If you’ve spent any time looking at crypto charts lately, you’ve probably noticed they look like a heart rate monitor during a horror movie. One day everyone is a genius; the next, people are deleting their banking apps so they don't have to look at the damage. But amidst the noise, one question keeps popping up in group chats and at dinner tables: what is bitcoin's all-time high?

Honestly, the answer depends on when you ask, but as of right now, the number to beat is $126,272.76.

That peak didn't happen years ago in some distant memory. It happened on October 6, 2025. For a few glorious hours, the "digital gold" narrative felt invincible. But if you're looking at the price today—which is hovering around $94,058—you might be wondering how we got here and why that massive six-figure number matters so much for the future of the market.

The Road to $126,000: How We Got There

Bitcoin doesn't just wake up and decide to break records. It usually takes a perfect storm of institutional money, retail FOMO, and technical milestones. The 2025 peak was the culmination of the "Trump Pump" from late 2024 and the delayed reaction to the April 2024 halving.

You see, during the 2024 halving, the mining reward dropped to 3.125 BTC. Historically, the "supply shock" takes about 12 to 18 months to really kick in. By late 2025, that scarcity finally met a wall of demand from Wall Street. We weren't just talking about hobbyists anymore. We were talking about BlackRock, Fidelity, and even a few small nation-states quietly adding to their reserves.

It’s kinda wild to think about. Back in 2010, you could buy a Bitcoin for pennies. By October 2025, it cost more than a high-end Porsche.

Breaking Down the Major Milestones

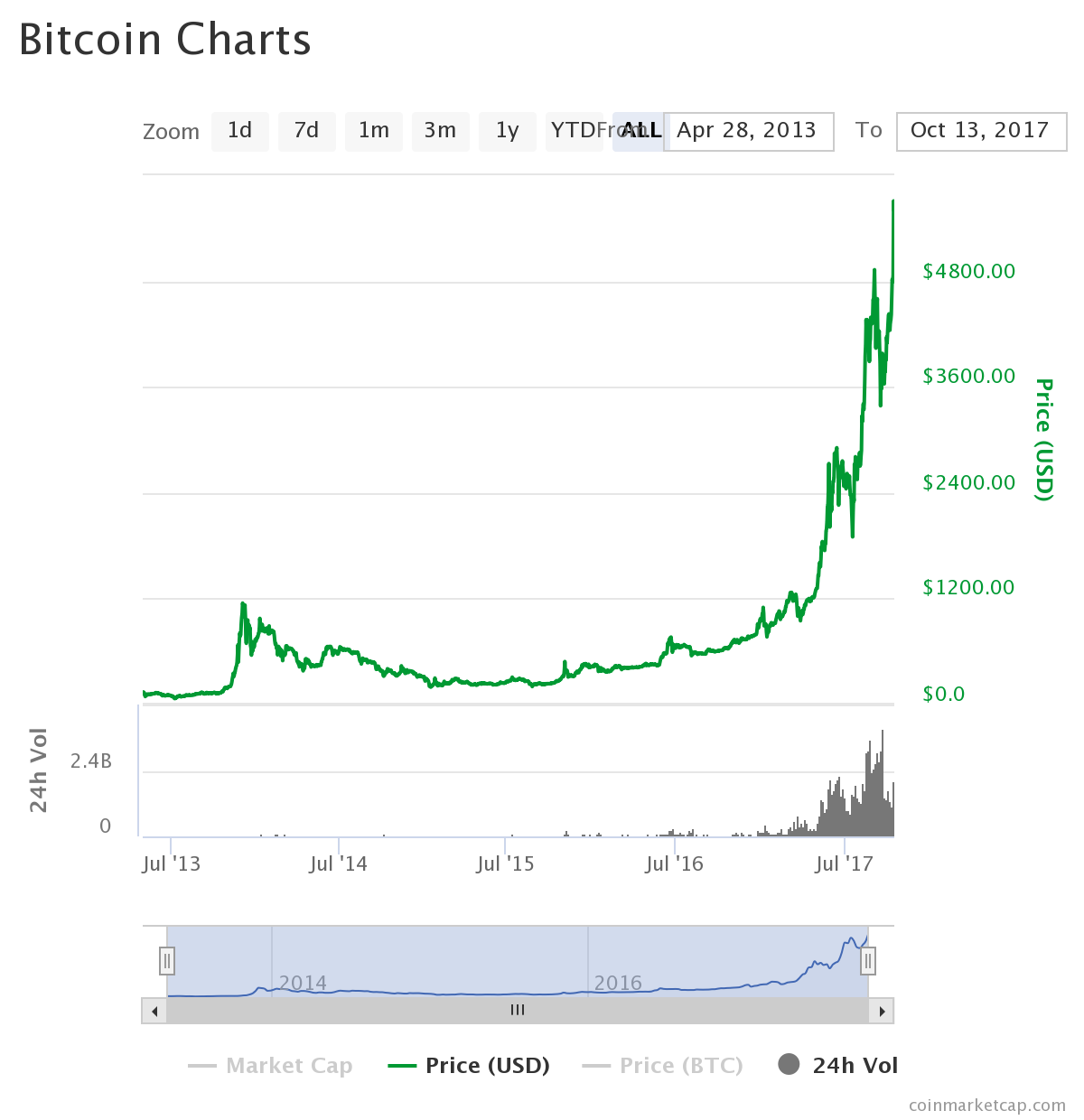

To understand what is bitcoin's all-time high, you have to look at the "mini-peaks" that built the ladder. Bitcoin doesn't move in a straight line; it moves like a drunken sailor trying to climb a flight of stairs.

