If you’re staring at a chain of option Greeks and feeling like you’re trying to decode the Matrix, you’re not alone. Honestly, most people dive into options because they saw a screenshot of a 400% gain on Reddit, but they forget the boring stuff that actually makes those trades possible. Finding the best option stocks to trade isn’t just about picking a company you like; it’s about finding a stock where the "bid-ask spread" won't eat your lunch before the trade even starts.

In 2026, the game has changed a bit. We've seen some massive shifts. Remember the "Liberation Day" tariffs back in April 2025? Or that government shutdown that felt like it lasted forever last fall? Those events injected a brand-new kind of "jitter" into the market. While the S&P 500 managed to claw its way up by 17% last year, the winners in the options world weren't necessarily the stocks that went up the most. They were the ones with the most volume.

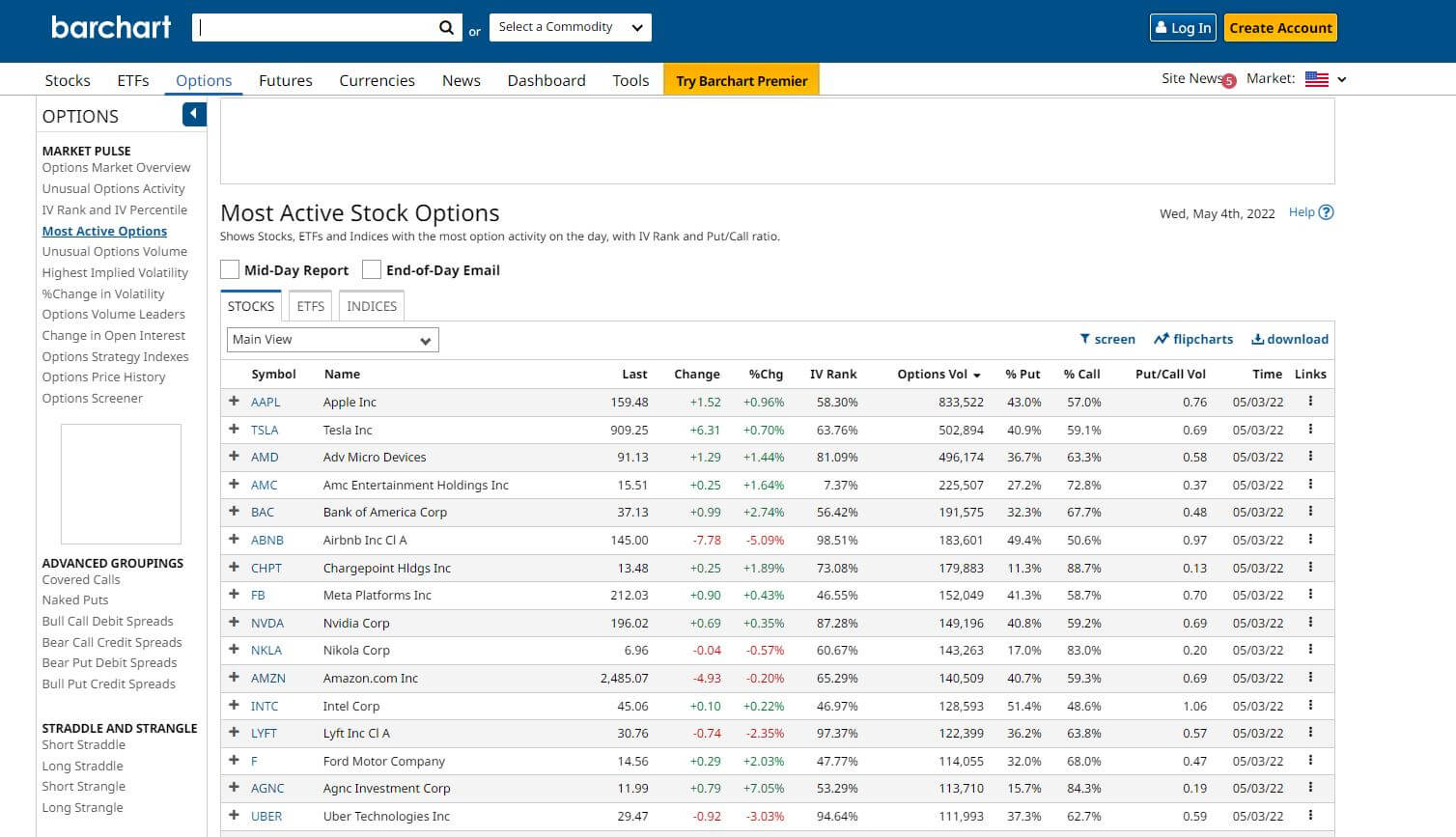

The Liquidity Kings: Where the Money Moves

You basically can't talk about options without mentioning the SPDR S&P 500 ETF Trust (SPY). It’s the undisputed heavyweight champ. As of mid-January 2026, SPY is seeing daily volumes north of 9 million contracts. Why does this matter? Because if you want to get out of a trade at 2:00 PM on a Tuesday, there’s always someone on the other side. You aren't going to get stuck with a "bad fill."

Then you've got the tech-heavy Invesco QQQ Trust (QQQ). It’s basically the go-to for anyone betting on the Nasdaq-100. Right now, its daily volume is hovering around 5.8 million. If you're looking for individual names rather than ETFs, Tesla (TSLA) and Nvidia (NVDA) are still the kings of the hill.

