You’ve probably looked at your bank statement recently and felt a tiny bit of annoyance. Maybe you saw a few cents of interest trickling in. Or maybe it was literally $0.01. Honestly, it’s frustrating when you hear about "high rates" in the news, but your own balance seems to be standing perfectly still.

The truth about the average bank account interest rate is that it is a tale of two very different worlds. As of January 2026, the national average for a standard savings account is still hovering around a measly 0.39% to 0.62% APY, depending on which index you trust. If you have $10,000 sitting in one of those big-name traditional banks, you’re basically earning enough for a couple of pizzas a year. That’s it.

Meanwhile, just a few clicks away in the digital banking world, things look completely different.

The Gap Between "Average" and Reality

Banks are kind of like gas stations. Some charge a premium because they’re on a convenient corner with a shiny lobby, while the one three blocks away is significantly cheaper. In banking, the "convenience" of having a physical branch on every street corner is paid for by your interest rate.

The Federal Deposit Insurance Corp (FDIC) currently pegs the national average savings rate at roughly 0.39%. But that number is a bit of a mathematical trick. It is dragged down by the massive "Too Big to Fail" banks that often pay a symbolic 0.01% on their basic savings tiers.

On the flip side, high-yield savings accounts (HYSAs) at online-only institutions like Newtek Bank or Axos are still dangling rates between 3.75% and 4.35% APY.

🔗 Read more: DJT Stock Price: What Most People Get Wrong About Trump Media

Why the massive chasm?

Traditional banks don't really need your deposits right now. They have plenty of cash. Online banks, however, use higher rates as their primary way to lure in new customers. They don't have to pay for thousands of brick-and-mortar buildings, so they pass those savings on to you. It’s a simple trade-off: give up the ability to walk into a lobby and talk to a teller named Linda, and in return, you get 10 times the interest.

Checking and Money Markets: The Middle Ground

If you think savings rates are low, don't even look at checking accounts. The national average there is a pathetic 0.07%. It’s basically a digital mattress.

Money Market Accounts (MMAs) are a bit more interesting. They’re sort of a hybrid—you get a debit card or check-writing privileges, but the rates are higher than regular savings. The average MMA rate is sitting around 0.58% right now. But again, "average" is a trap. Top-tier MMAs from places like Quontic or HUSTL Digital are hitting over 4.10%.

