Ever wondered what the person behind the DMV counter actually takes home? Or why some local fire captains seem to be making more than the Governor? Honestly, california public employee salaries are a bit of a lightning rod for debate. You’ve got one group of people arguing that public servants are overpaid, while others point out that living in San Jose or San Francisco on a government paycheck is basically a recipe for poverty.

It's complicated.

If you look at the raw data from 2024 and early 2025, the numbers can be pretty jarring. We're talking about a system that employs over 2.5 million people across the state, ranging from the folks who fix the potholes to the investment geniuses managing billions in pension funds.

The High Earners and the "Other Pay" Trap

Most people head straight for the top of the list when they look up california public employee salaries. You'll see names like Christopher Ailman, who was the Chief Investment Officer for CalSTRS. Before he retired recently, his total compensation was over $1.7 million.

But here is the thing: most of that isn't "salary" in the way we think about it.

In California's reporting system, "Total Wages" is broken down into base pay, overtime, and "Other Pay." That last category is where things get wild. It includes:

- Incentive bonuses for investment officers.

- Lump-sum payouts for unused vacation time when someone retires.

- Special stipends for having specific certifications.

Take a look at the Department of Corrections. You’ll often find correctional officers or nurses making $300,000 or more. Usually, a massive chunk of that is overtime. Because of staffing shortages in prisons, people are working double shifts constantly. They’re getting paid, sure, but they’re also living at the office.

Breaking Down the Averages

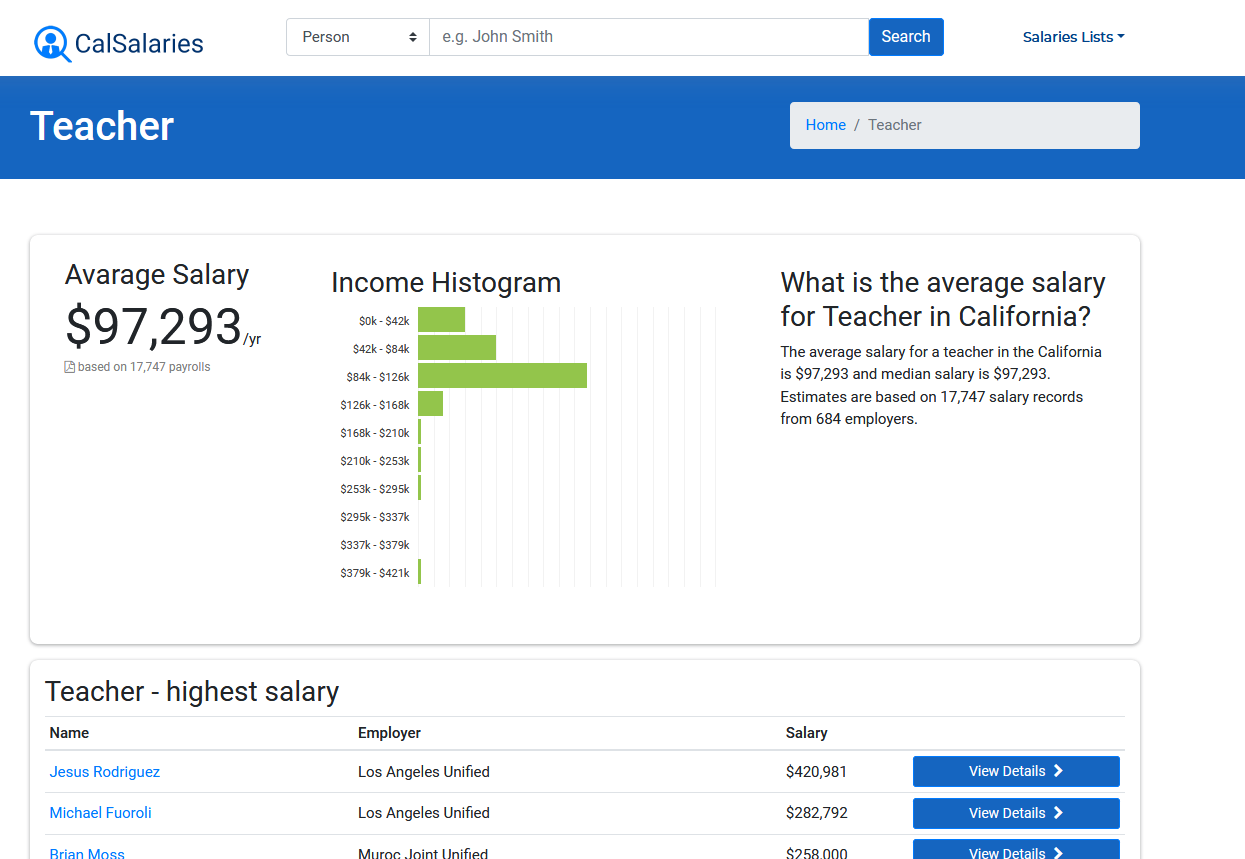

If we ignore the million-dollar outliers, what does the average person actually make?

