If you thought the bankruptcy courts would quiet down after the post-pandemic chaos, the early 2026 data just dropped a cold bucket of water on that theory. Honestly, it’s getting a bit wild out there. We aren't just seeing a "trickle" of filings anymore. We’re seeing a full-blown structural shift in how companies and regular people handle debt when the "free money" era is officially dead and buried.

Total consumer bankruptcy filings jumped a staggering 12% over the last year, hitting over 533,000 cases in 2025. Now, as we roll through January 2026, the momentum isn't slowing.

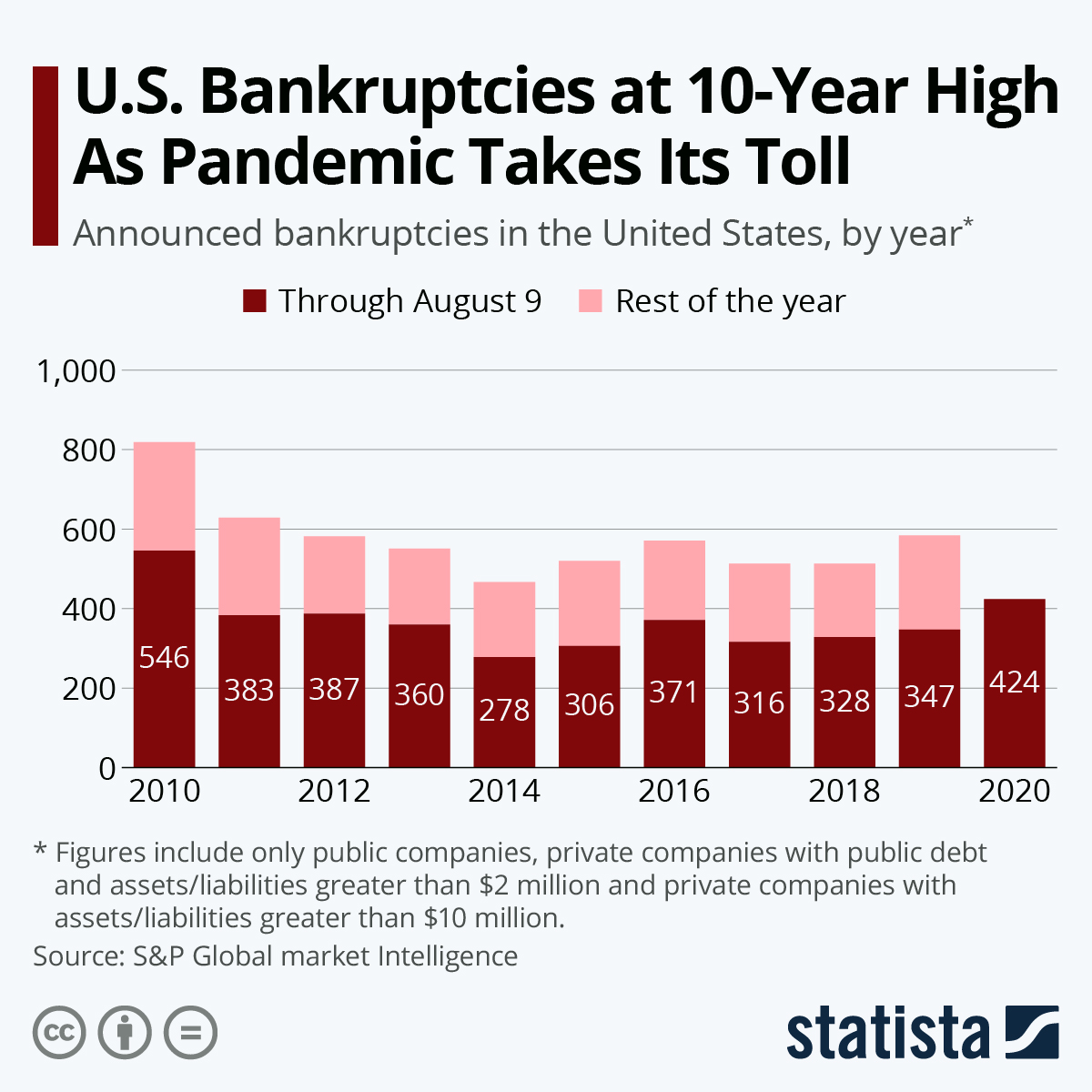

Commercial filings are even more intense. They’ve hit an 11-year high. You’ve likely noticed the headlines about the "Chapter 22" club—those unlucky companies like Rite Aid and Joann Fabrics that filed for bankruptcy, thought they were fine, and then had to file again just months later. It’s a mess.

