You've probably seen those viral videos of giant robotic arms "printing" houses out of concrete in a matter of days. It looks like the future. Naturally, investors are hunting for the "next Tesla" of the building world, which often leads them straight to Blackwell 3D Construction stock (ticker: BDCC).

But here's the thing.

Most people looking at this stock are seeing the dream of 3D-printed skyscrapers and missing the cold, hard reality of the Pink Sheets. It’s a wild ride. Honestly, if you aren't looking at the SEC filings, you're just gambling on a cool YouTube concept.

The Reality of Blackwell 3D Construction Stock Right Now

Blackwell 3D Construction Corp (BDCC) is currently trading as a penny stock on the OTC Markets. As of mid-January 2026, the price sits around $0.03 to $0.04. That’s a far cry from its 52-week high of nearly $3.00.

Why the massive drop? Basically, the company is in what experts call the "development stage." That’s a fancy way of saying they have big ideas and some technology assets, but they aren't actually making money yet. In their 2025 fiscal year report, they reported $0 in revenue. Yes, zero.

The market cap is tiny—roughly $1.5 million. This makes the stock incredibly volatile. On a random Tuesday, it might jump 20% because of a press release about a new advisor, then crater 25% the next morning because of a late filing.

✨ Don't miss: Why Your Example of a 1098 T Matters More Than You Think

Why the UAE and India Matter for BDCC

Instead of fighting the massive regulatory hurdles in the U.S. residential market right away, Blackwell has pivoted. They are betting big on Dubai and India.

- The Dubai Move: They recently moved their corporate headquarters to the Business Bay in Dubai. The UAE is obsessed with 3D printing; they want 25% of their new buildings to be 3D-printed by 2030.

- The Hyderabad Project: Just recently, in early 2025, they signed a deal with a landowner in India to develop a 25-villa residential project.

- Feasibility Studies: They are currently doing soil testing and "field studies" to see if their concrete mix works with the local dirt.

It's a smart strategy, kinda. The regulations over there are often more flexible for experimental tech than in, say, California. But a signed "agreement" isn't a finished house. It's just a promise.

The "Going Concern" Red Flag

If you read the footnotes of their SEC 10-K filings, you’ll see a phrase that makes most seasoned investors sweat: "Going Concern."

This is an auditor's way of saying, "We aren't sure this company will exist in twelve months if they don't get more cash." Blackwell has been funding itself by issuing millions of new shares and taking on convertible notes. For a shareholder, this is a double-edged sword. It keeps the lights on, but it dilutes your ownership. Basically, your "slice of the pie" gets smaller every time they need to pay the rent.

On top of that, they’ve had some issues with timing. In early 2026, they filed a Form 12b-25, which is a notification that their quarterly report (10-Q) would be late. They said it was because of the "unreasonable effort and expense" required to finalize the numbers. That’s rarely a sign of a smooth-running machine.

What’s the Tech, Anyway?

