Wall Street has a short memory. In late 2025, when Arista Networks Inc stock (ANET) hit its all-time high of $162.03, people were talking about it like it was the only company on earth that knew how to plug in a router. Then, the inevitable "cooling off" happened. By mid-January 2026, the price settled into a range between $123 and $132.

It’s easy to look at a 20% dip and think the party is over. Honestly, if you only look at the ticker symbol, you're missing the actual story of what’s happening inside the data centers of Microsoft and Meta. The "plumbing" of the internet is being ripped out and replaced.

The AI Back-End is the New Battleground

For the last two years, everyone obsessed over GPUs. If you didn't have an Nvidia chip, you weren't in the game. But 2026 is becoming the "Year of the Network." You can have 100,000 H100s, but if they can't talk to each other without lagging, they’re just expensive space heaters.

Arista is basically the architect of the AI back-end. They aren't just selling switches; they are selling the ability to handle "Elephant Flows." These are massive, bursty data transfers typical of Large Language Model (LLM) training. While Cisco still holds a huge chunk of the general Ethernet market, Arista has effectively surpassed them in high-speed data center switching.

They’ve done this by betting on Ethernet when others clung to proprietary tech. Nvidia’s InfiniBand was the gold standard for a minute, but the industry is shifting. The Ultra Ethernet Consortium (UEC) is pushing for open standards. Why? Because nobody wants to be locked into a single vendor’s ecosystem forever. Arista is a founding member here. By early 2026, Ethernet has captured roughly 65% of new AI back-end deployments.

