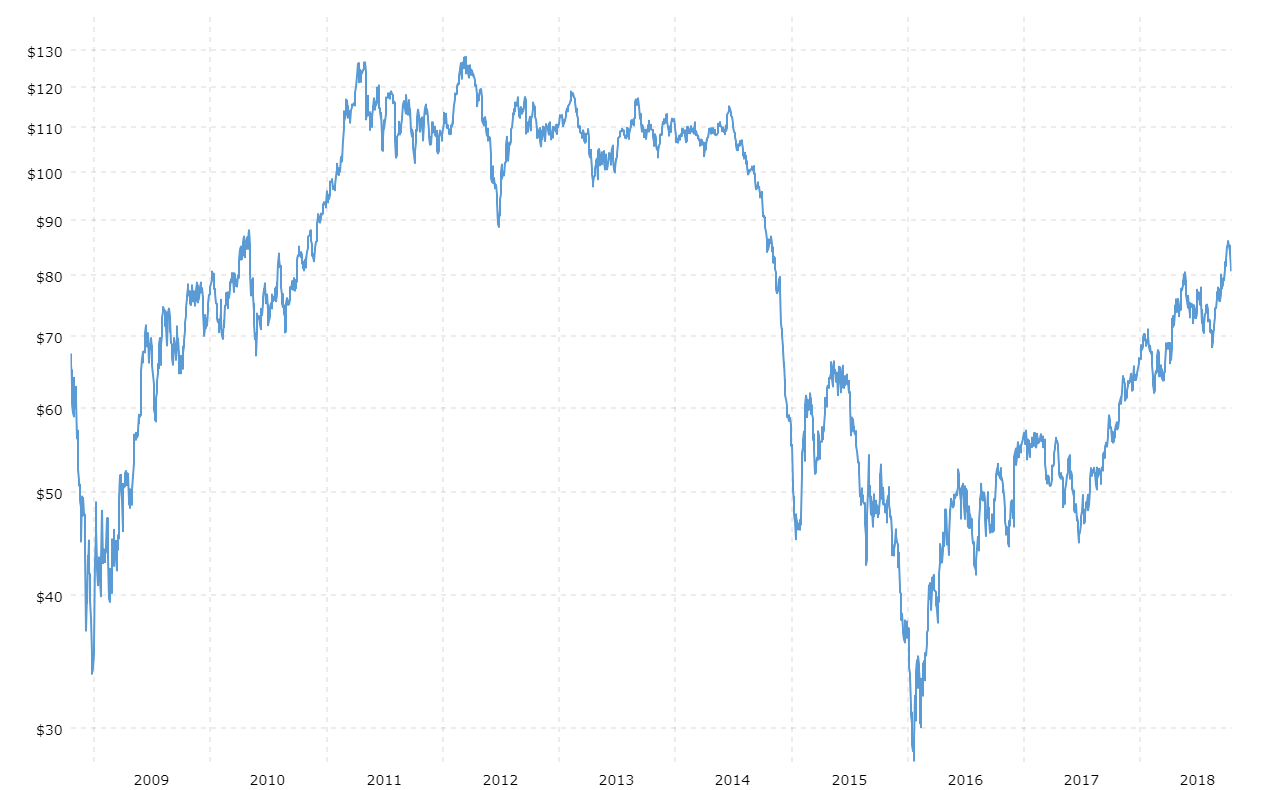

Honestly, if you've been watching the news lately, you've probably noticed that the energy market is kind of a mess. Brent North Sea crude oil prices just haven't been able to catch a break. On January 15, 2026, we saw Brent tumble down to about $63.64 per barrel. That’s a sharp 4% drop in a single day.

It's wild. Just a year ago, things looked completely different. We are currently sitting about 21% lower than where we were this time in 2025.

Why? Basically, the world is producing way more oil than it actually needs. It’s the classic "supply glut" story, but with a few modern twists that most people are getting wrong.

What's actually driving Brent North Sea crude oil prices right now?

