You just landed the job. The offer letter says $75,000 a year, and for a fleeting second, you feel like a high roller. Then Friday hits. You open your banking app, squint at the screen, and realize that a massive chunk of that "salary" evaporated before it ever touched your account. It’s a universal gut punch. Understanding what is my paycheck after taxes isn't just about math; it’s about figuring out why the government, the state, and your HR department all have their hands in your pockets.

Most people think of their pay in gross terms. That’s a mistake. Gross pay is a vanity metric. Net pay—the "take-home"—is the only number that pays the rent.

The Big Three: Federal, FICA, and State

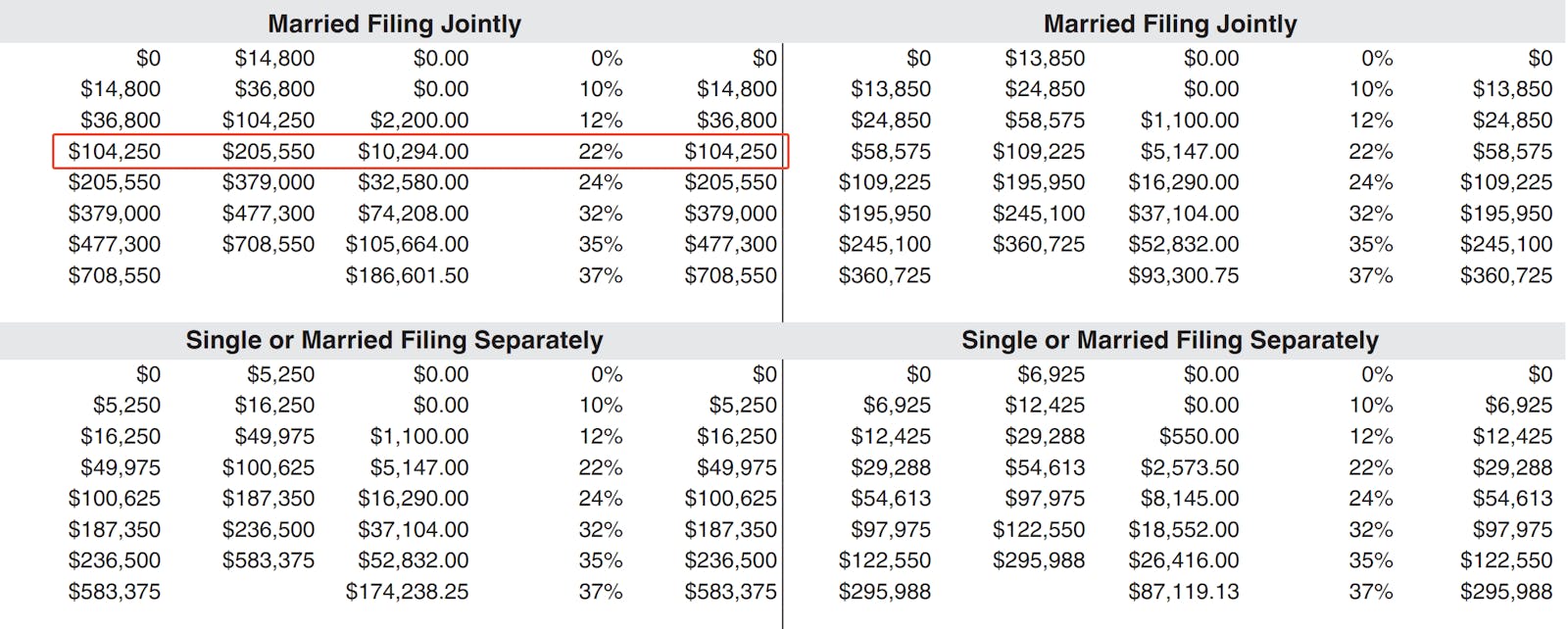

Your paycheck is basically a block of marble, and the IRS is a sculptor with a very large chisel. First, they take the Federal Income Tax. This isn't a flat fee. Because the U.S. uses a progressive tax system, your income is sliced into brackets. For 2025 and 2026, those brackets range from 10% to 37%.

But here is where people get tripped up: earning more doesn't mean your entire check is taxed at a higher rate. If you jump into the 22% bracket, only the dollars inside that specific range are hit with the 22% tax. The rest are taxed at the lower rates of the bottom brackets.

Then comes FICA.

It stands for the Federal Insurance Contributions Act.

You know it as Social Security and Medicare.

