The rumors had been swirling around Miami for a while. If you spend any time in the 305, you know how it goes. People talk at the coffee shops in Mary Brickell Village, and suddenly everyone is an amateur real estate mogul. But when the news finally broke about the Brickell City Centre mall sale, it wasn’t just local gossip anymore. It was a seismic shift in how we look at "High Street" retail in the South.

Swire Properties, the massive developer behind the project, decided to part with a significant chunk of the retail component. They didn’t just sell to anyone. They sold to a partnership between Simon Property Group and authentic retail powerhouses.

🔗 Read more: Jordan Belfort: The Wolf of Wall Street Book (What Really Happened)

People were shocked. Why would Swire sell the crown jewel of Brickell?

The Real Numbers Behind the Brickell City Centre Mall Sale

Let's be real for a second. In the world of commercial real estate, "sale" doesn't always mean someone is jumping ship because the boat is sinking. Sometimes, it's just about cashing in your chips when the table is hot. Swire Properties sold the retail portion of the $1.05 billion development for a reported $157.45 million back in 2020. That sounds like a lot, but in the context of a billion-dollar mixed-use project, it’s a specific strategic move.

The buyers weren't just looking for a passive income stream. Simon Property Group is the biggest mall owner in the U.S., and they teamed up with Institutional Mall Investors (IMI). They saw what everyone else saw: Brickell isn't just a neighborhood anymore. It’s a global destination.

It's crowded. Honestly, if you've tried to park there on a Saturday, you know it's a nightmare. But that's exactly why the buyers wanted in.

Why Swire Let Go of the Reins

You've gotta understand Swire's DNA. They are long-term builders. They spent years assembling the land, fighting through zoning, and dealing with the logistical hell of building over active Miami streets. Once the mall was up and running—once those "Climate Ribbon" shades were actually keeping people cool—the heavy lifting was done.

By executing the Brickell City Centre mall sale, Swire freed up massive amounts of capital. They didn't leave Miami; they just pivoted. They are still heavily involved in the office towers and the residential side, like the Rise and Reach towers. They basically handed the keys of the retail engine to the people who specialize in running retail engines.

👉 See also: Point Guard Management Wichita Explained (Simply)

Simon Property Group knows how to squeeze every cent out of a square foot of retail space. They have the relationships with the Diors, the Chanels, and the Apple Stores of the world. Swire is a developer; Simon is a landlord. It’s a fundamental difference in business models.

