If you’re looking for a sign that the stock market is getting a little too "frothy" for its own good, you don't need to look at complicated charts or listen to yelling pundits on TV. You just need to look at what Warren Buffett—or more accurately, the team at Berkshire Hathaway—is doing with their money. Or rather, what they aren't doing with it.

Right now, Berkshire Hathaway stock holdings look a lot different than they did even eighteen months ago. As we roll through early 2026, the big story isn't just what they own; it’s the mountain of cash they’re sitting on. We are talking about a record $381.7 billion. That is not a typo. It’s a war chest so big it basically rivals the GDP of some medium-sized countries.

Honestly, it's a bit of a vibe shift. For decades, Buffett was the guy telling you to be "greedy when others are fearful." But lately? He’s the one being fearful while everyone else is chasing AI hype.

The Big Five: The Core of the Berkshire Portfolio

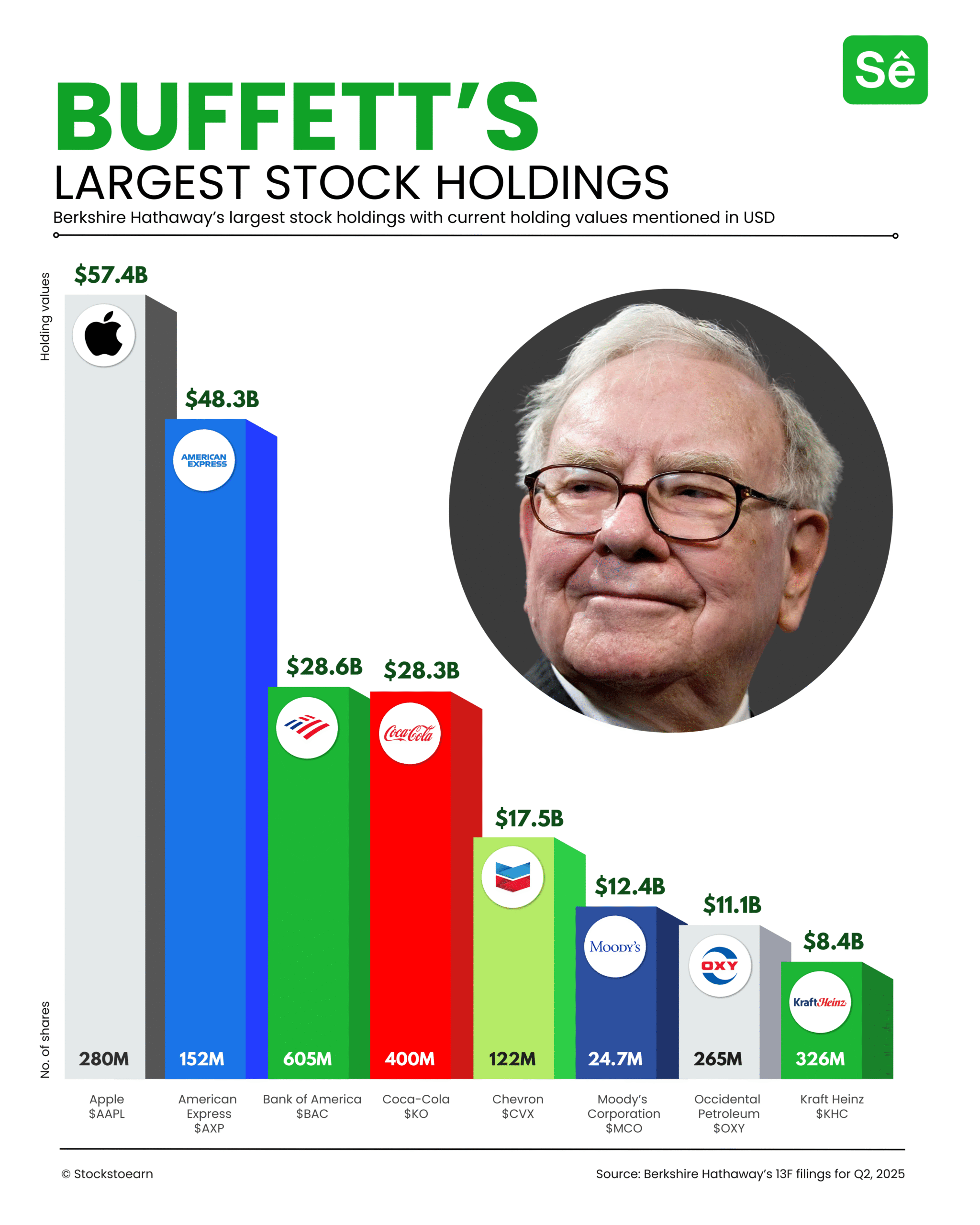

Even with all that cash, Berkshire still has some massive bets on the table. They don't really do "diversification" in the way your local financial advisor might suggest. They believe in finding a few great businesses and betting the farm on them.

Apple is still the big kahuna here, making up about 23% of the equity portfolio. But here’s the thing: they’ve been trimming it. In late 2025, Berkshire sold off another chunk of Apple shares—about 20 million of them. They still hold roughly 238 million shares, worth over $60 billion, so it’s not like they’re "breaking up" with Tim Cook. It feels more like a tactical retreat to manage risk.

Then you’ve got American Express. This one is basically a permanent fixture. It makes up nearly 20% of the portfolio now. Buffett bought his first shares in the 60s, and he’s often said he wouldn't sell a single share. It’s a classic "moat" business—everyone knows the brand, and people with money love using the cards.

