Money talks, but market cap screams. Honestly, if you've spent more than five minutes looking at a brokerage account or a crypto tracker, you've seen the rankings. It’s that massive, constantly shifting leaderboard where Apple, Gold, and Microsoft fight for the top spot while Bitcoin breathes down their necks. But here’s the thing. Most people look at assets by market cap and think they’re looking at a list of the "biggest" companies or things in the world.

That's a trap.

Market cap isn't a vault filled with cash. It's a hallucination—a collective agreement on what something might be worth if we all tried to sell it at the exact same time (which, by the way, we can't).

Why Assets by Market Cap Isn't Just for Tech Bros

When we talk about the landscape of global wealth, we’re usually comparing apples to oranges—and sometimes to literal gold bars. The standard formula is dead simple: share price multiplied by the number of outstanding shares. For a commodity like gold, it's the current spot price multiplied by the estimated total amount of gold ever mined (roughly 212,000 tonnes, according to the World Gold Council).

It sounds scientific. It isn't.

Think about Nvidia. In early 2024, Nvidia’s market cap did things that shouldn't be possible in a sane universe. It was adding the entire value of a Netflix or a Tesla to its valuation in a matter of weeks. Does that mean Nvidia suddenly became 20% more "useful" to humanity in fourteen days? Of course not. It means the marginal buyer decided the future of AI was worth a higher premium, and the math followed the mood.