The "Climate Ribbon" and the Reality of Outdoor Shopping

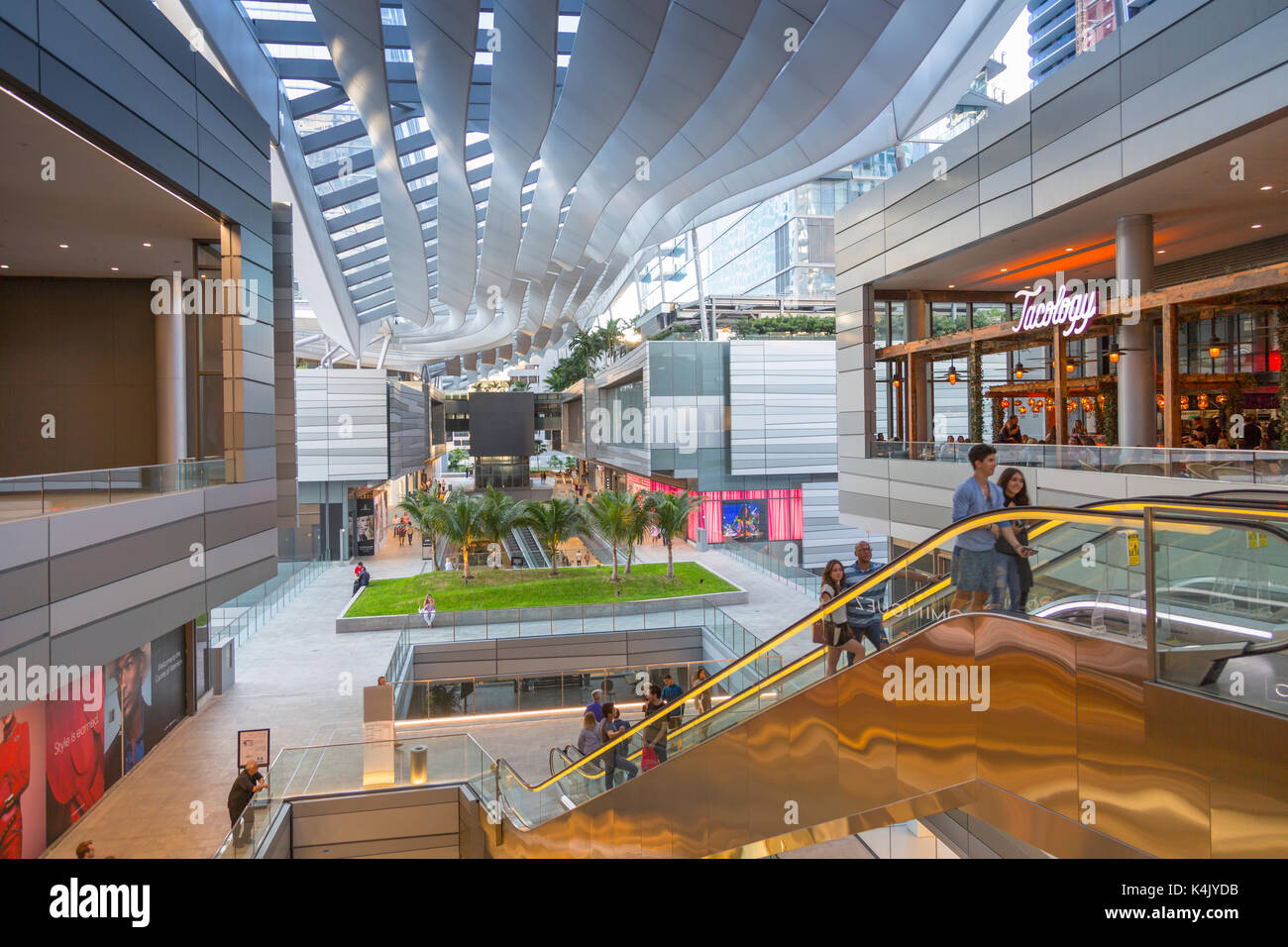

If you've walked through the mall, you've seen it. That $30 million undulating steel and glass trellis. It’s called the Climate Ribbon. It’s supposed to harvest the breeze and keep the walkways cool without traditional air conditioning.

Does it work? Sorta.

On a breezy November day, it’s magic. In the middle of an August humidity spike? You’re still sweating. But the Brickell City Centre mall sale wasn't based on the temperature of the hallways. It was based on the fact that this mall solved a massive problem for Miami: it gave the city a central "downtown" shopping experience that didn't feel like a stuffy, enclosed box from the 1980s.

Retailers noticed. Saks Fifth Avenue anchored the space, bringing a level of luxury that Brickell residents used to have to drive to Bal Harbour for. When the sale happened, it proved that the "urban mall" concept wasn't just a trend. It was a viable, high-value asset class.

The Competition: Design District vs. Brickell

Miami's retail scene is a literal arms race. On one side, you have Craig Robins and the Design District. On the other, you have the Brickell City Centre mall sale signaling that the financial district is ready to play.

The Design District is all about art and ultra-luxury. Brickell is more about the "live-work-play" lifestyle. The people buying $2 million condos in the surrounding towers don't want to drive 20 minutes north to buy a pair of shoes. They want to walk downstairs, grab a coffee at Casa Tua Cucina, and browse Zara.

This proximity is what drove the valuation of the sale. It’s "captive audience" marketing at its finest.

What This Means for Future Development in Miami

Look at what happened right after the retail sale. The momentum didn't stop. We saw the announcement of "One Island Park" and the massive office tower that Swire is partnering on with Related Companies.

The Brickell City Centre mall sale acted as a proof of concept. It showed institutional investors that Brickell could support top-tier retail rents. It turned the neighborhood from a "9-to-5" banking hub into a "24/7" lifestyle zone.

- Institutional Confidence: When Simon Property Group buys in, other big banks and hedge funds follow.

