You've probably seen the headlines. Maybe you've even scrolled through a few government charts while nursing a lukewarm coffee, wondering why your bank account doesn't seem to reflect the "record wage growth" everyone keeps talking about. Honestly, the average pay rate in Canada is a bit of a tricky beast. On paper, things look great. In reality? Well, it depends on whether you're a software architect in Toronto or a line cook in rural New Brunswick.

Numbers can lie, or at least, they can hide the truth.

As of early 2026, if we look at the broad strokes provided by Statistics Canada, the average hourly wage for all employees across the country is hovering around $37.00 to $38.00. That’s roughly $77,000 a year if you’re pulling a standard 40-hour week. But here’s the kicker: almost nobody is "average."

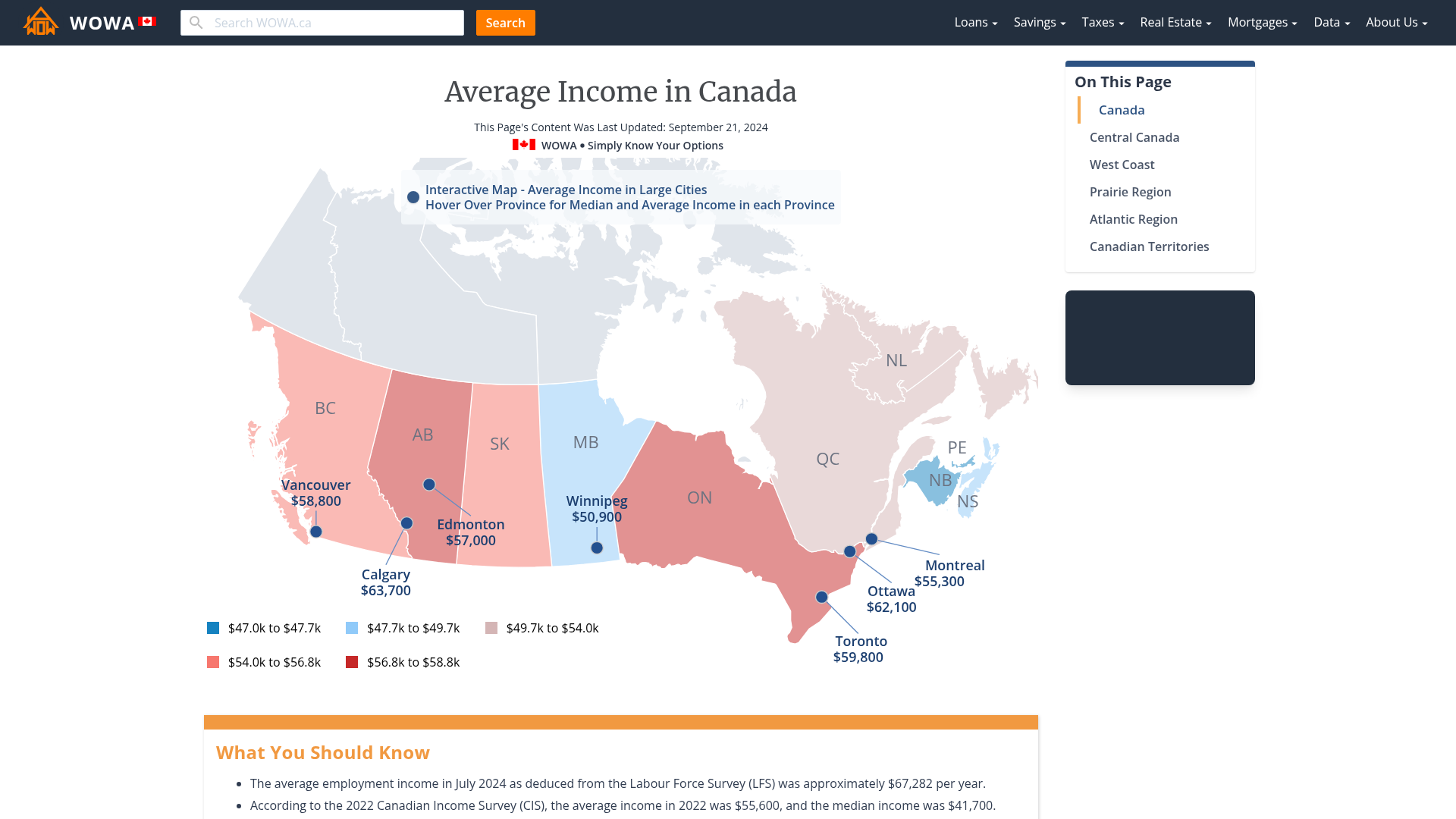

The Great Provincial Divide

If you’re looking for the biggest paychecks, you generally head west or stick to the massive hubs in Ontario. But even that is changing.

