You're looking at your calendar. You're looking at your bank account. Something doesn't quite add up, does it? The word "biweekly" is a linguistic nightmare that causes more headaches in HR departments and scheduling offices than almost any other term in the English language.

It's a mess.

Honestly, the biggest problem with understanding biweekly is that the word itself is an auto-antonym. It means two things that are diametrically opposed. In the world of business and payroll, it almost always means once every two weeks. But if you’re talking about a magazine or a neighborhood newsletter, it might mean twice a week. That ambiguity is why people constantly find themselves short on cash or showing up to meetings on the wrong Tuesday.

The Two Faces of Biweekly Schedules

Let's get the dictionary stuff out of the way so we can talk about how this actually affects your life. According to Merriam-Webster, biweekly can mean occurring every two weeks or occurring twice a week. It’s frustrating.

In most professional settings, especially in the United States, we use the "every two weeks" definition. This results in 26 pay periods a year. If you were paid "bimonthly," which people often confuse with biweekly, you’d only get 24 paychecks. Those two extra checks in a biweekly system are what people affectionately call "magic pay months."

Imagine you get paid every other Friday. Most months, you get two checks. But because a year has 52 weeks and change, two months out of the year will gift you three paychecks. For anyone living on a tight budget, those months feel like winning a small lottery, even though the total annual salary remains exactly the same.

Why do companies do this? It’s usually about the math of a 40-hour work week. Processing payroll every two weeks is often cheaper for a company than doing it every single week, but it’s more frequent—and thus "friendlier" to employees—than waiting a whole month to get paid.

The "Every Two Weeks" Math That Catches People Off Guard

Payroll is where the biweekly definition really lives and breathes. Let's look at a real-world scenario. If you earn $60,000 a year, your gross pay isn't just your salary divided by 12 months. That would be $5,000 a month. Instead, on a biweekly schedule, you divide that $60,000 by 26.

That’s roughly $2,307.69 every two weeks.

In a standard month, you take home $4,615.38. Wait. That’s nearly $400 less than the "monthly" average of $5,000. This is where people get tripped up. They budget based on their monthly salary but their cash flow is dictated by a biweekly cycle. You have to survive on that lower amount for ten months of the year, then you "catch up" during those two triple-paycheck months.

✨ Don't miss: PayPal Share Price Today: What Most People Get Wrong About This Comeback

It’s a forced savings plan you didn't ask for.

Is Biweekly the Same as Semimonthly?

Nope. Not even close.

Semimonthly means you get paid twice a month, usually on the 1st and the 15th, or the 15th and the 30th. This results in 24 paychecks. The amounts are larger, but they come less often.

With a biweekly schedule, the day of the week is king. It’s always Friday (usually). With semimonthly, the date is king. If the 15th falls on a Sunday, your payroll department has to decide if they pay you on Friday the 13th or Monday the 16th. It’s a logistical juggle for the accounting team, which is why many modern startups and tech companies prefer the rhythmic, predictable nature of a biweekly cycle.

According to the Bureau of Labor Statistics (BLS), biweekly is actually the most common pay frequency in the U.S. private sector. About 43% of employees are on this schedule. It’s the "standard" for a reason—it balances the company's need to keep administrative costs low with the worker's need for consistent cash flow.

The Confusion in Publishing and Events

Now, let's pivot. If you’re a gamer or a tech enthusiast, you might see a "biweekly update" from a developer. In this context, they almost always mean every two weeks. But in the 19th and early 20th centuries, "biweekly" was frequently used to mean twice a week in the newspaper industry.

If someone says, "We're having biweekly meetings," and you show up on Tuesday only to find out the next meeting is in 14 days, that’s a failure of terminology. Experts in communication, like those at the Harvard Business Review, often suggest abandoning the word entirely.

✨ Don't miss: The GM Fairfax Assembly Plant in Kansas City: What’s Really Going On Behind the Gates

Just say "every two weeks."

Or "twice a week."

Precision beats brevity every single time when people's schedules are on the line.

Budgeting When You’re Paid Biweekly

If you're living the biweekly life, your budget needs to be bulletproof. Most financial advisors, like Dave Ramsey or the folks over at YNAB (You Need A Budget), suggest budgeting based on a "two-check month."

Here is how you do it:

- Ignore the "Magic" Months: Base your rent, car payment, and grocery budget on the two paychecks you receive in a standard month.

- The Bonus Factor: When those two months with three paychecks roll around, treat that third check as a "bonus." Use it to crush debt, pad your emergency fund, or finally buy that ergonomic chair you've been eyeing.

- The Gap Year Problem: Every 11 years or so, because of how leap years and the calendar drift work, some companies end up with 27 pay periods in a year. This is a nightmare for HR. If you’re a salaried employee, your paycheck might actually decrease slightly that year because the total salary is being split into more pieces. It's rare, but it happens.

Why the "Twice a Week" Meaning Still Lingers

You might wonder why we don't just kill the "twice a week" definition. Language is stubborn. In some British English circles, "fortnightly" is the preferred term for every two weeks. It's elegant. It's specific. It’s 14 nights.

In America, we don't use "fortnightly." We’re stuck with biweekly.

Because we don't have a dedicated word for the two-week interval that feels natural to us, biweekly does double duty. This is the same reason "bimonthly" is a mess—it can mean every two months or twice a month. It’s linguistic chaos.

The Psychological Impact of the Biweekly Cycle

There is a weird psychological rhythm to living biweekly. The first week after payday feels like you’re flush. The second week—the "off" week—is often when people start checking their banking apps more frequently.

