You've probably looked at a ticker for Berkshire Hathaway Inc. Class A (BRK.A) and done a double-take. As of mid-January 2026, a single share is trading for roughly $740,750. No, that isn't a typo. You didn't misplace a decimal point. That is the price of a single piece of the company Warren Buffett built.

It's kind of wild when you think about it. For the price of one share, you could buy a very nice house in most American suburbs, or maybe a fleet of luxury cars. But that sticker shock is exactly where most people start getting things wrong about stock prices berkshire hathaway. They see the massive number and assume the stock is "expensive" in the way a $100 steak is expensive. Honestly, though? Price and value are two very different animals.

The $700,000 Elephant in the Room

The reason the Class A shares look like a high-score on an old arcade game is simple: Warren Buffett hates stock splits. Most companies, when their price gets too high for the average person to afford, will do a 2-for-1 or 10-for-1 split. It makes the shares look cheaper and easier to trade. Buffett always felt that was basically a gimmick. He wanted long-term shareholders who wouldn't treat the stock like a casino chip.

By never splitting the Class A stock, he ensured that the people buying in were usually "serious" investors. It kept the volatility low. But eventually, even Buffett realized that a $30,000 or $100,000 entry fee was a bit much for the regular guy. That’s why we have the Class B (BRK.B) shares.

As of January 2026, those Class B shares are trading around $493. Much more reasonable, right? They represent 1/1500th of the economic interest of a Class A share. You get the same exposure to the underlying businesses—GEICO, BNSF Railway, Dairy Queen—just in a bite-sized format.

✨ Don't miss: Scrub Daddy and Aaron Krause: What Really Happened Behind the Scenes

The Post-Buffett Era has Actually Started

We are officially living in the "after" period. At the end of 2025, Warren Buffett, at 95 years old, finally stepped down as CEO. He’s still the Chairman, and he still shows up to the office in Omaha five days a week, but the "decider" is now Greg Abel.

A lot of folks were terrified that the stock prices berkshire hathaway would crater the moment the "Oracle of Omaha" handed over the keys. It hasn't happened. In fact, the market seems to have sighed in relief that the transition was so boring. Abel has been running the non-insurance side of the house for years. He isn't a "mini-Buffett"—he’s a Canadian-born accountant who is known for being incredibly detail-oriented and, frankly, a bit more hands-on than Warren ever was.

One big change that's already ruffled some feathers? Abel’s salary. While Buffett famously took a $100,000 salary for forty years, the board just bumped Abel to **$25 million**. It’s a more "normal" corporate salary, but for old-school Berkshire purists, it felt like a bit of a shift in the company's "we’re all in this together" culture.

What’s Under the Hood in 2026?

If you buy Berkshire today, what are you actually owning? It's basically a giant mutual fund disguised as a corporation, backed by a mountain of cash. As of the latest filings, the company is sitting on over $350 billion in cash. That is an absurd amount of money. It’s a "war chest" that allows them to buy entire companies whenever the market panics.

The Big Five Holdings

Despite trimming some positions lately, the equity portfolio is still very concentrated. If these companies hurt, Berkshire hurts:

👉 See also: Oklahoma Income Tax Calculator: Why Your Refund Might Look Different This Year

- Apple (AAPL): Still the crown jewel, though Buffett cut the position significantly over the last two years.

- American Express (AXP): Buffett calls this a "forever" stock. It's about 18% of the portfolio now.

- Bank of America (BAC): A massive stake, though they've been nibbling away at it.

- Coca-Cola (KO): The ultimate "recession-proof" play. They’ve owned it since 1988.

- Chevron (CVX): A big bet on energy and "old economy" cash flows.

There was a bit of a surprise in the 2025 year-end report: a major new position in Alphabet (GOOGL). For years, Buffett lamented missing out on Google. It seems Greg Abel and his team (Ted Weschler and Todd Combs) finally decided the price was right to fix that mistake.

Why the Stock Might Be "Cheap" at $740k

Value investors look at "Price-to-Book" (P/B) ratio to see if Berkshire is a deal. Historically, Buffett said he’d buy back shares if the P/B dropped below 1.2. Right now, it’s hovering around 1.5x. That’s not "dirt cheap," but it’s fair.

