Money moves. It flows across borders in a constant, invisible stream of digital transfers and physical shipping containers. Most of us don't think about it until we see a headline about China or a "Buy American" bumper sticker. But when economists talk about a balance of trade def, they’re basically just looking at a country’s receipts. It's the difference between what a nation sells to the rest of the world and what it buys. Simple, right?

Not really.

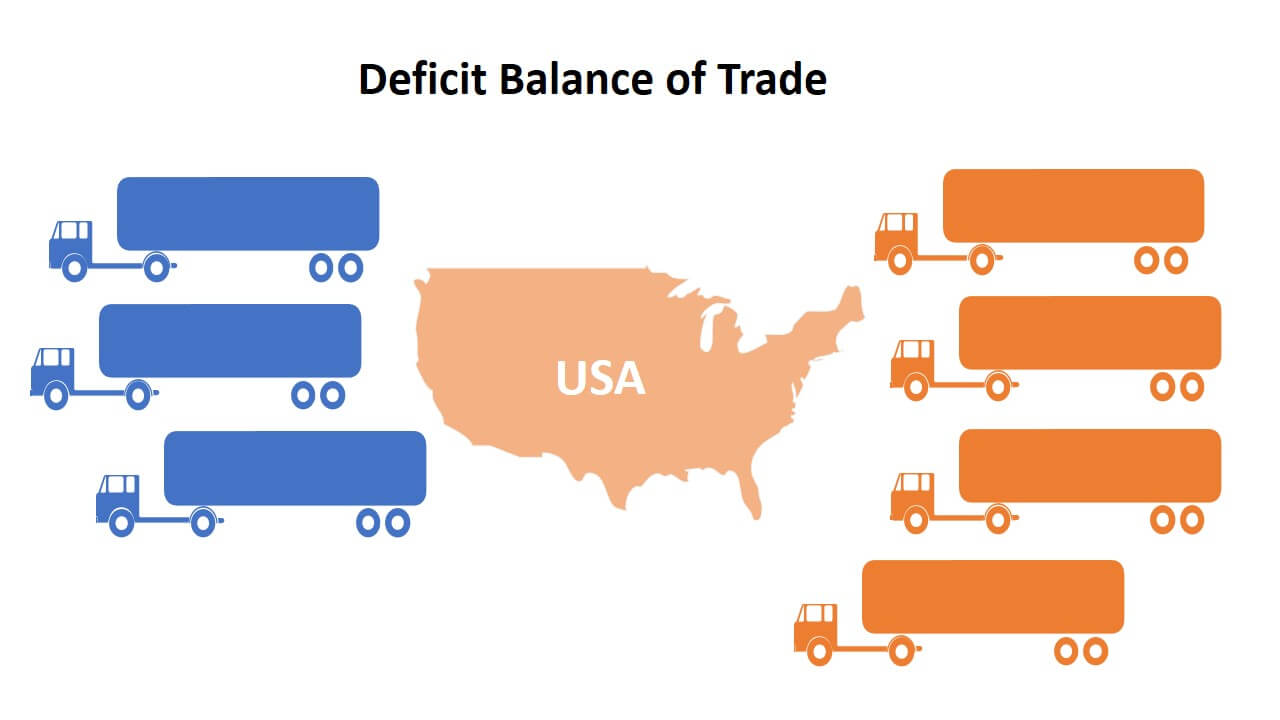

If you sell more than you buy, you have a trade surplus. If you buy more than you sell, you have a trade deficit. For decades, politicians have treated the word "deficit" like a dirty word, as if the country is "losing" at business. But that's a massive oversimplification that ignores how modern global finance actually functions.

What the Balance of Trade Def Really Measures

Basically, the balance of trade is the largest component of a country's current account. It tracks visible goods—think cars, grain, electronics—and invisible services like insurance or tourism. When you hear the balance of trade def discussed on the news, they are usually talking about the "net exports" variable ($NX$) in the classic GDP formula:

$$GDP = C + I + G + (X - M)$$

Here, $X$ represents exports and $M$ represents imports. If $M$ is bigger than $X$, you've got a deficit.

Does this mean the country is poor? Hardly. The United States has run a persistent trade deficit since the 1970s. During that same period, it remained the largest economy on the planet. Honestly, a trade deficit can sometimes be a sign of a very wealthy population that has a lot of disposable income to spend on foreign goods. If people are buying BMWs and iPhones, it means they have the cash to do so.

The Service Sector Gap

One thing people almost always get wrong is forgetting about services. We get obsessed with "stuff" we can touch. Steel. Soybeans. But the U.S., for example, often runs a deficit in goods but a massive surplus in services. When a student from Brazil pays tuition at NYU, or a company in London uses software designed in California, that’s an export. It counts toward the balance.

Why Deficits Happen (and why they aren't always bad)

Economies aren't static. They breathe.

👉 See also: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

A trade deficit often happens because a country’s currency is strong. If the Dollar is worth a lot, foreign goods become cheaper for Americans to buy. Conversely, it makes American goods more expensive for people in other countries. So, imports go up and exports go down. It’s a natural see-saw effect.

Then there’s the investment angle.