Bank of America and Coca-Cola are the other two "old guards" that keep the lights on. They’ve been trimming the BofA stake lately, too, which has some people wondering if they're soured on big banks. But Coke? That 400-million-share position hasn't budged in years. It just sits there, collecting dividends like a high-yield savings account that also happens to sell soda.

✨ Don't miss: Starting Pay for Target: What Most People Get Wrong

The Surprising Tech Pivot: Alphabet and Amazon

Wait, I thought Buffett hated tech? Well, that’s what people used to say. But the Berkshire Hathaway stock holdings list now includes some names that would have shocked investors ten years ago.

The newest heavy hitter is Alphabet (GOOGL). Berkshire surprised everyone in 2025 by building a massive $4.3 billion position. It’s now a top-10 holding. Why now? Probably because even though it's "tech," Google has all the hallmarks of a Buffett stock: a dominant market position (search), incredible cash flow, and a valuation that—at least when they bought it—wasn't totally insane.

They also have a decent slice of Amazon. It’s not a huge position compared to Apple, but it shows that the "new" Berkshire (led more and more by investment managers Todd Combs and Ted Weschler) is comfortable in the digital age.

The Energy Gamble and the OxyChem Deal

If there’s one place Berkshire is actually aggressive right now, it’s energy. They’ve been buying Occidental Petroleum (OXY) like it’s going out of style. As of early 2026, they own nearly 30% of the company.

But the real kicker happened on January 2, 2026. Berkshire officially closed a $9.7 billion deal to buy OxyChem, Occidental’s chemical unit. This wasn't a stock market move; it was a straight-up acquisition. It tells you exactly where Greg Abel—the new CEO who took the reins from Buffett this month—sees the future. They want hard assets that produce cash, regardless of what the S&P 500 is doing today.

What’s With the Massive Cash Pile?

Let’s talk about that $381 billion. It’s the elephant in the room. Why is Berkshire holding so much cash in U.S. Treasury bills?

🔗 Read more: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

- Valuation: Basically, everything is expensive. Buffett has always said he’d rather do nothing than do something stupid.

- Interest Rates: In 2025 and 2026, those Treasury bills have been yielding over 5%. When you have $380 billion, 5% interest means you’re making $19 billion a year just by sitting on your hands. That’s more than most Fortune 500 companies make in profit.

- The "Abel" Transition: Warren Buffett officially stepped down as CEO at the end of 2025 (though he’s staying on as Chairman). Giving Greg Abel a massive pile of dry powder is the ultimate parting gift. It allows the new leadership to strike the second a market crash happens.

The Japanese Experiment

One of the coolest moves in the Berkshire Hathaway stock holdings lately has been the "Japanese Trading Houses." Buffett started buying these back in 2020—companies like Mitsubishi and Mitsui.

Most American investors ignored Japan for thirty years. Not Buffett. He saw companies that were basically "mini-Berkshires"—diversified, old-school, and cheap. He’s been adding to these positions throughout 2025. It’s a classic example of looking where no one else is looking.

Why Most People Get Berkshire Wrong

A lot of folks look at the 13F filings and think they can just copy-paste the portfolio. Don't do that. You've gotta remember that these filings are delayed by 45 days. By the time you see that Berkshire "bought" something, the price has usually already spiked because everyone else is trying to copy them.

Also, Berkshire has advantages you don't. They have "float" from their insurance businesses (like Geico). They can negotiate private deals—like the OxyChem acquisition—that you can't access on E-Trade.

The Greg Abel Era Begins

As of January 2026, Greg Abel is officially the CEO. Does this mean the portfolio is going to change overnight? Probably not. Abel has been at Berkshire for decades. He’s "Buffett-lite" in all the right ways.

However, you might see more "industrial" bets. Abel comes from the energy side of the business. He likes things you can touch—power plants, railroads, and pipelines. While the stock portfolio will still have Apple and Coke, the "wholly owned" side of Berkshire is likely to get even more heavy on infrastructure.

💡 You might also like: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

What You Should Do Now

So, what’s the takeaway for a regular person looking at these Berkshire Hathaway stock holdings?

First, realize that the smartest money in the world is currently very cautious. When the guy who wrote the book on investing is sitting on $381 billion in cash, it’s okay for you to have some "dry powder" too. You don't have to be 100% invested all the time.

Second, look for quality. Whether it’s American Express or Alphabet, the common thread in the Berkshire portfolio is "cash flow." They don't buy "hopes and dreams" companies. They buy companies that make money today.

Actionable Insights for Your Portfolio:

- Check your concentration: Is your portfolio 50% one stock? Even Berkshire, which loves concentration, keeps their biggest bet (Apple) around 23%.

- Watch the "Cash" position: Having 10-20% in a high-yield money market or Treasuries isn't "missing out." It's being prepared for a sale.

- Look at the "Moats": If you're buying a stock, ask yourself: "Could a competitor with $10 billion destroy this company tomorrow?" If the answer is yes, it’s not a Buffett stock.

- Focus on the "Greg Abel" shift: Keep an eye on energy and infrastructure. Those "boring" sectors are where the world's biggest conglomerate is currently putting its real money.

The 2026 landscape is weird. We have high valuations and a changing of the guard at the world’s most famous investment firm. But the strategy remains the same: buy good businesses at fair prices and wait. Sometimes, "waiting" means sitting on a $381 billion pile of cash until the right pitch comes along.

Next Steps for You

Check the most recent 13F filing yourself on the SEC Edgar website to see if any new "confidential" positions have been revealed. Often, Berkshire gets permission to hide a buy while they are still building the position. That’s where the real "secret" stocks are usually found.