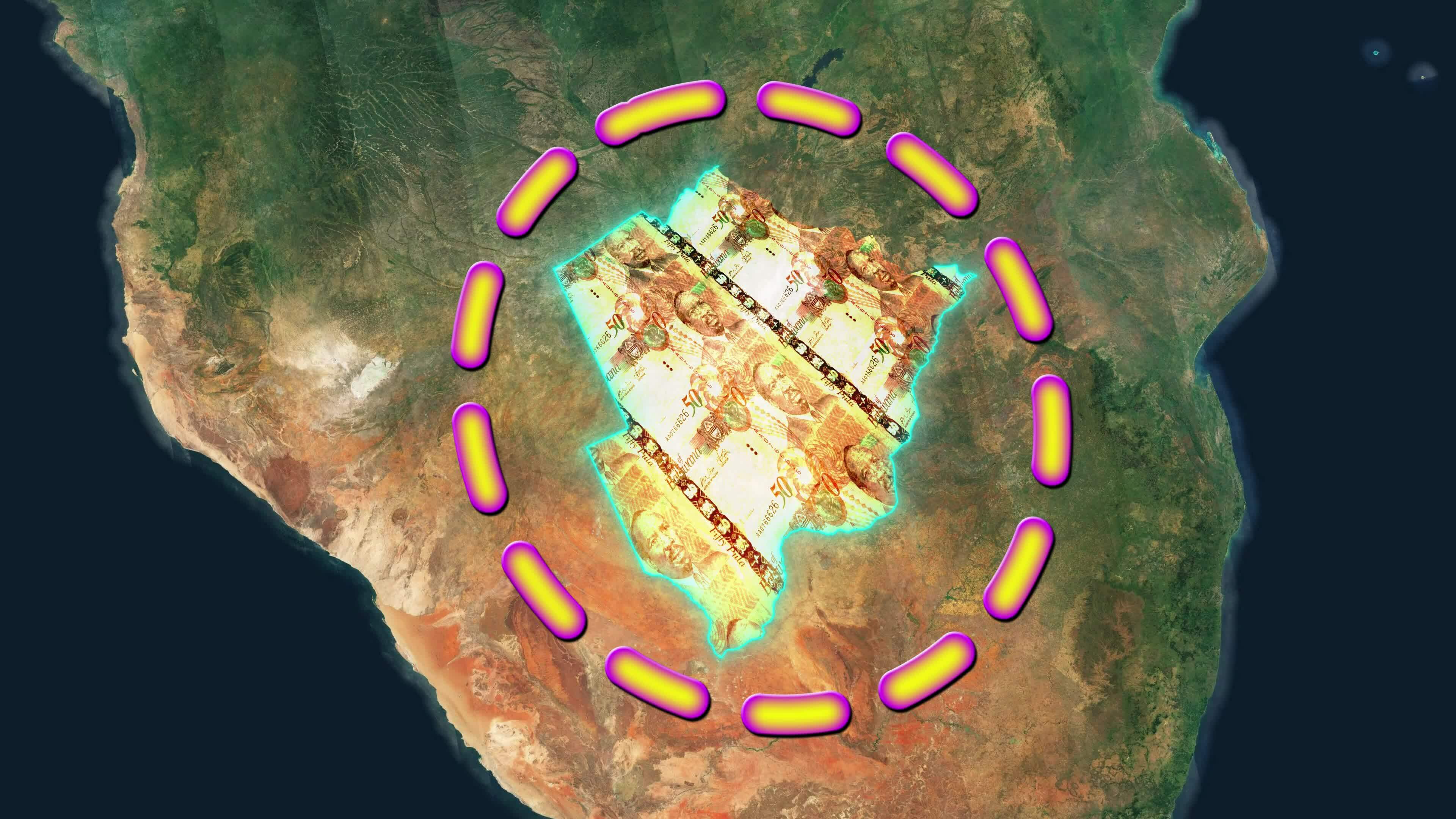

Honestly, if you're looking at the Botswana pula to USD exchange rate right now, you might be scratching your head. It’s not just a numbers game anymore. Usually, Botswana is the poster child for African economic stability, but 2026 has brought some curveballs that even the most seasoned forex traders didn't see coming.

The pula isn't just a currency; it’s basically a mirror of the global diamond market. And right now, that mirror is looking a little foggy. As of January 17, 2026, the exchange rate is hovering around 0.0748 USD per 1 BWP. If you're doing the math the other way, $1 gets you about 13.37 pula.