The 2026 Dollar Adjustment: Why Your Exemptions Just Changed

One of the most boring-sounding but actually vital pieces of bankruptcy law news today is the massive triennial adjustment to the Bankruptcy Code's dollar amounts. This isn't some minor tweak. Because inflation has been such a beast, the Judicial Conference of the United States just pushed through a roughly 13.2% increase in statutory limits.

Why does this matter to you?

🔗 Read more: Price of Tesla Stock Today: Why Everyone is Watching January 28

Well, if you're filing for Chapter 7 or Chapter 13, the amount of property you can keep—your "exemptions"—is now significantly higher. For example, the debt limit for a small business to qualify for Subchapter V reorganization has shifted. It’s now sitting around $3,424,000.

Why Subchapter V is the Real MVP

Small businesses used to get absolutely crushed by the legal fees of a standard Chapter 11. It was basically a rich man's game. But Subchapter V is basically the "lite" version of corporate bankruptcy. It's faster. It's cheaper. And with the new higher debt thresholds that took effect recently, way more "mom and pop" shops that grew too fast are using it to stay alive.

The Supreme Court Just Threw a Wrench in "The Texas Two-Step"

If you follow the big corporate drama, you’ve probably heard of the "Texas Two-Step." It’s that cheeky move where a company splits into two, gives all the debt to one entity, and then has that entity file for bankruptcy in a friendly court.

Well, the courts are officially over it.

💡 You might also like: GA 30084 from Georgia Ports Authority: The Truth Behind the Zip Code

Recent rulings in the Northern District of Texas and the Third Circuit have been slamming the brakes on these maneuvers. The big takeaway from the latest bankruptcy law news today is that "good faith" actually matters again. You can't just use bankruptcy as a tactical shield to dodge mass tort liability (like the opioid or talc cases) without showing real financial distress.

The Supreme Court’s shadow is looming large here too. Following the Harrington v. Purdue Pharma decision, the era of "nonconsensual third-party releases" is basically on life support. You can’t just pay a settlement and get a permanent "get out of jail free" card for your billionaire owners unless the victims actually agree to it.

The "Invisible" Debt: Private Credit and PIK Toggles

Here is something nobody is talking about at the water cooler: the rise of PIK (Payment-in-Kind) structures.

Basically, many companies that should have gone bankrupt in 2024 or 2025 didn't. They survived by telling their lenders, "Hey, I can't pay you interest in cash, so let's just add that interest to the total amount I owe you." It's like trying to put out a fire with gasoline.

📖 Related: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

- The Problem: It makes the debt mountain grow even faster.

- The Result: We’re seeing "mega-bankruptcies" where the liabilities are over $1 billion because they waited too long to face the music.

- The Sector: Healthcare and Senior Living are getting hit the hardest right now. Labor costs are up, government funding is wonky, and that PIK debt is finally coming due.

Student Loans and the 2026 Sunset

For the individuals out there, there's a ticking clock you need to know about.

On January 1, 2026, the Qualified Principal Residence Indebtedness Exclusion expired. This is huge. Previously, if a bank forgave part of your mortgage in a workout or bankruptcy, the IRS didn't treat that "forgiven money" as taxable income.

As of right now? That protection is gone. If your bank forgives $50,000 of debt, the IRS might come knocking, looking for taxes on that $50k as if you earned it in a paycheck. It’s a brutal surprise for anyone trying to get their head above water.

What You Should Actually Do Now

Look, the "vibe" of bankruptcy law has changed. It's no longer just a way to wipe the slate clean; it’s becoming a highly technical battleground over assets and exemptions.

If you're even remotely considering filing, or if your business is staring down a pile of high-interest debt, don't wait for the "Chapter 22" scenario.

- Check the New Thresholds: Make sure you actually qualify for Subchapter V or Chapter 13 under the 2026 dollar amounts. You might have more breathing room than you think.

- Audit Your Tax Exposure: With the mortgage debt exclusion expired, talk to a CPA before you sign a debt settlement. You don't want a massive tax bill to replace your credit card debt.

- Watch the Supreme Court Docket: There are several cases pending for the 2025-2026 term regarding "bad faith" filings. If you're using bankruptcy for a tactical advantage in a lawsuit, your shield might be thinner than it was two years ago.

The reality of bankruptcy law news today is that the "safety nets" are being rewoven. Some parts are getting stronger (higher exemptions), while others (tax breaks and third-party releases) are being cut away. Staying ahead of these shifts is the only way to make sure a "fresh start" doesn't turn into a fresh nightmare.