It is January 2026, and if you glance at a ticker for Berkshire Hathaway Inc. (BRK.A), you might think there is a glitch in your software. The price is hovering around $740,000 per share. No, that isn't the market cap. That is the price for one single share of stock.

Honestly, the berkshire hathaway history of stock price is less of a financial chart and more of a testament to what happens when you just... don't sell. For sixty years, Warren Buffett has essentially ignored the "standard" rules of Wall Street. He refused to split the stock. He focused on book value. He sat on piles of cash when everyone else was buying tech bubbles. And the result is a number that looks fake to the average person.

The $7.50 Beginning and the Textile Trap

Most people assume Berkshire was always this massive conglomerate. It wasn't. In 1962, it was a failing textile mill in New Bedford, Massachusetts. Warren Buffett started buying shares at $7.50 each because he noticed a pattern. Every time the company closed a mill, they would use the cash to buy back their own stock.

He figured he could make a quick buck by selling his shares back to the company. But then, the management tried to "chisel" him. They orally agreed to buy his shares for $11.50, but when the official offer arrived in the mail, it was for $11.375.

That tiny 12.5-cent difference changed financial history.

Buffett got mad. Instead of selling, he bought more. He bought enough to take over the whole company just so he could fire the guy who tried to underpay him. He later called this his "200-billion-dollar mistake" because he tethered his capital to a dying textile business instead of starting fresh in insurance.

By the time he took full control in May 1965, the stock was trading at roughly $19 per share.

Why One Share Costs as Much as a Mansion

You've probably wondered why Buffett never split the Class A shares. Every other major company—Apple, Amazon, Google—splits their stock to keep the price "affordable" for retail investors. If Apple hadn't split its stock dozens of times, it would be expensive, but nowhere near Berkshire levels.

👉 See also: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

Buffett’s logic is kinda simple: he doesn't want "flippers."

He once said that he wanted to attract shareholders who are "investment-oriented" rather than "market-oriented." By keeping the price astronomical, he ensures that the people buying BRK.A are long-term partners who aren't going to panic-sell because of a bad jobs report on a Tuesday.

The Milestone March

The climb wasn't an overnight explosion. It was a steady, agonizingly consistent grind.

- 1970: The stock was still under $100.

- 1983: It finally crossed $1,000. This was a huge deal at the time. People thought it was "too expensive" then.

- 1992: It hit $10,000.

- 2006: The stock broke $100,000.

- 2021-2022: It surged past $500,000.

- Today (2026): We are looking at a range between $730,000 and $755,000.

Enter the Baby Berkshires (BRK.B)

By 1996, Buffett had a problem. Unit trusts were trying to "slice up" Berkshire shares to sell small pieces to regular people, charging high fees in the process. To kill that predatory industry, he created Class B shares, often called "Baby Berks."

Initially, these were worth 1/30th of a Class A share. However, in 2010, Berkshire did a massive 50-for-1 split on the Class B shares to facilitate the acquisition of the Burlington Northern Santa Fe (BNSF) railroad.

Now, the math is basically this: 1 share of Class A is equal to 1,500 shares of Class B.

If you want to own a piece of the Oracle’s empire but don't have three-quarters of a million dollars sitting under your mattress, you buy the B shares. As of early 2026, they trade for roughly $495 to $510. They move in lockstep with the A shares. You get the same economic interest, just 1,500 times smaller.

