If you’re landing in Buenos Aires right now, the first thing you’ll notice isn't the smell of grilled steak or the tango dancers in San Telmo. It’s the sheer confusion at the exchange counter. Honestly, trying to pin down the argentina currency exchange rate to us dollar in early 2026 feels like chasing a ghost. One minute you're looking at a screen that says one thing, and the next, a guy on Florida Street is whispering a completely different number.

Money here is a vibe, but a very stressful one.

As of mid-January 2026, the official rate is hovering around 1,452 pesos per dollar. But if you’ve spent more than five minutes researching Argentina, you know that number is only half the story. The "Blue Dollar"—that unofficial, parallel market rate that everyone actually uses—is sitting closer to 1,505 pesos. That gap, while smaller than the chaotic 100% spreads we saw a few years back, still dictates everything from the price of a caffè latte to the cost of a leather jacket.

The Two-Headed Beast: Official vs. Blue

Argentina’s economy is currently a massive experiment under President Javier Milei. You’ve probably heard of his "chainsaw" approach to government spending. It’s radical. It's loud. And surprisingly, it’s actually started to pull the official and parallel rates closer together.

In late 2025, the government shifted the "crawling peg" system. Basically, they used to let the peso devalue by a fixed 2% every month. Now, they’ve tied it more closely to monthly inflation, which is running at about 2.5% to 2.8%. This sounds like a minor technical tweak, but it’s huge for your wallet. It means the peso is losing value faster on paper, which ironically makes the black market less volatile because there's less "pent-up" devaluation pressure.

💡 You might also like: Did the Bill Pass for No Tax on Overtime? What’s Actually Changing in 2026

The "Blue Dollar" still exists because of lingering "cepo" (exchange controls). Even though many restrictions have been lifted for tourists and big companies, regular Argentines still face limits on how many greenbacks they can tuck under their mattresses.

Why the Rate Is Moving Now

Several things are hitting the market at once this January.

- Debt Repayments: The Treasury just had to cough up roughly $4.2 billion for bond payments. When the government needs dollars, the market gets jittery.

- US Support: Interestingly, the US Treasury recently stepped in with a $20 billion currency swap. This acts like a massive safety net, preventing the peso from just falling off a cliff.

- Inflation Cool-off: For the first time in forever, annual inflation has dropped to about 31.5%. To put that in perspective, it was over 200% not too long ago.

When inflation slows down, people stop panicking. When people stop panicking, they stop buying every dollar they can find. That’s why the argentina currency exchange rate to us dollar has been surprisingly stable this summer (Southern Hemisphere summer, that is).

👉 See also: The Big Short: What Most People Get Wrong About a Game of High Stakes in Global Finance

The "Tourist Dollar" Secret

If you’re visiting, don’t bother with the shady guys on the street anymore unless you really want the "cultural experience" of a windowless backroom.

Since the reforms in 2025, most international credit cards (Visa and Mastercard) now use the MEP rate. This is a legal, electronic exchange rate based on bond trading. Right now, it’s almost identical to the Blue Dollar rate. You pay with your card, the bank does some wizardry, and you get a rate that’s way better than the official one.

However, cash is still king for a reason. Many restaurants and shops will give you a 10% to 20% discount if you pay in "efectivo" (cash) because it helps them stay under the tax radar. If you bring crisp, $100 bills—the ones with the "big heads" (the newer series)—you can still get the absolute best value.

What Most People Get Wrong

There’s a common myth that the peso is about to be abolished. Milei talked a lot about "dollarization" during his campaign, but in 2026, we’re still very much in a two-currency system. The peso hasn't died; it's just been put on a very strict diet.

Another misconception is that the "Blue" rate is illegal. While it’s technically "informal," the entire country—from the grandmother buying groceries to the CEO of a tech firm—monitors the Blue rate on sites like Ámbito or Cronista every single morning. It’s the true heartbeat of the economy.

💡 You might also like: Dow Jones index open time: Why those first 15 minutes are total chaos

Looking Ahead: Will it Crash?

