Buying a home right now feels a bit like trying to catch a falling knife while wearing oven mitts. You know it’s risky, but you’re pretty sure you need to do it anyway. If you’ve been doom-scrolling Zillow or waiting for some "magic" crash to make everything cheap again, the latest Bank of America housing market predictions might be a bucket of cold water.

Honestly, the "crash" narrative is looking more like a myth every day.

Bank of America’s economists and the team at BofA Global Research aren't predicting a 2008-style meltdown. Instead, they’re describing a "thaw." But it's a slow one. Like, glacial slow. We’re talking about a market that is finally starting to breathe again after being choked by high mortgage rates and a total lack of inventory for years.

Why the Bank of America Housing Market Predictions Matter Right Now

The big takeaway from BofA’s latest outlook for 2026 is that the "lock-in effect" is finally losing its grip. For the last couple of years, homeowners with 3% mortgage rates were basically prisoners in their own houses. Why move and trade a $1,500 payment for a $3,500 one? You wouldn't. Nobody would.

But things are shifting.

Bank of America analysts, including Aditya Bhave, have pointed out that the Federal Reserve's pivot toward easing—which really picked up steam in late 2025—is changing the math. They expect the Fed to keep cutting rates through 2026, potentially landing the federal funds rate around the 3.00% to 3.25% range.

This doesn't mean we’re going back to 3% mortgages. Get that out of your head.

But it does mean we might see the 30-year fixed rate settle into the mid-to-high 5% range. For a lot of people, that’s the "magic number" where moving finally starts to make sense again.

🔗 Read more: Are There Tariffs on China: What Most People Get Wrong Right Now

The Price Paradox: Why Houses Aren't Getting Cheaper

You’d think more supply would mean lower prices. Not necessarily. BofA is actually forecasting a modest increase in home prices—roughly 2% for the year.

Wait. Why?

Basically, because demand is still massive. There are millions of Gen Z and Millennial buyers who have been sitting on the sidelines, waiting for rates to drop even a tiny bit. The moment rates hit 5.8% or 5.9%, these buyers rush back into the market. This surge of demand keeps a floor under prices.

It's a "sideways" market. Prices aren't skyrocketing like they did in 2021, but they aren't cratering either. BofA’s data suggests that while nominal prices might go up 2%, when you factor in inflation (which they expect to be around 3%), "real" home prices are actually slightly declining.

The Great Migration Flip: Sun Belt vs. Midwest

One of the most interesting parts of the Bank of America housing market predictions involves where people are actually moving. For years, the story was: "Everyone is moving to Florida and Texas."

Well, the script is flipping.

BofA’s internal data—which tracks where their customers are actually spending and moving—shows a cooling trend in former "boomtowns" like Miami, Phoenix, and Austin. These places have become victims of their own success. They aren't affordable anymore.

💡 You might also like: Adani Ports SEZ Share Price: Why the Market is kida Obsessed Right Now

Meanwhile, "boring" markets in the Midwest are becoming the new magnets. We're seeing growth in:

- Columbus, Ohio

- Indianapolis, Indiana

- Cleveland, Ohio

Why? Affordability. You can still get a decent house in Indianapolis for a price that doesn't require selling a kidney. BofA notes that these markets are seeing higher-than-average price growth because they started from such a lower baseline.

Inventory is the "X-Factor"