👉 See also: Illinois Residential Lease Agreement: Why You Need to Rethink Your Template in 2026

It sounds steady. It isn't.

Behind that decimal point is a massive tug-of-war between the Bank of Botswana and a global economy that’s fallen out of love with natural diamonds. If you're planning a trip to the Okavango Delta or trying to move capital, you've gotta understand the "crawling peg" and why the government is intentionally letting the currency lose value.

The Diamond Problem No One Saw Coming

Botswana's economy is basically three diamonds in a trench coat. About 75% of their foreign exchange earnings come from those shiny rocks. But here’s the kicker: lab-grown diamonds are eating the market alive.

In late 2025, Debswana—the giant joint venture between De Beers and the government—had to slash its production target by a massive 40%. We’re talking about a drop from 25 million carats down to just 15 million. When you stop selling diamonds, you stop bringing in US dollars.

🔗 Read more: Chief Investment Officer Bank of America: What the Market Leaders Actually Do

When USD supply dries up, the Botswana pula to USD rate should, in theory, plummet.

But it hasn't crashed. Why? Because the Bank of Botswana is playing a very sophisticated game of chess with something called the "Pula Basket."

How the Pula Basket Actually Works

The pula isn't free-floating like the US dollar or the Euro. It’s pegged to a mix of two things:

- The South African Rand (ZAR): Usually weighted around 45-50%.

- The SDR (Special Drawing Rights): A basket of international heavyweights like the Dollar, Euro, and Yen.

Because the Rand has been volatile lately, the Pula often follows it down the drain or up the mountain, regardless of what’s happening in Gaborone.

The "Rate of Crawl" is the Real Story

You’ve probably heard of a "fixed" or "floating" rate. Botswana uses a "crawling peg." Basically, the President and the Minister of Finance, Ndaba Gaolathe, decide how much the pula should gain or lose over a year to keep local businesses competitive.

On January 1, 2026, the government confirmed they’re keeping the downward rate of crawl at 2.76%.

Wait, what?

Yes, they are intentionally making the pula weaker. It sounds crazy, but it’s a survival tactic. By letting the pula lose about 2.7% of its value against the USD and Rand over the year, Botswana makes its beef and tourism exports cheaper for foreigners. It also protects their dwindling foreign exchange reserves, which hit a scary low of five months of import cover in early 2025.

What This Means for Your Wallet

If you’re a traveler or a business owner, these "micro-adjustments" matter more than the daily fluctuations.

The Bank of Botswana recently hiked the Monetary Policy Rate (MoPR) to 3.5%. They did this to fight inflation, which is currently sitting at 3.9%. It’s a delicate balance: they want the currency weak enough to help exporters but strong enough so that your groceries (which are mostly imported from South Africa) don't become unaffordable.

If you're holding USD and looking to buy Pula:

✨ Don't miss: Where Is the Ford Escape Made? The Surprising Truth About Louisville

- The trend is your friend: The intentional 2.76% depreciation means your dollars will likely buy more pula in six months than they do today.

- The Rand factor: Keep one eye on the South African Rand. If the Rand tanked because of political news in Pretoria, the Botswana pula to USD rate will likely dip too, even if Botswana’s economy is doing just fine.

A New Era of Diversification?

President Duma Boko, who took office in late 2024, has been shouting from the rooftops about moving away from diamonds. They're looking at copper—specifically the Khoemacau Mine expansion—and even a "golden passport" program for investors putting in at least $75,000.

There's even talk of Botswana buying a bigger stake in De Beers from Anglo American. It’s a high-stakes gamble. If the diamond market recovers in the second half of 2026 as the IMF predicts, the pula might see a surprise rally. If it doesn't, that 2.76% downward crawl might just be the beginning.

Actionable Next Steps

If you need to exchange money or hedge your exposure to the Botswana pula to USD rate, don't just look at the spot price today.

- Check the Rand: Since the ZAR makes up nearly half of the Pula’s value, a volatile Rand means a volatile Pula. Use a multi-currency tracker that shows both.

- Watch the June Review: The Ministry of Finance reviews the "rate of crawl" twice a year. The next big update is scheduled for June 2026. If the diamond slump continues, they might increase the depreciation rate even further.

- Use Asymmetric Margins: The Central Bank recently changed how it buys and sells currency to commercial banks. This means the "spread" (the difference between buying and selling price) can be wider than you expect. Shop around at local banks like ABSA Botswana or Standard Chartered rather than just using an airport kiosk.

The days of the pula being a "boring" stable currency are over for now. It’s an active, managed, and fascinating piece of the Southern African economic puzzle. Stay sharp.