Social Security takes 6.2% of your gross pay, up to a certain wage base (which usually adjusts upward every year with inflation). Medicare takes another 1.45%. Unlike federal income tax, these don't care about your filing status or deductions. They are flat, relentless, and mandatory.

If you live in a place like Florida, Texas, or Nevada, you stop there. Lucky you. But if you’re in California, New York, or Oregon, the state takes another bite. Some states, like Pennsylvania, use a flat tax (around 3.07%), while others mimic the federal progressive system. In places like New York City or Philadelphia, you might even get hit with a local municipal tax just for the privilege of living within city limits.

👉 See also: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

The "Silent" Deductions You Chose

Sometimes the answer to what is my paycheck after taxes is lower than expected because of your own decisions. We’re talking about pre-tax deductions. These are actually your best friends, even if they make your check look smaller today.

Think about your 401(k) or 403(b). When you contribute $200 to your retirement plan, that money is taken out before the federal government calculates your income tax. It lowers your taxable income. You're essentially "hiding" that money from the IRS for now. Health insurance premiums work the same way. If you’re paying $150 a month for a PPO plan, that’s $150 of income that isn't being taxed.

Then there are HSAs (Health Savings Accounts) and FSAs (Flexible Spending Accounts). These are "triple-tax-advantaged" if handled correctly, but they do mean your Friday deposit will be lighter. Honestly, it’s a trade-off between "richer now" and "secure later."

Let’s Look at a Real-World Example

Imagine you are a single filer in Chicago, Illinois, earning $60,000 a year. You don't have a 401(k) yet (you should, but let's keep this simple).

- Gross Monthly: $5,000

- Federal Tax: ~$480

- FICA (Social Security/Medicare): ~$382

- State Tax (Illinois is roughly 4.95%): ~$240

Your take-home pay is roughly $3,898. You just "lost" over $1,100 to the void. If you add in a decent health insurance premium and a 5% 401(k) contribution, that $3,898 quickly drops toward the $3,500 mark. That is a massive difference from the $5,000 you "earned."

✨ Don't miss: USD to UZS Rate Today: What Most People Get Wrong

The W-4 Trap

Why do some people get a huge tax refund while others owe thousands in April? It usually comes down to the Form W-4. This is the document you filled out on your first day of work while you were still trying to remember where the coffee machine was.

If you claim "zero" or don't account for a spouse's income, your employer might withhold way too much. You’re essentially giving the government an interest-free loan. On the flip side, if you have a side hustle (1099 income) and don't adjust your W-4 at your main job to cover the extra taxes, you’re going to get a nasty surprise during tax season.

The IRS updated the W-4 a few years back to get rid of "allowances." Now, it asks for specific dollar amounts for dependents and other income. If your life has changed—you got married, had a kid, or started driving for Uber—you need to update this form immediately.

Why Your Bonus Looks So Small

Ever get a $1,000 bonus and see only $600 show up in your account? You weren't necessarily taxed more; you were withheld more. The IRS often considers bonuses "supplemental wages." Many employers choose a flat withholding rate of 22% for these payments. When you add in FICA and state taxes, it feels like half the bonus vanished.

Don't panic.

When you file your taxes at the end of the year, that bonus is just part of your total annual income. If the 22% withholding was too high for your actual tax bracket, you’ll get that extra money back as part of your refund. It's frustrating in the moment, but the money isn't gone forever.

🔗 Read more: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

Actionable Steps to Master Your Cash Flow

To truly answer what is my paycheck after taxes, you need to stop guessing and start auditing. Start by downloading your last three pay stubs. Look for the "YTD" (Year-To-Date) column. This tells you exactly how much has been siphoned off since January 1st.

Next, use an updated tax calculator for the current year. The Tax Foundation and SmartAsset both provide reliable tools that account for specific state and local nuances. If you find you are getting a $5,000 refund every year, go to your HR portal and adjust your W-4. Increasing your take-home pay by $400 a month is usually better for your mental health and debt repayment than waiting for one big check in April.

Finally, check your "voluntary" deductions. Are you paying for a life insurance policy through work that you don't need? Is your health insurance the "Gold" plan when a "Silver" or "Bronze" with an HSA would save you $2,000 a year? Every line item on that stub is a lever you can pull to change your financial reality.

Knowing your net pay is the first step toward actual budgeting. You can't plan a life on a $75,000 salary if you’re only living on $52,000 of it. Total transparency with your own pay stub is the only way to avoid the mid-month "where did my money go" panic.