The Numbers That Actually Matter

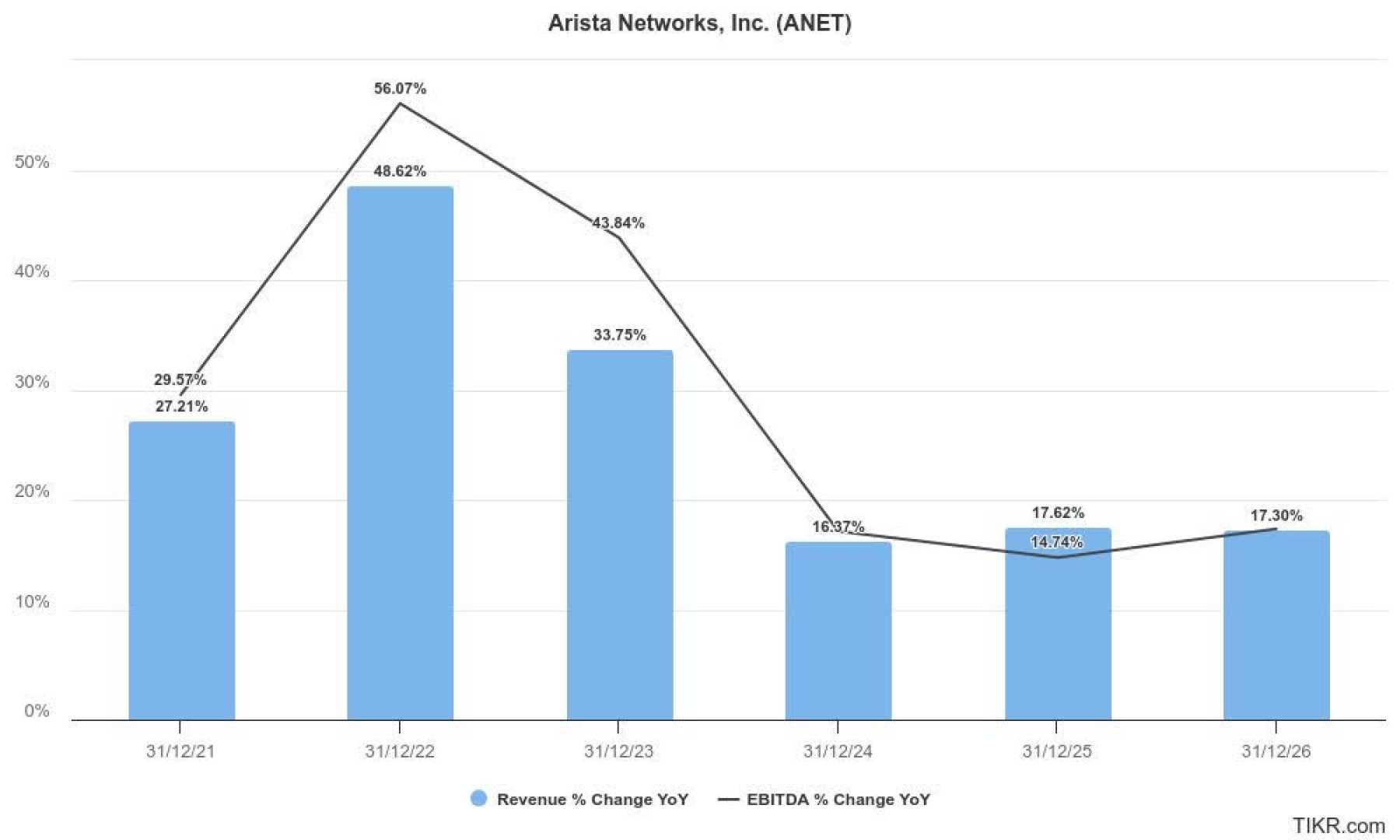

If you’re tracking Arista Networks Inc stock, the Q3 2025 earnings call was a bit of a wake-up call. Revenue was up 27.5% year-over-year to $2.31 billion. That’s massive. But the stock dropped anyway.

Why? Because management warned about "supply chain constraints" and "shipment variability."

Lead times for some components are still sitting between 38 and 52 weeks. That is a long time to wait for a box of wires. Yet, the company raised its 2026 revenue target to $10.65 billion. They are also targeting $2.75 billion specifically from their AI Center segment for the 2026 fiscal year.

- Gross Margin: Hovering around 62-64% (down slightly from 65%).

- Deferred Revenue: A massive $4.7 billion cushion as of late 2025.

- Cash on Hand: Over $10 billion in cash and investments.

That deferred revenue is the "secret sauce" for 2026. Because of how AI cluster contracts work, Arista can't always recognize the money the moment the hardware leaves the dock. This creates a backlog that provides incredible visibility into the second half of 2026.

Why the "Cisco Killer" Label is Kinda Wrong

People love a David vs. Goliath story. They’ve been calling Arista the "Cisco Killer" since Jayshree Ullal left Cisco to lead Arista. But it’s more nuanced. Cisco is actually fighting back hard. In their most recent quarter, Cisco reported $1.3 billion in AI orders and expects $3 billion in AI revenue for fiscal 2026.

Cisco is winning with "sovereign clouds"—governments that want their own AI infrastructure. Arista, on the other hand, owns the "Cloud Titans." If you are a hyperscaler, you are likely running Arista EOS.

EOS (Extensible Operating System) is the reason Arista stays ahead. It’s a single image. One OS for every switch. Cisco has historically struggled with a fragmented OS landscape. If you're a network engineer, would you rather manage five different operating systems or one? It’s a no-brainer.

💡 You might also like: Dollar to UK Pound Exchange Rate: What Most People Get Wrong

The 1.6T Ramp and the "Blue Box" Strategy

We are currently seeing the move from 400G and 800G to 1.6T (Terabit) switches. The second half of 2026 is when this refresh cycle really hits the fan. This isn't just a small upgrade. It’s a total overhaul of the data center spine.

Arista is also playing a clever game with their "blue box" solution. Some massive companies want to use "white box" switches—generic, cheap hardware. Arista says, "Fine, keep the cheap hardware, but put our software on top of it." This allows them to capture revenue even when they don't sell the physical box. It’s a software-first approach that protects their margins when hardware prices get competitive.

Risks Nobody Mentions

It isn't all sunshine. CEO Jayshree Ullal recently sold about 24,000 shares in late 2025. Insiders sell for many reasons, but when the boss trims a position by 70%, people notice.

There's also the "concentration risk." Arista is heavily dependent on a few massive customers. If Microsoft decides to take a breather on capital expenditures, Arista feels it immediately. Plus, Nvidia isn't just sitting there. They are aggressively pushing their own Ethernet products (Spectrum-X) to compete directly with Arista's 7800R4 series.

What to Do With Arista Networks Inc Stock Now

If you're looking at ANET today, you've got to decide if you believe the AI build-out is a bubble or a foundation. Most analysts, including those at Piper Sandler and Morgan Stanley, remain "Overweight" on the stock. They see 2026 as a "Year of Refresh."

The current price-to-earnings ratio is high—around 49 to 50. That’s not cheap. But for a company with no debt and 40% net margins, you're paying for quality.

Next Steps for Investors:

- Watch the 1.6T Rollout: Keep an eye on the Q1 2026 earnings (expected mid-February). If the guidance for 1.6T adoption stays strong, the stock likely tests its previous highs.

- Monitor the Backlog: Check the deferred revenue numbers in the next SEC filing. If that $4.7 billion starts shrinking without a corresponding jump in recognized revenue, there might be a "digestion" period where customers slow down.

- Check the Campus Growth: Arista is aiming for 50% growth in the "Campus" (enterprise offices) segment for 2026. This is their way of diversifying away from just the "Cloud Titans." Success here makes the stock much safer.

Arista is no longer the scrappy startup. It is the incumbent of the AI age. The "healthy volatility" we’re seeing in Arista Networks Inc stock is just the market trying to figure out how high the ceiling really is for a company that makes the world's fastest switches.