You’re standing in a driveway in Queens or maybe a rainy parking lot in Buffalo. Cash is changing hands. You have the title, but there's this nagging feeling about the paperwork. New York is notorious for its bureaucracy, and honestly, the DMV doesn't make things easy. People often ask if a New York State car bill of sale is even mandatory. The short answer? Sorta. While the title is the "gold standard" for ownership, the Bill of Sale (Form MV-912) is the legal glue that keeps the tax man and the liability lawyers off your back.

Think of it as your receipt. Without it, you’re basically flying blind.

New York isn't like some states where a handshake and a signed title suffice for every scenario. Here, the Department of Motor Vehicles (DMV) uses the bill of sale to calculate sales tax and verify the purchase price. If you leave it blank or mess up the numbers, you might find yourself stuck in a loop of "Form DTF-802" hell, trying to prove you didn't underpay the state. It's about protecting yourself from the "what-ifs." What if the buyer gets a speeding ticket before they register the car? What if the seller lied about the odometer?

The Legal Reality of the New York State Car Bill of Sale

Let's get real about the law. Under NY Vehicle and Traffic Law, the title is the document that transfers ownership. However, the DMV explicitly states that a bill of sale is required if the transfer is a "non-titled" vehicle or if the title doesn't have a dedicated space for the purchase price.

Most modern NY titles do have a price section. So why bother?

Because the buyer needs it to register the car. When they walk into that DMV office—likely after waiting three weeks for an appointment—the clerk is going to ask for proof of what they paid. If the title is messy or the price is illegible, the New York State car bill of sale becomes the primary evidence. If you’re the seller, you want a copy of this document to prove you no longer own the hunk of metal. If that car is abandoned on the BQE tomorrow, the police are coming for the last registered owner. You want that signed paper to show you washed your hands of it at 2:14 PM on a Tuesday.

What Must Be Included (The "No-Brainers")

You don't need a lawyer to write this, but you do need to be precise. If you miss a digit on the VIN, the whole thing is trash.

- The Basics: Year, make, and model. Simple.

- The VIN: Check it three times. Look at the dashboard, then the door jamb, then the title. They must match.

- The Money: The exact purchase price. Don't "help a friend out" by writing a lower price to save them on sales tax. That’s tax fraud. The NY Department of Taxation and Finance actually flags cars sold significantly below "Fair Market Value" and will send a bill for the difference later.

- The People: Full names and addresses for both parties. No nicknames.

- The Odometer: This is huge. Federal law requires an odometer disclosure for most vehicles. In New York, if the car is less than 10 years old, you absolutely must record the mileage at the moment of sale.

The "Gift" Complication

Sometimes no money changes hands. Maybe you're giving your old Corolla to your niece. You still need a New York State car bill of sale, but the price is "Gift."

✨ Don't miss: Am I Gay Buzzfeed Quizzes and the Quest for Identity Online

But wait. There's a catch.

New York requires Form DTF-802 (Statement of Transaction) for gifts. If the gift is between "family members" (defined strictly by the state as spouses, parents, children, or siblings), it’s usually sales tax exempt. If you’re gifting it to a friend or a "cousin" who isn't actually a legal relative, the state might still want its cut of the taxes based on the car's value. Honestly, it's a bit of a headache, which is why having the bill of sale clearly stating "Gift" helps establish the intent from day one.

