You’ve probably seen the green and white statements from the Social Security Administration (SSA). Maybe you even have a "my Social Security" account login saved somewhere. But if you think that one estimated number on your dashboard is set in stone, you’re in for a massive surprise. Honestly, the way most people try to calculate your social security benefit is fundamentally flawed because they treat it like a simple savings account. It isn't. It’s a complex, inflation-adjusted insurance annuity governed by a formula that looks like something out of a high-level calculus textbook.

The math is weird. It’s weighted. It’s designed to help lower earners more than the wealthy, yet it rewards those who stay in the workforce for decades. If you don't understand how your "Average Indexed Monthly Earnings" (AIME) converts into your "Primary Insurance Amount" (PIA), you are essentially flying blind into your retirement years.

The 35-Year Trap Everyone Falls Into

Here is the kicker. The SSA doesn't just look at your "career." They look at exactly 35 years. Not 34. Not 30. If you worked for 32 years and spent three years traveling or raising kids, Uncle Sam drops three big, fat zeros into your calculation. Those zeros are absolute killers. They drag your average down more than a bad year of earnings ever could.

✨ Don't miss: LR Health and Beauty: Why This German Giant Still Dominates the Network Marketing Space

To accurately calculate your social security benefit, you have to understand indexing. The government doesn't just use the dollar amount you made in 1992. They "index" it to reflect the change in general wage levels that occurred during your work years. This is why a $20,000 salary in the nineties might be worth significantly more in the eyes of the SSA today. However, indexing stops at age 60. Any money you earn after 60 is treated as raw dollars. This is a nuance most "retirement gurus" miss entirely.

If you’re sitting at 33 years of work, staying employed for just two more years—even in a part-time capacity—can replace two of those "zero" years and spike your monthly check for the rest of your life. It's probably the highest ROI you'll ever get on a Monday morning.

The Formula Behind the Curtain

Let’s talk about "Bend Points." This is where the real magic (or frustration) happens. The Social Security benefit formula is regressive. For 2024 and 2025, the SSA takes your AIME and applies three different percentages to it.

First, you get 90% of the first chunk of your earnings. Then you get 32% of the next chunk. Finally, you only get 15% of anything above the top threshold. Essentially, the more you make, the lower your "replacement rate" is. A person making $40,000 a year might see Social Security replace 50% of their income, while a high-flier making $160,000 might only see a 25% replacement.

✨ Don't miss: Development Credit Bank Ltd Share Price: What Most People Get Wrong

Understanding these bend points is vital. If you are right on the edge of a bracket, earning a little more might not actually move the needle on your check as much as you'd think. Conversely, if you're a lower earner, every extra dollar you report is being multiplied by that 90% factor. That's huge.

Why 62 is Often a Mathematical Mistake

We have to be honest here. Taking the money at 62 is tempting. You’ve worked hard. You want your "fair share" before the system goes bust—which, by the way, isn't actually happening, but rather facing a projected 20-25% haircut in the 2030s if Congress stays paralyzed.

But when you calculate your social security benefit at 62 versus 70, the gap is staggering. We are talking about a 76% increase in the monthly check if you wait.

- At age 62: You get roughly 70% of your PIA.

- At Full Retirement Age (FRA): You get 100%.

- At age 70: You get 124% thanks to "Delayed Retirement Credits."

Think about that. Where else can you get a guaranteed, government-backed, inflation-adjusted 8% return per year just for waiting? Nowhere. If you are in good health and have longevity in your family, claiming early is essentially betting against yourself. You’re betting that you’ll die young. It’s a grim wager, and statistically, most Americans are losing it by claiming too early.

