If you’ve ever sat at your kitchen table staring at a pile of bills and wondered why the "average" Canadian seems to be doing fine while you're stretching every loonie, you aren't alone. Honestly, the way we talk about the average household income in Canada is kinda broken. We toss around big numbers like $106,300—the current estimated national average before taxes—but that doesn't really explain why a family in Red Deer feels rich while a couple in Vancouver is basically one repair bill away from a meltdown.

The truth is, the "average" is a mathematical ghost. It's heavily skewed by the top 20% of earners who saw their investment income jump by over 7% last year. If you want to know how much the person next to you in the Tim Hortons line is actually making, you have to look at the median. As of early 2026, the median after-tax income for Canadian households is hovering around $73,000 to $75,000. That’s the real midpoint. Half of the country makes more, and half makes less.

Why Your Location Changes Everything

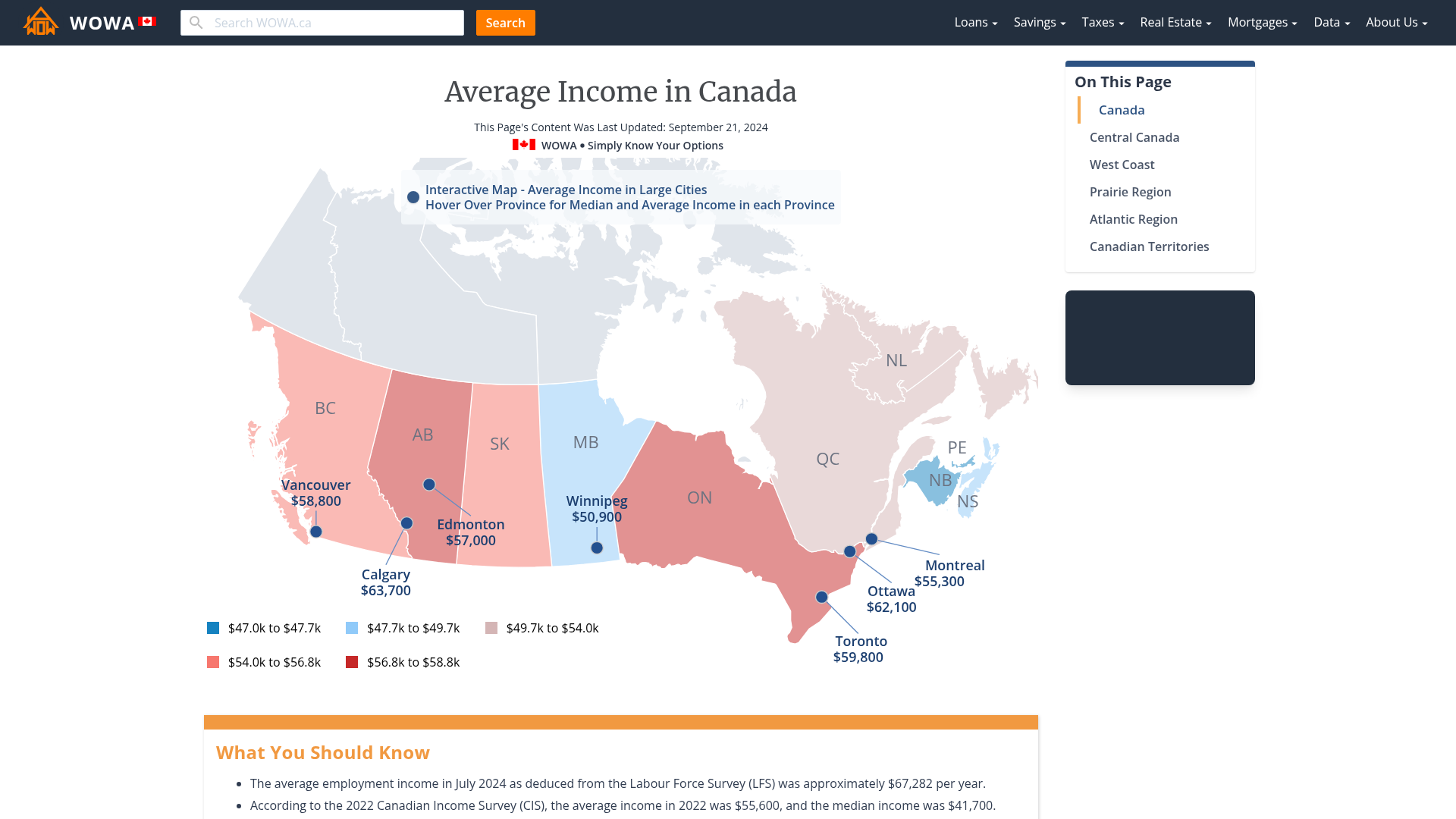

Canada is less like one country and more like ten different economies wearing a trench coat. You can’t compare an Ontario salary to a Quebec one without looking at the massive gap in daycare costs and electricity bills.