Why the DMV Form MV-912 is Your Best Friend

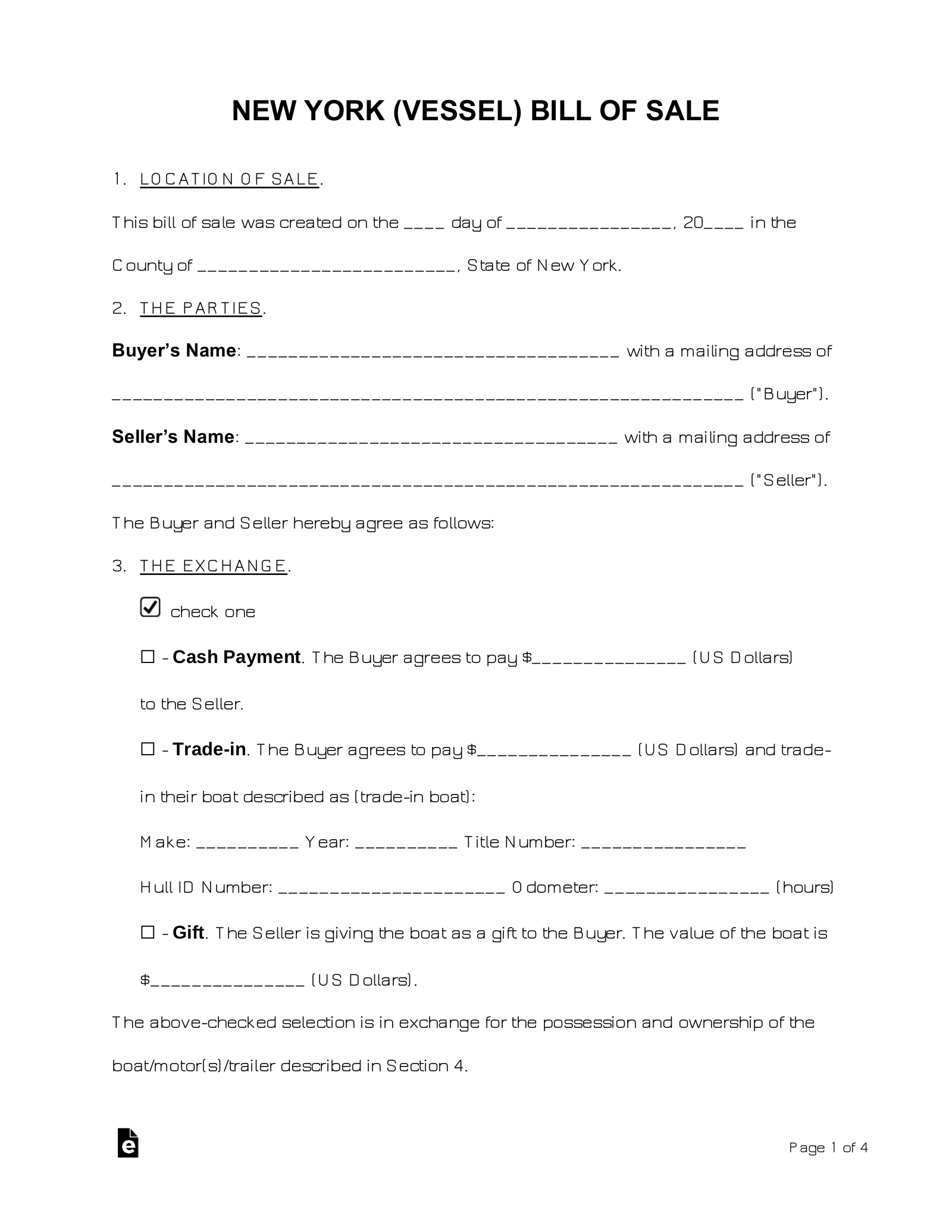

You could write your own contract on a napkin. Legally, that's often acceptable. But why risk it? The New York DMV provides an official form called the MV-912. It’s a one-page document that covers every legal base the state cares about.

Using the official form speeds up the registration process. The clerks see it every day. They know where the VIN is, they know where the signatures go, and they're less likely to squint at it with suspicion. If you're selling a car in a high-stress environment—like the middle of Manhattan—having the printed MV-912 ready makes you look like a pro. It builds trust.

Dealing with Liens

Here’s where things get sticky. You cannot legally sell a car in New York if there’s an active lien on it unless that lien is satisfied. If you’re the buyer, check the title. If there’s a bank listed at the bottom, that seller needs a "Lien Release" from the financial institution.

Never, ever accept a New York State car bill of sale for a car with an active lien without seeing the original, signed lien release paper. If you buy it anyway, you won't be able to register it, and the bank could technically repo the car from your driveway. It happens more than you’d think. People get excited about a deal and forget to look at the fine print.

Odometer Scams and New York Law

New York takes odometer fraud seriously. It’s a felony. When you fill out the bill of sale, the mileage should be exact. If the odometer has rolled over (common in vintage cars) or if it’s broken, you must check the box that says "not the actual mileage."

🔗 Read more: Easy recipes dinner for two: Why you are probably overcomplicating date night

I once knew a guy in Syracuse who bought a "low mileage" truck only to find out the cluster had been swapped. Because he didn't have a detailed bill of sale with the mileage recorded at the time of purchase, he had a nightmare of a time proving the seller had defrauded him. Documentation is your armor.

The Signature: Does it Need a Notary?

In New York State, you generally do not need a notary for a standard car sale.

However, there’s a "but."

