You probably remember the ticker BRG. It was a staple for yield-hungry investors who wanted a piece of the Sunbelt rental boom. Then, seemingly overnight, it vanished from the New York Stock Exchange. If you’re looking for Bluerock Residential Growth REIT Inc today, you won't find it on a ticker tape because it’s a ghost—a very profitable ghost for some, but a confusing memory for others.

Real estate investment is usually slow. Boring. Predictable. But the saga of Bluerock was anything but that. It was a high-stakes chess match involving Blackstone, a spin-off, and a massive bet on where Americans actually want to live. Honestly, it’s one of the cleanest examples of "buying low and selling high" in the modern REIT era.

The Day Blackstone Wrote a $3.6 Billion Check

In late 2021, the real estate world caught fire. Blackstone Real Estate Advisors reached across the table and basically bought the heart of Bluerock Residential Growth REIT Inc. The price? Roughly $3.6 billion. It wasn't just a random acquisition; it was an all-cash deal at $24.25 per share.

Investors cheered. The stock popped. But the deal was complicated. Blackstone didn't want everything. They specifically wanted the "institutional quality" multifamily properties—those shiny, high-end apartment complexes in places like Atlanta, Phoenix, and Orlando. These are the "Live, Work, Play" hubs where Millennials and Gen Z are flocking.

While the deal closed in 2022, it left behind a trail of paperwork that still confuses people looking at their old brokerage statements. You didn't just get cash. You got a piece of a new company called Bluerock Homes Trust (BHM).

Why the Sunbelt Focus Changed Everything

Bluerock wasn't just buying buildings. They were buying a demographic shift. They leaned hard into the "smile states." Think of a smile drawn across the US map, starting in the Northwest, dipping through Texas and the Southeast, and ending in the Mid-Atlantic.

They focused on Class A properties. These aren't your "fixer-upper" units. These are buildings with saltwater pools, dog wash stations, and high-speed fiber internet. During the pandemic, when people fled cramped New York or San Francisco studios, they landed in Bluerock’s backyard.

✨ Don't miss: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

The strategy was simple: Target markets with high job growth and limited housing supply. When you own the best building in a city where everyone is moving, you don't have to worry about vacancies. You just worry about how fast you can legally raise the rent.

The Spinoff: Meet Bluerock Homes Trust

When the Blackstone deal finalized, Bluerock Residential Growth REIT Inc effectively split in two. Blackstone took the big, stabilized apartment buildings. What was left? The single-family rental (SFR) business.

This became Bluerock Homes Trust.

If you held BRG stock at the time, you received one share of BHM for every eight shares of BRG you owned. It was a "tax-free" spin-off, which sounds great until you realize you now own a much smaller, more volatile company focused on houses instead of apartments.

Single-family rentals are a different beast entirely. Instead of one roof covering 300 units, you have 300 roofs spread across a county. The maintenance costs are higher. The logistics are a nightmare. But the demand is insane because nobody can afford to buy a house with 7% mortgage rates anymore.

What Most People Get Wrong About the Buyout

A lot of folks think Bluerock "failed" because it's gone. That’s just wrong. In the REIT world, getting bought out by Blackstone is like winning the Super Bowl. It means your portfolio was so well-assembled that the biggest player in the world decided it was easier to buy you than to compete with you.

🔗 Read more: Missouri Paycheck Tax Calculator: What Most People Get Wrong

The "Growth" in Bluerock Residential Growth REIT Inc wasn't just a marketing buzzword. Between 2014 and the buyout, they grew their portfolio from a handful of assets to over 15,000 units. They used a "pre-development" strategy where they would invest in a project before it was even built, securing a lower price and higher eventual yields.

