Math is funny. We spend years in school learning how to find a basic average, but then real life hits and the numbers don't play fair. You’re looking for a calculate weighted average calculator because, let’s be honest, not every number deserves an equal seat at the table. If you're a college student, a 1-credit "Intro to Library Services" course shouldn't tank your GPA as much as a 5-credit Organic Chemistry nightmare. In the business world, a small price drop on a product you sell once a year doesn't matter nearly as much as a penny fluctuation on your bestseller.

Weighted averages are everywhere. They are the invisible gears in your 401(k) performance, your semester grades, and even how Google decides which websites are actually useful. But most people just hit "average" in Excel and call it a day. That's a mistake. A big one.

The Basic Average is a Liar

Standard averages—what math teachers call the arithmetic mean—assume a perfect, egalitarian world. You add everything up and divide by the count. Simple. But the world is messy.

Imagine you’re buying shares of a tech stock. In January, you buy 10 shares at $100. In February, you get excited and buy 100 shares at $50. If you just average $100 and $50, you get $75. You’d think your "break-even" point is $75. You'd be wrong. You own way more of the $50 stock. Your actual average cost is much closer to $50 than $100. This is exactly why you need to calculate weighted average calculator values manually or with a dedicated tool before making financial moves. Using the wrong math here means you might sell your stock thinking you made a profit when you’re actually still in the red.

How the Weighting Actually Works

It’s all about the "weight." Think of it like a physical scale. The weight represents the importance, frequency, or volume of a specific data point.

To find this manually without a calculate weighted average calculator, you follow a specific flow. You multiply each number by its weight. Then you add those results together. Finally, you divide that big sum by the total of all the weights.

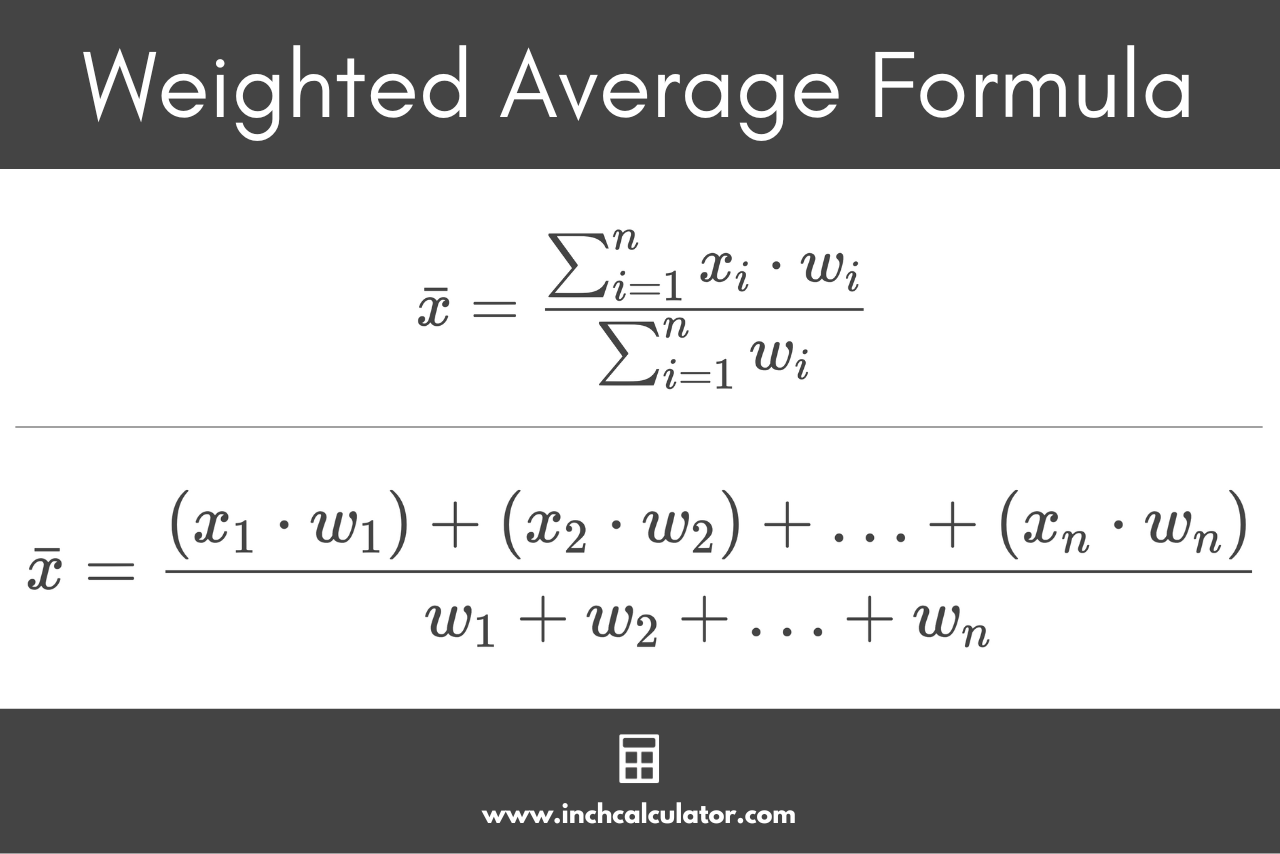

The formula looks like this:

$$W = \frac{\sum_{i=1}^{n} (w_i \cdot x_i)}{\sum_{i=1}^{n} w_i}$$

Where $W$ is the weighted mean, $w_i$ is the weight of each value, and $x_i$ is the value itself.

