Selling a car in Tennessee is surprisingly informal compared to states like California or New York, but that's exactly where people trip up. You’re standing in a driveway in Franklin or a parking lot in Memphis, cash in hand, and you think, "Is this it?" Honestly, the Tennessee Department of Revenue is pretty chill about the paperwork, but if you don't get an auto bill of sale Tennessee form sorted out right then and there, you are asking for a headache later.

It's a legal shield. That’s the best way to look at it. Without it, you’re just some person who handed over keys to a stranger who might go blast through every red light camera in Knoxville tomorrow.

What the State actually requires (and what it doesn't)

Tennessee doesn't actually require a bill of sale to register a vehicle if the title has a spot for the purchase price. Most people don't realize this. If you look at a standard Tennessee title, there's a line on the back for the "Selling Price." If you fill that out, the county clerk is usually happy.

But wait.

Just because the state doesn't mandate it for the title transfer doesn't mean you shouldn't have one. In fact, if the title is an older version or if the price isn't clearly legible, the clerk's office—especially in high-volume counties like Davidson or Shelby—will demand a separate auto bill of sale Tennessee document to verify the sales tax. They aren't trying to be difficult; they just need to know exactly how much to charge for that 7% state tax plus the local option tax.

Why you’re taking a risk without one

Imagine you sell your old Ford F-150. Three weeks later, a police officer knocks on your door because that truck was involved in a hit-and-run. If you didn't get a bill of sale, you have zero physical proof of when ownership transferred. You're stuck in a "he-said, she-said" nightmare with the authorities.

👉 See also: Sport watch water resist explained: why 50 meters doesn't mean you can dive

A solid bill of sale proves the exact minute you stopped being responsible for that hunk of metal. It documents the Odometer Disclosure, which is a federal requirement anyway for most vehicles under 20 years old. If you're selling a car "as-is," which most private sales are, you absolutely need that phrase in writing. Without it, a disgruntled buyer might try to sue you in small claims court the second the transmission slips.

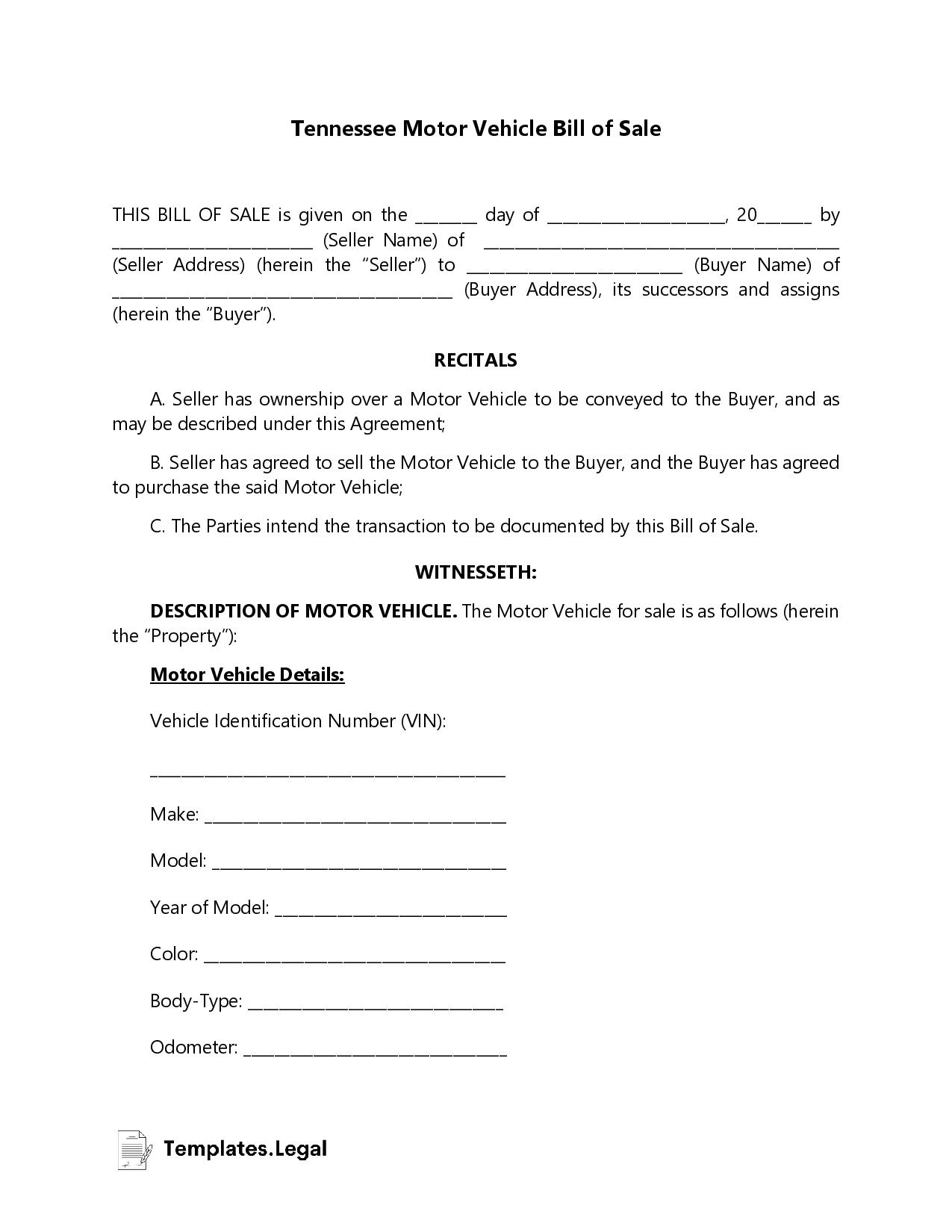

The anatomy of a Tennessee bill of sale

You don't need a lawyer to write this. You can literally scribble it on a napkin, though I wouldn't recommend it if you want the clerk to take you seriously. It just needs the basics.

