It is Tuesday, January 13, 2026. If you’re checking your banking app and wondering why your line of credit still feels like a heavy weight, blame the math happening in Ottawa. Specifically, blame the Bank of Canada bank rate.

Right now, that rate sits at 2.50%.

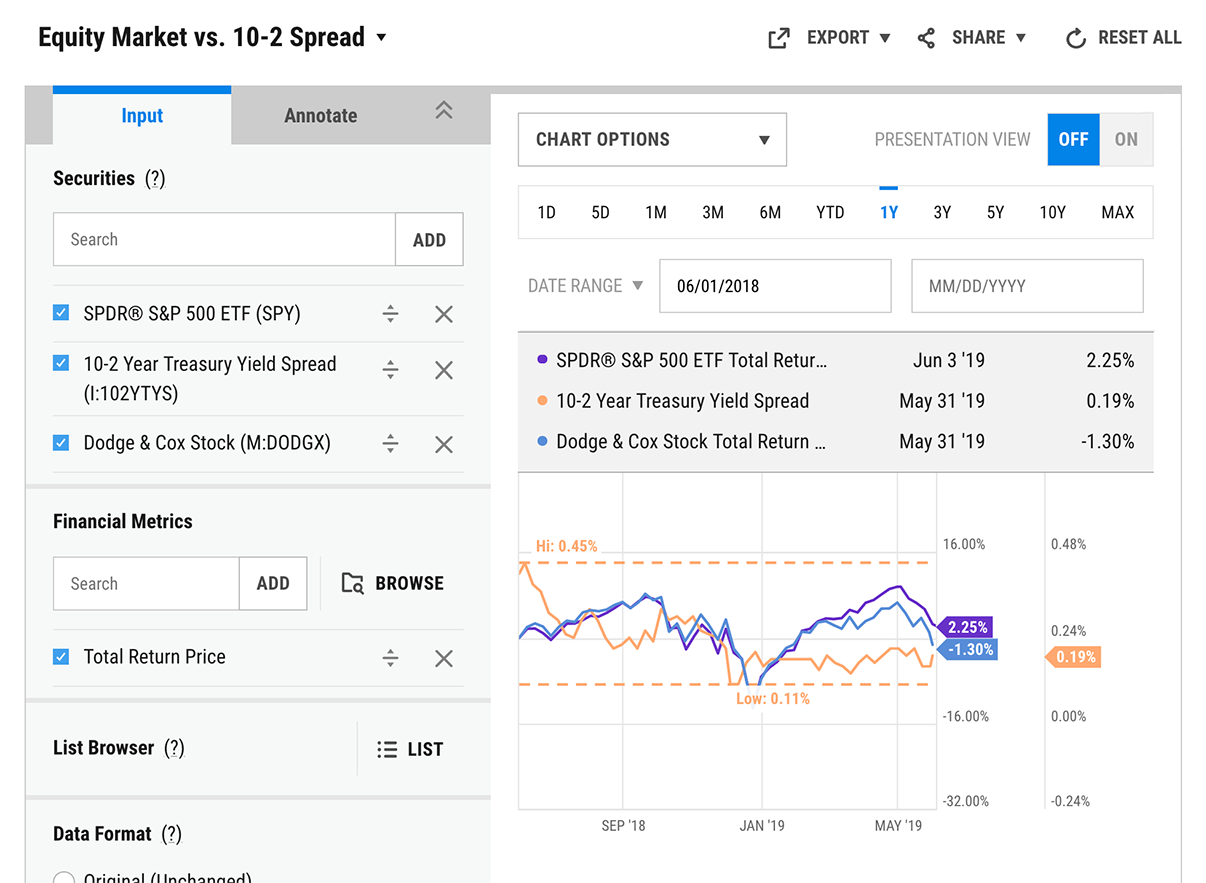

Wait. You might have seen the number 2.25% floating around in the news. Here is the first thing most people get wrong: the "policy rate" and the "bank rate" aren't actually the same thing, though we use them interchangeably at cocktail parties. The 2.25% is the target for the overnight rate—the heart of the machine. The bank rate is technically the interest the Bank of Canada (BoC) charges major banks for one-day loans, usually set 25 basis points above that target.

It’s a tiny distinction that carries massive weight for your wallet.

Why the Bank of Canada bank rate is stuck in place

We just came off a wild few years. Remember 5.0%? That was the peak back in June 2024. Since then, Tiff Macklem and his team at the BoC have been on a bit of a diet, trimming rates down to the current levels. But as of January 2026, the cutting spree has hit a brick wall.

The BoC held the rate steady at its last meeting on December 10, 2025. Why? Because the world is getting "kinda" complicated again.