Wait, let's make that human.

✨ Don't miss: 2000 euros to dollars: Why the Math is Harder Than You Think

Basically: (Value A x Weight A) + (Value B x Weight B) divided by (Weight A + Weight B).

If you’re a teacher grading a class, your "values" are the scores students got. Your "weights" are the percentages of the final grade. If the final exam is 40% and a quiz is 10%, that final exam carries four times the "gravity" of the quiz. If a student bombs the quiz but aces the final, they’re still in good shape. Flip those scores, and they're in trouble.

Why Your Portfolio Depends on This

In finance, we talk about "Volume Weighted Average Price" or VWAP. Day traders live and die by this. If a stock trades at $10 for most of the day with millions of shares moving, and then jumps to $12 on a tiny trade of 100 shares at the very last second, the "average" price for the day isn't $11. It's still basically $10.

Investment giants like Vanguard or BlackRock don't just look at price; they look at the weight of the market cap. When you buy an S&P 500 index fund, you aren't putting equal money into all 500 companies. You're putting a massive chunk into Apple and Microsoft because they have higher weights. If you tried to calculate your portfolio return by just averaging the percentage gains of every stock you own, you’d get a total fantasy number. You have to weight them by the dollar amount invested.

The GPA Trap

Students are the biggest users of a calculate weighted average calculator, and for good reason. The "Quality Point" system is a weighted average.

Most universities use a 4.0 scale. An 'A' is 4.0, a 'B' is 3.0. But if that 'A' was in a 1-unit physical education class and the 'B' was in a 4-unit Calculus class, your GPA isn't 3.5. It's actually lower.

Let's do the math real quick.

(4.0 x 1) + (3.0 x 4) = 16.

Total units = 5.

16 divided by 5 = 3.2.

That 3.2 is a lot different than the 3.5 you'd get with a simple average. This is how students get surprised on graduation day. They see the "raw" average of their grades but forget that the heavy-duty labs and core requirements are dragging the weight in a different direction.

Inventory and Business Costs

Small business owners often get crushed because they don't understand weighted averages in inventory. It's called WAC (Weighted Average Cost).

Say you run a coffee shop. You buy 50 lbs of beans at $10/lb. Next week, the price jumps, and you buy 50 lbs at $15/lb. Your average cost is $12.50. Easy. But what if you bought 100 lbs at the higher price? Now your cost basis shifts. If you keep pricing your lattes based on that original $10/lb cost, you're slowly bleeding money without realizing it. A calculate weighted average calculator keeps your margins real. It reflects the actual cost of the physical items sitting on your shelf, not just the price you remember paying once upon a time.

Common Mistakes People Make

Most people mess up the denominator. They divide by the number of items instead of the sum of the weights. If you have three categories of weights (30%, 30%, 40%), you divide by 100 (or 1.0), not by 3.

Another weird one? Using negative weights. Unless you're doing some very advanced physics or weird accounting offsets, weights should be positive. You can't have something that is "negatively important" to an average; it just doesn't work that way.

Also, watch out for "percent of percent" errors. If your weights are already percentages, make sure they actually add up to 100%. I've seen plenty of business proposals where the "weighted" importance of various factors added up to 110% because of sloppy rounding. That’s a fast way to lose credibility in a boardroom.

🔗 Read more: Over 20 Years Experience: Why the Resume Gold Standard is Changing

Real World Nuance: The Simpson’s Paradox

There is a weird quirk in statistics called Simpson’s Paradox. It’s a bit of a brain-melter. It happens when a trend appears in different groups of data but disappears or reverses when those groups are combined.

This usually happens because of—you guessed it—uneven weights. A classic example is a medical study where Treatment A looks better than Treatment B in two separate small trials. But when you look at the weighted average of the whole population, Treatment B actually performed better. Why? Because Treatment B might have been tested on much harder cases. Without weighting for the "severity" of the patient's condition, the raw average tells a lie. This is why researchers are so obsessed with how they calculate weighted average calculator inputs; it’s literally a matter of life and death in clinical trials.

Actionable Steps for Accuracy

Stop using a regular calculator for complex distributions. It's too easy to miss a parenthesis or mess up the order of operations ($PEMDAS$).

- List your values in one column. These are your scores, prices, or data points.

- Assign a weight to each. This could be hours, dollars, or percentage of importance.

- Check your weight sum. If you're working with percentages, ensure they hit 100. If they don't, your "average" will be scaled incorrectly.

- Multiply across, then sum. Get your "weighted total" first.

- Divide by the total weight count. This "normalizes" the number back into a range that makes sense.

- Double-check against the "Eye Test." If your weighted average is higher than your highest value or lower than your lowest, you did something wrong. The result must always sit somewhere between the extremes.

If you're using Excel, skip the manual math. Use the =SUMPRODUCT(values_range, weights_range) / SUM(weights_range) formula. It’s the cleanest way to handle it without pulling your hair out.

The goal isn't just to get a number. It's to get a number that actually reflects reality. Whether you're tracking your kid's grades, managing a stock portfolio, or trying to figure out the true cost of shipping for your e-commerce store, the weighted average is the only metric that accounts for the fact that some things simply matter more than others.

Check your data, assign your weights carefully, and always verify that the total weight matches your sample size. This is how you move from guessing to knowing.