Walk through the streets of Buenos Aires today and you’ll feel a vibe that’s honestly hard to pin down. One minute you’re looking at a sleek new wine bar in Palermo filled with tourists, and the next you’re passing a retiree counting small change at a supermarket checkout. It’s a land of extremes. But if you’re asking how is argentina economy doing right now in early 2026, the answer isn’t a single number. It’s a weird, messy, and surprisingly hopeful tug-of-war.

The Chainsaw Worked—Mostly

Two years ago, Javier Milei took office with a literal chainsaw. People thought he was nuts. He slashed ministries, fired tens of thousands of state employees, and stopped the central bank from printing money like it was Monopoly cash.

The results? They’re kinda staggering if you look at the raw data.

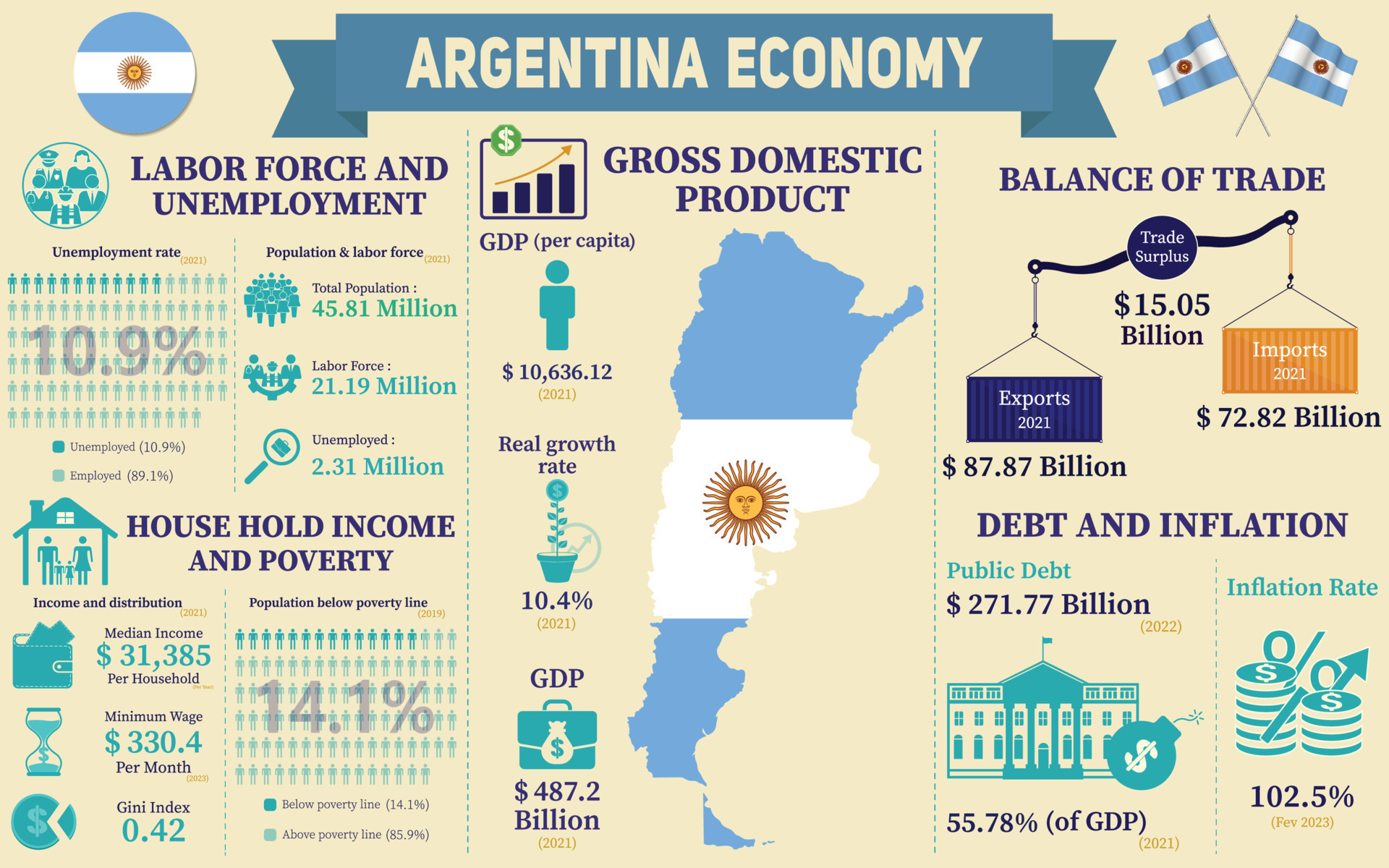

Inflation, which was screaming at over 200% when he started, has plummeted. We just saw the December 2025 numbers come in at an annual rate of about 31.5%. For most countries, 31% is a national emergency. In Argentina? It’s the lowest it has been since 2017. It feels like a victory.