Take Alberta. It still leads the pack for the highest provincial average, with households often pulling in over $110,000 before taxes. But even there, the "oil and gas" effect is real. If you aren't in energy or tech, that high average might feel like a myth. On the flip side, the Atlantic provinces like Nova Scotia and New Brunswick have historically seen lower averages—closer to $87,000—but they’ve actually seen some of the fastest growth recently as remote workers flooded in, bringing their big-city salaries with them.

Then there are the territories. It’s wild, but the Northwest Territories often posts an average household income well over $120,000. Why? Because you basically have to pay people that much to convince them to deal with $10 heads of lettuce and -40°C winters. It’s a high-income, high-cost-of-living trap that many people forget when they just look at the raw data.

✨ Don't miss: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

The Tax Man and the 2025 "Mark Carney" Cut

We have to talk about taxes because nobody actually takes home their gross salary. In a major move last year, the federal government under Prime Minister Mark Carney introduced a middle-class tax cut that officially kicked in for the full year in 2026.

They dropped the lowest federal tax rate from 15% down to 14%. It sounds small, like pocket change, right? But for a two-income family, that’s about $840 back in your pocket annually. For someone earning $55,000, it’s an extra $500 a year. It isn't going to buy you a summer home, but it covers a few trips to the grocery store.

Current Federal Tax Brackets for 2026:

- 14% on the first $57,375 (This is the new reduced rate).

- 20.5% on the portion between $57,375 and $114,750.

- 26% on the portion between $114,750 and $177,882.

- 29% on the portion between $177,882 and $253,414.

- 33% on anything above that.

But wait. There’s a catch. Because the federal tax rate dropped, the "value" of your non-refundable tax credits, like the Basic Personal Amount, also dropped slightly. It’s one of those weird tax quirks where the government gives with one hand and takes a tiny bit back with the other.

🔗 Read more: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Is the Average Household Income in Canada Actually Enough?

Let’s get real. Is $106,000 (average) or $74,000 (median) enough to live?

According to recent data from RBC and CMHC, housing affordability is the biggest thief of your income. In 2024, the average homebuyer was spending about 54% of their gross income just to cover the mortgage and taxes. By early 2026, that has eased slightly to around 53%, but it's still way above the "safe" 30% mark that experts usually recommend.

In Vancouver, you basically need a household income of $230,000 to comfortably own a home without living on ramen. In contrast, in a place like Trois-Rivières or Regina, a household making the national average of $106,000 lives like royalty.

The Age Gap is Widening

Statistics Canada recently pointed out a record high in the wealth gap. Younger households (under 35) are seeing their disposable income grow at the slowest pace—just 1.3% compared to the national average of nearly 4%. If you're 25 and feel like you're falling behind, the data says you're right. You’re fighting higher rents with slower wage growth than your parents' generation did at your age.

💡 You might also like: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

The "Good Salary" Metric for 2026

If you’re looking for a target, many experts now say a "good" individual salary in 2026 starts around $67,000 to $72,000. For a household, hitting that $115,000 mark is where the breathing room starts to happen in most mid-sized Canadian cities.

- Tech and Health are the safe bets. Nurses and IT pros are seeing the most consistent raises, with many hovering in the $85k to $105k range.

- The "Side Hustle" is now a "Main Stay." Nearly 30% of Canadian households now report some form of secondary income just to keep up with the 4-5% annual rise in grocery costs.

- Savings are the new luxury. Net saving has actually worsened across the board this year, marking a weird period where people are earning more but keeping less.

What You Should Do Next

Knowing the average household income in Canada is a good benchmark, but it’s useless if you don't apply it to your specific situation.

First, calculate your "Real Take-Home." Use the 2026 blended tax rates to see exactly what hits your bank account. Don't budget based on your gross salary.

Second, check the "Affordability Index" for where you live. If your housing costs more than 40% of your take-home pay, you aren't "bad with money"—you're just living in a market that's out of sync with your income.

Finally, keep an eye on your payroll deductions. With the tax changes from the Carney government fully implemented this month, your January 2026 paystub should look slightly different than your June 2025 one. If it doesn't, talk to your HR department or your accountant.

The numbers are shifting fast. Don't get distracted by the big national averages; focus on the median and your local cost of living to see where you actually stand.