If you are dealing with a boat (which often goes through similar DMV channels) or certain out-of-state titles, a notary might be required. For a standard New York passenger vehicle? Just the signatures of the buyer and seller. But make sure those signatures match the names on the title. If "Jonathan Smith" is on the title, don't let him sign as "Jon Smith." The DMV will kick it back.

Common Mistakes That Kill the Deal

People get lazy. It’s the end of a long day of haggling, and you just want to go home.

- Ignoring the Date: The date on the bill of sale starts the clock for the buyer to get insurance and registration.

- Using Pencil: Seriously. Use a blue or black pen. The DMV will reject anything that looks like it can be erased or altered.

- No Copy for the Seller: Sellers often hand over the title, take the cash, and walk away with nothing. If the buyer never registers the car and racks up tolls on the Tappan Zee Bridge (now the Mario Cuomo, but let's be real, it's the Tappan Zee), the seller is going to get those bills in the mail. A copy of the New York State car bill of sale is your "get out of jail free" card with the E-ZPass authorities.

The Insurance Gap

In New York, insurance follows the car, but the registration follows the person. As soon as that bill of sale is signed and the plates are removed, the seller should cancel their insurance—but only after they've turned the plates in to the DMV.

Pro tip: Never let the buyer drive away with your plates. Even if they promise to mail them back. They won't. Then you'll face an insurance lapse fine from the DMV that grows every single day. Take the plates off, sign the bill of sale, and tell them to bring a trailer or get their own transit plates.

💡 You might also like: How is gum made? The sticky truth about what you are actually chewing

The Sales Tax Math

New York isn't just one tax rate. You pay the rate of the county where the buyer lives, not where the car is sold. If you live in a 4% county but buy a car in an 8.875% NYC zone, you pay your local rate. The New York State car bill of sale is what the DMV uses to trigger that calculation.

If you bought the car for $5,000, expect to pay around $400-$450 in taxes at the window. If the bill of sale says $500, and the car is a 2022 BMW, the DMV will pause. They have a "valuation book." If your price is wildly off, they'll make you fill out additional paperwork explaining why (e.g., "engine is blown," "frame is rusted").

AS-IS vs. Warranties

Unless you’re a dealer, most private sales in New York are "As-Is." This means once the bill of sale is signed, the buyer owns the problems. However, the seller can't actively deceive. If the seller writes "perfect condition" on the bill of sale and the transmission drops out ten miles later, the buyer might actually have a small claims case.

Most sellers should include the phrase "Sold As-Is, No Warranty" directly on the document. It's a simple phrase that saves a lot of legal heartache.

What Happens After the Handshake?

Once the New York State car bill of sale is in the buyer's pocket, the process moves fast. The buyer needs to get a New York State insurance card. You cannot register a car in NY without it. Then, they take the bill of sale, the signed title, the proof of insurance, and the sales tax form to the DMV.

The seller's job is simpler: take the plates to a DMV office or mail them. Get a plate surrender receipt (FS-6T). This is the most important piece of paper you will ever own. It is the only thing that officially stops your insurance requirement in the eyes of the state.

Nuance: Out-of-State Buyers

If you’re selling your NY car to someone from New Jersey or Connecticut, the bill of sale is even more critical. New York titles are generally respected, but out-of-state DMV offices are often unfamiliar with NY's specific forms. Providing a clean, clear bill of sale alongside the NY title ensures the transition across state lines doesn't hit a snag.

Actionable Next Steps

Don't leave the paperwork to the last minute. If you are prepping for a sale today, here is exactly what you should do:

- Download Form MV-912: Don't write it yourself. Get the official PDF from the NY DMV website. It’s free and it’s the standard.

- Verify the ID: Ask to see the buyer's (or seller's) driver's license. Make sure the name they are signing on your New York State car bill of sale matches the ID in front of you.

- Photograph Everything: Before you hand over the keys, take a high-res photo of the signed title (front and back) and the completed bill of sale. Store these in a cloud drive.

- The Plate Surrender: If you’re the seller, get those plates off the car immediately. Do not let the buyer drive home on your registration. If they need to move the car, they can apply for an "In-Transit Permit" from the DMV, which gives them 30 days of legal transport time.

- Check for Liens: If you’re the buyer, run a quick VIN check online to ensure there are no undisclosed liens that didn't make it onto the physical paper title.

Getting the paperwork right feels like a chore, but in New York, it's the difference between a smooth ride and a multi-month battle with the Department of Taxation and Finance. Clear records make for short memories and zero stress.