But here’s the thing: while the "macro" is looking sharp, the "micro" is still hurting.

The government reached a primary fiscal surplus—meaning they’re finally bringing in more than they’re spending—but that came at the cost of massive subsidy cuts. Your electricity bill in Buenos Aires isn’t a joke anymore. Gas prices are real. The days of the "cheap" Argentina are basically over for the locals.

Why the Growth Forecast Just Got a Haircut

The World Bank recently tweaked its outlook. They were expecting 4.6% growth for 2026, but they just trimmed that back to 4%. Still solid, but it shows the "rebound" phase is starting to cool off.

The reason? Political jitters.

👉 See also: Why XRP Is Going Down Today: What Most People Get Wrong

Even though Milei’s party, La Libertad Avanza, crushed it in the October midterms, there’s still a lot of friction in Congress. The market hates uncertainty. When investors see a fight over labor reforms or pension tweaks, they hit the pause button.

Then there's the currency. We’ve moved away from that rigid "crawling peg" where the peso dropped exactly 2% a month. Now, we have these inflation-adjusted bands. It’s more flexible, sure, but it keeps everyone on edge. If the peso hits the top of that band, the Central Bank has to step in, and their reserves aren't exactly overflowing. They’re sitting on a narrow buffer.

The Sectors Carrying the Team

If you want to know where the money is actually moving, look at the ground—literally.

- Vaca Muerta: This massive shale formation is the crown jewel. Oil and gas exports are finally pumping real dollars into the economy.

- Lithium and Copper: With the "RIGI" investment regime in place, mining companies are circling. We’re talking over $30 billion in announced investments.

- Agriculture: The farmers are the backbone, as always. But they’re still grumbling about export taxes (retenciones) that haven't vanished as fast as they’d hoped.

It’s a lopsided recovery. If you’re in tech or energy, life is good. If you’re in traditional manufacturing or construction, you’re likely facing high costs and slow demand. It’s not a "rising tide lifts all boats" situation yet.

The Poverty Paradox

This is the part that gets people heated.

Depending on who you talk to, poverty is either a catastrophe or a miracle in progress. Official stats show the national poverty rate has dropped significantly from the 50%+ highs of late 2023. In Buenos Aires city, it actually dipped to around 17.3% recently.

The government argues that by killing inflation, they’ve stopped the "stealth tax" on the poor. And they’ve actually increased targeted aid for families, like the Universal Child Allowance (AUH), while cutting the "middleman" organizations that used to handle social plans.

But talk to a schoolteacher or a nurse. Their wages haven't kept pace with the new "real" prices of food and medicine. The "middle class" is shrinking into a "struggling class."

🔗 Read more: What Does Persona Mean? Why Most Businesses Are Getting It Dead Wrong

What to Watch in the Coming Months

The big test for how is argentina economy doing will be January and February of 2026.

The government has huge debt payments coming up—roughly $5 billion in principal and another $3 billion in interest. Most of this is the legacy of the IMF deals from years ago. If the Central Bank can’t keep building reserves, the "calm" could evaporate.

There’s also the "Trump Factor." With a friendly administration in the U.S. and a massive $20 billion currency swap recently secured, Milei has a bit of a safety net. But a safety net isn't an engine.

Actionable Insights for Investors and Observers

If you’re looking to engage with the Argentine market, here’s the reality on the ground:

- Look Beyond the Capital: The real growth isn't in the cafes of Recoleta; it's in the mining hubs of Salta and the energy corridor in Neuquén.

- Monitor the Spread: Watch the sovereign risk (EMBI). It’s been hovering around 600 basis points. If that drops further, Argentina might actually be able to return to international credit markets properly for the first time in years.

- Labor Reform is Key: Keep an eye on the negotiations with the unions. If Milei manages to pass his structural labor reforms in early 2026, it could unlock a wave of formal hiring that has been frozen for a decade.

- Currency Band Buffers: Check the Central Bank (BCRA) daily reports. If they start losing reserves to defend the peso band, it’s a sign that a sharper devaluation might be coming.

Argentina is no longer the basket case of the world, but it’s not a Swiss watch yet either. It’s a high-stakes experiment in libertarian economics that is currently defying the skeptics—while leaving the vulnerable waiting for the "trickle-down" to finally reach their wallets.