Living in the Golden State basically means you're trading sunshine for one of the most complex tax codes in the country. Honestly, if you’ve lived here long enough, you know the drill: the state always seems to find a way to squeeze just a little more out of your paycheck. But with the ca income tax rates 2024 now in full swing, there are some specific shifts—like inflation adjustments and a pretty massive change to payroll caps—that might actually catch you off guard if you're just looking at the basic brackets.

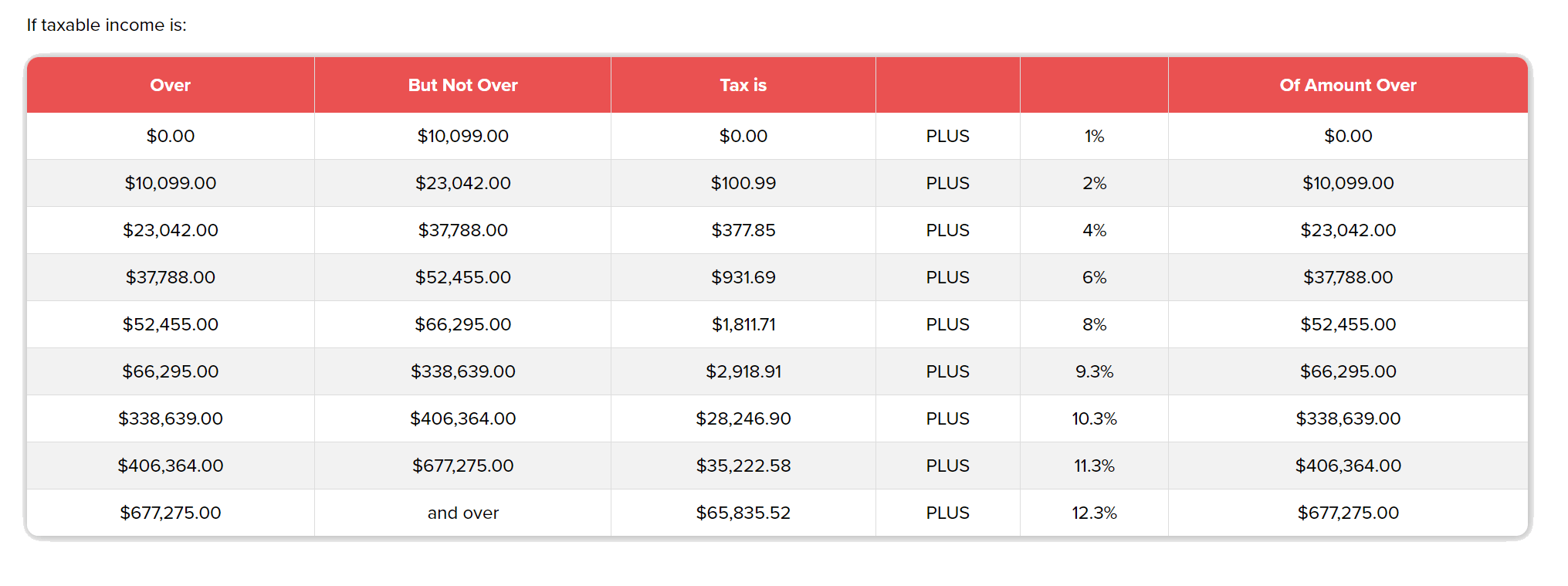

California doesn't just have high taxes; it has progressive taxes. That's a fancy way of saying the more you earn, the more the Franchise Tax Board (FTB) wants a piece of. For the 2024 tax year—which are the taxes you're likely sitting down to file right about now in 2025—the rates still range from a modest 1% all the way up to 12.3%.

Wait, it actually gets higher. If your taxable income clears the $1 million mark, you get hit with an extra 1% Mental Health Services Act tax. That brings the top effective rate to 13.3%. And if you're a high-earner with W-2 wages, there’s a new "hidden" hike this year because the state removed the wage cap on State Disability Insurance (SDI), which we'll get into in a bit.

What Most People Get Wrong About the Brackets

One of the biggest misconceptions is that if you "move into a higher bracket," all your money is suddenly taxed at that new, higher percentage. That’s just not how it works. You only pay the higher rate on the dollars that actually fall into that specific bucket.

Think of it like a series of cups. You fill the 1% cup first, then the 2% cup, and so on.

For a single filer or someone married filing separately in 2024, the first $10,756 of your taxable income is taxed at just 1%. If you earn $50,000, you aren't paying 6% on the whole $50k. You’re paying 1% on that first chunk, 2% on the next chunk (up to $25,499), and 4% on the amount between $25,499 and $40,245. Only the last bit of your income—roughly $9,755 of it—actually touches the 6% rate.

