Talking about money is weirdly taboo in America, but everyone wants to know where they stand. You've probably seen those headlines claiming the "average" person makes $60,000 or $70,000 and thought, Who are these people? Honestly, the numbers are messy. If you look at the average salary in the us through the lens of a single number, you’re seeing a distorted reality. Why? Because a handful of billionaires in tech and finance pull the "average" way up, leaving the rest of us looking at a figure that doesn't actually reflect the typical paycheck.

The Real Numbers for 2026

As of early 2026, the data from the Bureau of Labor Statistics (BLS) and the Social Security Administration (SSA) paints a specific picture. If we look at the median—which is the true middle point where half make more and half make less—the numbers feel a bit more grounded.

In the third quarter of 2025, median weekly earnings for full-time workers hit $1,214. If you do the math for a full year, that's roughly $63,128.

But wait.

The National Average Wage Index, which the Social Security Administration uses for its calculations, recently pegged the 2024 average at $69,846.57. By the time we factor in the 3.4% to 3.5% raises projected by major firms like Mercer and The Conference Board for 2025 and 2026, the "mean" average is likely hovering closer to $74,000.

See the gap? There is a $10,000 difference between the "average" and the "median." That gap is where most of the confusion lives.

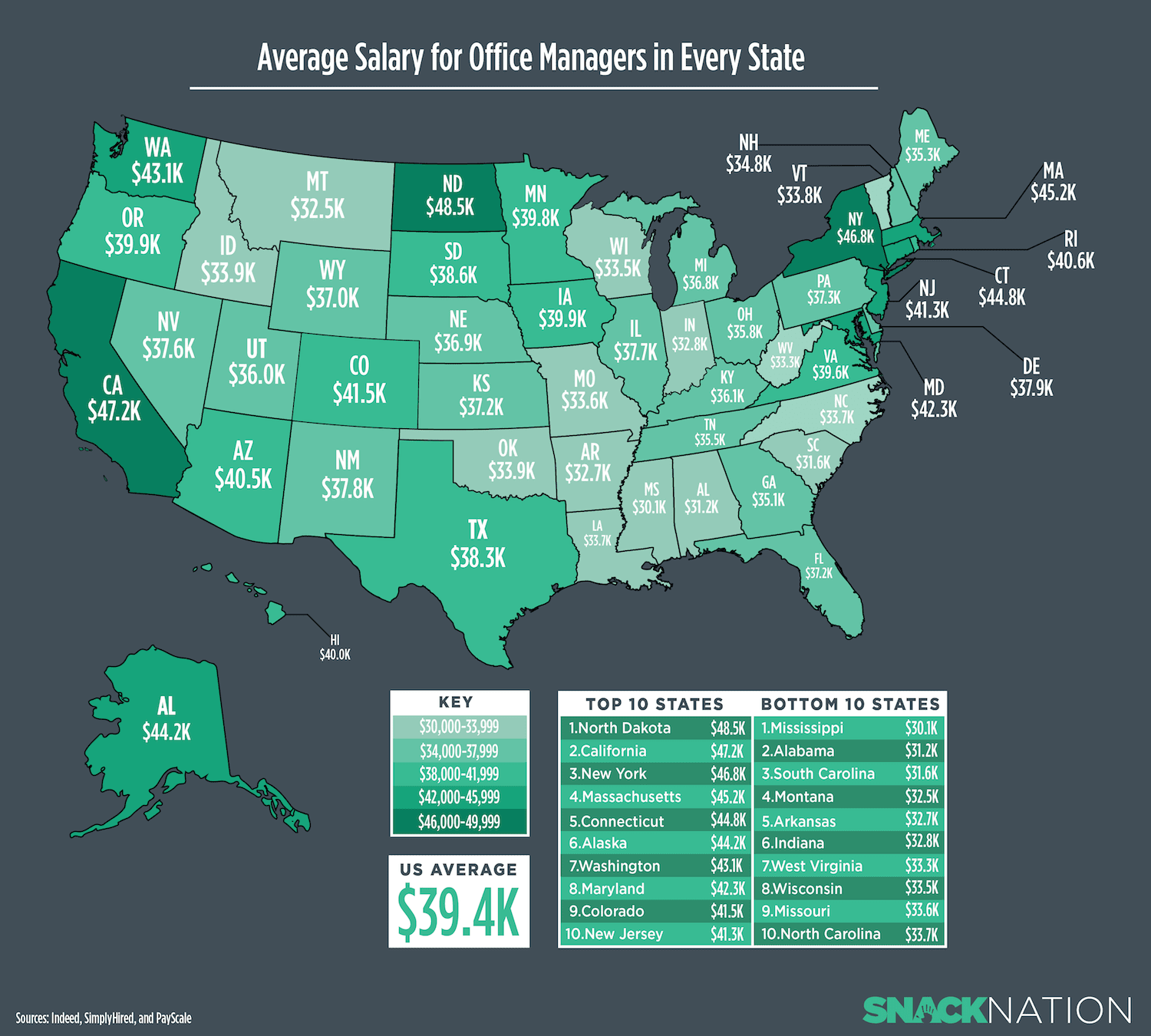

Why Your Location Changes Everything

You can’t talk about pay without talking about zip codes. A $70,000 salary in Jackson, Mississippi, feels like a small fortune. In San Francisco? You’re basically looking for roommates and eating ramen.

Washington, D.C. continues to lead the pack with a median weekly wage of about $2,290. That’s over $119,000 a year. Meanwhile, workers in Mississippi are seeing a median closer to $49,920.

Look at the heavy hitters:

- Massachusetts: Median annual wages are pushing $90,272.

- Washington State: Not far behind at $92,612 (thanks, tech giants).

- California: Sitting around $88,088, though the "no income" household rate there is surprisingly high at 23%.

- Arkansas & West Virginia: These stay on the lower end, often hovering between $56,000 and $58,000.

The "adjusted for cost of living" metric is the one people usually ignore. When you account for how much a gallon of milk or a two-bedroom apartment costs, states like North Dakota and Minnesota actually jump to the top of the list for "real" purchasing power.

💡 You might also like: Print On Demand Magazines: Why They Are Reinvigorating Niche Media

The Education and Age Factor

It’s the oldest cliché in the book: stay in school. But the data doesn't lie here.

If you have a Bachelor’s degree, the median weekly earnings are about $1,747. Compare that to someone with only a high school diploma, who is bringing home around $980. That’s a massive 78% "education premium."

Age also plays a huge role. We usually hit our peak earning years between 35 and 54. Men in this bracket are seeing median weekly pulls of about $1,500, while women in the same age group are closer to $1,200.