Retailers know this. Data suggests that consumer spending spikes on "Green Fridays" (the Fridays when the majority of biweekly-paid workers get their checks). If you’re trying to save money, the best thing you can do is shop for your big-ticket items on the Thursday before payday. You’re more likely to be frugal when the balance is low.

Actionable Steps for Navigating Biweekly Life

If you just started a job or a project that uses a biweekly schedule, don't just wing it.

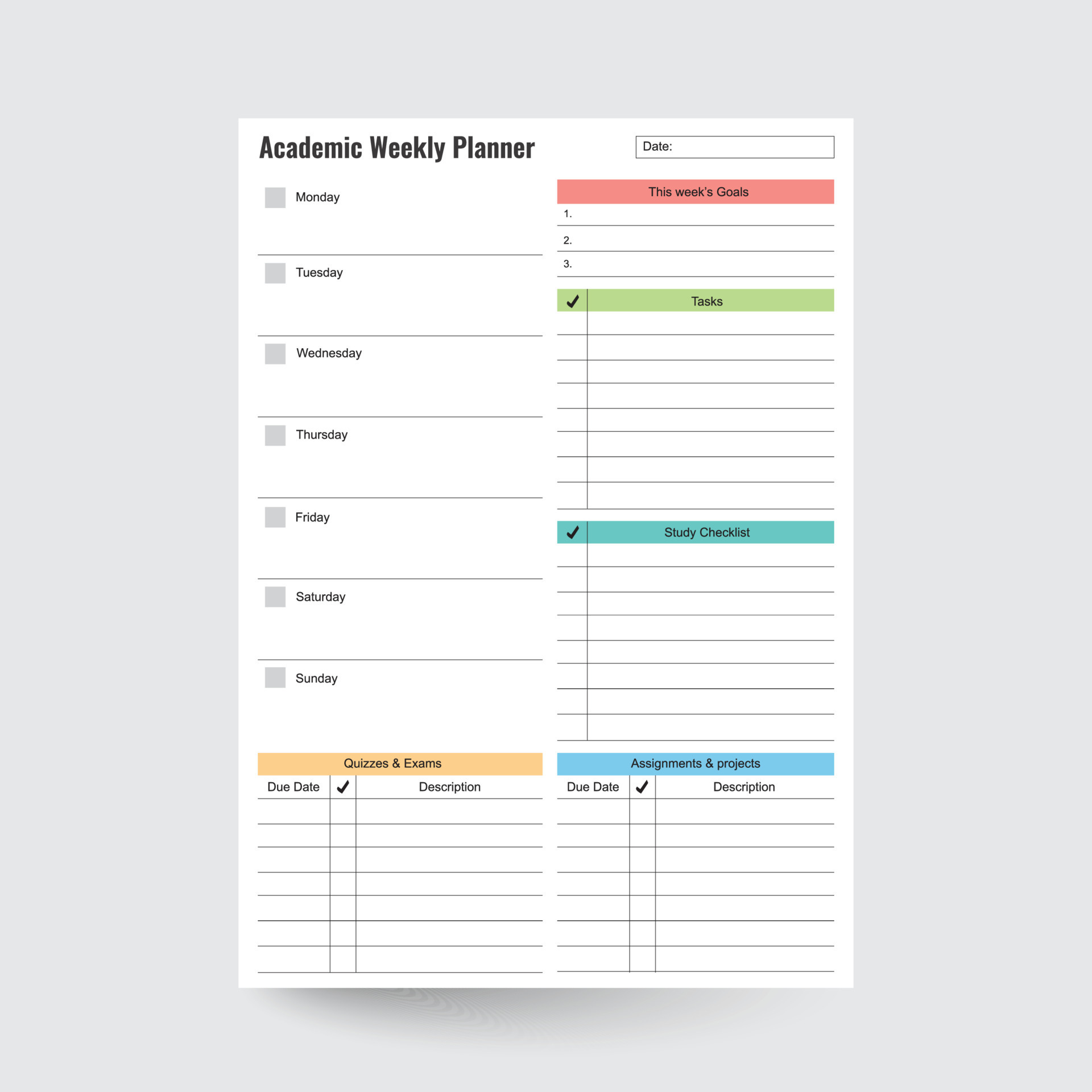

- Mark Your Calendar: Literally go through the next 12 months. Circle every payday. Identify the two months where you get three paychecks. Usually, if you get paid on January 2nd, your three-check months will be January and July.

- Adjust Automatic Payments: If your rent is due on the 1st, but your second paycheck doesn't come until the 28th, you might have a liquidity problem. Call your creditors. Many utility companies and even some landlords will let you shift your due date to align better with your "on" weeks.

- Clarify the Terms: If a client asks for "biweekly reports," ask them: "Just to be sure, do you want those every Tuesday and Thursday, or every other Wednesday?" It feels a little dorky to ask, but it's better than missing a deadline or overworking yourself.

- Use the "Half-Payment" Trick: For big bills like a mortgage or a car payment, some people find it easier to send half the payment every time they get a biweekly check. By the end of the year, you’ll have made 26 half-payments, which equals 13 full payments. You’ll pay off your debt faster without even noticing the extra money leaving your account.

Understanding biweekly isn't just about knowing a definition. It’s about mastering the cadence of your time and your money. The calendar is a tool, but only if you know how to read the fine print of the weeks. Stop letting the ambiguity of the term dictate your stress levels. Clear communication and a labeled calendar are the only real cures for the biweekly blues.