According to the State Controller’s Office data for 2024, the Department of Corrections and Rehabilitation is the biggest employer, with over 55,000 employees. The total wages paid there topped $5.7 billion. If you do the quick math, that averages out to roughly $104,000 per employee in wages.

But "wages" is only half the story.

California also reports the cost of health and retirement contributions. For a typical state worker, the state might be paying another $30,000 to $50,000 a year just for benefits. That’s why you’ll see critics say public workers make "twice as much" as the private sector. It's often because they're comparing a public worker's total compensation (including a pension and Cadillac health plan) to a private worker's gross salary (where the 401k match is 3% and the health insurance has a $5,000 deductible).

A Quick Reality Check on Costs

As of January 1, 2026, the state's minimum wage bumped up to $16.90. To even be considered an "exempt" (salaried) employee in California now, you have to earn at least $70,304 a year.

That might sound like a lot if you're living in Fresno. But if you’re a mid-level analyst in Sacramento trying to buy a house? It's tight.

Why Some Cities Pay So Much More

You’ll notice a huge disparity between counties. Los Angeles County is the behemoth, paying out over $11.6 billion in wages in 2024. But look at Santa Clara County. The average wage there is often significantly higher because they have to compete with Silicon Valley tech giants. If the county doesn't pay its IT directors or lawyers a competitive rate, they just walk across the street to Google or Meta.

It's a market reality that frustrates taxpayers in lower-cost areas.

The Transparency Movement

You’ve probably heard of Transparent California. It’s a third-party site that scrapes all this data and puts it in an easy-to-search format. While the government has its own site (PublicPay.ca.gov), Transparent California is often where the "viral" stories come from.

There is a real tension here. On one hand, transparency is great. We should know where our tax dollars go. On the other hand, these databases often lack context. They don't show that a "high" salary for a doctor at a state hospital might actually be 20% less than what that same doctor would make in a private practice.

What's Changing in 2026?

The rules around pay are getting even stricter. A new law, SB 642, took effect this month. It forces employers (including public ones) to be even more transparent about "pay scales" in job postings. They can't just give a vague range anymore; it has to be a "good faith" estimate of what they actually expect to pay.

Also, the state is now tracking pay data based on even more demographic categories, including a new requirement to track employees of Middle Eastern or North African (MENA) descent. They're looking for pay gaps, trying to ensure that "substantially similar work" gets "substantially similar pay."

🔗 Read more: Executive Coaching Industry News: Why the "Old Guard" is Panicking in 2026

How to Check Your Own Industry

If you're looking for a job or just want to see if you're being lowballed, you can actually use these databases as a tool.

- Go to the State Controller's "Public Pay" site. 2. Filter by "Position." Look for your specific title.

- Check the "Minimum" and "Maximum" ranges. This tells you the "Pay Scale" the state has officially approved.

- Look at "Other Pay." If you see a lot of people in your field making $20k in "Other Pay," there’s likely a certification or shift differential you should be asking about.

Honestly, the "gold" in a government job isn't the base salary anyway. It's the stability and the defined-benefit pension. In a world where private-sector layoffs can happen via a 2:00 AM email, that "boring" government salary starts to look a lot more attractive.

Actionable Steps for Navigating Public Pay

If you are researching this for a career move or just to stay informed, here is what you should actually do:

- Look at the "Benefit" column, not just the "Wages" column. The "Total Compensation" is usually 30-40% higher than the number on the paycheck.

- Search for "Salary Ranges" on CalHR. The state publishes "Pay Scales" that show you exactly how much you can expect to earn at each "step" of your career. Unlike the private sector, there is very little "negotiating" your way into a higher bracket once you’re in.

- Check the "Memorandum of Understanding" (MOU). Every public job is usually tied to a union contract. These MOUs are public documents. They list exactly when the next 3% or 5% raise is coming. It's all scheduled years in advance.

- Use the 2x Rule for Exempt Status. If a public job offer is for a salaried position (Exempt) and pays less than $70,304 in 2026, it likely doesn't meet California's legal threshold for overtime exemption. Know your rights.

The world of california public employee salaries isn't just about the high-flyers at the top. It's a massive, rigid, and surprisingly transparent machine. Whether you're a taxpayer looking for accountability or a job-seeker looking for a fair shake, the data is all there. You just have to know how to read between the lines of "base pay" and "total comp."

To get the most accurate picture of your specific region, start by comparing your county's data against the state average on the State Controller's official portal. This will show you if your local area is keeping pace with the rising cost of living in the Golden State.