🔗 Read more: Why A Force of One Still Matters in 2026: The Truth About Solo Success

The 2024 Numbers for Single Filers

If you're filing as Single or Married/RDP Filing Separately, here is how the state carves up your income:

- 1% on income up to $10,756

- 2% on income between $10,756 and $25,499

- 4% on income between $25,499 and $40,245

- 6% on income between $40,245 and $55,866

- 8% on income between $55,866 and $70,606

- 9.3% on income between $70,606 and $360,659

- 10.3% on income between $360,659 and $432,787

- 11.3% on income between $432,787 and $721,314

- 12.3% on income over $721,314

Married Filing Jointly? The Buckets are Bigger

For couples, the brackets basically double. If you're Married Filing Jointly or a Qualified Surviving Spouse, you don't hit that 9.3% "middle-class" wall until your combined taxable income exceeds $141,212.

- 1% on income up to $21,512

- 2% on income up to $50,998

- 4% on income up to $80,490

- 6% on income up to $111,732

- 8% on income up to $141,212

- 9.3% on income up to $721,318

- 10.3% on income up to $865,574

- 11.3% on income up to $1,442,628

- 12.3% on income over $1,442,628

The Massive SDI Change Nobody Talks About

While everyone stares at the ca income tax rates 2024 charts, there’s a quiet change that happened on January 1, 2024, that specifically hurts high-earning W-2 employees.

Previously, the 1.1% State Disability Insurance (SDI) tax was capped. Once you earned more than $153,164 (the 2023 limit), they stopped taking that 1.1% out of your check.

As of 2024, that cap is gone. History.

💡 You might also like: Who Bought TikTok After the Ban: What Really Happened

Now, every dollar of your wages is subject to that 1.1% tax. For most people, this doesn't change much. But if you're a doctor, a tech exec, or an attorney making $500,000, you’re now paying an extra few thousand dollars in mandatory "payroll tax" that didn't exist for you last year. When you add that 1.1% to the top income tax rate of 13.3%, high-earning Californians are looking at an all-in top marginal rate of roughly 14.4%.

That is currently the highest in the nation.

Standard Deductions and Credits (The Good News)

It's not all bad news. California adjusts its standard deductions for inflation every year. For 2024, the standard deduction is:

- $5,540 for Single or Married Filing Separately.

- $11,080 for Married Filing Jointly, Head of Household, or Qualifying Surviving Spouse.

If your itemized deductions—things like mortgage interest (up to a $1 million limit in CA, unlike the $750k federal limit), large medical bills, or charitable gifts—don't add up to more than those amounts, you just take the standard and run.

California also does something unique with Exemption Credits. Instead of a "personal exemption" that lowers your taxable income like the federal government used to do, California gives you a flat credit that comes right off the tax you owe.

📖 Related: What People Usually Miss About 1285 6th Avenue NYC

- For 2024, that credit is $149 for individuals and $298 for joint filers.

- Got kids? Each dependent gives you another $461 credit.

If you're a renter and make less than $52,421 (single) or $104,842 (joint), don't forget the Nonrefundable Renter's Credit. It’s small—$60 or $120—but hey, it’s a free lunch in a state where lunch costs $20.

Why Your "Taxable Income" Isn't Your Salary

You've got to remember that these rates apply to your taxable income, not your gross salary. Before you even look at the brackets, you subtract your deductions.

California also doesn't play by the same rules as the IRS on everything. For instance, California still taxes most pension and 401(k) withdrawals as ordinary income. And if you have a Health Savings Account (HSA), be careful. California is one of the few states that doesn't recognize HSAs as tax-advantaged at the state level. You’ll have to add back those contributions and pay tax on the interest or dividends earned inside the account on your state return. It’s a total headache.

Real World Example: The "Typical" Professional

Let's look at Sarah, a single software engineer in Irvine earning $150,000 in taxable income.

Because of how the ca income tax rates 2024 are tiered, Sarah’s first $70k is taxed at rates between 1% and 8%. The remaining $79,394 of her income falls into the 9.3% bracket.

Even though her "top" bracket is 9.3%, her effective tax rate (the actual percentage of her total income that goes to the state) is usually closer to 7% or 8% once you factor in those lower initial buckets and her personal exemption credit.

Actionable Steps for Tax Season

Don't just hand a pile of papers to a CPA and hope for the best. Being proactive saves money.

- Check your SDI withholdings: If you have multiple jobs and earned over $153,164 combined, you might have actually overpaid your SDI. The state won't automatically give that back; you have to claim it as a credit on your Form 540.

- Review the Renter's Credit: If you moved to a more expensive area and your income stayed steady, check those AGI limits ($52k single / $104k joint). It’s one of the most skipped credits in the state.

- Account for HSA Interest: If you have an HSA, pull your 1099-SA or your year-end statement. You need to report the earnings (interest/dividends) from that account on your California return, even though it's invisible on your federal return.

- Mind the "Mental Health" Threshold: If you're a business owner or had a massive capital gain year that pushed you over $1 million, prepare for that extra 1% surtax. It’s a flat 1% on everything over $1M, with no deductions to shield it.

The 2024 tax year is technically "business as usual" for the brackets, but with the elimination of the SDI cap and the usual inflation adjustments, the math has definitely changed. Keep an eye on your AGI—that's the number that really determines which of these "cups" you end up filling.