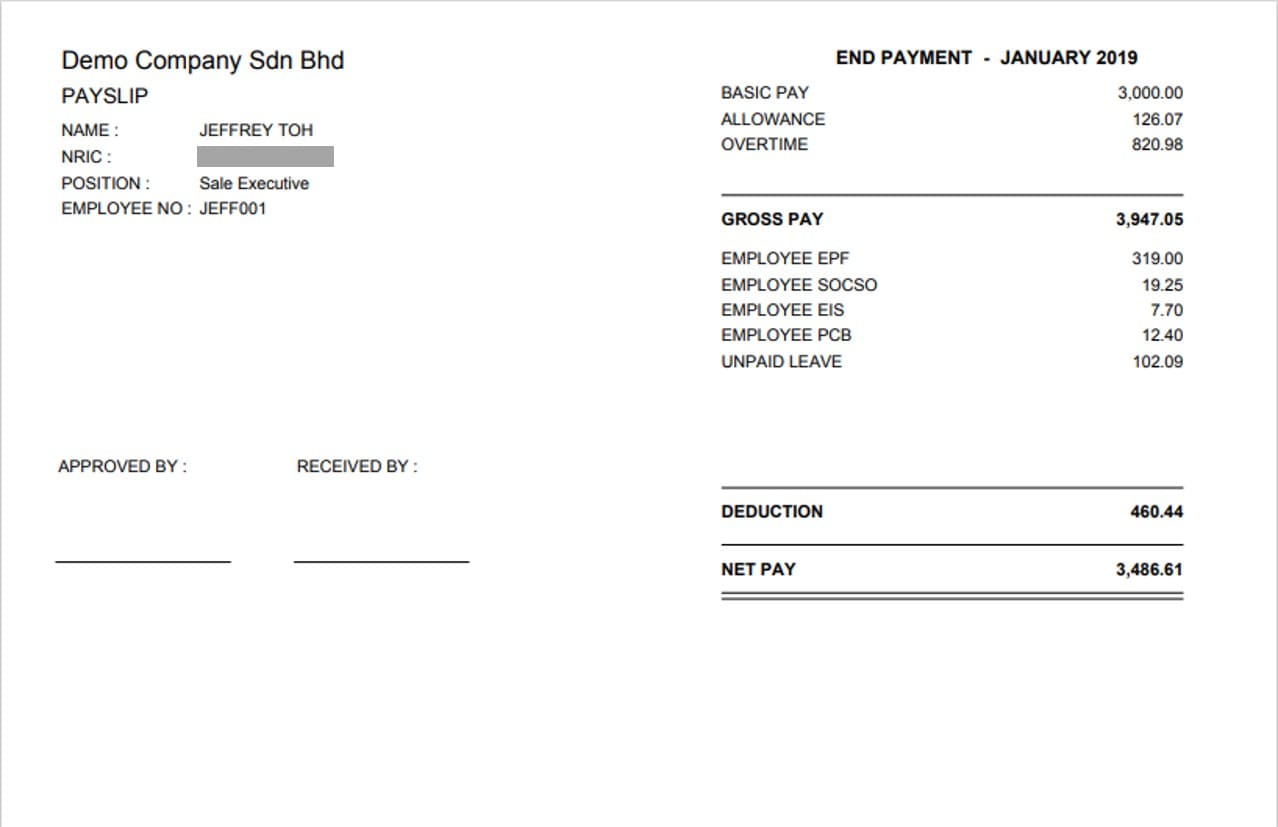

Most people make the mistake of looking at a base salary and thinking that’s the whole story. It isn't. In the public sector, the "total compensation" is the real number you need to watch.

For a typical state worker, the base pay might look lower than a tech job in San Jose. But when you add in the health premiums, the CalPERS pension contributions, and those "pay differentials" (extra money for having a degree or working a weird shift), the number jumps. In 2025, the average state and local government worker in the US cost their employer about $63.94 per hour. Roughly 38% of that wasn't even the paycheck—it was the benefits.

Real Numbers from the 2024-2025 Payroll

If we look at the actual data from the California State Controller, the high-fliers aren't who you’d expect. It’s mostly doctors and psychiatrists working in the prison system (CDCR).