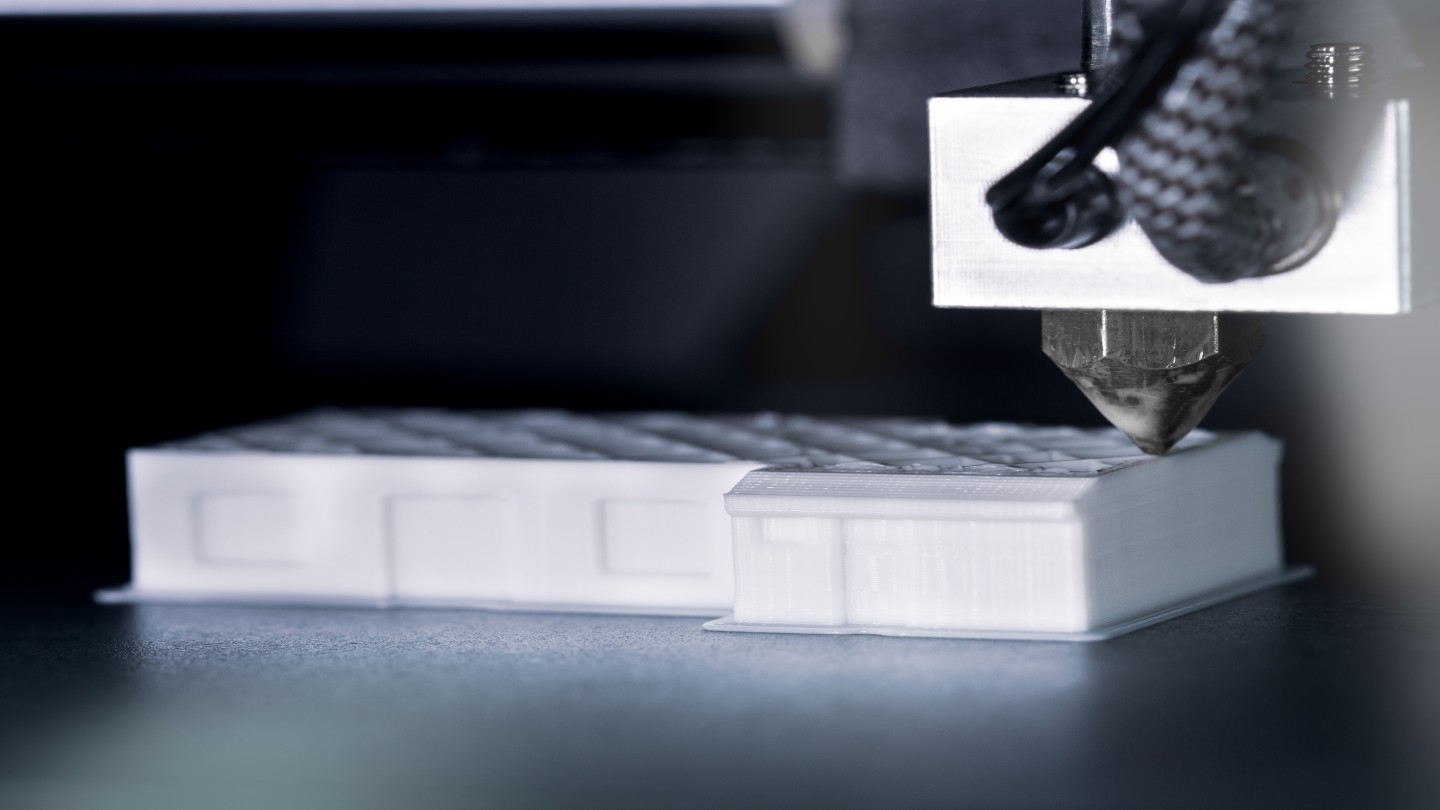

Blackwell claims to use large-scale printers and a specialized concrete mixture. The goal is to cut construction time by 50% to 70% and slash waste by 60%.

Standard construction is messy. It's slow. It uses too many people. 3D printing is automated.

👉 See also: Convert Chinese Yen to USD: What Most People Get Wrong

But here’s the rub: Blackwell doesn’t necessarily own the "only" 3D printer in the world. They are competing with well-funded giants like ICON and Diamond Age. To win, BDCC has to prove their specific "concrete recipe" is cheaper or stronger. So far, we’re still waiting for the mass-scale proof of that.

Is This a Total Gamble?

Kinda. It depends on your risk tolerance.

The bull case is simple. If they actually finish those 25 villas in India and prove the tech works at scale, the stock could skyrocket from its current sub-five-cent levels. It’s a "lottery ticket" play.

The bear case is even simpler. They are a "shell risk" company (according to OTC Markets) with no revenue, high debt, and a history of late filings. Most companies in this position eventually vanish or undergo a massive reverse split that wipes out retail investors.

Key Factors to Watch in 2026

- The India Project Progress: If they actually start pouring concrete in Hyderabad, that's a huge milestone. Watch for "groundbreaking" news.

- The Dubai Consulting Subsidiary: They launched a consulting arm in the UAE. If this starts generating actual fees, it’ll be the first time the company has "real" revenue.

- Share Cancellation: In late 2024, they announced plans to cancel 25 million shares of common stock. This is usually done to boost the value of the remaining shares. If they follow through, it shows management is actually thinking about shareholders.

What Most People Get Wrong About BDCC

The biggest mistake is thinking this is a "construction company." It isn't. Not yet.

Right now, Blackwell 3D is a technology and licensing play. They are trying to sell a method, not just build houses. If you buy the stock thinking they are going to be the next Lennar or D.R. Horton next month, you’re going to be disappointed.

You also have to watch the "Shell Risk" designation. OTC Markets flags companies that look like shells. Blackwell has been working to get these "caveats" removed, and they’ve had some success, but the stigma remains.

Actionable Steps for Potential Investors

If you’re looking at Blackwell 3D Construction stock, don't just follow the hype on Twitter or Discord. Use these specific steps to vet the move:

🔗 Read more: The Carolina Federal Credit Union Cherryville NC Reality: Why Local Banking Hits Different

Verify the Filings

Go to the SEC EDGAR database or OTC Markets website. Check if they have filed their 10-Q for the period ending November 30, 2025. If they keep missing deadlines, that's a massive warning sign.

Watch the "Volume"

This stock often has very low trading volume. That means if you buy $5,000 worth of shares, you might not be able to sell them quickly without crashing the price. Only trade what you can afford to lose.

Monitor the Debt

Look at the "Working Capital Deficit." Last check, it was nearly $900,000. They need to clear that debt or convert it before the stock can have a healthy run.

Check the "Dubai South" Expansion

Keep an eye on their news feed for specific permits in Dubai. The UAE is very transparent with their construction permits. If Blackwell isn't on the official lists of approved 3D construction providers in Dubai, the "headquarters move" might just be for show.

Invest with your eyes wide open. The tech is revolutionary, but the stock is a high-wire act without a net.

Next Step for You: Open the OTC Markets page for ticker BDCC and check the "Security Details" tab. Look specifically at the "Total Shares Outstanding" versus the "Public Float" to see how much of the company is actually available to trade versus what is held by insiders.