You’re staring at a digital form or a paper check, and it's asking for those nine digits. You know the ones. Most people just call it the Bank of America routing number, but if you look closer, things get weird. Fast. Depending on where you opened your account or what you’re trying to do—like setting up a wire transfer versus a standard direct deposit—that number changes. It isn't a "one size fits all" situation.

Banks are massive, sprawling bureaucracies. Bank of America is one of the biggest. Because they’ve swallowed up so many smaller banks over the decades (think FleetBoston or Merrill Lynch), their internal wiring is a patchwork of old systems. That’s why your friend in New York has a totally different routing number than you do in California, even though you’re both using the same app.

Honestly, getting this wrong is a headache. A wrong digit can send your paycheck into the ether for three to five business days. Nobody wants that. Let’s break down how to find the right one without losing your mind.

The geography of your Bank of America routing number

Most people don't realize that routing numbers—officially known as ABA (American Bankers Association) numbers—are basically digital addresses. They tell the Federal Reserve exactly which "vault" the money needs to land in. For Bank of America, these are assigned based on the state where you originally opened the account.

It doesn't matter if you moved. If you opened your account in Miami and now live in Seattle, you’re likely still using the Florida routing number. This is a common trip-up. People move, update their address in the app, and assume their routing info updates too. It doesn't.

Here is a look at some of the heavy hitters. If you’re in California, you’re often looking at 121000358. Over in Texas, it’s frequently 111000614. New York accounts often run on 026009593. But wait. There’s a catch. These numbers can vary even within states if the bank acquired a specific branch network. You have to verify. Don't just guess based on a list you saw online.

📖 Related: Olin Corporation Stock Price: What Most People Get Wrong

Wire transfers are a different beast entirely

This is where things get really messy. If you are receiving an international wire transfer, the standard nine-digit code you see on the bottom of your checks probably won't work. Bank of America typically uses a specific "Electronic" or "Wire" routing number for these transactions.

For domestic wires, BofA often uses a centralized number, frequently 026009593, but again, this can be account-specific. International wires add another layer of complexity: the SWIFT code. For Bank of America in the U.S., that's usually BOFAUS3N. If you provide your domestic routing number to someone sending money from London or Tokyo, the transaction will likely bounce. Or worse, it gets stuck in "pending" purgatory while the banks try to figure out where the money belongs.

Where to find your specific number right now

Stop Googling general lists. Seriously. The most accurate way to find your Bank of America routing number is to look at your own data.