- The 2021 Glory Days: We all remember when it hit roughly $69,000. At the time, we thought that was the moon.

- The 2024 Pre-Halving Spike: Thanks to the approval of Spot ETFs, Bitcoin actually broke its old record before the halving even happened, hitting $73,000 in early 2024.

- The Six-Figure Barrier: It took until 2025 for Bitcoin to finally smash through the $100,000 psychological barrier. Once it did, the FOMO was real.

- The Current Record: That $126,272 mark set on October 6 remains the "final boss" of the current cycle.

Why the All-Time High Keeps Moving

Markets are basically just giant psychological experiments. When Bitcoin hits a new high, two things happen simultaneously. First, the "O.G." investors who bought at $10,000 or $20,000 start selling to buy houses and islands. This is what we call "profit-taking," and it’s why the price usually crashes right after a big peak.

Second, the people who were waiting on the sidelines suddenly feel like they're missing out. They buy at the top, which provides the liquidity for the pros to exit. It’s a brutal cycle, honestly.

✨ Don't miss: Trade-in phone for cash: Why you are probably leaving money on the table

But there’s a deeper reason for the shifting peak. It’s the halving cycle.

Every four years, the amount of new Bitcoin being created is cut in half. This is hard-coded into the math. You can't lobby the CEO of Bitcoin to print more because there is no CEO. This absolute scarcity is what drives the price to new highs every few years. While the 2024-2025 cycle was "muted" compared to the 7,000% gains of the early days, a 3X move from $40,000 to $126,000 is still nothing to sneeze at.

Is $126,000 the Ceiling?

Probably not. But it’s complicated.

Expert analysts like Ben Loughery often point out that Bitcoin is maturing. It’s no longer a "get rich quick" scheme for everyone. It’s becoming a "don't get poor slowly" asset. As more institutional money pours in, the volatility—those heart-stopping 50% drops—is starting to dampen.

We saw this in late 2025. After hitting the high, Bitcoin corrected by about 36%. In the old days, a 36% drop was just a Tuesday. Now, it causes massive headlines and government warnings.

What Most People Get Wrong About the Price

The biggest misconception about what is bitcoin's all-time high is that the "price" is the same everywhere. It isn't.

If you were looking at a Korean exchange during the peak, you might have seen Bitcoin trading for $5,000 more than on a U.S. exchange like Coinbase. This is called the "Kimchi Premium." It happens because of capital controls and high demand in specific regions. So, while $126,272 is the widely accepted global intraday high, some people technically paid way more (or sold for way more) depending on where they lived.

Another thing? The "real" high isn't always the "daily close." On October 6, 2025, the price hit $126,272 for a split second (an intraday high) but closed the day much lower. If you're looking at a chart, make sure you know if you're looking at the "wicks" or the "candles."

Actionable Insights for the Current Market

So, what do you do with this information? Knowing the all-time high is great for trivia, but it’s more useful as a benchmark for risk.

👉 See also: Why 29 Divided by 30 Is the Most Interesting Math Problem You’re Ignoring

- Zoom Out: If you bought at $120,000, you’re currently "underwater." But if you look at the 4-year trend, Bitcoin has never failed to break its previous all-time high eventually. Patience is the only real "cheat code" here.

- Watch the $94,000 Level: Right now, in early 2026, Bitcoin is struggling to stay above $94,000. This has become a major "resistance" point. If it breaks this, we might see another run toward the $100k mark.

- Don't Ignore Macro: Bitcoin doesn't exist in a vacuum. If the Federal Reserve cuts interest rates, Bitcoin usually goes up. If there’s a global recession, even "digital gold" can get sold off as people scramble for cash.

- The ETF Factor: Keep an eye on the weekly "inflow" data for the major Bitcoin ETFs. If Wall Street stops buying, the price loses its biggest engine.

The current all-time high of $126,272 is a reminder of how far this weird internet money has come. Whether we see $200,000 or $50,000 next is anyone's guess, but the history of the peak tells us one thing for sure: Bitcoin loves to prove the skeptics wrong, usually right when they think it's finally dead.

Your next move: Check your current portfolio allocation and ensure you aren't over-leveraged. If a 30% drop from the all-time high makes you lose sleep, you might have too much "skin in the game." Diversification into less volatile assets can help you stomach the ride toward the next potential peak.