The Hierarchy of Value

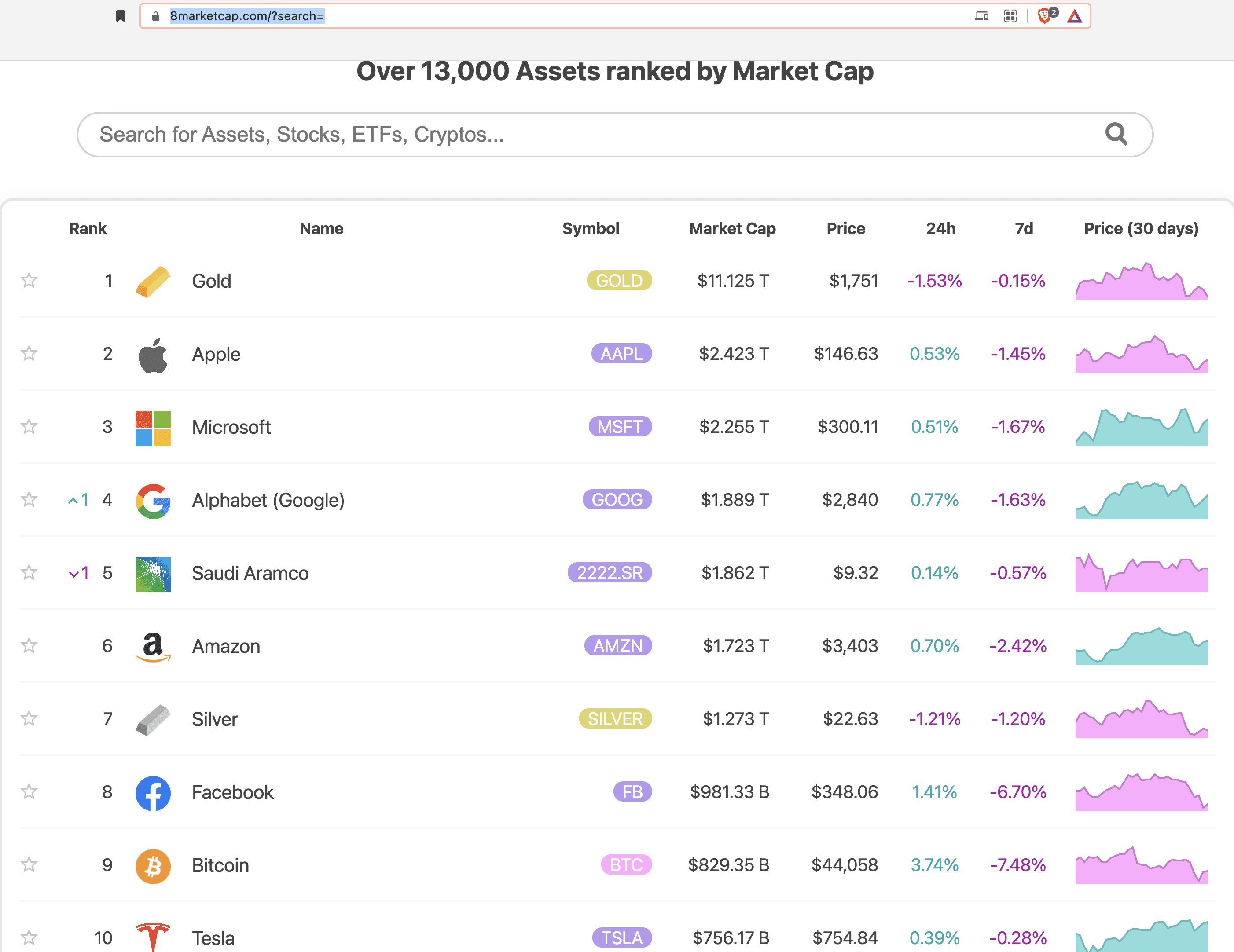

Right now, Gold sits on a throne that nobody can seem to topple. With a market cap hovering around $14 trillion to $16 trillion (depending on the day's volatility), it makes even the biggest tech titans look like mid-sized startups. Why? Because Gold has a 5,000-year head start.

✨ Don't miss: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

Then you have the "Trillion Dollar Club." This is where the air gets thin.

- Gold: The undisputed heavyweight. It's the ultimate "I don't trust the government" insurance policy.

- Microsoft: The ultimate pivot story. From Windows 95 to the backbone of the enterprise cloud and OpenAI's silent partner.

- Apple: The world's most profitable ecosystem. People don't buy iPhones; they buy a subscription to a lifestyle they can't leave.

- Nvidia: The pickaxe seller in a digital gold rush.

- Saudi Aramco: The literal oil that keeps the physical world spinning.

It’s worth noting that Saudi Aramco is a bit of an outlier. While its market cap is astronomical, the "free float"—the amount of stock actually available for you and me to buy—is tiny. The Saudi government owns the vast majority of it. So, while the paper value is high, the liquidity is nothing like Apple’s.

The Crypto Elephant in the Room

You can't talk about assets by market cap without mentioning Bitcoin. A decade ago, it wasn't even on the map. Today, it frequently flips Silver and hovers near the top ten global assets.

Bitcoin's market cap is probably the most controversial number in finance. Critics like Peter Schiff argue it's a "bubble of nothing," while BlackRock's Larry Fink—who used to be a skeptic—now calls it "digital gold." The math for Bitcoin's market cap is transparent: 21 million (the hard cap) minus the lost coins, multiplied by the price.

But wait. There’s a catch.

Estimates suggest that roughly 3 to 4 million Bitcoins are lost forever—trapped in hard drives in landfills or belonging to Satoshi Nakamoto, who hasn't touched them in 15 years. If those coins can never be sold, is the "real" market cap 20% lower than what the charts say? Probably. But the market doesn't care about "real." It cares about the number on the screen.

🔗 Read more: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

The Problem with "Paper Wealth"

Let’s get real for a second. If Tim Cook decided to sell every single share of Apple tomorrow, the market cap would vanish. The act of selling at that scale creates a price collapse. This is why comparing the market cap of a highly liquid stock like Microsoft to the market cap of a real estate market is tricky.

Total global real estate is estimated to be worth over $300 trillion. That dwarfs gold. It dwarfs every stock market on the planet. But you can't "trade" a suburban home in Ohio as easily as you can trade a share of Amazon.