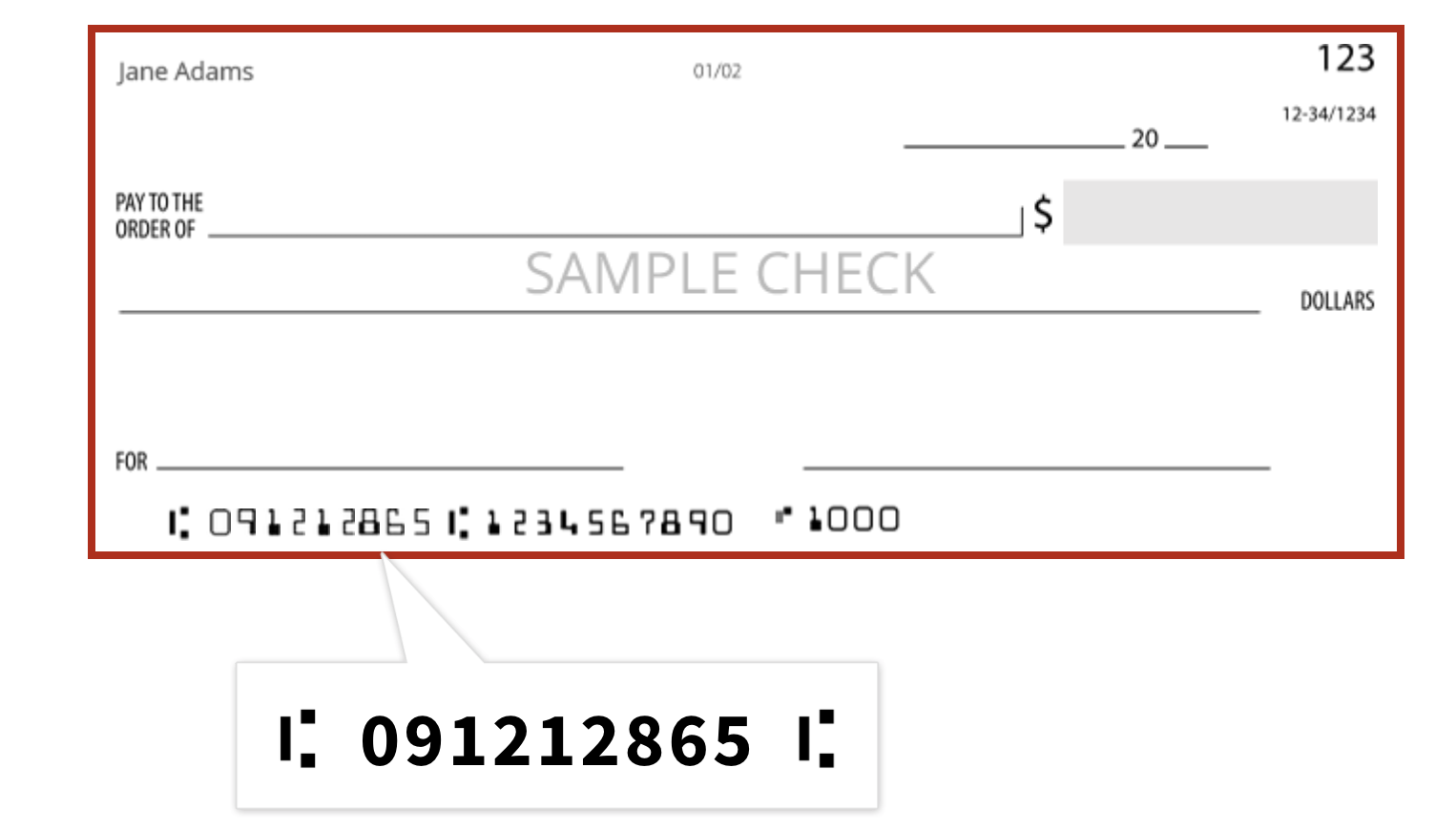

- The Check Method: If you still have a physical checkbook, look at the bottom left corner. There are three sets of numbers. The first nine digits on the far left? That's your routing number. The middle set is your account number. The last set is the check number.

- The Mobile App: Log in. Tap on your specific account (Checking or Savings). Look for "Account Details" or "Routing & Account Numbers." It will show you exactly which one to use for paper checks and which one to use for electronic transfers.

- Paper Statements: It’s usually tucked away in the top right or the fine print at the bottom of the first page.

It is worth noting that some older "Money Market" accounts behave like savings accounts but have routing numbers that act like checking accounts. If you're setting up a recurring payment for a mortgage or a car loan, double-check that the service accepts the specific type of account you’re linking.

Why are there nine digits anyway?

The ABA routing transit number (RTN) system has been around since 1910. It was created to make check processing faster. Before this, banks had to manually figure out which bank owed what to whom. It was a mess.

👉 See also: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

The first two digits of the routing number tell you which Federal Reserve district the bank is in. The third digit tells you which Federal Reserve check processing center handles their business. The rest is unique to the institution. If you see a routing number starting with "12," that's the 12th District—San Francisco. "02" is New York. It’s a literal map of the U.S. financial system hidden in plain sight.

Common myths and mistakes to avoid

One of the biggest misconceptions is that the routing number is "secret" or "private" like a password. It's not. It’s public information. Every time you give someone a check, you’re handing them your routing and account numbers. The security happens at the bank level, not by hiding these digits.

Another mistake? Assuming your savings and checking accounts share a routing number. Usually, they do at Bank of America, but not always. If you have an old account from a state where BofA merged with another bank, your savings might be on an old "legacy" routing number while your new checking account is on the standard one.

Watch out for "Direct Deposit" forms. Many employers ask for a voided check. If you don't have one, don't just pull a number off a random website. Use the app to get a "Direct Deposit Setup" form. It’s a PDF that BofA generates specifically for your account. It guarantees the money hits your pocket on Friday morning instead of floating in space.

What happens if you use the wrong number?

Usually, the transaction just fails. The sending bank gets a message saying "Account Not Found" or "Invalid RTN."

✨ Don't miss: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

But sometimes, it gets "manually repaired." This is bad. A human at the bank has to look at the transaction and try to guess where it goes. They might charge you a fee for this. Or, it might sit in a suspense account for weeks. If you’re paying a credit card bill or rent, that delay could trigger late fees or hits to your credit score. It’s a small detail with massive consequences.

Moving forward with your BofA account

If you are setting up a new payment today, take thirty seconds to verify. Open the app.

- Check if the recipient needs the Paper or Electronic number.

- Confirm the state where your account was originally opened.

- If it's a wire, get the specific Wire Routing Number, not the one from your checks.

For those managing multiple accounts, keep a "cheat sheet" in a secure password manager. Label them clearly: "BofA Checking - Florida - Domestic" or "BofA Savings - California - Electronic." This saves you from having to hunt down your checkbook every time you want to link a new Venmo or PayPal account.

If you ever see a routing number that starts with something other than 0, 1, 2, or 3, be careful. Numbers starting with 5 are usually for internal bank use or specific government purposes. For 99% of people, your Bank of America routing number will start with 0, 1, or 2.

Actionable Next Steps:

Log into your Bank of America online portal and navigate to the "Help & Support" tab. Search for "Direct Deposit" to download the official form for your specific account. Save this PDF to your phone or computer. Having this document ready—which contains your verified routing and account numbers in one place—prevents errors when you're filling out payroll forms or setting up new utility bills in the future.