You’ve probably seen the headlines. Some say the economy is booming, while others claim we’re all one missed paycheck away from disaster. It’s confusing. Honestly, looking at the average salary in the us is a bit like looking at a weather report for the entire continent; it doesn't tell you if you need an umbrella in your own backyard.

The numbers are moving, though.

By late 2025, the Bureau of Labor Statistics (BLS) reported that the average weekly wage for non-government employees hit roughly $1,264. If you do the math, that’s about $65,728 a year.

But wait.

Averages are sneaky. If Elon Musk walks into a dive bar, the "average" net worth of everyone in the room suddenly jumps to a billion dollars. That doesn’t help the guy at the end of the bar trying to pay for his burger. That is why we have to look at the median—the middle point where half of the people earn more and half earn less.

The Real Middle Class Number

In the third quarter of 2025, the median weekly earnings for full-time workers sat at $1,214.

For a single person, that’s roughly $63,128 per year. It is a 4.6% jump from 2024. On paper, that sounds great. And it is! Especially because inflation finally cooled down to around 2.7%. For the first time in a while, your raise might actually be buying you more eggs and gas instead of just keeping you from drowning.

But "average" is a ghost.

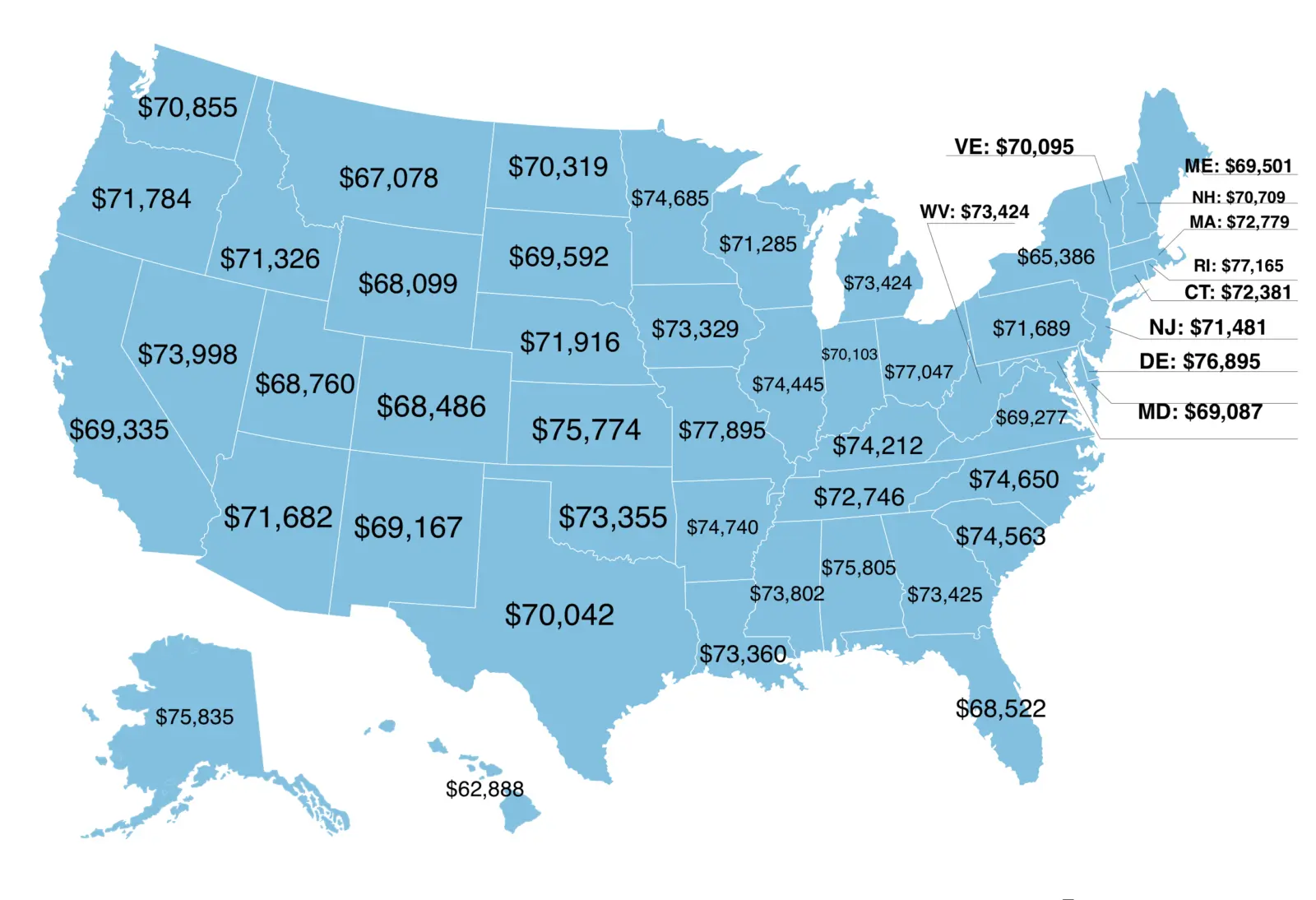

It changes based on where you stand. If you’re in Mississippi, you’re looking at an average weekly wage of about $993. Cross the country to Washington state, and that number climbs to **$1,489**. It’s a completely different world.