Take Alberta, for instance. For decades, it was the undisputed king of high wages thanks to the oil patch. While it still boasts a high average—with weekly earnings often crossing the $1,350 mark—it isn't the outlier it used to be. British Columbia and Ontario have caught up, driven largely by the tech and finance sectors.

In Ontario, the average hourly rate is sitting at about $37.36. Sounds decent, right? But then you look at the rent in a place like Mississauga or downtown Toronto, and suddenly that $37 an hour feels like it’s barely keeping your head above water.

Out east is a different story. In Nova Scotia and New Brunswick, the average weekly earnings are closer to $1,180 to $1,190. It's a significant gap. However, I’ve talked to plenty of folks who moved from Vancouver to Halifax. They took a 15% pay cut but ended up "richer" because their mortgage didn't require a kidney donation.

What Industry Are You In?

This is where the numbers get wild. Basically, if you work in Utilities or the "Forestry, Fishing, Mining, Quarrying, Oil and Gas" sector, you’re in the elite tier. We’re talking average hourly rates of $55 to $60. That’s over $120,000 a year on average.

💡 You might also like: Big Lots Milton FL: Why This Location Survived the Retail Purge

Compare that to the service sector.

Accommodation and food services? You’re looking at about $21 an hour.

Retail trade? Around $27 to $28.

It’s a massive gulf. And it’s not just about the "type" of work. It's about how much the industry is struggling to find people. The skilled trades are seeing some of the fastest wage growth in 2026. If you’re a licensed electrician or a specialized welder, you’re basically writing your own ticket right now. Companies are desperate.

The Public vs. Private Debate

There’s always been this tension between public sector and private sector pay. In 2026, the public administration average is roughly $47.63 per hour. The private sector average is generally lower, but the ceiling is much higher. A senior developer at a private tech firm might make $150,000, while a government IT manager is capped by a strict pay scale.

However, the public sector has those legendary benefits. Pensions. Job security. Things that are becoming increasingly rare in the gig-heavy private market.

The Age and Experience Factor

Age matters. A lot.

Statistics Canada data shows a clear peak. Younger workers (aged 15–24) are naturally at the bottom, averaging around $22.10 per hour. This makes sense—they're often in entry-level retail or hospitality.

The "prime" earning years are between 45 and 54. At this stage, the average annual income hits about $79,000. After 55, the numbers start to dip slightly, often because people begin transitioning to part-time work or early retirement roles.

📖 Related: How Much is Meta Stock: Why the Price is Moving Today

Education acts as a multiplier here. Someone with a bachelor’s degree earns, on average, about $25,000 more per year than someone with only a high school diploma. But—and this is a big "but"—skilled trades certificates are now rivaling university degrees in terms of ROI. You can spend four years and $40,000 on a BA in Philosophy, or you can get paid to learn as an apprentice and potentially out-earn the philosopher by age 25.

The Minimum Wage Ripple Effect

Most provinces have been aggressive with minimum wage hikes. Ontario is at $17.60, BC is at $17.85, and even the federal minimum wage has climbed to $17.75.

Why does this matter for the average pay rate in Canada?

Because of "wage compression." When the bottom moves up, the people making $20 an hour suddenly feel like they aren't being paid enough for their extra responsibility. This forces employers to raise wages all the way up the chain. It’s part of why we’ve seen a 3.8% to 4% year-over-year increase in general earnings.

Real Talk: The Cost of Living Reality

Honestly, the "average" salary in Canada—roughly $65,000 to $70,000 for most people—is becoming a "survival" wage in the biggest cities.

In 2026, a "comfortable" life for a single person in an urban center requires roughly $60,000 to $75,000. If you're earning $50,000 in Vancouver, you’re likely living with three roommates and eating a lot of chickpeas.

Inflation has slowed down from the peak madness of a few years ago, but the prices didn't go back down. They just stopped rising so fast. So, while your boss might give you a 3.3% merit increase this year, your grocery bill is still 20% higher than it was in 2022.

Actionable Steps for Your Career

If you’re looking at these numbers and feeling like you’re on the wrong side of the average, here’s what you actually do:

- Check the "Median," not just the "Average." Averages are skewed by CEOs. The median (the middle person) is often a better reflection of what's possible. In Canada, the median individual income is closer to $45,000–$50,000, which is much lower than the average.

- Pivot to "Goods-Producing" if you can. Construction, manufacturing, and resource extraction are paying significantly more than the service sector right now.

- Negotiate using specific regional data. Don't just ask for a raise. Point to the StatCan "Payroll employment, earnings and hours" report for your specific province. If the provincial average for your sector went up 4% and you got 0%, you have a data-backed argument.

- Watch the Federal updates. Federally regulated industries (banks, airlines, telecommunications) often lead the way in wage trends. What happens there usually trickles down to provincial sectors six months later.

Canada is a massive country with a fragmented economy. The "average" is just a ghost. Your goal isn't to hit the average; it's to find the pocket of the country and the industry where your specific skills are in the shortest supply.