It’s kinda wild how Nvidia has stayed this relevant. Even with predictions from folks like David Sekera at Morningstar suggesting a bit of a cooling period for AI hardware, the options market for NVDA remains incredibly thick. Traders are still piling into calls, with call volume often making up over 60% of the total activity.

Why Penny Wide Spreads Are Your Best Friend

- Efficiency: In stocks like Apple (AAPL) or Microsoft (MSFT), the difference between what a buyer wants to pay and what a seller wants to get is often just one cent.

- Safety: High liquidity means you can set "Stop Losses" that actually work.

- Flexibility: You can trade "0DTE" (Zero Days to Expiration) contracts on SPY and QQQ, which is basically the sport-tuning of the options world.

Chasing the Juice: High Volatility Plays

If liquidity is the "safety," volatility is the "fuel." Some traders hate it. Others live for it.

🔗 Read more: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

Right now, if you're looking for high Implied Volatility (IV), you’re looking at names that most people wouldn't touch with a ten-foot pole for a long-term retirement account. We're talking about Sable Offshore Corp (SOC) with an IV over 180%, or SELLAS Life Sciences (SLS). These aren't for the faint of heart.

[Image comparing Implied Volatility vs. Historical Volatility for a high-growth tech stock]

Basically, when IV is high, the options are expensive. It’s like trying to buy insurance for your beach house while a hurricane is actually making landfall. If you’re a buyer, it’s tough. But if you’re a "seller" of options—like people who do Covered Calls or Cash Secured Puts—high IV is where the "juicy" premiums live.

The Mid-Cap Volatility Sweet Spot

There’s a middle ground. You don't have to trade penny stocks to get movement. Look at Palantir (PLTR) or Advanced Micro Devices (AMD). These aren't just "best option stocks to trade" because they move; they’re great because they have enough institutional interest to keep the spreads tight but enough "drama" to keep the premiums high.

AMD, for instance, has been a favorite lately. While it struggles to catch up to Nvidia on the high-end GPU front, it’s absolutely eating Intel’s lunch in the consumer space. That constant tug-of-war makes for great price swings.

💡 You might also like: Private Credit News Today: Why the Golden Age is Getting a Reality Check

The "Safe" Side: Income Strategies for 2026

Maybe you aren't trying to turn $1,000 into $10,000 overnight. Maybe you just want to make your existing portfolio work harder. This is where the "Blue Chips" come in.

For selling covered calls, you want stocks that are somewhat predictable but still have enough "pulse" to pay you. Ford (F) is a classic example. It usually trades in the teens, has a decent dividend (around 4%), and the options are incredibly liquid. It’s boring. It’s stable. And for an options seller, boring is beautiful.

- Verizon (VZ): With a dividend yield that’s been hitting 6.6% recently, it’s a fortress.

- PepsiCo (PEP): It’s a "Dividend Aristocrat." It doesn't move 10% in a day, which is exactly why it's a great candidate for conservative option strategies.

- Johnson & Johnson (JNJ): This is the ultimate defensive play. When the rest of the market is freaking out over tariffs or interest rates, people still need their Tylenol.

What Most People Get Wrong About Option Trading

A lot of traders think that if they get the direction of the stock right, they’ll make money. Nope. Not even close. You can be 100% right about the stock going up and still lose money on a call option. Why? Because of "Theta" (time decay) and "Vega" (changes in volatility).

If you buy a call on Amazon (AMZN) before an earnings report, you're paying for the "uncertainty." Once the news is out, that uncertainty vanishes. This is called an "IV Crush." The stock might go up 2%, but if the option was priced for a 5% move, your contract could actually lose value. It’s a brutal lesson that almost every rookie learns the hard way.

The 2026 Economic Backdrop

We're in a weird spot. The Fed-funds rate is sitting between 3.5% and 3.75%. Inflation has cooled to around 2.6%, but it’s still lingering. This "higher for longer" environment means that the "time value" of money actually matters again.

📖 Related: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

Actionable Steps for Your Next Trade

If you're ready to start, don't just jump into the first thing you see on a scanner.

First, check the Average Daily Volume. If a stock trades fewer than 500,000 shares a day, its options are probably going to be a nightmare to exit.

Second, look at the IV Rank. Is the current volatility high or low compared to the last year? If it’s low (under 20), you might be better off buying options. If it’s high (over 50), you might want to look into selling them to collect that fat premium.

Finally, keep an eye on the calendar. Earnings season is the "Super Bowl" for options. It’s when the most money is made and lost. If you're trading around names like Netflix (NFLX) or Apple (AAPL) in late January, make sure you know exactly when their reports are dropping. One headline can change everything in seconds.

Start small. Maybe try a "Paper Trade" on a platform like Thinkorswim or Tastytrade first. Get a feel for how the price of an option moves relative to the stock. Once you can predict the "wiggle," then you're ready for the real thing.

Next Steps:

- Scan the Top 20 most active options list (like SPY, TSLA, and NVDA) to identify which ones have narrow bid-ask spreads today.

- Check the earnings calendar for the upcoming week to avoid being blindsided by an "IV Crush."

- Determine your risk tolerance: Are you looking for high-IV "lotto tickets" or low-volatility income generation?