Why the Average Salary in the US Varies So Much

Location is the obvious one, but the industry gap is wild.

If you’re in the Information sector—think software, data, tech—you’re likely seeing average weekly checks around $1,996. Meanwhile, the people serving those tech workers lunch in the leisure and hospitality sector are averaging $592 a week.

It’s a massive spread.

✨ Don't miss: Who is High Yield Harry? Why This Anonymous Twitter Account Controls the Finance Vibe

- Management & Professional: These folks are the heavy hitters, with men averaging $1,912 a week and women around $1,466.

- Service Occupations: This is the tougher end of the stick, often hovering under $900 a week.

- The Diploma Tax: If you have a bachelor’s degree or higher, the median jumps to $1,747 weekly. Without a high school diploma? You’re looking at $777.

Education still pays, basically.

But it’s not just about the degree anymore. We’re seeing a shift where specialized trade skills are starting to close the gap. Electricians and specialized construction roles are seeing some of the steadiest growth because, quite frankly, you can't outsource a leaky pipe or a blown circuit to an AI in another country.

The Age Factor (It’s Not Just Experience)

Your 40s and 50s are generally your "golden years" for earning.

Data from the BLS shows that men aged 45 to 54 hit a median of $1,520 per week. For women in the same age bracket, it’s about $1,189.

There is a weird dip that happens after 65. People assume it’s because everyone retires, but it’s often because those who stay in the workforce might shift to part-time or lower-stress roles. Or they’re just getting pushed out. It’s a reality of the modern market that nobody really likes to talk about.

✨ Don't miss: BlackRock AUM Q1 2025: Why $11.58 Trillion Still Feels Like a Warning

Is Your Paycheck Actually Growing?

This is the big question.

Nominal wages—the actual dollar amount on your check—rose by about 3.8% through the end of 2025. Since inflation was 2.7%, your "real wage" growth was about 1.1%.

It’s a win. A small one, but a win.

However, the Federal Reserve Bank of Atlanta notes a growing asymmetry. The top 75th percentile of earners saw their wages grow much faster than the median. Basically, the rich are still getting richer faster than the middle class is catching up.

Actionable Steps to Improve Your Position

Knowing the stats is fine for trivia night, but it doesn't pay the mortgage. If you’re looking at these numbers and feeling like you’re on the wrong side of the average, here is how you actually move the needle.

1. Negotiate with Real Data

Don’t just ask for "more." Go to the BLS website or use tools like the Atlanta Fed’s Wage Tracker. If you know that the average salary in the us for your specific sector rose by 3.5% this year, and you didn't get a raise, you are effectively taking a pay cut. Bring that data to the table.

2. Audit Your "Geo-Arbitrage" Potential

With remote work stabilizing, you don't always have to live in a high-cost-of-living area to get a high-cost-of-living salary. Washington, Massachusetts, and California still have the highest wages, but states like North Dakota and Minnesota actually have higher "adjusted" wages when you factor in how much a gallon of milk costs.

✨ Don't miss: The Real Story of 175 Water Street: Why This Financial District Landmark Is Changing Forever

3. Skill-Stacking over Degree-Chasing

The data shows that advanced degrees earn more, but the "return on investment" is shrinking because of tuition costs. Instead of a $60k Master's, look at certifications in high-growth sectors like renewable energy management or specialized healthcare. Healthcare services and social assistance are the two sectors that added the most jobs in 2025.

4. Watch the 2026 Projections

Employers are planning to keep merit increases around 3.2% for 2026. If your company is offering less, it might be time to start "window shopping" for a new role. The biggest pay bumps almost always come from switching companies, not staying loyal.

The average salary in the us is a benchmark, not a destiny. Whether you're in a high-paying tech hub or a rural service economy, the trend is clear: wages are finally starting to outpace the cost of living, but you have to be aggressive about capturing that growth for yourself.

Track your "real" income—what’s left after inflation and taxes—and focus on the skills that the 2026 market is actually hiring for, rather than relying on old-school career paths that might be cooling off.