When you see a headline saying "Company X lost $100 billion in value today," nobody actually lost $100 billion in cash. It’s just that the collective consensus of what the company is worth shifted. It’s a giant, global game of "What have you done for me lately?"

Misconceptions that Cost You Money

- High market cap means low risk: Tell that to the people who owned General Electric in 2000 or Nokia in 2007. Size is a lagging indicator of past success, not a guarantee of future survival.

- Stock price equals value: A company with a $1,000 stock price can have a smaller market cap than a company with a $10 stock price. Shares outstanding matter. Always check the share count.

- Silver is "cheap" compared to Gold: Silver’s market cap is a fraction of Gold’s (around $1.3 trillion vs $15 trillion). People see the lower price and think it's a bargain, but Silver is an industrial metal. It gets used up. Gold just sits there. They aren't the same asset class.

The Shift Toward Intangible Assets

We are moving into an era where the most valuable assets by market cap aren't things you can touch. In the 1950s, the top companies were Sears, US Steel, and General Motors. They owned factories, railroads, and inventory.

Today? Alphabet (Google) owns algorithms. Meta owns your social graph. Microsoft owns code.

This shift is why we see such massive valuations. Software scales in a way that steel never could. If Microsoft wants to sell another million copies of Office, the cost is basically zero. If US Steel wanted to sell another million tons of steel, they had to build a new furnace.

💡 You might also like: How Much Do Chick fil A Operators Make: What Most People Get Wrong

This "infinite scalability" is what drives the top of the leaderboard. It's why tech dominates the top five spots. It's also why these companies are under constant fire from regulators. When your market cap is larger than the GDP of most countries, you aren't just a company anymore. You’re a sovereign entity.

How to Use This Information

So, what do you actually do with this? Staring at the assets by market cap list is fun for trivia, but it’s a tool for your portfolio if you know how to read between the lines.

First, look at concentration. When the top five assets represent a massive percentage of the total market (like we see in the S&P 500 today), the market is "top-heavy." If Apple has a bad quarter, the whole world feels it. Diversification isn't just about owning different stocks; it's about making sure you aren't over-exposed to the "Trillion Dollar Club."

Second, watch the flippings. When a new asset enters the top ten, it’s a signal of a structural shift in the global economy. When Nvidia overtook Amazon, it wasn't just a stock move. It was the world's way of saying "Hardware for AI is now more valuable than the world's largest retail platform."

Third, pay attention to the gap between the #1 and #2 spots. Usually, when the gap narrows, we're in for a period of extreme volatility as the market tries to decide who the new king is. We saw this with Apple and Microsoft for years.

Actionable Steps for the Modern Investor

- Check the Weighting: If you own an S&P 500 index fund, you are heavily invested in the top 10 assets by market cap. You might think you're diversified, but 30% of your money might be in just six companies.

- Monitor the "Real" Assets: Keep an eye on Gold and Bitcoin as a percentage of the total global asset pie. If their share is growing, it usually means investors are getting nervous about the stability of fiat currencies and traditional stocks.

- Look for the "Laggards": Sometimes, companies with massive cash flows have suppressed market caps because of temporary bad press or sector rotations. These are the value plays.

- Don't ignore the "Mid-Caps": The next trillion-dollar company is currently a $50 billion company. While the giants provide stability, the real growth happens when an asset climbs from the bottom of the list to the top.

Market cap is a snapshot of human psychology. It tells you what we value, what we fear, and where we think the future is going. It’s not a scoreboard of who is "best"—it's a scoreboard of who has the most influence.

Keep an eye on the leaders, but don't forget that the leaderboard is written in pencil, not stone. History is littered with "permanent" market leaders that no longer exist. In 1917, the most valuable company in the world was US Steel. Today, it’s a rounding error compared to the tech giants. The only constant in the world of assets is that eventually, someone else takes the crown.