According to the Balance of Payments identity, a trade deficit must be offset by a capital account surplus. This is a fancy way of saying that if we send dollars abroad to buy goods, those dollars eventually have to come back—often in the form of foreign investment in U.S. stocks, real estate, or Treasury bonds.

Foreigners aren't just taking our money and burying it in a hole. They are using it to buy pieces of the American economy.

Comparative Advantage: The Secret Sauce

Back in the early 1800s, David Ricardo came up with the idea of comparative advantage. It still holds up. If country A is amazing at making wine and country B is amazing at making cloth, they should both focus on what they’re best at and trade.

Even if country A is technically better at making both, it’s still more efficient to specialize.

This is why your t-shirt is made in Vietnam and your medical imaging software is made in Germany. Trying to do everything yourself usually just makes everything more expensive for the average person. When we talk about a balance of trade def, we have to acknowledge that "protecting" local industries by forcing a surplus often results in higher prices at the grocery store.

The Dark Side: When the Numbers Actually Matter

I don't want to make it sound like deficits are always sunshine and roses. They aren't.

✨ Don't miss: 121 GBP to USD: Why Your Bank Is Probably Ripping You Off

If a country is running a massive trade deficit because it’s borrowing money to fund consumption rather than investment, that’s a ticking time bomb. Think of it like a household. If you take out a loan to start a business, that's smart. If you take out a loan to buy champagne and caviar every night, you’re headed for a crash.

- Debt Traps: Persistent deficits mean a country is becoming a "net debtor" to the world.

- Job Displacement: When manufacturing moves offshore because it's cheaper to import, specific communities get hit hard. This is the "Rust Belt" phenomenon.

- Currency Devaluation: If a country can't find enough investors to offset its trade deficit, its currency might plummet. This makes imports suddenly very expensive, leading to inflation.

The Case of Mercantilism

Some countries, like China or Germany, have historically focused on maintaining a trade surplus. This is often called a neo-mercantilist strategy. By keeping their currency artificially low or providing massive subsidies to exporters, they suck up global demand.

While this creates lots of jobs at home, it can lead to "trade wars" and global instability. It's a delicate game of chicken.

Real World Examples: The US vs. Germany

Look at the contrast.

The U.S. runs a deficit because it is the world’s consumer of last resort. The U.S. Dollar is the global reserve currency, which gives it a unique ability to run deficits that would sink a smaller country.

Germany, on the other hand, is the "Export Champion." They produce high-end machinery and cars that the whole world wants. This creates a massive surplus. However, some economists argue that Germany’s surplus actually hurts its neighbors in the Eurozone because it means Germans aren't spending enough on their neighbors' goods.

One country's surplus is always another country's deficit. The global math has to add up to zero.

Debunking the "Losing" Narrative

You've probably heard a politician say we are "giving away our wealth" to other nations.

🔗 Read more: Yangshan Deep Water Port: The Engineering Gamble That Keeps Global Shipping From Collapsing

Honestly, that's just not how it works. When you buy a TV from Japan, you aren't "losing" $500. You are gaining a TV that you valued more than the $500. The Japanese company is gaining $500 that they will likely use to buy U.S. software, invest in a U.S. factory, or buy U.S. government debt.

The wealth hasn't vanished. It has just changed form.

How to Analyze Trade Data Like a Pro

If you’re looking at economic reports, don't just look at the raw deficit number. It’s a trap. Instead, look at these three things:

- The Energy Component: Is the deficit high just because oil prices went up? Many countries have a "structural" deficit simply because they don't have their own oil.

- Capital Goods vs. Consumer Goods: Is the country importing machinery (which will make them more productive later) or just luxury handbags?

- The Savings Rate: If a country has a low domestic savings rate, it must import capital from abroad, which almost always triggers a trade deficit.

Actionable Steps for Navigating Trade Volatility

Understanding the balance of trade def isn't just for academics. It impacts your wallet and your business strategy.

Monitor Exchange Rates

If you see the trade deficit widening significantly, expect the currency to eventually face downward pressure. If you're a business owner importing components, you might want to hedge your currency risk now before your costs spike.

Diversify Your Supply Chain

Trade deficits often lead to political friction. Tariffs are the "solution" politicians use to close the gap. If your business relies 100% on a country that has a massive surplus with yours, you're at high risk for sudden tax hikes on your imports. Spread your sourcing across different regions.

Follow the Investment, Not the Trade

Instead of worrying about the "loss" of money through trade, look at where that money is flowing back in. Are foreign companies building plants in your country? Those are the sectors that will likely see growth and job creation, regardless of what the trade balance says.

Focus on Value-Added Services

If you're an individual or a small business, remember that the "goods" trade is a race to the bottom on price. The "services" side of the balance of trade is where the high margins are. Intellectual property, consulting, and specialized tech are much harder to "displace" with cheap imports than physical commodities are.

Ignore the Heat, Watch the Light

Don't panic when you see a "record trade deficit" headline. Check if the economy is also growing. If GDP is up, unemployment is down, and the deficit is widening, it usually just means the country is thriving and buying more stuff. It's when the deficit grows while the economy shrinks that you need to start worrying about the exits.