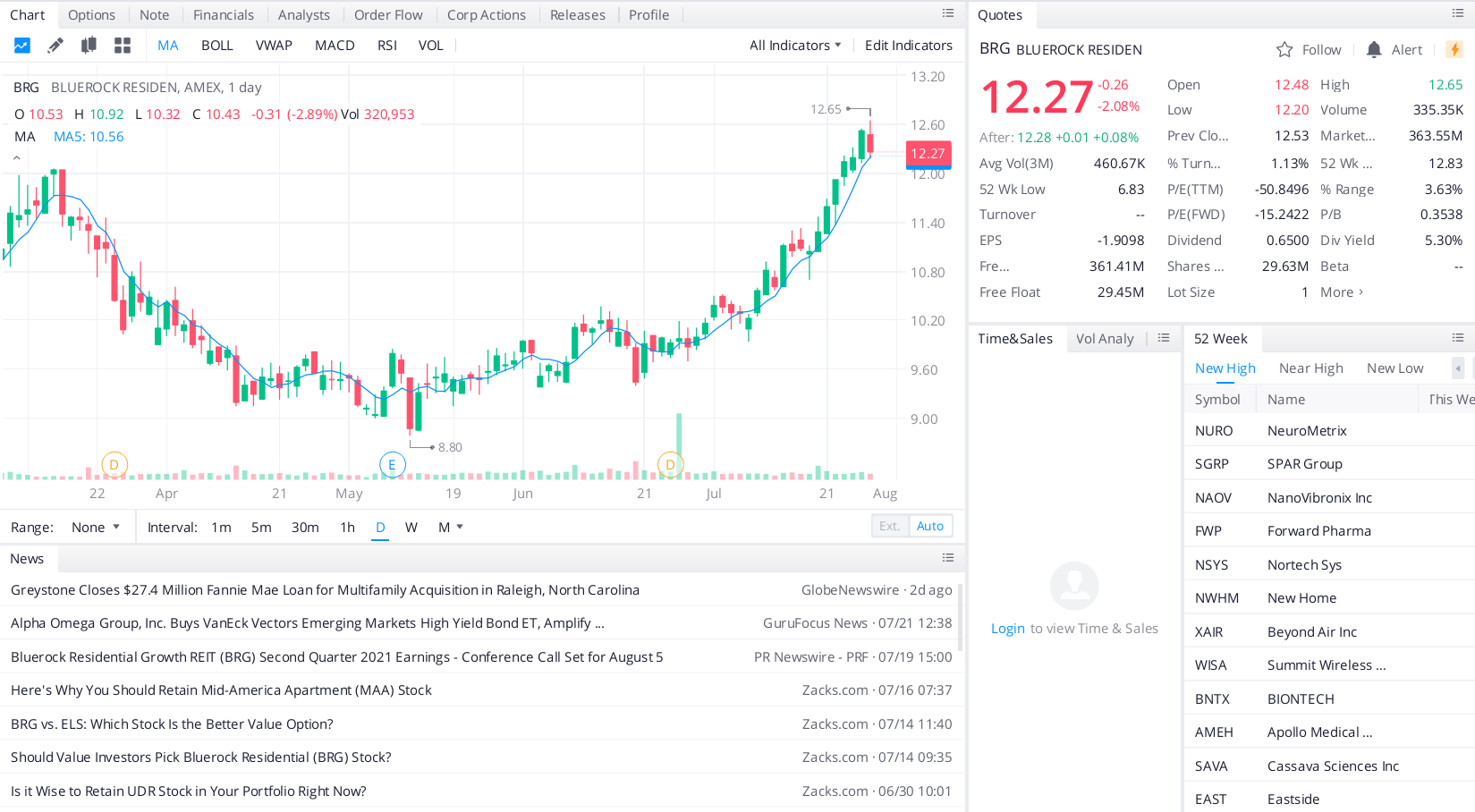

Real Numbers and the Reality of Dividends

Before the buyout, BRG was known for its dividends. REITs are legally required to pay out 90% of their taxable income to shareholders. Bluerock was aggressive here. But they also had a complex capital structure with multiple classes of preferred stock (Series B, Series C, Series D).

If you were a preferred shareholder, you were basically in a different league than common stockholders. You got paid first. When Blackstone moved in, these preferred shares were mostly redeemed at their "par value" plus any accrued dividends.

- Common Shares: Received $24.25 in cash.

- Preferred Shares: Usually redeemed at $25.00 per share.

- The BHM Bonus: The spin-off shares added a bit of "lottery ticket" value to the deal.

Is There Still a Way to Invest in This Strategy?

Since Bluerock Residential Growth REIT Inc as we knew it is gone, you have to look elsewhere. The management team didn't just retire to the Bahamas. They are still active through Bluerock Capital Markets and the now-public Bluerock Homes Trust (BHM).

If you’re looking for that same Sunbelt multifamily vibe, you’re now looking at competitors like Mid-America Apartment Communities (MAA) or Camden Property Trust (CPT). They operate in the exact same dirt that Bluerock made famous.

The lessons from BRG are clear:

💡 You might also like: Why Amazon Stock is Down Today: What Most People Get Wrong

- Geography is destiny. You can have a mediocre building in a booming city and still make money.

- Consolidation is the endgame. Small and mid-cap REITs are often just "feeding shops" for giants like Blackstone or Prologis.

- Structure matters. If you didn't understand the difference between your common shares and the preferred series, the buyout was probably a confusing time for your portfolio.

Actionable Steps for Former and Future Investors

If you still have "stub" positions or are looking to replicate the Bluerock success, here is how you handle it.

First, dig up your 1099-B from the year of the merger (2022). Many investors still haven't properly adjusted their cost basis for the BHM spin-off. Because it was a pro-rata distribution, your "price paid" for those new shares is actually a portion of what you originally paid for BRG. If you sell BHM now without adjusting that basis, you’re going to pay way too much in taxes.

Second, watch the Sunbelt "supply wave." The reason Blackstone was so eager to buy Bluerock was the lack of housing. Today, in 2026, a lot of new apartments have finally hit the market in cities like Austin and Nashville. Rents are stabilizing, or even dipping. The "easy money" period of 2021 is over.

Third, look at the "institutionalization" of housing. Bluerock was a pioneer in taking what used to be a "mom and pop" business—landlording—and turning it into a high-tech, data-driven machine. If you're looking for the next Bluerock, look for companies integrating AI into property management to cut overhead.

The story of Bluerock Residential Growth REIT Inc is a reminder that in real estate, you don't hold forever. You build, you scale, and if you're lucky, you get an offer you can't refuse.

Verify your current holdings in any successor entities. Check the tax treatment of your 2022 distributions. Evaluate current Sunbelt REITs not on past performance, but on their ability to maintain occupancy as new supply hits the streets.