✨ Don't miss: Is The Housing Market About To Crash? What Most People Get Wrong

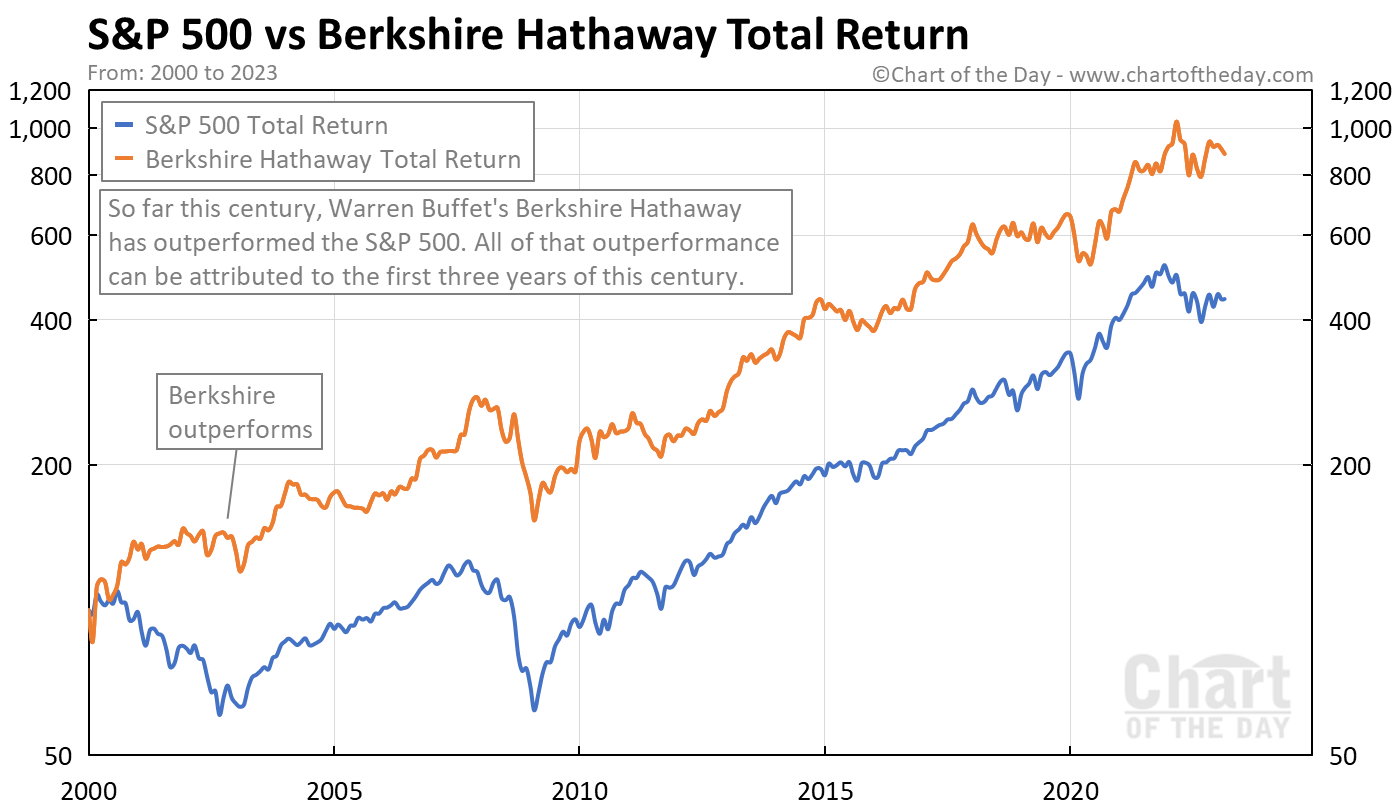

The Performance Gap: Berkshire vs. S&P 500

It is easy to look at a $740,000 stock price and think it’s a sure thing. But the berkshire hathaway history of stock price shows some pretty scary valleys.

During the dot-com bubble in the late 90s, everyone thought Buffett was "washed up." He refused to buy tech stocks. Berkshire's stock price dropped significantly while the S&P 500 was soaring. He looked like a dinosaur.

Then the bubble burst. Berkshire stayed standing while the "geniuses" went broke.

Between 1964 and 2024, the numbers are frankly stupid. Berkshire delivered an overall gain of more than 5,500,000%. To put that in perspective, the S&P 500 (with dividends) returned about 39,000% in that same window. Both are good. One is life-changing; the other is world-altering.

But keep in mind: the "outperformance" has slowed down.

It is much harder to move the needle when you are a trillion-dollar company. In 2025, Berkshire's share price gained about 10.9%, which is respectable but didn't blow the doors off the market. Size is the enemy of returns. Buffett has admitted this many times. You can't compound a trillion dollars at 20% forever. There isn't enough money in the world.

The Post-Buffett Reality

We are now in the "Greg Abel era." As Warren Buffett has stepped back, the market is watching the stock price with a hawk's eye. There’s always been this "Buffett Premium"—the idea that the stock is worth more simply because he is at the helm.

🔗 Read more: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

What’s interesting is that the stock hasn't collapsed. In fact, it has been remarkably resilient. The company is basically a fortress of cash, insurance float, and energy assets.

The biggest risk to the stock price history going forward isn't the lack of Buffett; it's the sheer weight of the company's own success. They have so much cash—regularly over $150 billion—that they struggle to find things to buy that are big enough to matter.

Actionable Insights for Investors

If you are looking at the history of this stock and wondering if you missed the boat, here is the reality of how the "pros" look at it:

1. Watch the Price-to-Book (P/B) Ratio

Buffett used to say he’d buy back shares if the price dropped to 1.1 or 1.2 times book value. He’s moved away from a strict limit, but if you see Berkshire trading near its book value, history says that is a screaming buy.

2. Don't Fear the "A" Price Tag

If you have a high-net-worth portfolio, Class A shares have slightly better voting rights and can be converted into B shares at any time (but not vice versa). For most of us, the B shares are the way to go for liquidity and tax planning.

3. Expect "Market-Plus" Not "Moon"

The days of 2,000,000% returns are over. You are buying Berkshire today for stability and a "slightly better than the S&P 500" performance over a decade. It’s a defensive play.

4. The Cash Pile is a Weapon

The reason the stock price stays high during crashes is that Berkshire is usually the one buying when everyone else is selling. They are the "Lender of Last Resort" to corporate America. That protects the downside.

The berkshire hathaway history of stock price isn't just about a number going up. It's a 60-year lesson in avoiding the "chisel," staying patient when you look like a fool, and never, ever splitting your stock just to look "affordable" to the masses.

Next Steps for You:

- Check the current Price-to-Book ratio of BRK.B on a site like Yahoo Finance or Morningstar to see if it's historically "cheap."

- Review the most recent Annual Shareholder Letter (usually released in February) to see how Greg Abel and the team plan to deploy the current cash hoard.

- Evaluate your portfolio's beta; adding Berkshire is a classic way to reduce volatility without completely sacrificing growth.