If you’ve recently moved to the Eastern Panhandle or you’re just staring at that yellow "ticket" in the mail wondering why the math feels like a riddle, you aren’t alone. Property taxes in West Virginia are a bit of a quirk. Specifically, Berkeley County WV property tax rules can catch you off guard if you're coming from Virginia or Maryland where they do things… well, normally.

Honestly, the biggest shock for most people isn't even the rate—it’s the timing. You’re essentially paying for the past. But let’s break down how this actually works before you write that check to the Sheriff.

How Your Bill Is Actually Calculated (The 60% Rule)

West Virginia doesn't tax you on what your house is "worth" in the way you’d think. It uses an assessed value, which is exactly 60% of the market value determined by the Assessor's office.

So, if Larry Hess (the current Assessor) and his team decide your home in Hedgesville is worth $300,000, you aren't paying taxes on $300k. You’re paying on $180,000.

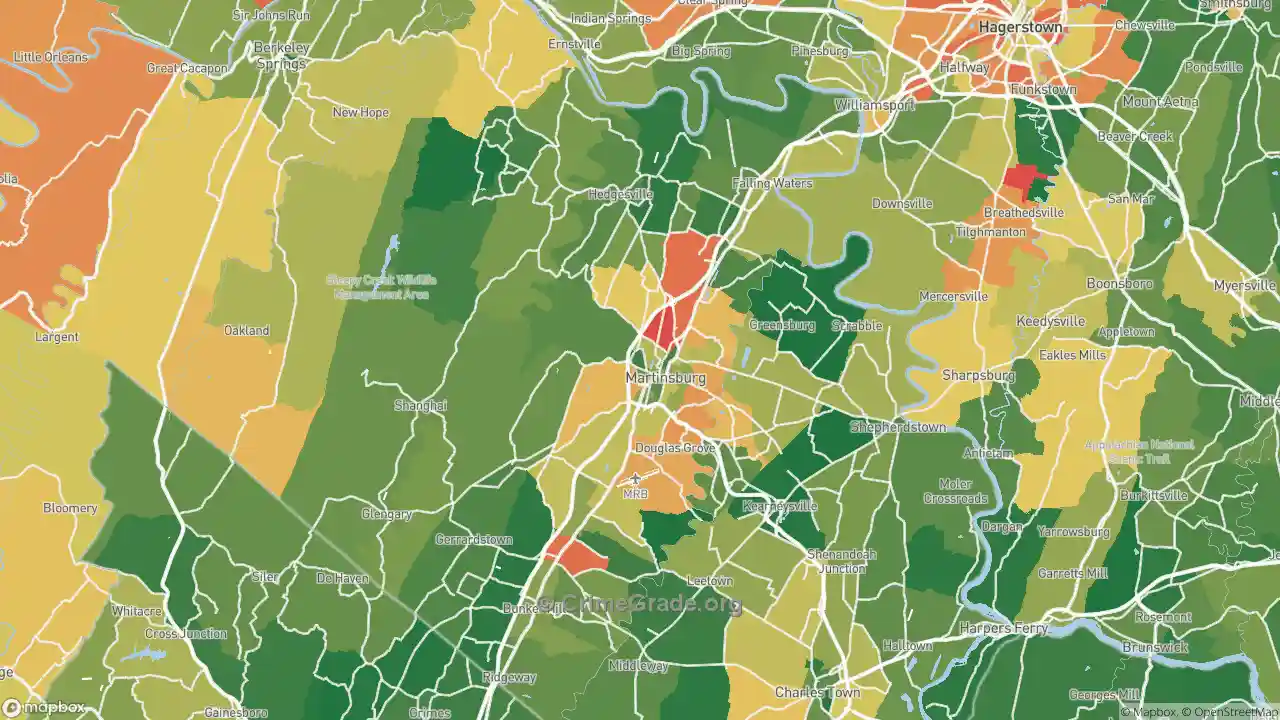

Once that 60% number is set, they apply the levy rate. These rates change slightly depending on where exactly your mailbox is. If you’re in the City of Martinsburg, you’re paying for city services, so your rate is higher than someone out in the rural Arden or Falling Waters districts. For the 2025-2026 fiscal year, the Berkeley County Commission actually kept the county-level levy rate steady at 13.39 cents per $100 of assessed value.