What the Fed is Doing to Your Pocketbook

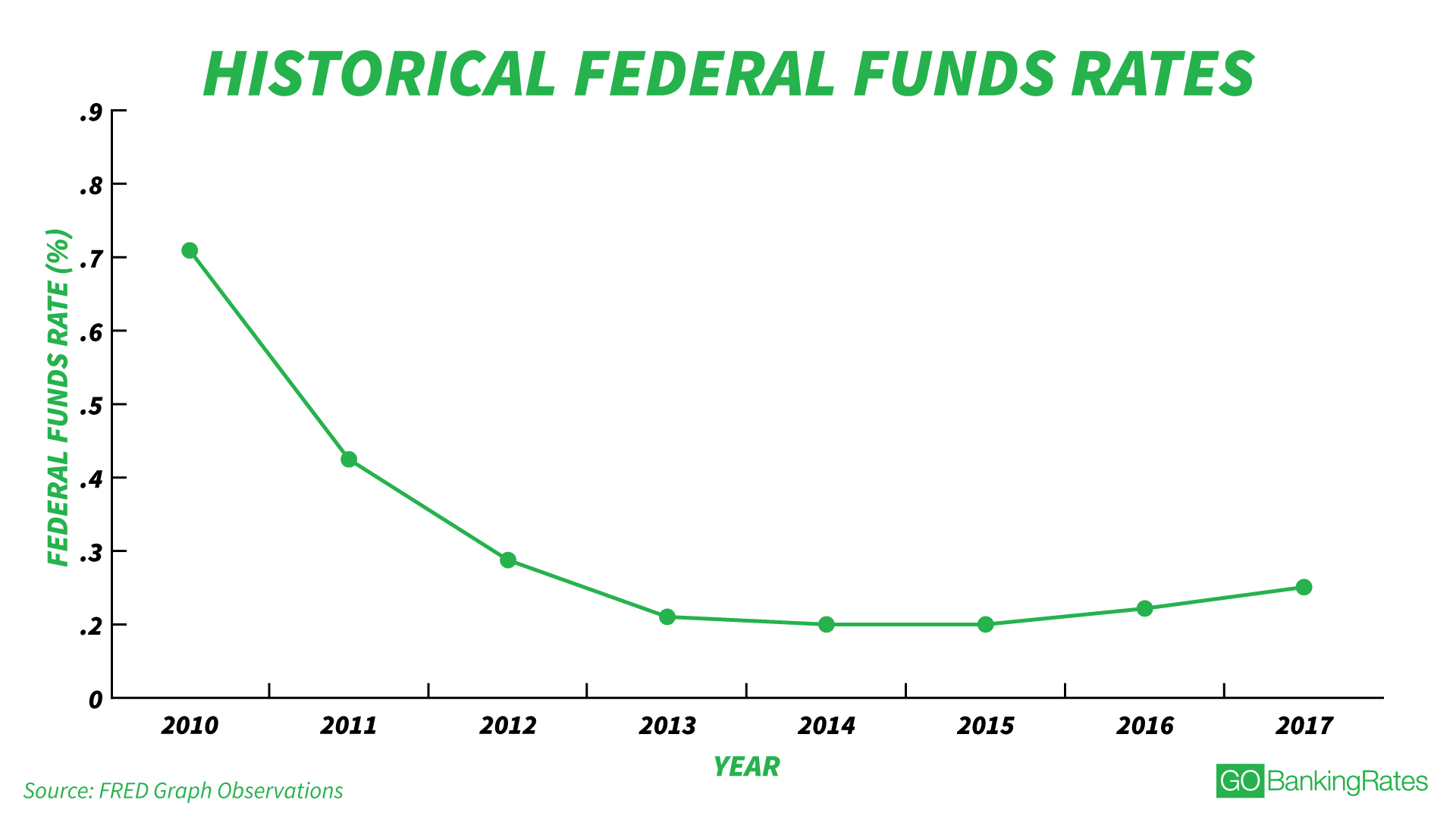

We can't talk about interest rates without mentioning the Federal Reserve. It’s been a wild ride. After a string of rate cuts in late 2025, the federal funds rate is currently sitting in the 3.50% to 3.75% range.

Most analysts, including folks at Goldman Sachs, expect the Fed to be cautious in 2026. There is a lot of talk about a "pause" in January, with maybe one or two small cuts later in the year. This means the window for locking in a high rate might be closing, but it hasn't slammed shut yet.

If you're waiting for rates to go back up to 5% or 6%, you might be waiting a long time. The "easy money" era is cooling off.

Stop Settling for the National Average

The smartest thing you can do right now is realize that the average bank account interest rate doesn't have to be your rate.

Let's look at the math. If you have $20,000:

- At a 0.01% "Big Bank" rate, you earn $2 a year.

- At the 0.39% national average, you earn $78.

- At a 4.00% high-yield rate, you earn $800.

That is a $722 difference for doing about 15 minutes of paperwork online. It’s essentially a free weekend getaway just for moving your digital pixels from one bank to another.

Is Your Money Safe in an Online Bank?

This is the number one thing people get wrong. As long as the bank is FDIC-insured, your money is protected up to $250,000 per person, per account category. It doesn't matter if the bank has a skyscraper in Manhattan or just a server farm in a basement; the insurance is the same.

📖 Related: Bahraini BD to US Dollar: What Most People Get Wrong

Some "fintech" apps aren't actually banks themselves—they partner with banks to hold your money. Always look for the "Member FDIC" logo and check the fine print to see which partner bank is actually holding your cash.

CDs: The "Lock It and Leave It" Strategy

If you don't need your money for a year, Certificates of Deposit (CDs) are looking pretty decent. While the average 12-month CD is around 1.63%, you can find specialized "specials" offering 4.00% to 4.16%.

The downside? If you touch that money early, the bank will hit you with a penalty that usually eats up three to nine months of interest. It’s a commitment. But in an environment where the Fed might cut rates further, locking in a 4% rate now is a hedge against the future.

Moving Beyond the Average

Don't let your money rot in a 0.01% account. Honestly, it's just giving the bank a free loan.

The first step is checking your current APY. If it’s under 3%, you’re leaving significant money on the table. Open a high-yield savings account at a reputable online bank—most have no minimum balance requirements and no monthly fees. Transfer your "emergency fund" there, but keep your local checking account for your day-to-day bills if you like having a local branch.

Once that's set, look at your timeline. If you have cash you won't touch for six months, a short-term CD or a Money Market account might give you that extra edge. The goal isn't to beat the market; it's to make sure inflation isn't eating your hard-earned savings while you sleep.

Actionable Next Steps:

- Check your current rate: Look at your most recent bank statement for the "APY" or "Interest Rate" line.

- Comparison shop: Use a site like Bankrate or NerdWallet to find the top 5 highest-paying accounts today.

- Verify FDIC insurance: Ensure any new bank you choose is a member of the FDIC.

- Transfer in stages: Move $500 first to test the connection between your old and new bank, then move the rest once you're comfortable.