- Diversification: Swire proved you can build a city-within-a-city and then sell off pieces of it to maximize ROI.

- Retail Evolution: The mix of tenants shifted. We started seeing more "experience-based" tenants like Puttshack and high-end cinemas.

It’s not just about clothes. It’s about keeping people on the property for four hours instead of forty minutes.

The Impact on Local Residents

If you live in Brickell, the sale was mostly invisible. Your favorite stores didn't vanish overnight. But behind the scenes, the management shifted. You might have noticed the events got a bit more "polished." The marketing became more aggressive.

The downside? Prices. Everything in Brickell is expensive, and a high-profile sale like this only reinforces the area's status as a premium zone. Rents for small businesses in the surrounding blocks often spike when a major asset like BCC trades for big numbers.

Misconceptions About the Deal

One thing people get wrong is thinking Swire "lost" money. They didn't. They recycled capital. In the world of high-stakes real estate, holding onto an asset forever isn't always the goal. The goal is to build, stabilize, and then exit at the right time to fund the next massive project.

Another myth: that the mall was struggling. While the first couple of years were a slow burn—mostly because of construction in the surrounding area—the foot traffic numbers leading up to the Brickell City Centre mall sale were trending upward. Simon Property Group doesn't buy losers. They buy assets where they can add value through their massive global leasing network.

Real-World Actionable Insights

If you are looking at the Miami real estate market or just trying to understand why your neighborhood is changing, here is the ground-level reality.

- Watch the Anchors: The health of a mall sale is tied to its anchors. Saks and the cinema are the pillars here. If they stay healthy, the asset stays healthy.

- Follow the "Smart Money": When groups like Simon and IMI move into an area, it’s a signal of long-term stability. They don't do "flip" deals.

- Transit Matters: The fact that the Metromover runs right through the middle of the mall is a huge factor in its valuation. Direct transit access is the "holy grail" for urban retail.

- Mixed-Use is King: Retail on its own is risky. Retail attached to 500,000 square feet of office space and thousands of condos is a much safer bet.

The Brickell City Centre mall sale wasn't an ending. It was the start of the project's second act. It transitioned from a "new development" into a "stabilized institutional asset." For the rest of Miami, it served as a wake-up call that the center of gravity in the city has officially shifted south.

📖 Related: Coca Cola Co Stock Price: Why Most Investors Are Missing the Real Story

If you're tracking the value of property in the area, keep an eye on the remaining "Phase II" lands. Swire still holds plenty of cards, and how they play them will dictate the next decade of the Miami skyline. The retail sale was just the first major domino to fall in a much larger game of chess.

To get a true sense of the impact, visit the mall on a Thursday evening. Watch the office workers from the surrounding towers merge with the tourists and the locals. That density is exactly what Simon Property Group paid for. It’s a machine that converts foot traffic into revenue, and right now, the machine is humming.

For anyone looking to invest in the area, the key is to look at the periphery. The "BCC Effect" has pushed property values up in a half-mile radius. Small retail pockets and older apartment buildings are now prime targets for redevelopment because of the gravity exerted by the City Centre. The sale didn't just change the mall; it re-anchored the entire neighborhood's economy.

The next time you hear about a "sale" in Miami, don't assume something is wrong. In this city, a sale is usually just a sign that the stakes have been raised once again. Swire did the impossible by building it, and Simon is doing the predictable by scaling it. It's a classic Miami story of ambition meeting institutional capital.

Actionable Steps for Investors and Observers:

- Monitor the Vacancy Rates: Keep an eye on the "second-floor" retail spaces; these are the hardest to fill in urban malls and are the true indicator of a mall's health.

- Track Office Occupancy: The success of the retail component is inextricably linked to the nearby office towers. High occupancy in the towers means a guaranteed lunch and happy hour crowd for the mall's restaurants.

- Study the Phase II Timeline: Swire's next moves on the remaining vacant lots will provide the most significant clues about the next "jump" in local property values.

- Analyze Tenant Turn-over: When a "standard" mall brand is replaced by a high-end luxury brand, the valuation of the entire complex moves up a notch. This "upscaling" is a core part of the Simon Property Group playbook.