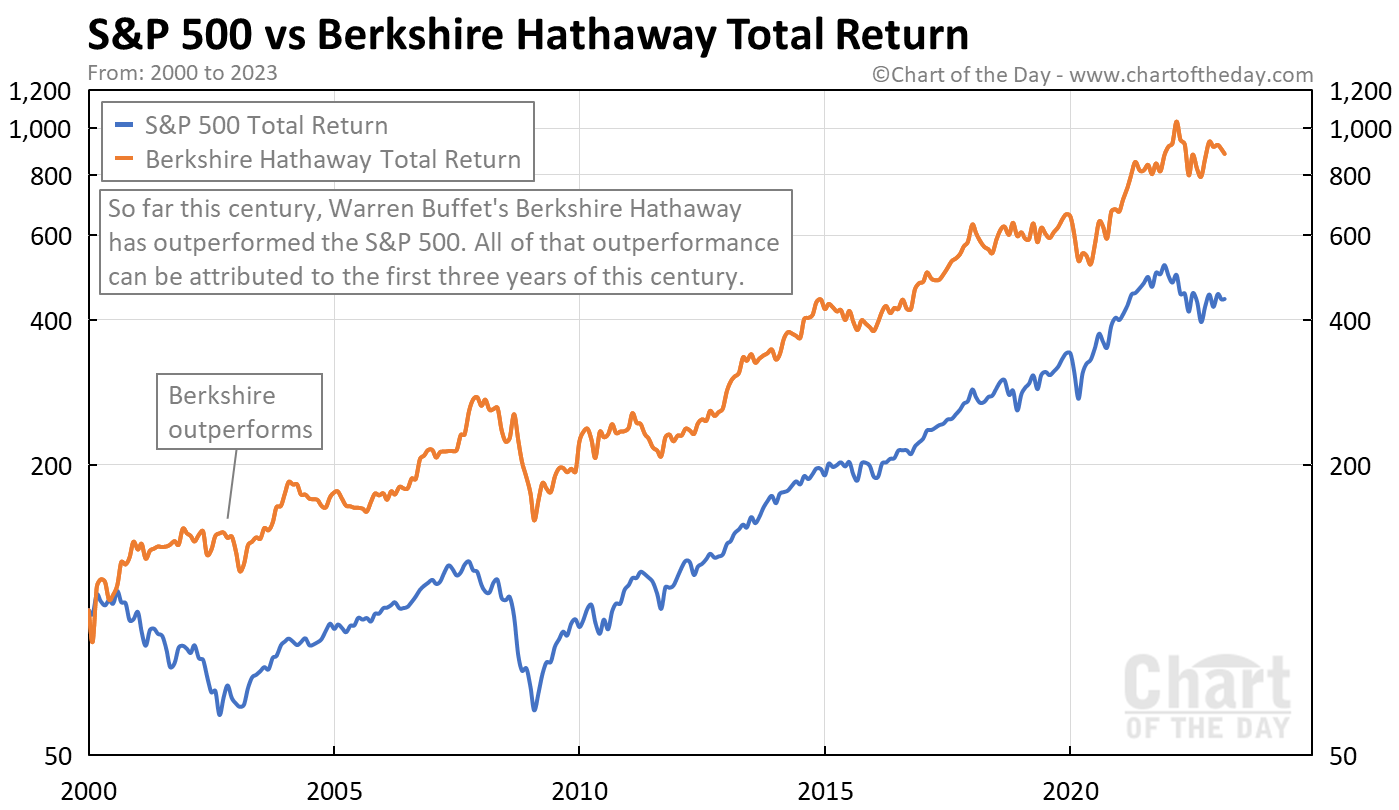

Morningstar analysts recently pegged the fair value of Class A shares at $765,000. If you believe that math, the stock is actually trading at a slight discount. But you have to be careful. Berkshire is so big now that it’s hard for them to "beat the market" like they did in the 70s and 80s. When you're a $1 trillion company, you are the market. You can't double your money overnight when you're that size.

The "Dividend" Question

This is the big one. Will Greg Abel finally start paying a dividend? Buffett always hated them because he thought he could reinvest the money better than you could. But with $350 billion sitting in Treasury bills earning 4-5%, the pressure is mounting.

If Abel announces a dividend in 2026, expect the stock prices berkshire hathaway to jump as income-seeking funds pile in. If he stays the course and keeps the cash for a "big elephant" acquisition, the stock will likely continue to track the S&P 500 but with less "downside" risk because of that cash cushion.

Is it a Buy? A Few Realities

- The "Key Man" Risk: It’s mostly gone. The market has priced in Buffett’s age.

- The Cash Problem: It’s a high-class problem, but it’s still a problem. They have too much money and not enough "cheap" companies to buy.

- The Insurance Engine: GEICO and the reinsurance arms are still printing money. That "float" is the secret sauce that funds everything else.

Actionable Steps for Investors

If you’re looking at stock prices berkshire hathaway and wondering if you should jump in, don’t just stare at the chart. Here is how you actually play this:

- Choose your class wisely. Unless you need the voting power (which you probably don't), stick with BRK.B. It’s more liquid and easier to sell in small chunks if you need cash.

- Check the P/B Ratio. Before you buy, look at the most recent book value per share (usually found in the quarterly 10-Q filing). If the stock price is more than 1.6 times that book value, it might be a bit "frothy."

- Watch the 13-F filings. These come out every quarter and tell you exactly what stocks the team bought or sold. It’s the closest thing to a "cheat code" for seeing what the smartest guys in Omaha are thinking.

- Think like a business owner. Don't buy Berkshire if you plan to sell in six months. This is a "set it and forget it" stock. It’s for the part of your portfolio that you want to still be there in 2040.

The era of 20% annual gains might be over, but as a fortress for your capital, Berkshire remains one of the most unique experiments in American capitalism. It's basically a bet on the United States economy—with a $350 billion insurance policy.