The Tax Bite Nobody Mentions

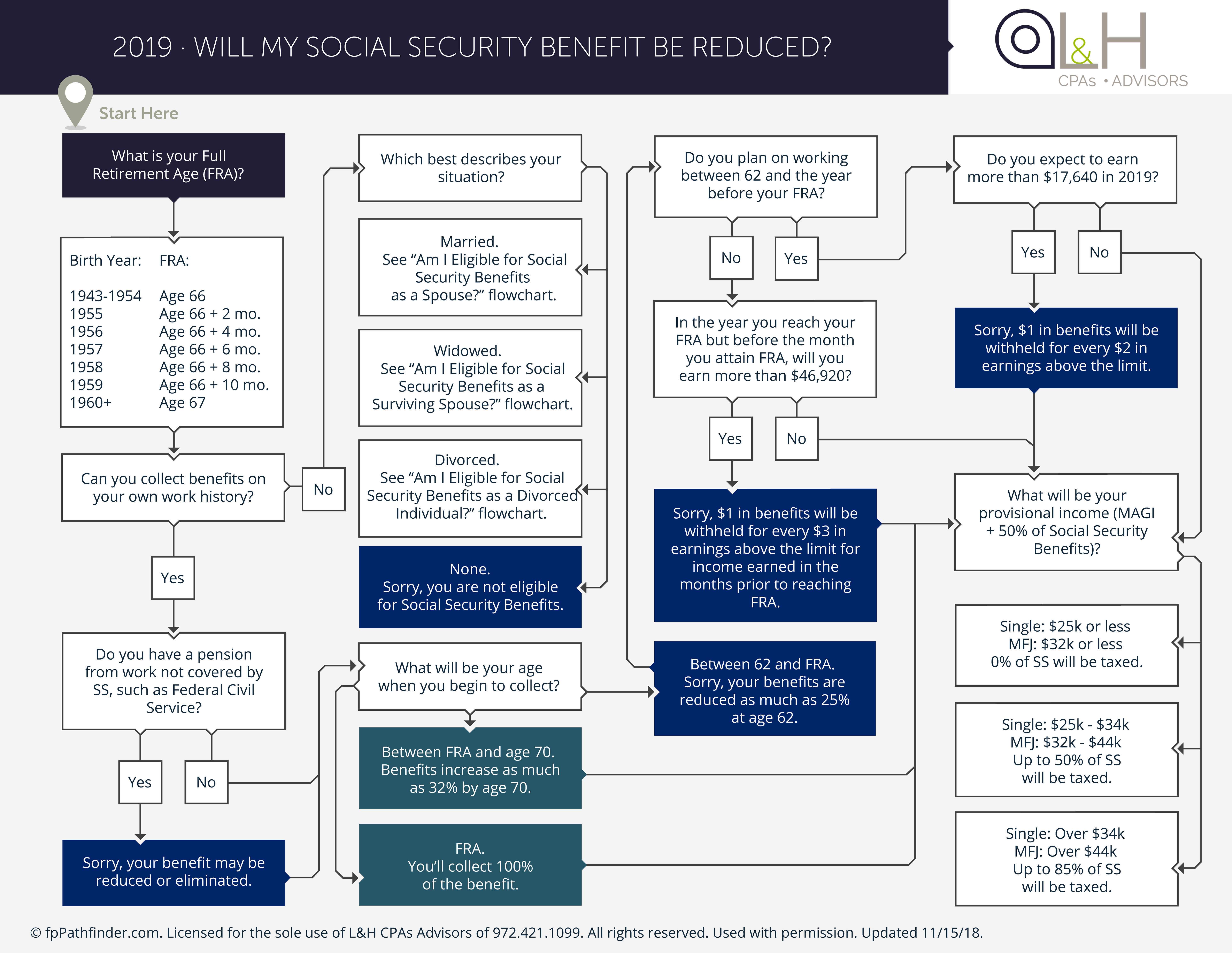

You did the math. You think you're getting $2,800 a month. But then the IRS knocks on the door. Depending on your "provisional income"—which is your adjusted gross income plus tax-exempt interest plus half of your Social Security—you might owe taxes on up to 85% of your benefit.

This is the "tax torpedo." If you have a large 401(k) or IRA and you're taking Required Minimum Distributions (RMDs), those distributions can push your provisional income into the bracket where your Social Security starts getting taxed. Suddenly, your effective tax rate on those RMDs isn't 12% or 22%—it’s nearly double because every dollar you pull out of the IRA is also "unlocking" a dollar of Social Security to be taxed.

Real-World Example: The "Stay-at-Home" Impact

Take Sarah. Sarah worked for 20 years as a dental hygienist, took 10 years off to raise her three sons, and then went back to work for 5 years before retiring. Total years: 25. When she goes to calculate her social security benefit, she has 10 years of zeros. Her neighbor, Mark, worked 35 years straight at a lower-paying job.

Surprisingly, Mark might end up with a higher check than Sarah, even though Sarah had "better" years. The 35-year average is the great equalizer. It punishes gaps. If Sarah worked just five more years—even at a local retail shop—she could replace five of those zeros and potentially increase her monthly check by $200 or more. Over a 30-year retirement, that’s $72,000. Not bad for a part-time gig.

Divorce and Death: The Social Security Wildcards

Divorced? If you were married for at least 10 years and haven't remarried, you can claim based on your ex-spouse's record. This doesn't take a dime away from them. They won't even know you did it. But if their 50% benefit is higher than your 100% benefit, you take theirs. It's a no-brainer.

Then there’s the survivor benefit. This is the one that really trips people up. When one spouse dies, the smaller of the two checks disappears. This is why the higher earner—usually the husband, statistically speaking—should almost always wait until age 70 to claim. By doing so, he is "locking in" the highest possible survivor benefit for his wife. It’s life insurance that you don't have to pay a premium for; you just have to pay in patience.

Actionable Steps to Maximize Your Number

Stop guessing. If you want to actually take control of this, you need a plan that isn't just "I'll retire when I'm tired."

- Download your "Detailed Earnings Record." Don't just look at the summary. Check for errors. If the SSA missed a year of your earnings in the 90s, your benefit is wrong. You have to prove it to them with old W-2s or tax returns, which is a pain, but it's your money.

- Run a "What-If" scenario for the zeros. If you have fewer than 35 years of work, use a calculator like the "Social Security Detailed Calculator" (the actual software the SSA actuaries use) to see how much 2-3 more years of work changes your PIA.

- Coordinate with your spouse. Do not claim in a vacuum. If the high earner claims at 62 and dies at 75, they have permanently capped the survivor's income at a poverty level.

- Watch the "Earnings Test." If you claim before your Full Retirement Age and keep working, the SSA will withhold $1 for every $2 you earn above a certain limit ($22,320 in 2024). They give it back later, but it ruins your cash flow now.

- Factor in Medicare Part B. Remember, your "check" isn't what you get. The Medicare premium (usually around $174.70 or more) is deducted directly from your Social Security. If you’re calculating your budget, subtract that first.

The system isn't broken, but it is incredibly rigid. It doesn't care about your "intentions" or "how hard you worked." It only cares about the 35 highest indexed years and the exact month you flip the switch. Treat this like the largest financial contract of your life, because for most Americans, it is. If you're 55 or 60 right now, you still have time to "fix" your average. Every year you work now is a year of zeros you're deleting from the record. That is the most effective way to calculate your social security benefit and ensure it actually covers the bills when the paychecks stop coming.

Keep in mind that while the online tools provide a baseline, they cannot predict future Cost of Living Adjustments (COLA) or changes in federal law. The "COLA" is your best friend in retirement, as it’s one of the only income sources that actually keeps pace with the price of eggs and gas. By delaying your claim, you are applying those percentage-based COLA increases to a larger base number, compounding your wealth every single January. It is the closest thing to a "cheat code" in the American financial system.

***