The big thing to understand is that the balance of power has shifted. For a long time, everyone obsessed over OPEC+. If they cut production, prices went up. If they pumped more, prices fell.

But in 2026, the story is about the "non-OPEC" guys—specifically Brazil, Guyana, and Argentina. These countries are pumping out an extra 0.6 million barrels per day. Combine that with a world that isn't exactly craving more fuel, and you've got a recipe for a price slide.

🔗 Read more: Is The Housing Market About To Crash? What Most People Get Wrong

The massive surplus nobody can ignore

The numbers are pretty staggering. The International Energy Agency (IEA) and the EIA are both pointing to a global surplus that could average nearly 3.8 million barrels per day through 2026.

Think about that.

That is a mountain of oil that has nowhere to go. Much of it is literally sitting on ships out at sea because land-based storage is filling up. When you see "contango" in the market—where future prices are higher than today's—it's a sign that traders are basically being paid to store oil and wait for a better day.

The China and India factor

You'll often hear that China is the engine of the oil market. That's still mostly true, but the engine is sputtering. China's demand growth has slowed to about 0.2 million barrels per day. Instead of using oil to power new factories, they are busy building up strategic stockpiles.

💡 You might also like: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

India is actually the more interesting story. They are expected to add about 0.3 million barrels per day in demand this year. But even with India's growth, it's not enough to offset the flood of supply coming from the Americas.

Geopolitical "Wildcards"

Of course, it’s never just about supply and demand. Geopolitics are the ultimate "what if" in this industry.

- Russia and Ukraine: If peace talks actually lead to something concrete, the "risk premium" vanishes. Some analysts think a peace deal could push Brent down into the $50s almost instantly.

- Iran and Venezuela: Sanctions are still the name of the game here. If the U.S. decides to get tougher or lean into deregulation, it shifts the math for everyone.

- The "Trump Put": There’s a lot of chatter about the U.S. administration prioritizing lower energy prices to fight inflation. They’ve hinted at wanting oil near $50, which puts a ceiling on how high prices can go.

Brent North Sea Crude Oil Prices: What the experts are saying

Different banks have different vibes on where we go from here.

J.P. Morgan is looking at an average of $58 for the year. Meanwhile, the EIA is even more bearish, forecasting a $56 average. UBS is a bit more optimistic, thinking we might bottom out at $60 in the first quarter before a small recovery later in the year.

📖 Related: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

It’s a tight range. Basically, everyone is betting that the days of $80 or $90 oil are over for a while.

What should you watch?

If you're trying to figure out where Brent North Sea crude oil prices are headed next week, don't just look at the ticker. Watch the "crack spreads"—the difference between the price of crude and the price of the products made from it, like diesel.

Also, keep an eye on the U.S. rig count. If prices stay in the $50s for too long, American shale producers will start shutting down. They need a certain price to break even, and we are getting dangerously close to that line.

Actionable insights for the road ahead

If you're an investor or just someone trying to hedge your fuel costs, here’s how to handle this market.

- Respect the $55 Floor: Most models suggest $55 is the "magnet" for the first half of 2026. If it dips below that, it’s likely a buying opportunity, but don’t expect a massive rally.

- Watch the Curve: If the market stays in contango, don't buy the "bounce." Wait for the front-month prices to start trading higher than the future months (backwardation) before believing a recovery is real.

- Hedge Early: If you're a business owner, these prices are the lowest we've seen in years. It might be a good time to lock in long-term fuel contracts while the glut is still weighing things down.

- Monitor Inventories: Specifically, look at "oil on water." If those floating storage numbers start to drop, it means the surplus is finally being absorbed.

The reality is that 2026 is shaping up to be a "surplus year." It’s a boring answer, but the data doesn't lie. Unless a major pipe blows up or a new war starts, we are looking at a slow, grinding market where supply is king.

Keep your eyes on the production numbers from Guyana and the stockpile reports from China. Those will tell you more about the future of Brent North Sea crude oil prices than any politician's speech ever will.