Speaking of the gender gap, it’s still very much a thing. Women are currently earning about 80.7% of what men earn. Interestingly, this gap is much narrower for younger workers (ages 16-24), where women earn about 89% of their male counterparts' wages. As people get older, the gap tends to widen significantly.

Breaking it Down by What You Actually Do

What’s your business? If you’re in Management or Professional roles, you’re looking at a median of $1,662 a week.

If you’re in Service occupations, that number drops to $795.

The "Information" sector (think software, data, media) is currently the gold mine, with average weekly earnings hitting $1,996. On the flip side, Leisure and Hospitality remains the toughest grind financially, with averages often staying below $600 a week.

What's Happening with Raises in 2026?

If you're waiting for a massive bump, the news is... okay. Not great, just okay.

🔗 Read more: Finding the PG\&E Phone Number Without Losing Your Mind

Most US employers are planning to keep their 2026 salary increase budgets flat compared to last year. We’re looking at an average merit increase of about 3.1% to 3.2%. Total increases (which include promotions and cost-of-living adjustments) are expected to hit 3.5%.

Some industries are being more generous:

- Energy: Projecting 3.7% total increases.

- Financial Services: Also looking at 3.7%.

- High-Tech: Staying competitive at 3.7%.

- Healthcare & Retail: These are the laggards, projecting only about 2.9% to 3.0% for merit raises.

There's also a weird trend where companies are spreading their budget thin. Instead of giving big raises to "top performers," about 83% of employers are just giving everyone the same percentage increase to keep things simple. It's a "safe" move, but it might not help you if you’re looking to get ahead based on pure hustle.

The Actionable Bottom Line

Knowing the average salary in the us is a good benchmark, but it shouldn't be your only yardstick.

If you want to actually increase your standing in 2026, stop looking at national averages and start looking at industry-specific benchmarking.

Step 1: Use tools like the BLS "Occupational Outlook Handbook" to find the specific median for your job title in your specific city. National data is too broad to be useful for a salary negotiation.

🔗 Read more: Why Your www mcgift giftcardmall com mastercard Isn't Working (and How to Fix It)

Step 2: Focus on "Hot Skills." While hiring has cooled slightly, companies are still paying premiums for AI integration skills, specialized nursing roles, and trade-specific engineering.

Step 3: Factor in the "hidden" salary. In 2026, more companies are increasing their "other" base-pay budgets—things like 401k matching or wellness stipends—rather than just the raw number on your W-2.

Moving the needle on your income requires knowing these nuances. Don't let a generic "average" number discourage you or make you feel complacent. The market is fragmented, and your specific niche likely has its own rules.