🔗 Read more: Monroe Central High School Ohio: What Local Families Actually Need to Know

It’s worth noting that the Berkeley County Commission has been pretty aggressive about keeping this rate flat—it hasn't gone up in about eight years.

The Weird Calendar: When to Pay and Why

This is where people get tripped up. The "Tax Year" and the "Calendar Year" are like two ships passing in the night.

Taxes are assessed on July 1st. But you won't see a bill for that assessment until the following summer. Basically, you’re always paying in arrears.

The Deadlines You Can’t Miss

- September 1st: This is the big one. If you pay your first half by now, you get a 2.5% discount.

- October 1st: If you haven’t paid the first half by now, it’s officially "delinquent."

- March 1st: Deadline for the second half payment to get that 2.5% discount.

- April 30th: The absolute last day to pay without getting hit with heavy interest penalties.

If you like saving money—and who doesn't—mark September 1 and March 1 on your fridge. That 2.5% isn't a fortune, but it’s basically a free lunch or two just for being on time.

💡 You might also like: What Does a Stoner Mean? Why the Answer Is Changing in 2026

Don't Leave Money on the Table: Exemptions

If you are 65 or older, or you’re permanently disabled, stop what you’re doing and check your status. The Homestead Exemption is the single best way to slash your bill.

Currently, this exemption knocks $20,000 off your assessed value.

Let’s look at that $300,000 house again.

60% of $300,000 = $180,000.

Subtract the $20,000 Homestead Exemption.

Now you’re only paying taxes on $160,000.

There is a catch, though. You have to have lived in WV for at least two consecutive years before you apply. Also, there's a big change on the horizon. In the 2026 general election, West Virginians will vote on HJR1, a resolution that could jump that exemption from $20,000 to **$50,000**. If that passes, senior citizens in Martinsburg and Hedgesville are going to see a massive drop in their annual "rent" to the government.

Personal Property Tax: The "Car Tax" Headache

Yes, Berkeley County still taxes your cars, motorcycles, and even your utility trailers. This is the part that everyone complains about at the grocery store.

📖 Related: Am I Gay Buzzfeed Quizzes and the Quest for Identity Online

Every year by October 1st, you have to file a "Personal Property Assessment" with the Assessor. You list everything you owned as of July 1st. If you forget to file this, the Assessor’s office will just guess what you own (and they usually guess high) and you might lose your chance to challenge the value. Plus, you won't be able to renew your car tags at the DMV if your taxes aren't paid up.

Where Does the Money Go?

It’s easy to get annoyed when the bill comes, but roughly 70% of your property tax goes straight to Berkeley County Schools. The rest is split between the county government, the state, and—if you live in town—the municipality. It pays for the 68 law enforcement positions and the 34 paid firefighters currently in the county budget.

How to Pay Without Tearing Your Hair Out

The Sheriff’s Tax Office is located at 400 West Stephen Street in Martinsburg.

You’ve got options:

- Online: You can pay through the Sheriff’s online portal, though there’s usually a convenience fee for cards.

- In Person: You can walk into Suite 104 and pay.

- Mail: Use the envelope that comes with your ticket.

If you think your assessment is crazy high, you can’t just refuse to pay. You have to appeal it. You usually have until January 31st to talk to the Assessor about your value, and if you still disagree, you have to meet with the Board of Equalization and Review in February. They won't listen to "my taxes are too high," but they will listen to "my house is falling down and isn't worth what you say it is."

Your Next Steps

- Check your receipt: Look at your most recent tax ticket. If you’re 65+ and don't see the Homestead Exemption, head to the Assessor's office before December 1st to sign up.

- File your return: Ensure your personal property filing is done before October 1st to avoid the $25-$100 penalty and a "forced" assessment.

- Set a reminder: Put "Pay Taxes" in your phone for August 20th and February 20th so you never miss that 2.5% discount window.

- Watch the 2026 Ballot: Keep an eye on the Homestead Exemption Increase Amendment; it could significantly change your tax liability starting in 2027.