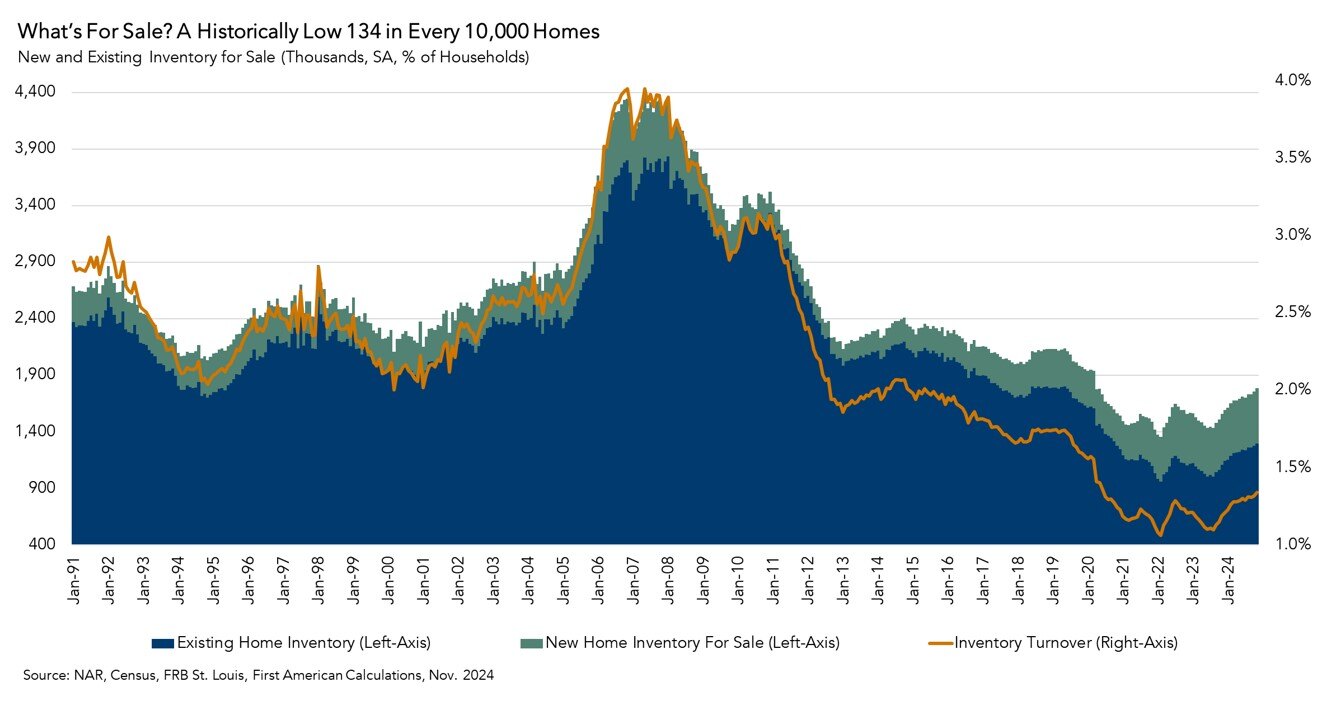

Inventory is finally climbing. BofA and other analysts expect active listings to rise by nearly 9% this year.

That sounds like a lot. It’s not.

Even with that growth, we are still significantly below pre-pandemic levels. We are basically climbing out of a very deep hole. Builders are helping, though. One of the weirdest quirks in the current market is that new construction is sometimes cheaper than existing homes. Builders are offering "mortgage rate buydowns," where they pay to lower your interest rate to 4.5% or 5% for the first few years.

If you're looking at the Bank of America housing market predictions to decide when to buy, this is the part you should pay attention to. Buying a new build might be the only way to get a monthly payment that doesn't feel like a car crash.

What's Keeping People on the Sidelines?

Bank of America’s Homebuyer Insights Report found that uncertainty is at a three-year high. About 75% of prospective buyers are still "waiting for rates to fall" before they pull the trigger.

📖 Related: 40 Quid to Dollars: Why You Always Get Less Than the Google Rate

That is a huge number.

It creates a "coiled spring" effect. If everyone is waiting for the same thing, the moment it happens, the market gets crowded again. Competition goes up. Multiple offers come back. Bidding wars start.

The report also highlighted how Gen Z is getting creative. About 30% of Gen Z homeowners took on a second job to afford their down payment. Even weirder? More people are buying homes with siblings or friends just to split the cost. It’s a "roommate economy" but for mortgages.

Actionable Insights: What You Should Actually Do

Stop waiting for a 20% price drop. It's likely not coming. Bank of America’s analysis suggests the market is stabilizing, not collapsing. If you're serious about buying in 2026, here is the move:

1. Watch the "Real" Price, Not the List Price

Don't just look at the $450,000 price tag. Look at the total cost of ownership. BofA points out that insurance premiums and property taxes are rising faster than home prices in many areas. A "cheap" house in Florida might cost you more per month than a pricier house in Ohio once you factor in the $6,000 insurance bill.

2. Explore New Construction Buydowns

If you can't afford the current 6% or 6.5% rates, look at builders. They are desperate to move inventory and are often willing to "buy down" your rate. This can save you hundreds of dollars a month compared to buying a "charmer" from the 1970s.

3. The Midwest is the New Front Frontier

If you have the flexibility to work remotely, stop looking at the Sun Belt. Look at the cities Bank of America is flagging for growth: Columbus, Indy, and even parts of the Northeast like Buffalo. You get more house for your money, and the competition isn't as cutthroat.

4. Refinance is the Goal, Not the Starting Point

If you find a house you love and can barely afford the payment, remember that BofA expects rates to keep dipping into 2027. You might be "marrying the house and dating the rate." If you buy at 6.3% now, there's a very high probability you can refinance to 5.5% or lower within 18 months.

The housing market isn't going back to 2019. That version of the world is gone. But according to the Bank of America housing market predictions, we are finally moving away from the "emergency" phase and into something that looks like a normal, functioning market. It’s not perfect, but it’s a start.