✨ Don't miss: Are Euros More Than US Dollars: Why the Exchange Rate Keeps Shifting

- Staff Psychiatrists: Many of these specialists in state hospitals or prisons are clearing $400,000 to $550,000 in total wages.

- Correctional Officers: A veteran officer can hit $150,000+ easily when you factor in the massive amounts of overtime required to keep the facilities running.

- University of California Coaches: This is where the millions live. Top football and basketball coaches at UCLA or UC Berkeley are consistently the highest-paid public employees, often topping $2 million to $4 million annually.

Why Location Changes Everything

California is huge. A $70,000 salary for a DMV clerk in Redding feels like you're rich. That same $70,000 in San Francisco? You’re basically living in a closet.

The state tries to balance this with "geographic pay" or "recruitment and retention" bonuses, but it's a constant struggle. Counties like Santa Clara and San Mateo have average weekly wages that are double or triple what you see in places like Modoc or Tulare.

Honestly, the "public vs. private" debate is kinda lopsided depending on your degree. If you have a high school diploma, the public sector usually pays better than the local retail or service jobs. But if you’re a lawyer or a specialized engineer? You’re likely taking a 10% to 20% "public service discount" on your salary compared to what Google or a big law firm would pay.

The 2026 Pay Transparency Shake-up

Starting January 1, 2026, things got even weirder (and more transparent) thanks to SB 642.

California already required employers to post salary ranges, but the new law tightened the screws. Now, those ranges have to be "good faith" estimates of what the employer actually expects to pay upon hire. No more posting a range from $50,000 to $500,000 just to stay legal.

For the California public employee salary seeker, this is a goldmine. You can now see the specific steps and grades. Most state jobs are on a "merit salary adjustment" (MSA) schedule. Basically, if you don't mess up, you get a 5% raise every year until you hit the top of your bracket.

Negotiating the "Non-Negotiable"

A lot of people think government pay is set in stone. It sort of is, but there’s a trick. When you get a job offer (the "Notice of Personnel Action"), you are usually started at the bottom of the range. However, you can request a "Hiring Above Minimum" (HAM) rate.

If you have specialized skills that are hard to find, or if you're currently making way more in the private sector, the department can actually start you at a higher "step" in the range. You've just gotta ask before you sign that final paperwork.

Pensions: The Invisible Paycheck

We can't talk about salary without talking about CalPERS. Most state employees contribute about 8% to 15% of their pre-tax pay into the pension fund.

It feels like a massive bite out of your take-home pay. It is. But on the flip side, the state is also dumping a massive percentage into that fund for you. For many "Safety" members (like Highway Patrol), the employer contribution is sometimes 30% or 40% of their salary. You won't see that in your bank account today, but it’s why people stay in these jobs for 30 years.

How to Find Any Salary (Legally)

Because of the California Public Records Act, everyone's salary is public. It’s not a secret.

- Transparent California: The most famous database. It’s easy to search but can be a year or two behind.

- Sacramento Bee Pay Scales: A great tool for searching current state-specific workers.

- State Controller’s Office (SCO) "Government Compensation in California": This is the "official" source. It includes cities, counties, and special districts.

Actionable Steps for the Savvy Resident

If you are looking to enter the public workforce or just want to audit what your local officials are making, here is how you do it effectively:

- Search for "Total Pay," not just "Base Pay." Total pay includes overtime and payouts for unused vacation, which often doubles the number.

- Look at the "Class Specifications." If you want a raise, find the job title one level above yours on the CalHR website. It will tell you exactly what skills you need to jump to the next salary bracket.

- Check the Bargaining Unit (BU) contracts. Most salaries are determined by unions (like SEIU Local 1000). Their contracts (MOUs) are online and tell you exactly when the next 3% or 4% "General Salary Increase" is coming.

- Factor in the OPEB. That's the "Other Post-Employment Benefits." Since 2018, most California public employees started "pre-funding" their retiree healthcare. It’s another small deduction, but it guarantees you won't be paying $2,000 a month for insurance when you’re 70.

The world of the California public employee salary is a mix of rigid bureaucracy and surprising opportunity. While the "million-dollar coach" is the outlier, the real story is the hundreds of thousands of workers navigating a system of steps, ranges, and benefit packages that are increasingly becoming the last stronghold of the American middle class.