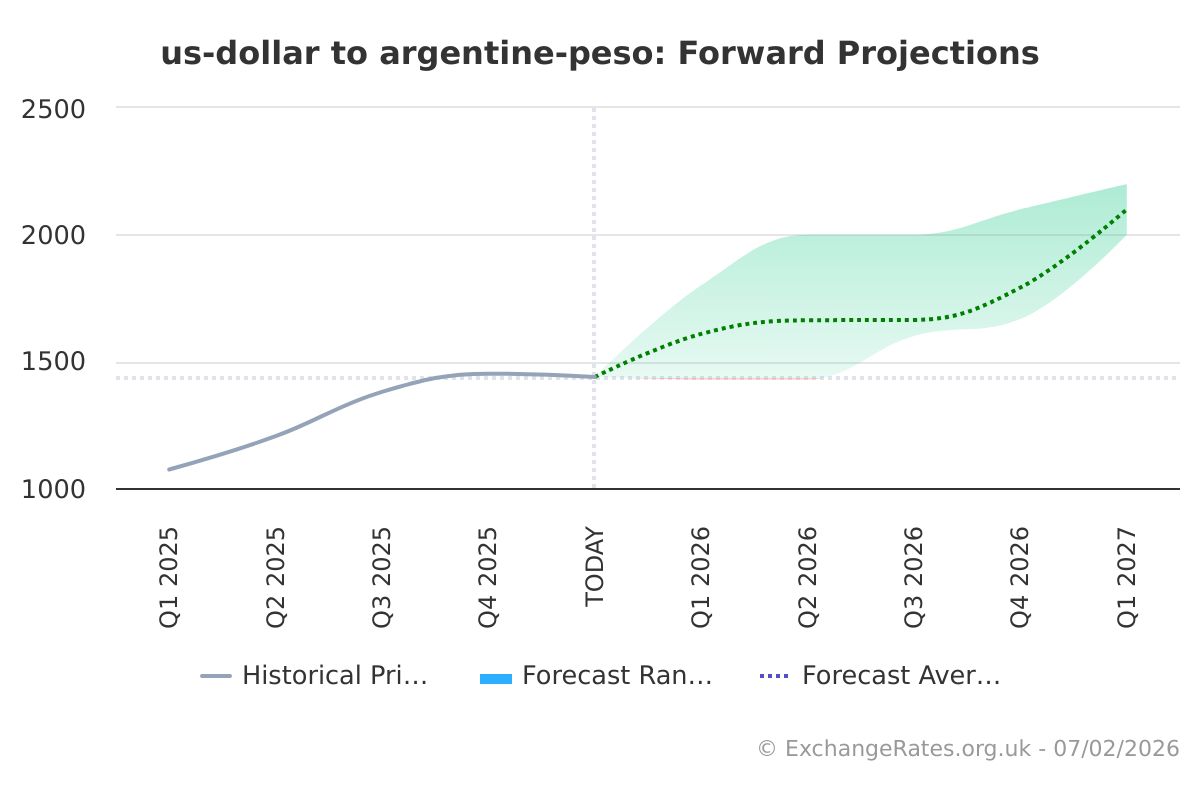

The World Bank recently trimmed Argentina’s growth forecast for 2026 to 4%. That’s still growth, but it’s a bit of a reality check. The government is trying to build up $10 billion in reserves by the end of the year. If they manage that, the exchange rate might stay boring. In Argentina, "boring" is a luxury.

If they fail to hit those reserve targets, or if the IMF gets cranky about the pace of reforms, expect that 1,500 level to be a distant memory by winter.

Actionable Tips for Navigating the Peso

- Check the "Dólar Hoy" website daily. Don't rely on Google's default converter; it usually shows the official rate, which is not what you'll actually pay or receive.

- Bring new $100 bills. In Argentina, a wrinkled or old $20 bill is worth significantly less than a pristine $100 bill at an exchange house (cueva). It's a weird quirk, but it's real.

- Use your credit card for big purchases. Since the MEP rate is now applied to foreign cards, you no longer need to carry suitcases of cash for hotel bills or expensive dinners.

- Always ask for a "descuento por efectivo." Before you pay, ask if there’s a cash discount. You’d be surprised how often a 15% discount magically appears.

- Keep a small amount of pesos. While dollars are preferred for big things, you'll still need pesos for the bus (SUBE card), small kiosks, and street food. Don't exchange more than $50-$100 at a time, as the value can change by next week.

Monitor the gap between the official and Blue rates. If that gap (the "brecha") starts expanding past 20%, it’s a signal that the market expects a big devaluation soon. In that case, spend your pesos as fast as you get them.