First, you need the "Who." That's the full legal names and addresses of both the buyer and the seller. No nicknames. If the title says "Robert," don't write "Bobby" on the bill of sale. Match the paperwork.

Then comes the "What." This is the vehicle's "fingerprint."

- Year, Make, and Model.

- Body type (SUV, Sedan, etc.).

- The VIN (Vehicle Identification Number). Check this twice. A single wrong digit makes the whole document trash.

- Color.

The money talk

The "How Much" part is where things get sticky with the Tennessee Department of Revenue. You must list the purchase price. If you’re giving the car as a gift to a family member, you don’t just put "$0." You actually need a different form for that—the Low Selling Price or Gift Affidavit (Form F-1301201). If you try to sell a Porsche for $50 to avoid taxes, the state is going to flag that faster than a speeding ticket on I-40. They use the NADA blue book values to check if you’re lowballing the price to screw them out of tax revenue.

✨ Don't miss: Pink White Nail Studio Secrets and Why Your Manicure Isn't Lasting

Common mistakes at the County Clerk's office

Every county in Tennessee—from Hamilton to Knox—has its own little quirks, but the rules for an auto bill of sale Tennessee are generally consistent. One thing that drives clerks crazy is missing signatures. If there are two owners listed on the title with "AND" between their names, both people must sign the bill of sale. If it says "OR," you can usually get away with just one.

Don't forget the Notary

Does it need to be notarized? Technically, no, not for a standard private sale in Tennessee. However, if you're dealing with a vehicle that has a complicated history or if you're buying from someone you don't trust 100%, a notary stamp is cheap insurance. It proves that the person signing the paper is actually who they say they are. It stops "curbstoners"—unlicensed dealers pretending to be private sellers—in their tracks.

Dealing with trailers and motorcycles

Tennessee is a bit of a "wild west" when it comes to trailers. If it’s a small utility trailer, you might not even have a title. In those cases, the auto bill of sale Tennessee becomes your only proof of ownership. For motorcycles, the process is identical to cars, but make sure you specify the engine displacement (CCs) on the bill of sale.

I’ve seen people buy custom bikes in Lynchburg and forget to list the frame numbers vs. the engine numbers. Don't be that guy. List everything.

How to handle the plates

In Tennessee, the license plate stays with the seller.

🔗 Read more: Hairstyles for women over 50 with round faces: What your stylist isn't telling you

This is huge.

Never, ever let a buyer drive off with your plates. They are registered to your name. If the buyer goes through a toll booth or gets a parking ticket, that bill is coming to your mailbox. When you finalize the auto bill of sale Tennessee, unscrew those plates and take them with you. The buyer can take the bill of sale and the signed title to the clerk to get a temporary tag or their own new plates.

Digital vs. Paper

We live in 2026. Can you use a digital signature? Tennessee is getting better about electronic records, but for vehicle titles and bills of sale, most county clerks still love their physical paper. If you use a digital service to sign, print a hard copy for the buyer to take to the DMV. Better yet, just use a blue pen. It sounds old-school, but blue ink proves it’s an original document and not a photocopy, which some picky clerks appreciate.

Finalizing the deal

Once the money has changed hands and you've both signed the auto bill of sale Tennessee, give the buyer the original. The seller should keep a clear, high-quality photocopy or a digital scan.

Wait.

There's one more step people forget. You need to notify the state that you sold the car. You can often do this online through the Tennessee Department of Revenue’s "Online Vehicle Services." This officially dissociates your name from the VIN in the state's database, providing an extra layer of protection on top of your bill of sale.

Actionable next steps for sellers

- Download a template: Don't wing it. Find a standard Tennessee-specific form that includes the Odometer Disclosure.

- Verify the VIN: Physically look at the plate on the dashboard and compare it to the title. If they don't match, walk away from the deal.

- Check IDs: Ask to see the buyer's driver's license. If they won't show it, they're probably trying to "flip" the title without registering it (which is illegal).

- Remove your stuff: Check the sunglasses holder, the trunk, and under the seats. Take your plates!

- Keep your copy: File that bill of sale away for at least five years. You never know when an old liability issue might resurface.

Actionable next steps for buyers

- Check for liens: Ensure the seller has a "clean" title in hand. If there's a lienholder listed, they need a lien release document before you can register it.

- Calculate your tax: Take the purchase price on your auto bill of sale Tennessee and multiply it by your local tax rate so you aren't surprised at the clerk's window.

- Insurance first: Call your agent before you drive the car home. Most policies have a grace period, but it's better to be certain.

- Head to the Clerk: Don't wait. You have a limited window to register the vehicle before you face late fees.