Inflation is the primary culprit. While the headline Consumer Price Index (CPI) hit 2.2% recently, which sounds great on paper, the "core" inflation—the stuff that strips out the volatile bits like gas—is still sticky. It’s hovering between 2.5% and 3.0%.

👉 See also: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

Basically, the Bank is worried that if they cut further, they’ll accidentally pour gasoline on a fire they just spent two years putting out.

Then there’s the trade stuff. With shifting trade policies south of the border and new tariffs entering the conversation, the Canadian economy is walking a tightrope. If the BoC cuts rates to help the economy grow, the Canadian dollar might tank against the USD, making everything we import more expensive. It’s a classic "damned if you do, damned if you don't" situation.

The real-world impact on your mortgage

If you’re one of the 60% of Canadians renewing a mortgage in 2025 or 2026, this pause in the Bank of Canada bank rate is bittersweet.

Honestly, it’s a tale of two cities.

If you have a 5-year fixed-rate mortgage from the pandemic era, you are likely looking at a "payment shock." Even with the bank rate sitting at 2.50% (and the prime rate at 4.45%), you're jumping from an interest rate of maybe 2% to something closer to 4% or 5%. Experts like those at Nesto and major banks are predicting that fixed-rate holders could see their monthly payments jump by 20% on average this year.

On the flip side, variable-rate holders are finally breathing.

✨ Don't miss: Is The Housing Market About To Crash? What Most People Get Wrong

If you held on during the dark days of 2023, you’ve seen your rate drop significantly from the peak. But don't expect it to fall much further. The market consensus right now is "stability." Most analysts, including those from BMO and CIBC, don't expect another cut in the first half of 2026. In fact, some outliers like Scotiabank have suggested we might even see a hike later this year if the economy heats up too much.

What the experts are saying (and why they disagree)

Economists are split. It’s what they do.

- The Doves: Some, like Bradley Saunders at Capital Economics, argue that the Canadian economy is still sluggish. They think the BoC needs to be more "accommodative" to prevent a recession, especially since domestic demand has been flat.

- The Hawks: Others look at the labor market. Unemployment actually declined to 6.5% recently. When people have jobs, they spend money. When they spend money, prices go up. This group thinks the BoC should keep the Bank of Canada bank rate exactly where it is—or even nudge it up—to ensure inflation doesn't stage a comeback.

Douglas Porter, the chief economist at BMO, recently noted that being "on hold" for a full year isn't actually that weird. It has happened in seven of the last 15 years. We've just become addicted to the drama of every six-week meeting.

Looking ahead: The 2026 schedule

The BoC doesn't move in secret. They have eight scheduled dates a year where they tell us what they're doing with the Bank of Canada bank rate. Mark these on your calendar:

- January 28, 2026: (Includes the big Monetary Policy Report)

- March 18, 2026

- April 29, 2026

- June 10, 2026

Most market-watchers—about 88% of them, according to recent swap pricing—are betting on a "hold" for the January 28 announcement.

Actionable steps for your finances

Stop waiting for a "hero" cut. The era of 0.25% rates is dead and buried. Here is how to handle the current Bank of Canada bank rate environment:

🔗 Read more: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

Stress-test your own budget. Don't wait for the renewal letter from your bank. Use a mortgage calculator to see what a 4.5% rate looks like compared to your current 2.1%. If the number scares you, start increasing your payments now to "practice" that higher cost and pay down principal.

Re-evaluate your "Variable vs. Fixed" strategy.

In a stable rate environment, the "spread" matters most. If the difference between a variable rate and a 3-year fixed is less than 0.50%, the fixed rate might offer the peace of mind you need given the trade uncertainty with the US.

Look at bond yields, not just the BoC.

Fixed mortgage rates are actually driven by the 5-year Government of Canada bond yield, which is currently sitting around 2.9%. If bond yields start climbing because of global instability, fixed mortgage rates will go up even if the BoC does nothing.

Watch the "Core" CPI numbers. When the news drops every month, ignore the "Headline" number that includes gas prices. Look for "CPI-trim" and "CPI-median." If those stay above 2.5%, the Bank of Canada bank rate isn't going anywhere but sideways.

The bottom line? We are in a period of "structural adjustment." The economy is trying to find its footing after a massive shock, and the BoC is trying to stay out of the way. Stability is the new growth.

Prepare for the rate to stay right where it is for a while.

Next Steps for You

- Review your mortgage renewal date. If it’s within the next 12 months, call a broker to see if you can lock in a rate hold.

- Check your HELOC. Since these are tied directly to the prime rate (which follows the BoC), your interest costs should remain steady for the next few months.

- Monitor the January 28 announcement. This will be the most significant update of the quarter, providing the Bank's full economic forecast for the rest of 2026.